New Jersey Self-Employed Independent Contractor Consideration For Hire Form

Description

How to fill out New Jersey Self-Employed Independent Contractor Consideration For Hire Form?

You can invest time on the web trying to find the authorized record template which fits the state and federal specifications you will need. US Legal Forms gives 1000s of authorized types that happen to be examined by experts. You can easily down load or print the New Jersey Self-Employed Independent Contractor Consideration For Hire Form from our services.

If you currently have a US Legal Forms accounts, you may log in and then click the Obtain key. Next, you may total, edit, print, or signal the New Jersey Self-Employed Independent Contractor Consideration For Hire Form. Each authorized record template you get is your own property eternally. To obtain yet another duplicate of the bought develop, visit the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms website the first time, follow the easy instructions beneath:

- Initially, be sure that you have selected the correct record template for that area/city that you pick. Browse the develop description to ensure you have picked the appropriate develop. If accessible, take advantage of the Preview key to look from the record template too.

- If you would like find yet another model in the develop, take advantage of the Research area to find the template that meets your needs and specifications.

- Once you have found the template you need, click Get now to continue.

- Find the costs program you need, key in your accreditations, and sign up for an account on US Legal Forms.

- Complete the deal. You may use your credit card or PayPal accounts to pay for the authorized develop.

- Find the formatting in the record and down load it to your product.

- Make adjustments to your record if necessary. You can total, edit and signal and print New Jersey Self-Employed Independent Contractor Consideration For Hire Form.

Obtain and print 1000s of record templates using the US Legal Forms web site, that provides the biggest variety of authorized types. Use specialist and state-certain templates to deal with your business or specific needs.

Form popularity

FAQ

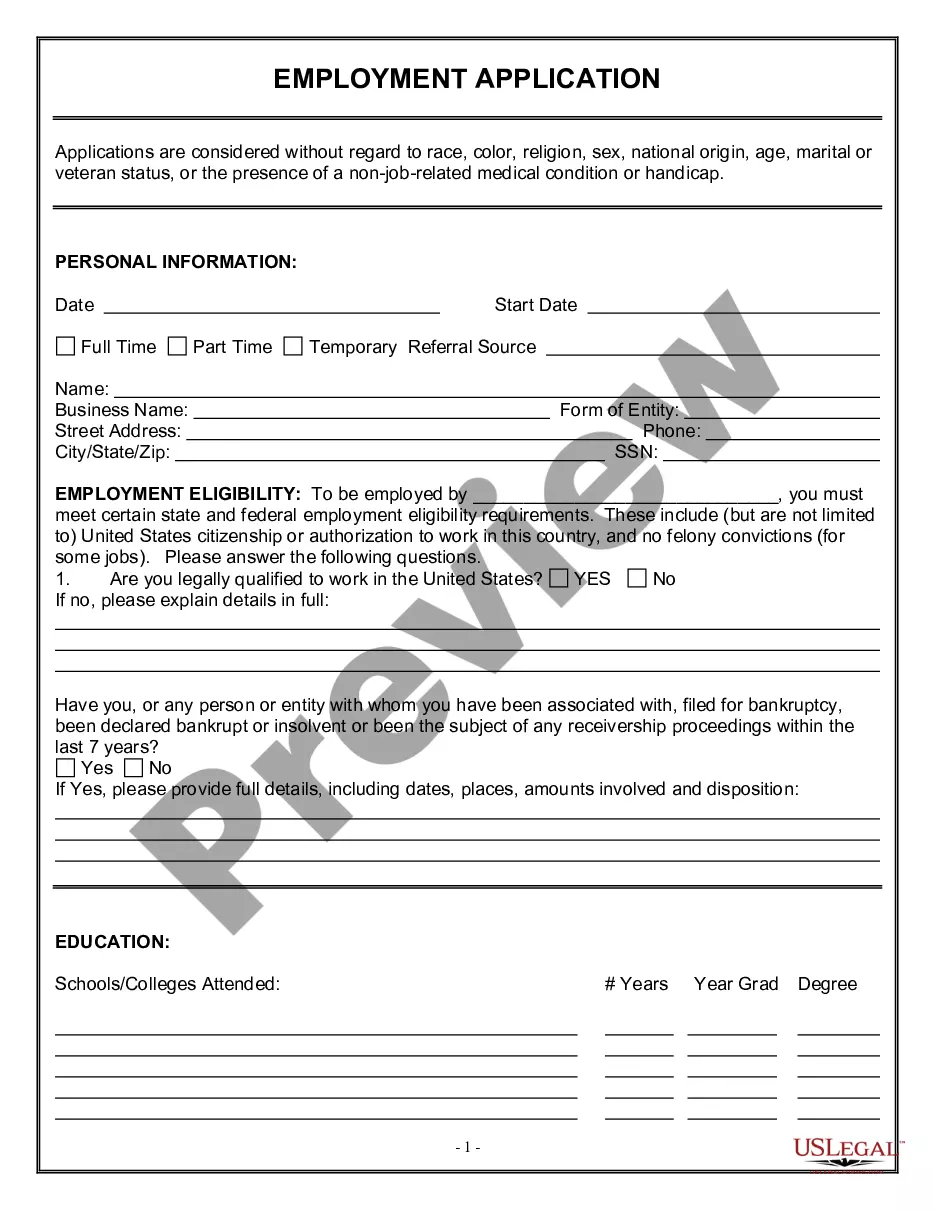

How to Fill Out a 1099-MISC FormEnter your information in the 'payer' section.Fill in your tax ID number.As a business owner, enter the contractor's tax ID number which is found on their form W-9.Fill out the account number you have assigned to the independent contractor.More items...

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

IRS Tax Form 1099-NEC. As of the 2020 tax year, the IRS Form 1099-NEC is the independent contractor tax form used by businesses to report payments to a contract worker in the previous tax year. This tax form for independent contractors is filed with the IRS and is also provided to the contractor for reporting income.

9s and 1099s are tax forms that businesses need when working with independent contractors. Form 9 is what an independent contractor fills out and provides to the employer. Form 1099 has details on the wages an employer pays to an independent contractor. This form is filed with the IRS and state tax authorities.

If you are classified as an "independent contractor," you may be paid with a 1099 with no deductions made for taxes, unemployment, or other contributions that an employee pays.

How to hire a 1099 employeeCorrectly classify the individual.Check credentials and employment history.Create a contract.Have them fill out the proper forms.Integrate into company.

You will need to fill out a W-9 form if you: Classify yourself as an independent contractor or freelancer. Are not a full-time employee of the business. Will be paid more than $600 for work provided to the business.

Companies often hire 1099 employees because they can help complete non-essential tasks quickly and allow businesses to grow and develop more easily. If you're hoping to work with independent contractors, it can be beneficial to understand their major benefits and the most efficient way to hire them.

Form 1099-NEC & Independent Contractors.

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.