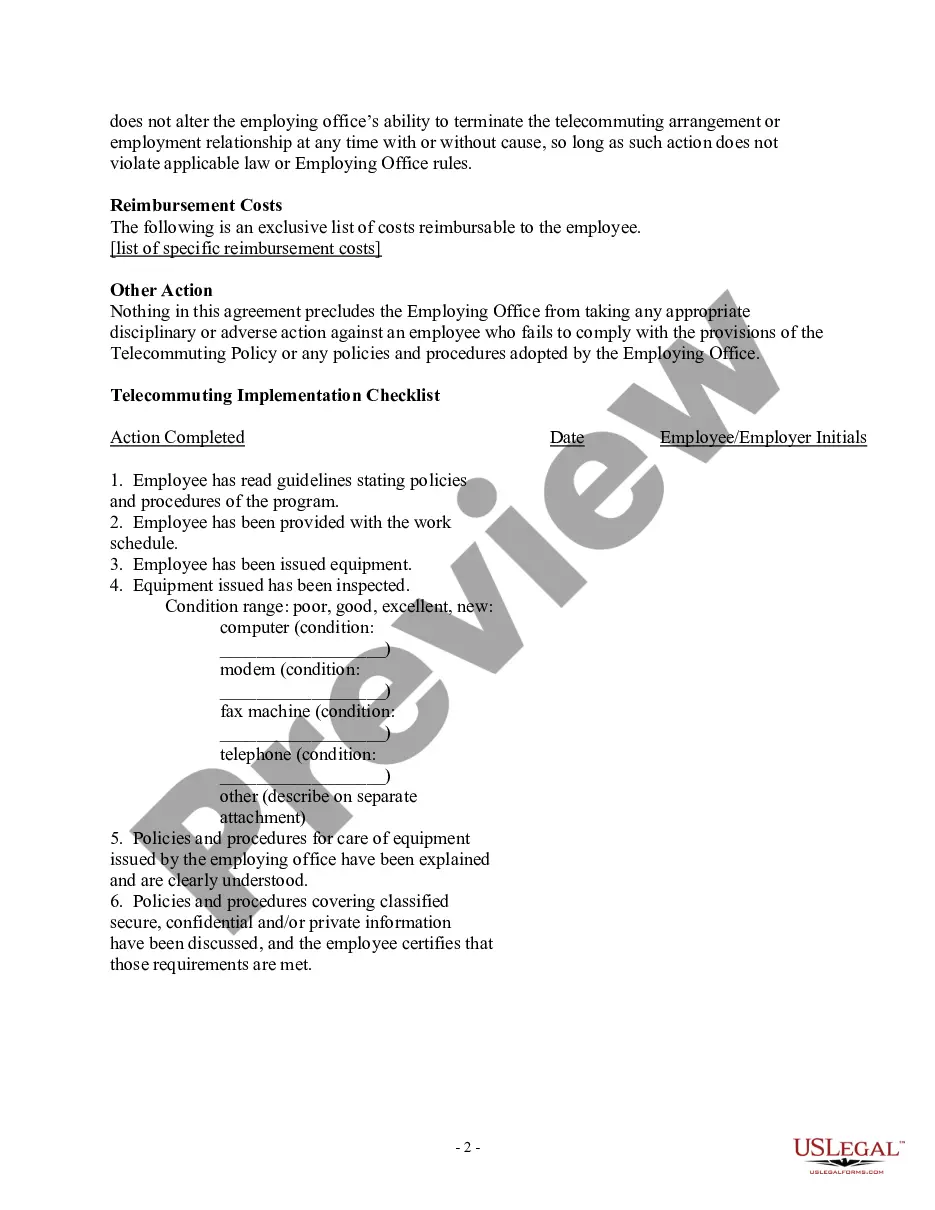

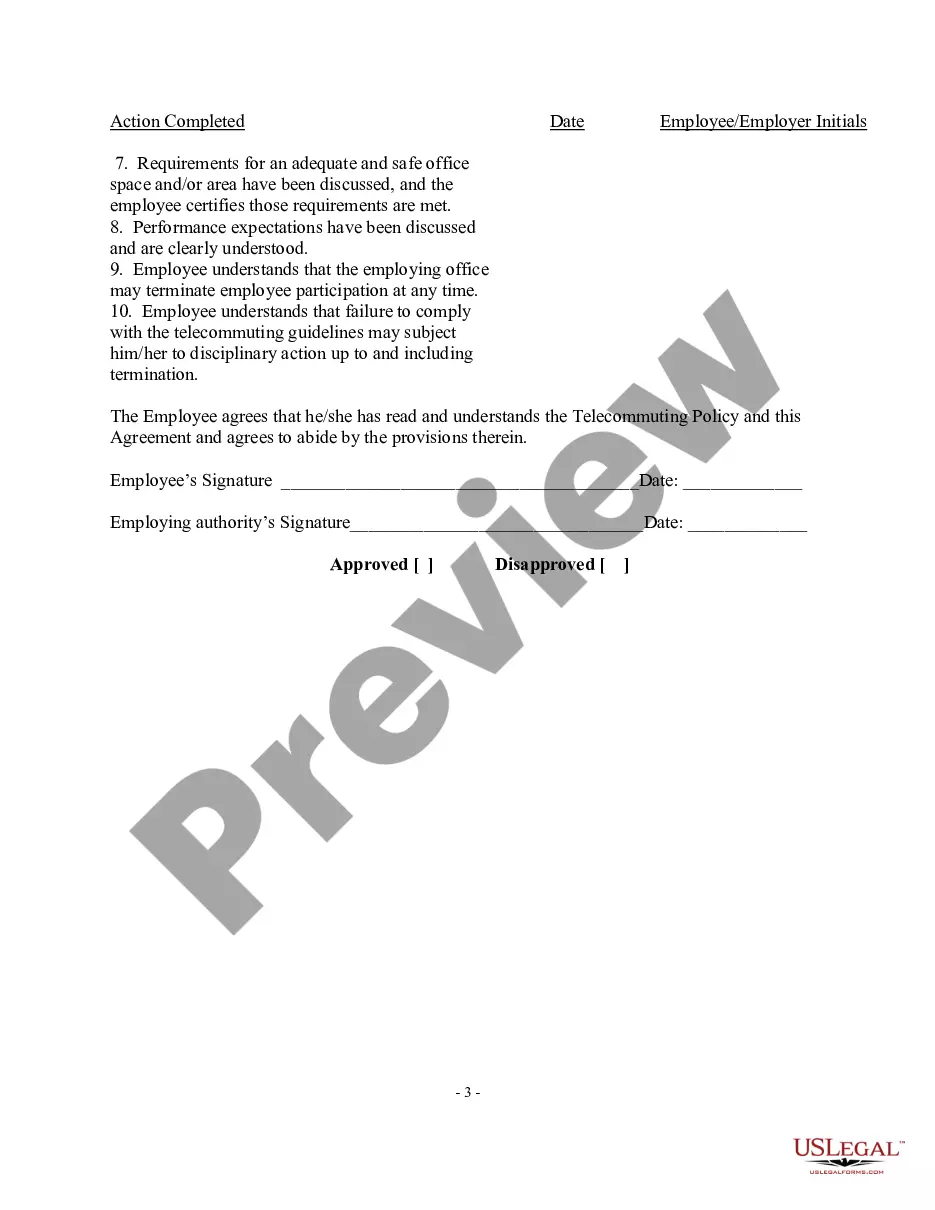

New Jersey Telecommuting Agreement refers to a formal contract established between an employer and an employee to govern the terms and conditions of remote work arrangements within the state of New Jersey. As telecommuting continues to gain popularity, this agreement aims to provide clarity and outline the expectations, responsibilities, and rights of both parties involved. The main purpose of the New Jersey Telecommuting Agreement is to establish a mutual understanding of the telecommuting arrangement and address various aspects to ensure a smooth and productive working relationship. It typically covers: 1. Eligibility and criteria: This agreement may state the eligibility requirements for employees to participate in telecommuting, such as job roles, performance standards, and experience levels. It may also include criteria for evaluating employees' suitability for remote work. 2. Work schedule: The agreement outlines the agreed-upon work schedule, including specific working hours or days, as well as any flexibility or core hours requirements. 3. Workspace and equipment: It specifies the expectations regarding the designated workspace, whether it is at the employee's home or an alternative remote location. It may also address the supply and maintenance of necessary equipment, such as computers, software, and other tools required for remote work. 4. Confidentiality and data security: To protect sensitive information, the agreement may include provisions regarding the handling of documents, data storage, encryption, and other security measures to ensure confidentiality and protect the company's intellectual property. 5. Communication and accessibility: It outlines the preferred communication methods, whether through email, instant messaging, video conferencing, or phone calls, and defines the expected response time for remote workers. It may also address the availability and accessibility expectations during working hours. 6. Performance measurement and expectations: The agreement may establish performance metrics, guidelines, and evaluation criteria for telecommuting employees to ensure productivity, accountability, and adherence to set goals and deadlines. 7. Compensation and benefits: It may address the compensation details, such as salary, overtime, reimbursement of work-related expenses, and eligibility for benefits as per the company policies and applicable labor laws. 8. Termination and modification: Terms related to the termination or modification of the telecommuting arrangement, including notice periods, reasons for termination, and the process for reassessing and modifying the agreement if necessary, can also be included. Different types of New Jersey Telecommuting Agreements may include variations based on individual organizations' policies and the nature of employment. For instance, there may be specific agreements tailored for full-time remote employees, part-time telecommuters, or temporary work-from-home arrangements during specific circumstances (e.g., emergencies or unforeseen events). These agreements can further specify unique requirements or considerations for different job positions or departments within the organization. In conclusion, a New Jersey Telecommuting Agreement serves as a vital tool to formalize remote work arrangements and ensure clarity for both employers and employees. It covers various essential aspects to establish a productive, secure, and mutually beneficial telecommuting environment.

New Jersey Telecommuting Agreement

Description

How to fill out New Jersey Telecommuting Agreement?

You are able to invest several hours on the web looking for the authorized papers design that meets the federal and state requirements you require. US Legal Forms provides a huge number of authorized kinds that are evaluated by professionals. You can easily obtain or print the New Jersey Telecommuting Agreement from my support.

If you have a US Legal Forms bank account, it is possible to log in and click on the Acquire switch. Next, it is possible to full, change, print, or indicator the New Jersey Telecommuting Agreement. Every single authorized papers design you buy is yours for a long time. To obtain one more duplicate of the acquired form, proceed to the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms website the very first time, follow the easy recommendations under:

- First, make sure that you have selected the correct papers design for that region/town of your liking. See the form outline to ensure you have picked out the correct form. If available, use the Review switch to check with the papers design as well.

- If you would like get one more version of the form, use the Research industry to discover the design that meets your needs and requirements.

- After you have located the design you desire, click on Purchase now to carry on.

- Select the rates plan you desire, enter your qualifications, and register for a merchant account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal bank account to purchase the authorized form.

- Select the structure of the papers and obtain it to your device.

- Make adjustments to your papers if possible. You are able to full, change and indicator and print New Jersey Telecommuting Agreement.

Acquire and print a huge number of papers templates using the US Legal Forms website, that offers the biggest selection of authorized kinds. Use specialist and status-certain templates to take on your company or personal requirements.

Form popularity

FAQ

If you are a new employer in New Jersey, you will need to register your business with the New Jersey Division of Revenue. This must be completed for OnPay to be able to file and pay your NJ taxes.

The employee shall first consent in writing to the direct deposit of his or her wages; 2. Consent under (h)1 above shall be obtained by the employer without intimidation, coercion, or fear of discharge or reprisal for refusal to accept the direct deposit arrangement; 3.

The most common methods of payroll payments to employees are direct deposit, prepaid debit cards or paper check. Physical checks can be handwritten or printed and require only that your business have a checking account with a bank.

How do I pay my employees? Collect employee information and payroll forms. Calculate gross pay based on their hourly rate and hours worked. Determine employee net pay by deducting the required taxes. Pay your employees by check or direct deposit. File payroll taxes. Document and maintain your payroll records.

NJ Taxation 125 was enacted on July 21, 2023 and establishes a ?convenience of the employer test? (convenience rule) for nonresident income sourcing.

Under the New Jersey Wage Payment Law, employers must establish regular paydays in advance and pay their employees at least twice a month. Wages must be paid within ten working days after the end of the pay period.

Go to The Division of Revenue & Enterprise Services - Online Filing Service, enter your taxpayer ID and PIN and hit ?Submit.? Choose ?Pay a Labor Bill,? select 4th quarter and the year printed on the assessment bill, and hit ?Submit.? For the Type of Labor Bill, use the drop down and select Combined Assessment Bill.

Until now, New Jersey law stated income should be taxed by the state where it was earned ? even if the employee works remotely. For example, a New Jersey resident who telecommutes to a job in New York City pays taxes in New York. New Jersey offered a tax credit, so workers weren't subject to double taxation.