New Jersey Partition Deed for Mineral / Royalty Interests

Description

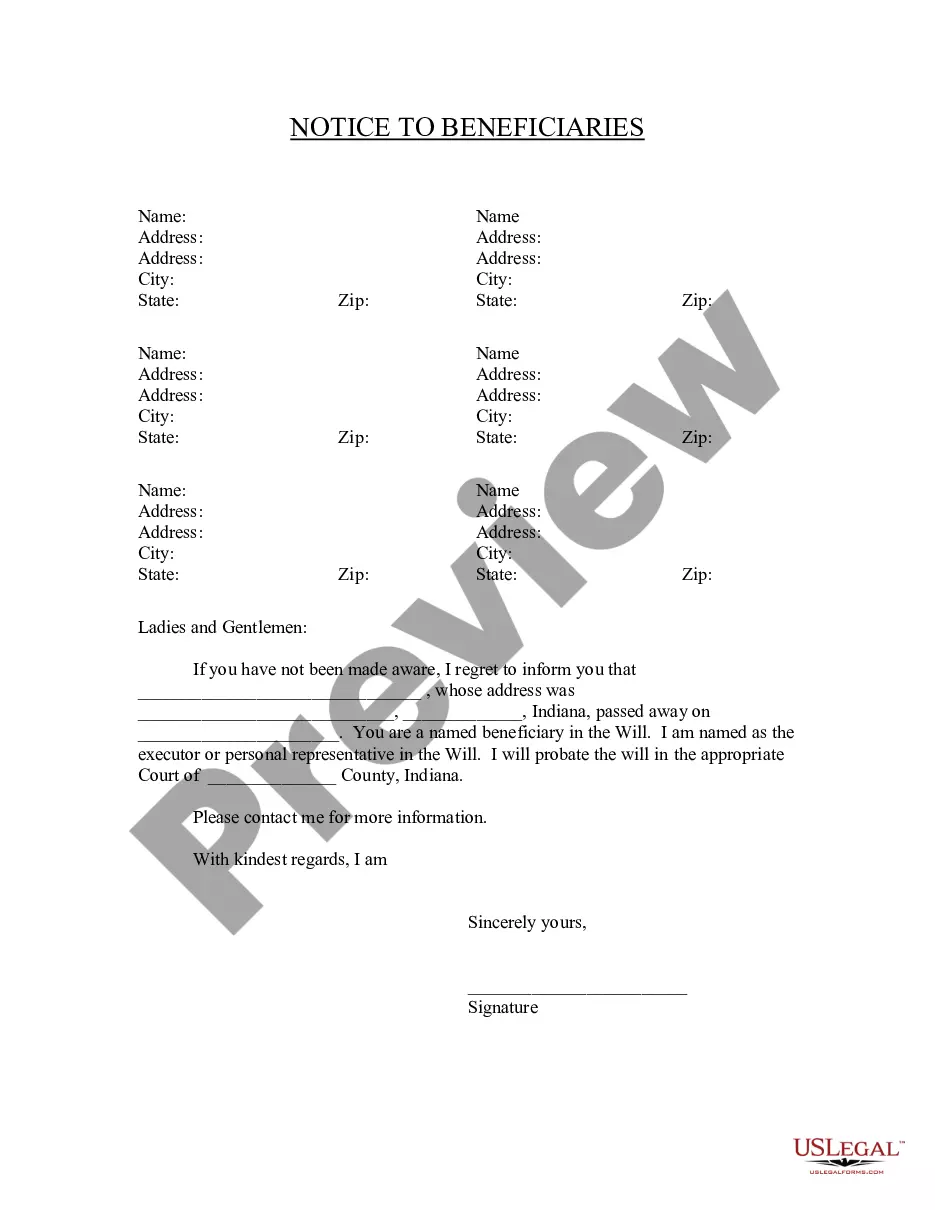

How to fill out Partition Deed For Mineral / Royalty Interests?

US Legal Forms - among the biggest libraries of legal kinds in America - offers a wide range of legal record themes you are able to down load or produce. Utilizing the internet site, you can get a large number of kinds for company and person functions, sorted by categories, suggests, or keywords.You will find the most recent models of kinds like the New Jersey Partition Deed for Mineral / Royalty Interests within minutes.

If you have a subscription, log in and down load New Jersey Partition Deed for Mineral / Royalty Interests from the US Legal Forms catalogue. The Acquire switch will show up on every single kind you perspective. You have accessibility to all previously downloaded kinds from the My Forms tab of your own bank account.

If you would like use US Legal Forms initially, listed here are straightforward instructions to help you get began:

- Make sure you have picked out the proper kind for your personal area/state. Click the Review switch to examine the form`s content material. Browse the kind explanation to ensure that you have selected the correct kind.

- If the kind does not satisfy your needs, utilize the Research discipline on top of the monitor to find the one who does.

- In case you are happy with the shape, affirm your choice by visiting the Get now switch. Then, pick the pricing strategy you favor and give your credentials to sign up for an bank account.

- Procedure the transaction. Make use of your charge card or PayPal bank account to finish the transaction.

- Choose the structure and down load the shape on the gadget.

- Make alterations. Fill up, modify and produce and indicator the downloaded New Jersey Partition Deed for Mineral / Royalty Interests.

Every template you added to your money lacks an expiration time and is also your own permanently. So, if you wish to down load or produce an additional version, just go to the My Forms portion and then click in the kind you need.

Gain access to the New Jersey Partition Deed for Mineral / Royalty Interests with US Legal Forms, probably the most considerable catalogue of legal record themes. Use a large number of expert and status-distinct themes that fulfill your organization or person requires and needs.

Form popularity

FAQ

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

If you want to sell the mineral rights to another person, you can transfer them by deed. You will need to create a mineral deed and have it recorded. You should check with the county Recorder of Deeds in the county where the land is located and ask if a printed mineral deed form is available to use.

The rising value of oil and minerals have increased the popularity of investing in the mineral rights but not the property rights. To research how to attain these rights, look at the county's courthouse. They typically have a deed record of mineral rights. From there you can contact the owners of the rights.

The following are methods for establishing mineral rights ownership: Deed. A deed is used to transfer mineral rights ownership from one party to another. Lease. ... Severance. ... Adverse Possession. ... Surface Use Agreement. ... Royalties. ... Mineral Estate. ... Texas Railroad Commission.

The mineral owner's interest in the spacing unit is calculated by dividing the number of acres owned by the mineral owner within the unit by the total number of acres in the unit (Acres Owned / Total Acres in Unit). This will result in a decimal.

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

Royalty income from an oil and gas lease will be paid so long as a product is produced from the lease. Royalties are a proportionate part of the revenue received from the sale of oil, gas or other materials from a well or lease and paid to the royalty owners based on a lease agreement or other contract.

Generally minerals are held in private ownership, and information on mineral rights, where available, is held by the Land Registry together with details of land surface ownership.