A New Jersey Partial Release of Mortgage or Deed of Trust on a Mineral/Royalty Interest Sold by the Granter is a legal document used to release a portion of a mortgage or deed of trust on a property's mineral or royalty interest that has been sold by the original granter. This partial release facilitates the transfer of ownership and ensures that the new owner has clear and unencumbered rights to the specific portion of the property. Keywords: New Jersey, partial release, mortgage, deed of trust, mineral interest, royalty interest, sold, granter, property, ownership, transfer. Different Types of New Jersey Partial Release of Mortgage or Deed of Trust on a Mineral/Royalty Interest Sold by Granter: 1. New Jersey Partial Release of Mortgage on a Mineral Interest Sold by Granter: This type of partial release is specifically used when a granter sells a portion of their mineral interest associated with a property, allowing them to release a corresponding portion of the mortgage debt related to that interest. 2. New Jersey Partial Release of Deed of Trust on a Mineral Interest Sold by Granter: Similar to the partial release of a mortgage, this type pertains to a deed of trust where the granter sells a portion of their mineral interest, requiring the release of the corresponding portion of the deed of trust. 3. New Jersey Partial Release of Mortgage on a Royalty Interest Sold by Granter: This document is employed when the granter sells a portion of their royalty interest related to a property, permitting the release of a proportionate amount of the mortgage on that specific interest. 4. New Jersey Partial Release of Deed of Trust on a Royalty Interest Sold by Granter: Like the previous type, this partial release of a deed of trust is applicable when a granter sells a portion of their royalty interest, necessitating the release of the corresponding portion of the deed of trust. These various types of New Jersey Partial Release of Mortgage or Deed of Trust on a Mineral/Royalty Interest Sold by Granter enable legal clarity and prevent any confusion or disputes regarding ownership rights and outstanding mortgage obligations.

New Jersey Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

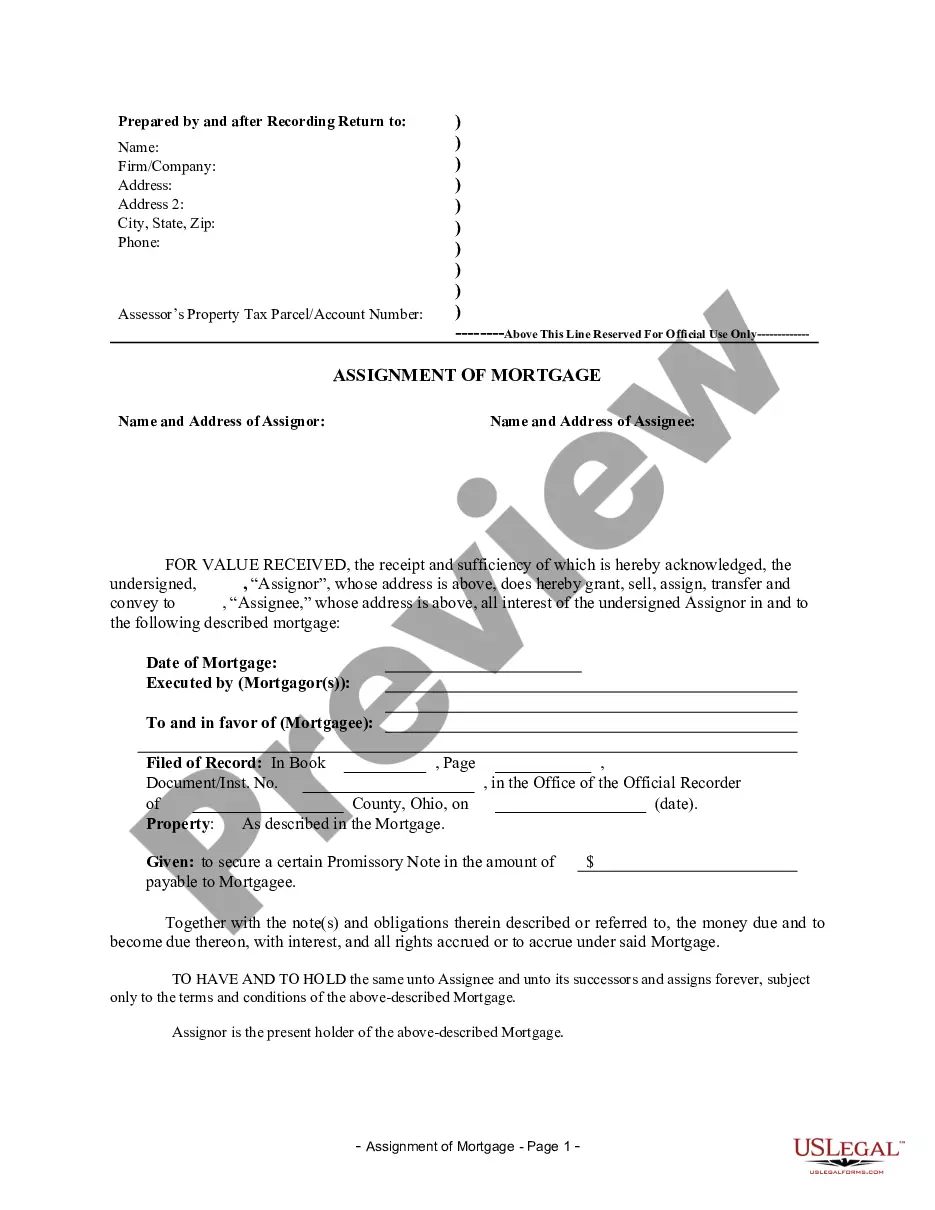

How to fill out New Jersey Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

Finding the right legitimate papers template can be quite a have difficulties. Obviously, there are plenty of templates available online, but how do you discover the legitimate type you will need? Utilize the US Legal Forms website. The support offers a large number of templates, for example the New Jersey Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, that you can use for organization and personal requires. All of the kinds are checked by professionals and fulfill state and federal needs.

In case you are previously authorized, log in to your profile and click on the Obtain key to have the New Jersey Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor. Make use of your profile to appear with the legitimate kinds you may have bought in the past. Proceed to the My Forms tab of your own profile and get another backup of your papers you will need.

In case you are a new end user of US Legal Forms, listed below are basic recommendations for you to adhere to:

- Initially, make sure you have chosen the correct type for your metropolis/region. You may check out the form while using Preview key and read the form outline to make certain this is basically the best for you.

- In the event the type is not going to fulfill your preferences, utilize the Seach area to find the proper type.

- When you are sure that the form is suitable, click on the Purchase now key to have the type.

- Pick the prices plan you want and enter the essential information and facts. Build your profile and buy your order using your PayPal profile or bank card.

- Opt for the submit file format and download the legitimate papers template to your device.

- Complete, change and print out and signal the acquired New Jersey Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor.

US Legal Forms is the greatest catalogue of legitimate kinds in which you can find different papers templates. Utilize the service to download professionally-created papers that adhere to status needs.