New Jersey Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands

Description

How to fill out Stipulation Of Ownership Of Mineral Interest Of Mineral Ownership In Specific Lands?

Have you been in a place the place you need to have documents for possibly business or specific uses almost every time? There are a lot of legal document layouts available online, but finding types you can depend on is not simple. US Legal Forms gives thousands of type layouts, much like the New Jersey Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands, that are created to fulfill federal and state demands.

If you are currently informed about US Legal Forms internet site and also have a free account, just log in. Next, you can acquire the New Jersey Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands web template.

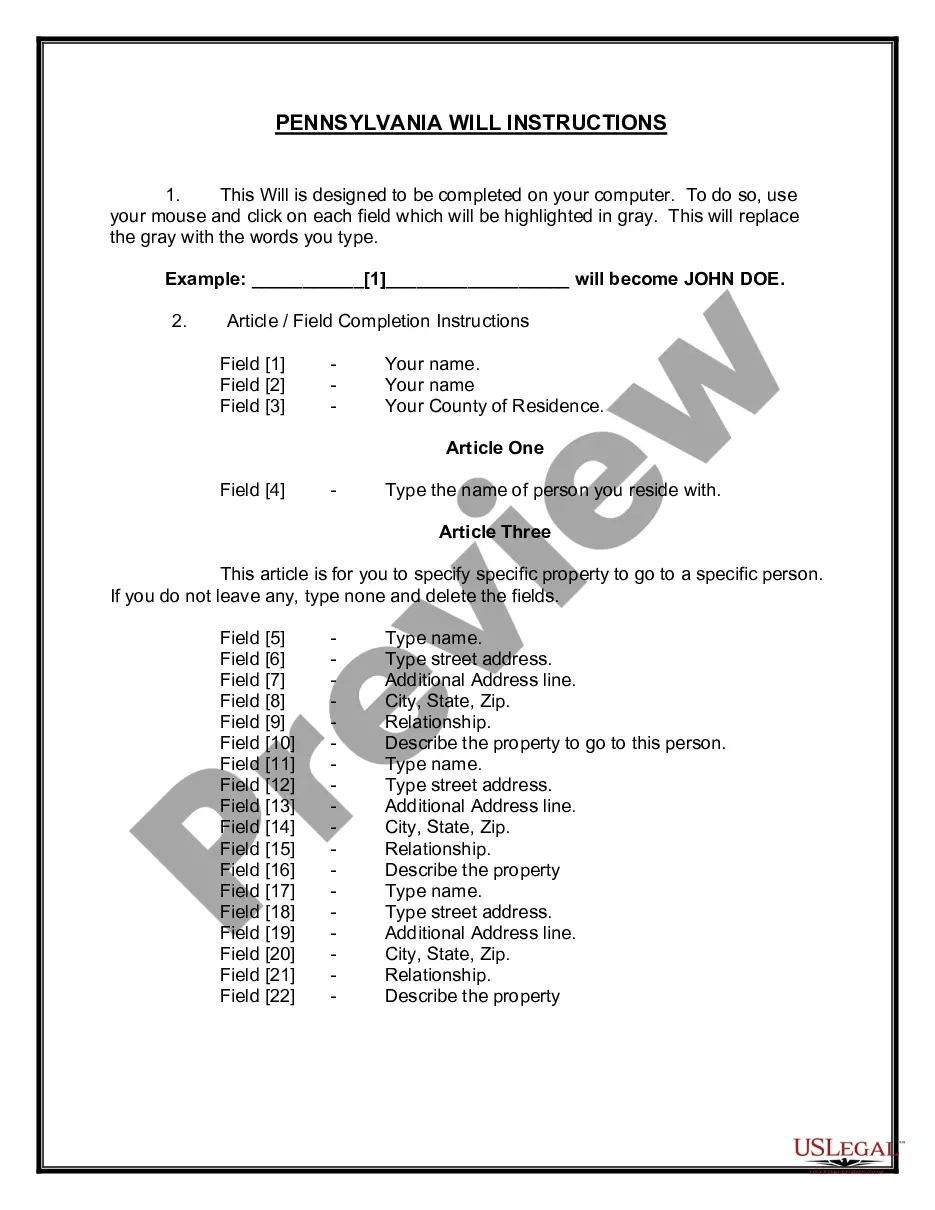

Should you not come with an bank account and would like to begin to use US Legal Forms, abide by these steps:

- Discover the type you want and ensure it is to the correct metropolis/county.

- Use the Preview switch to analyze the shape.

- See the description to ensure that you have chosen the right type.

- In case the type is not what you`re searching for, utilize the Lookup industry to get the type that meets your requirements and demands.

- If you obtain the correct type, click Get now.

- Pick the pricing prepare you desire, complete the desired details to produce your money, and purchase your order using your PayPal or charge card.

- Pick a convenient file structure and acquire your duplicate.

Get all the document layouts you might have bought in the My Forms menus. You can get a extra duplicate of New Jersey Stipulation of Ownership of Mineral Interest of Mineral Ownership in Specific Lands any time, if possible. Just click the needed type to acquire or print the document web template.

Use US Legal Forms, probably the most extensive assortment of legal forms, to save time and avoid blunders. The assistance gives appropriately manufactured legal document layouts which you can use for a selection of uses. Produce a free account on US Legal Forms and commence generating your way of life easier.

Form popularity

FAQ

One quick and dirty approach is the ?rule of thumb.? Those following the rule of thumb say that mineral rights are worth a multiple of three to five times the yearly income produced. For example, a mineral right that produces $1,000 a year in royalties would be worth between $3,000 and $5,000 under the rule of thumb.

In the United States, landowners possess both surface and mineral rights unless they choose to sell the mineral rights to someone else. Once mineral rights have been sold, the original owner retains only the rights to the land surface, while the second party may exploit the underground resources in any way they choose.

Whether you have an offer on the table or not, you may have good reasons to sell your mineral rights: To pursue other opportunities. If you have a nonproducing property, you might have to wait years for anything to happen ? and nothing may ever happen, even after multiple leases.

In exchange for these rights, the owner of the mineral rights may be required to pay royalties to the owner of the surface rights or to the government. The ownership of mineral rights can be transferred, leased, or sold, and it is a valuable asset that can generate income for the owner.

Cons of Selling Your Mineral Rights Loss of Potential Future Income: When you sell your mineral rights, you also give up any potential future income from those rights. This can be a significant loss if the mineral rights end up producing more than expected or if there are new discoveries in the future.

What are Outstanding and Reserved mineral rights? Outstanding mineral rights are owned by a party other than the surface owner at the time the surface was conveyed to the United States. Reserved mineral rights are those rights held by the surface owner at the time the surface was conveyed to the United States.

People sell their mineral rights for a variety of reasons. Some need immediate cash, while others are seeking to improve the quality of their lives. Most want to sell while their minerals still have value and to avoid burdening their heirs with the learning curve and management duties.

The general (common law) rule in the case of a split estate is that the mineral estate is ?dominant.? This means that the owner of the surface estate cannot prohibit the owner of the mineral estate from accessing and developing the minerals.