This lease rider form may be used when you are involved in a lease transaction, and have made the decision to utilize the form of Oil and Gas Lease presented to you by the Lessee, and you want to include additional provisions to that Lease form to address specific concerns you may have, or place limitations on the rights granted the Lessee in the “standard” lease form.

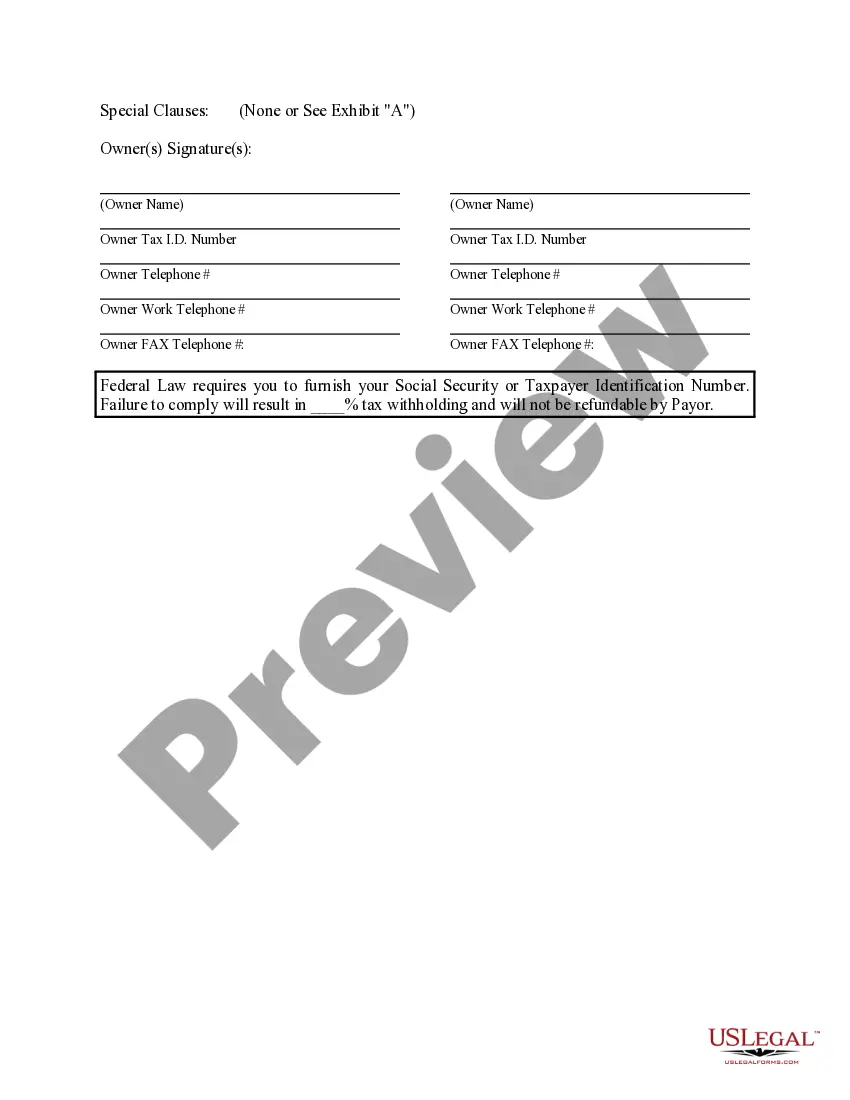

New Jersey Division Orders play a crucial role in the oil and gas industry within the state. They are legal documents that outline the distribution and allocation of revenue generated from the production and sale of oil, gas, or other mineral resources in New Jersey. These orders are typically issued by the operator of a well to the various mineral interest owners. The purpose of a New Jersey Division Order is to provide clear instructions on how the proceeds from the production will be divided among the mineral interest owners. It specifies the percentage or decimal interest that each owner is entitled to receive, based on their ownership stake. This ensures transparency and fairness among the parties involved. New Jersey Division Orders contain essential information such as the name and address of the operator, details of the well(s) or lease(s) in question, mineral ownership information, including the names and addresses of mineral interest owners, tax identification numbers, and their respective decimal interests. These documents also highlight any overriding royalties or other interests that may affect the distribution of revenues. There are different types of New Jersey Division Orders that may be issued depending on the specific circumstances. Some of these include: 1. Initial Division Orders: These are issued when a well is first brought into production, and the operator needs to establish the distribution of proceeds among the mineral interest owners. 2. Amended Division Orders: In cases where there are changes in ownership interests or other relevant factors, amended division orders may be issued to reflect the updated allocations. 3. Pooling Division Orders: When multiple wells are pooled or combined to optimize production efficiency, pooling division orders are employed. They outline how the revenues from the pooled wells will be distributed among the mineral interest owners. 4. Shut-In Division Orders: In situations where a well is temporarily shut down or not producing due to repairs, maintenance, or market conditions, shut-in division orders may be issued to address the suspension of revenue distribution. It is important for mineral interest owners to carefully review and understand the terms and calculations outlined in New Jersey Division Orders to ensure accuracy and fairness in revenue distribution. Legal assistance may be sought to clarify any complexities and protect the rights of the owners. Keywords: New Jersey, Division Orders, oil and gas industry, revenue distribution, mineral interest owners, operator, production, allocation, decimal interests, overriding royalties, well, lease, initial division orders, amended division orders, pooling division orders, shut-in division orders.New Jersey Division Orders play a crucial role in the oil and gas industry within the state. They are legal documents that outline the distribution and allocation of revenue generated from the production and sale of oil, gas, or other mineral resources in New Jersey. These orders are typically issued by the operator of a well to the various mineral interest owners. The purpose of a New Jersey Division Order is to provide clear instructions on how the proceeds from the production will be divided among the mineral interest owners. It specifies the percentage or decimal interest that each owner is entitled to receive, based on their ownership stake. This ensures transparency and fairness among the parties involved. New Jersey Division Orders contain essential information such as the name and address of the operator, details of the well(s) or lease(s) in question, mineral ownership information, including the names and addresses of mineral interest owners, tax identification numbers, and their respective decimal interests. These documents also highlight any overriding royalties or other interests that may affect the distribution of revenues. There are different types of New Jersey Division Orders that may be issued depending on the specific circumstances. Some of these include: 1. Initial Division Orders: These are issued when a well is first brought into production, and the operator needs to establish the distribution of proceeds among the mineral interest owners. 2. Amended Division Orders: In cases where there are changes in ownership interests or other relevant factors, amended division orders may be issued to reflect the updated allocations. 3. Pooling Division Orders: When multiple wells are pooled or combined to optimize production efficiency, pooling division orders are employed. They outline how the revenues from the pooled wells will be distributed among the mineral interest owners. 4. Shut-In Division Orders: In situations where a well is temporarily shut down or not producing due to repairs, maintenance, or market conditions, shut-in division orders may be issued to address the suspension of revenue distribution. It is important for mineral interest owners to carefully review and understand the terms and calculations outlined in New Jersey Division Orders to ensure accuracy and fairness in revenue distribution. Legal assistance may be sought to clarify any complexities and protect the rights of the owners. Keywords: New Jersey, Division Orders, oil and gas industry, revenue distribution, mineral interest owners, operator, production, allocation, decimal interests, overriding royalties, well, lease, initial division orders, amended division orders, pooling division orders, shut-in division orders.