The New Jersey State of Delaware Limited Partnership Tax Notice is a document issued by the state of New Jersey to limited partnerships that are registered in the state of Delaware. This notice serves as a reminder and requirement for limited partnerships to fulfill their tax obligations to the state of New Jersey. Limited partnerships that conduct business activities in Delaware and have certain connections to the state of New Jersey may be subject to taxation by both states. This tax notice outlines the specific details regarding the reporting and payment of taxes to ensure compliance with New Jersey tax laws. The New Jersey State of Delaware Limited Partnership Tax Notice includes important information such as filing deadlines, tax rates, and documentation requirements. It is crucial for limited partnerships to carefully review this notice and understand their tax responsibilities to avoid penalties or any legal consequences. This notice applies to various types of limited partnerships, including general partnerships, limited liability partnerships (Laps), and limited liability companies (LCS) that are structured as partnerships. Each entity must carefully assess its activities and determine whether it falls within the scope of the New Jersey State of Delaware Limited Partnership Tax Notice. Limited partnerships and other related entities must not only submit the necessary tax forms but also accurately calculate their tax liability based on the guidelines specified in this notice. Any income or profits derived from activities conducted in or connected to New Jersey may be subject to taxation. It is important to note that the New Jersey State of Delaware Limited Partnership Tax Notice may have different variations depending on factors such as the specific tax year or any changes in tax laws or regulations. Partnership entities should ensure they access the most current version of the notice, as provided by the New Jersey Division of Taxation. Adhering to the requirements outlined in the New Jersey State of Delaware Limited Partnership Tax Notice is paramount for limited partnerships in order to maintain compliance with state tax regulations and avoid any unnecessary legal issues. Partnership entities should consult with tax professionals or seek guidance from the New Jersey Division of Taxation if they have any questions or uncertainties regarding their tax obligations.

New Jersey State of Delaware Limited Partnership Tax Notice

Description

How to fill out New Jersey State Of Delaware Limited Partnership Tax Notice?

Choosing the best lawful papers design might be a struggle. Needless to say, there are a lot of web templates available on the net, but how would you get the lawful form you require? Utilize the US Legal Forms website. The assistance offers a large number of web templates, including the New Jersey State of Delaware Limited Partnership Tax Notice, which can be used for business and personal requirements. Every one of the kinds are checked out by professionals and satisfy federal and state demands.

Should you be currently listed, log in for your bank account and click on the Down load button to get the New Jersey State of Delaware Limited Partnership Tax Notice. Use your bank account to search throughout the lawful kinds you might have bought previously. Proceed to the My Forms tab of the bank account and get one more backup of your papers you require.

Should you be a whole new user of US Legal Forms, listed below are easy recommendations that you can follow:

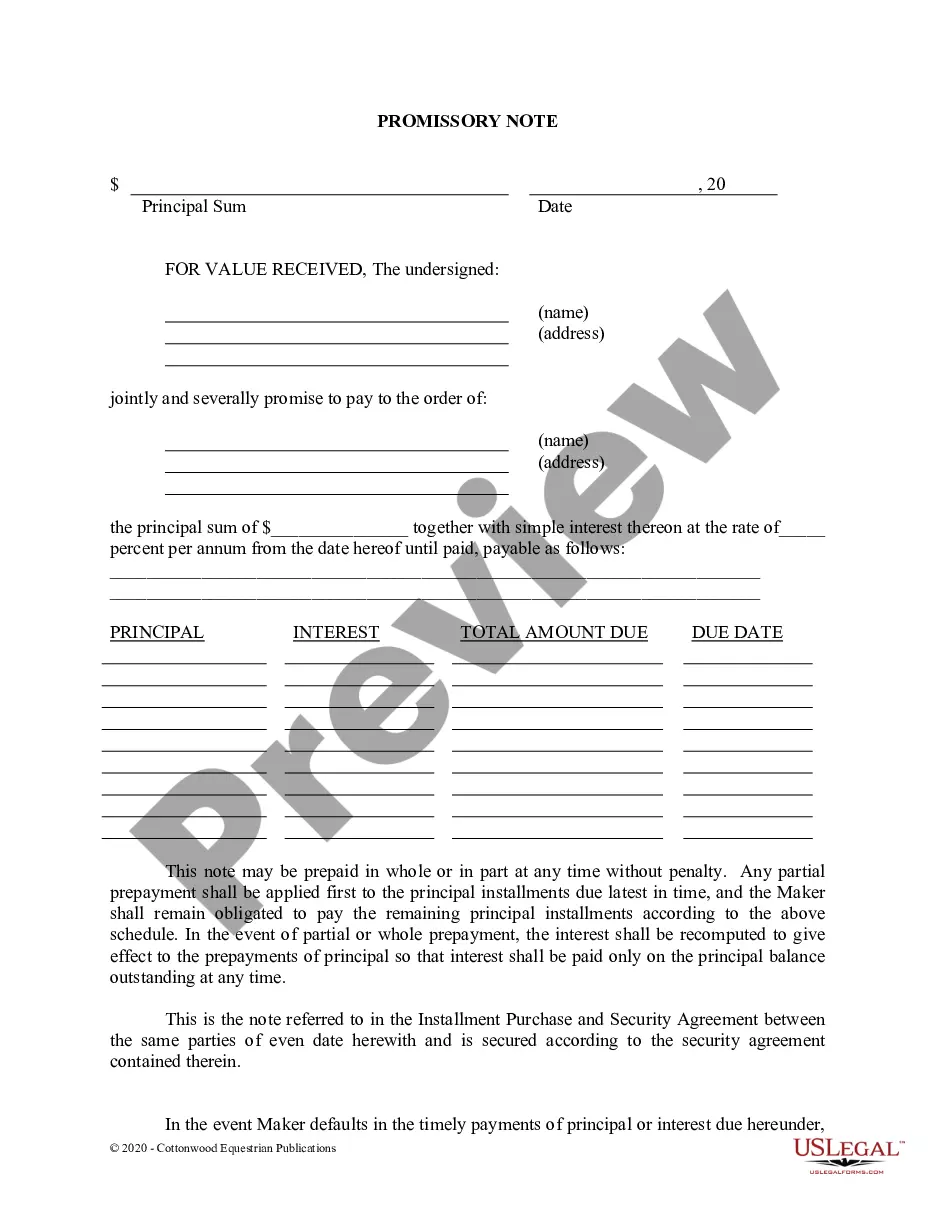

- Very first, make certain you have selected the right form to your metropolis/area. You are able to examine the shape making use of the Review button and look at the shape description to make sure this is the best for you.

- In case the form is not going to satisfy your preferences, take advantage of the Seach field to find the proper form.

- When you are certain that the shape would work, click on the Purchase now button to get the form.

- Select the prices prepare you would like and enter in the needed information. Make your bank account and purchase your order making use of your PayPal bank account or Visa or Mastercard.

- Pick the document formatting and acquire the lawful papers design for your system.

- Comprehensive, edit and print out and indicator the received New Jersey State of Delaware Limited Partnership Tax Notice.

US Legal Forms is definitely the greatest local library of lawful kinds that you can find different papers web templates. Utilize the service to acquire appropriately-created paperwork that follow status demands.