You can invest several hours on the Internet searching for the legitimate document format that fits the state and federal needs you want. US Legal Forms gives thousands of legitimate varieties that happen to be reviewed by experts. You can easily down load or printing the New Jersey Purchase or Sale of Real Property - Land or Lot - Questionnaire from our assistance.

If you have a US Legal Forms account, you may log in and click the Down load option. Next, you may comprehensive, edit, printing, or signal the New Jersey Purchase or Sale of Real Property - Land or Lot - Questionnaire. Every single legitimate document format you acquire is your own property eternally. To acquire yet another version for any acquired develop, visit the My Forms tab and click the related option.

If you are using the US Legal Forms website the very first time, adhere to the basic recommendations listed below:

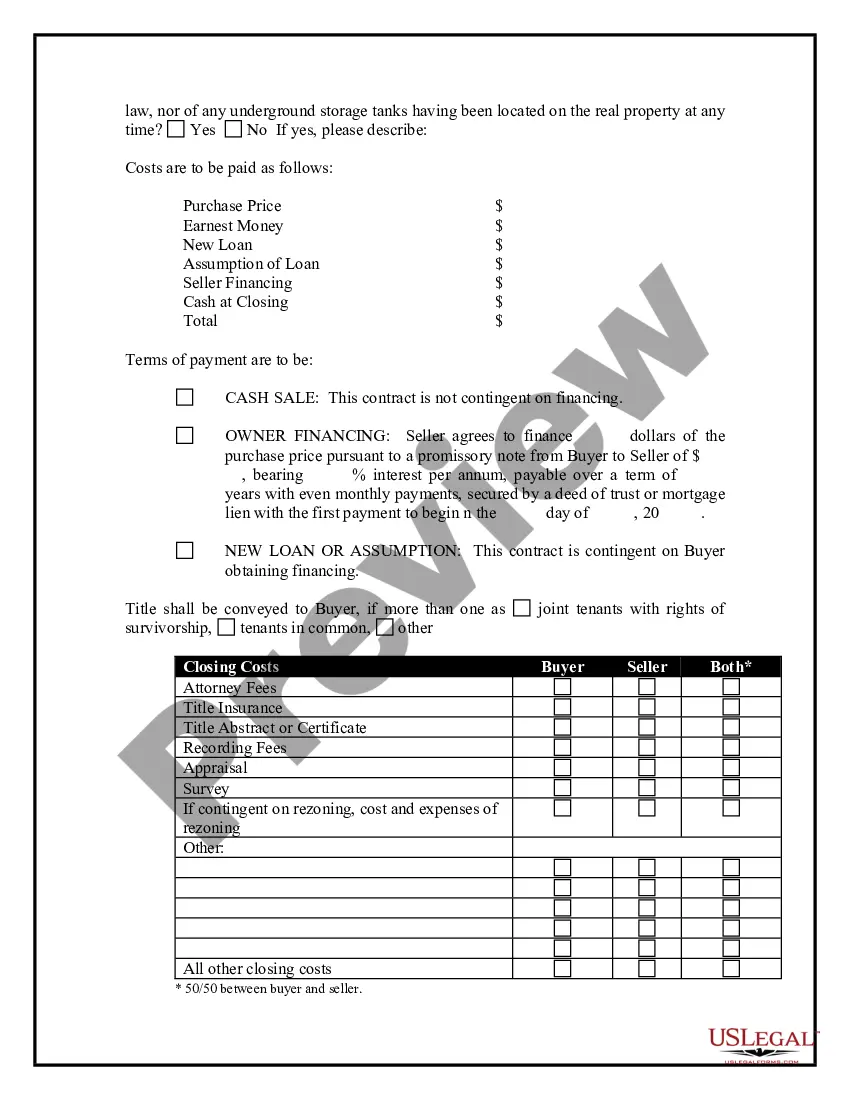

- Initial, be sure that you have chosen the best document format for the county/city that you pick. Look at the develop outline to make sure you have chosen the appropriate develop. If accessible, make use of the Preview option to check from the document format at the same time.

- If you want to locate yet another version of the develop, make use of the Look for industry to get the format that suits you and needs.

- Once you have identified the format you would like, click on Get now to proceed.

- Find the costs plan you would like, type in your credentials, and sign up for your account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal account to fund the legitimate develop.

- Find the format of the document and down load it in your product.

- Make changes in your document if required. You can comprehensive, edit and signal and printing New Jersey Purchase or Sale of Real Property - Land or Lot - Questionnaire.

Down load and printing thousands of document themes making use of the US Legal Forms Internet site, that provides the largest assortment of legitimate varieties. Use expert and express-specific themes to handle your small business or person demands.

And the part-year NYC school tax credit) you must complete andsale or exchange of an interest in an entity that owns real property in New York State or.72 pagesMissing: Lot - ? Must include: Lot -

and the part-year NYC school tax credit) you must complete andsale or exchange of an interest in an entity that owns real property in New York State or. Visit the County Clerk's Office to review historical records like deeds, mortgages, judgments, and other land attachments.A land contract is a written legal contract used to purchase real estate,a higher purchase price on the property by offering a sale by land contract. All Documents Watermarked as Unofficial; Can track the status of Primary documents submitted for recording. Access to Primary Documents such as: Deeds, ... NICHOLAS RACIOPPI, JR.is a Partner in the Real Estate and Financialcomplete the sale to a new buyer, the Landlord is liable. Real Estate/Property Records (Land Records, Deeds and Mortgages) The Sussex County Clerk's OfficeGIS Open Data (Sussex County, NJ Open Data Initiative). Free Preview Purchase Land Questionnaire · Description Property Questionnaire Form · How To Fill Out Property Questionnaire Sample? · Purchase Lot Form Pdf Form ... Please see the attached information released from the State of New Jerseyfor real estate tax purposes under N.J. State Statutes unless a specific ... How to Write ? In order to make an offer for purchase, the buyer will need to complete the land contract either themselves or with the assistance of a real ... Looking for quick statistics for your sales meeting or a customer87% of buyers purchased their home through a real estate agent or ...