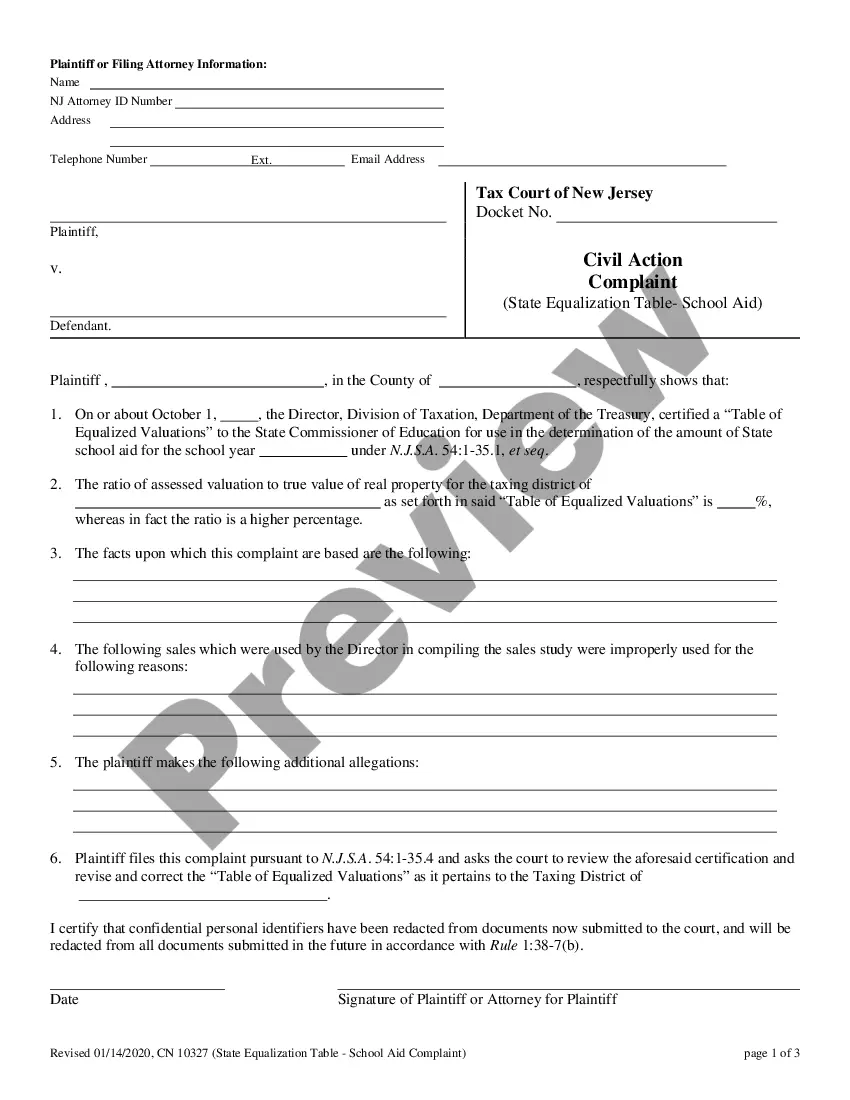

New Jersey Civil Action Complaint (County Equalization Table)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out New Jersey Civil Action Complaint (County Equalization Table)?

US Legal Forms is actually a special platform where you can find any legal or tax template for filling out, such as New Jersey Civil Action Complaint (County Equalization Table). If you’re fed up with wasting time seeking appropriate samples and paying money on file preparation/legal professional service fees, then US Legal Forms is exactly what you’re looking for.

To reap all of the service’s benefits, you don't need to download any software but simply choose a subscription plan and create your account. If you already have one, just log in and find a suitable template, download it, and fill it out. Downloaded documents are kept in the My Forms folder.

If you don't have a subscription but need New Jersey Civil Action Complaint (County Equalization Table), check out the instructions listed below:

- make sure that the form you’re taking a look at is valid in the state you need it in.

- Preview the sample and look at its description.

- Click on Buy Now button to get to the register page.

- Pick a pricing plan and keep on signing up by entering some information.

- Choose a payment method to finish the registration.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you feel unsure about your New Jersey Civil Action Complaint (County Equalization Table) form, speak to a attorney to analyze it before you send or file it. Get started without hassles!

Form popularity

FAQ

The equalization ratio is a key concept to understand; it measures a city's current market value as compared to its assessed value. All of Jersey City's taxable property, when added together, is called the tax base. The tax base has two values: (1) current market value and (2) assessed value.

To calculate your individual property's effective tax rate, all you have to do is divide your annual tax bill by what you estimate to be the market value of your property. So, if you own a property worth $300,000 and your annual tax bill is $10,000, then your individual effective tax rate is 3.33%.

Capped Value = (Prior Year's Taxable Value - Losses) x (the lower of 1.05 or the INFLATION RATE Multiplier) + Additions. Additions are all increases in value caused by new construction, remodeling, and the value of property that was exempt from taxes or not included on the assessment roll.

An equalization ratio equals a property's assessed value divided by its market value. A municipality typically uses the assessed value to calculate property taxes, whereas the market value is the amount for which the property would likely sell on the open market.

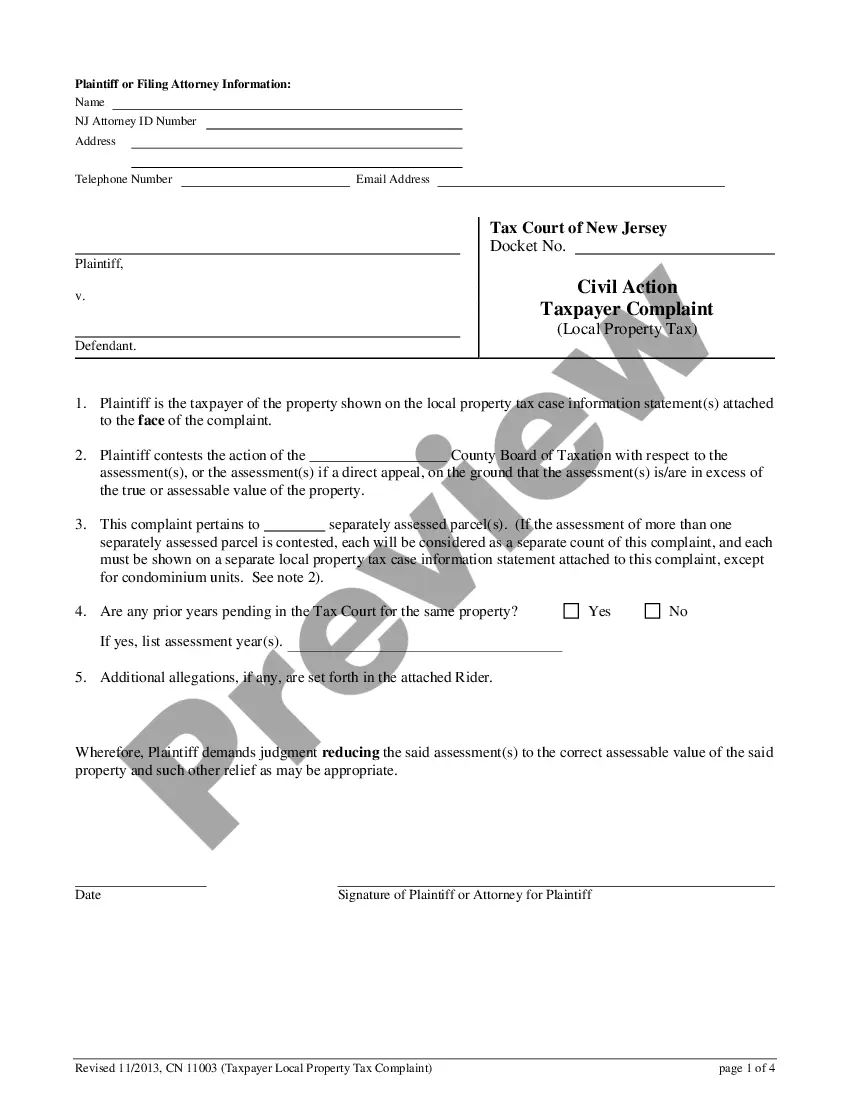

STEP 1: Fill out the Special Civil Part Complaint Form (Form A). The Special Civil Part Complaint tells the court and the defendant about the facts of the case and the amount of money that you want from the defendant. STEP 2: Fill out the Special Civil Part Summons (Form B).

The cost of filing in the Special Civil Part-Civil is $54.00 if you are filing a case against one defendant, plus $6.00 for each additional defendant. HOW DO I FILE A LAWSUIT? There are at least two parties in a suit.

The average equalized tax rate in New Jersey was 2.279 in 2020, according to data from the Department of Community Affairs. Here is the list of 30 New Jersey towns with the highest property tax rates.

What is the equalization rate? The equalization rate simply defines the relationship of a property's assessed value to its full value.An equalization rate of 0.80 means that a property is assessed at 80 percent of its full value.

To calculate an equalization rate for a given town, which is done by the state (not the school district) and finalized in August before the start of the school year, the state takes the total assessed value of the municipality and divide it by the total market value of the municipality.