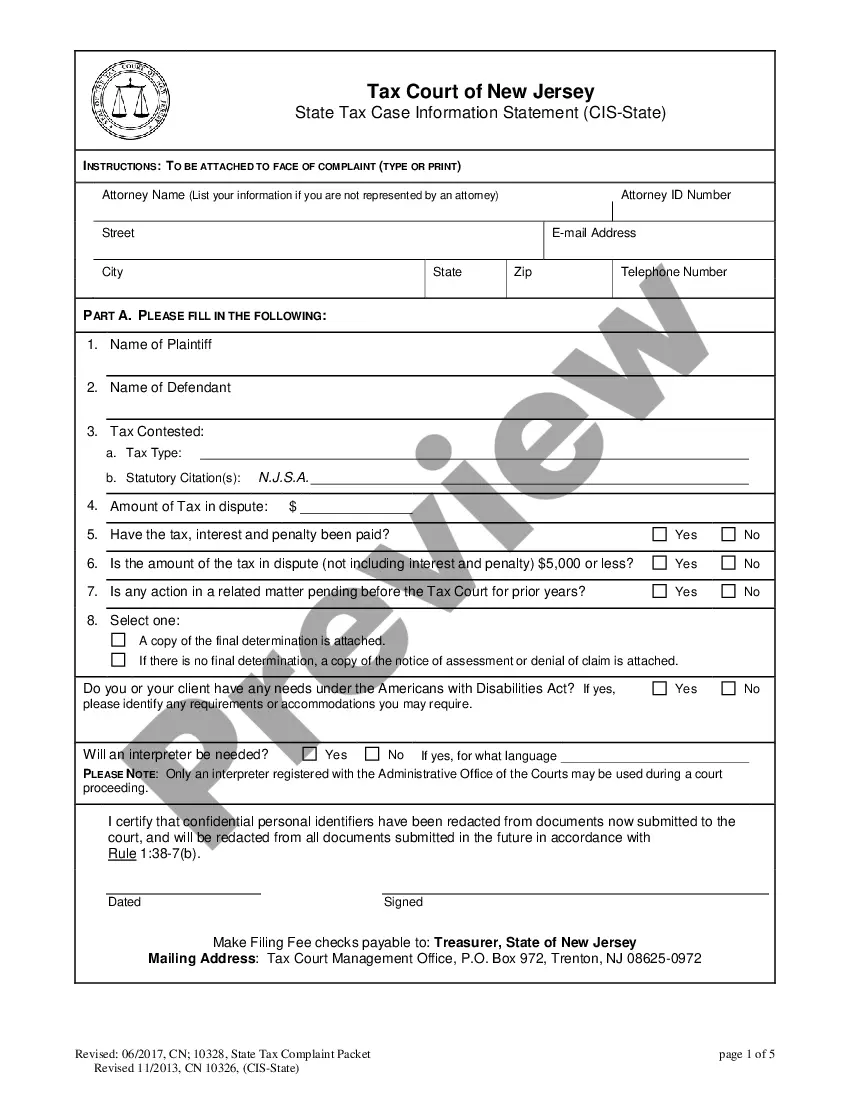

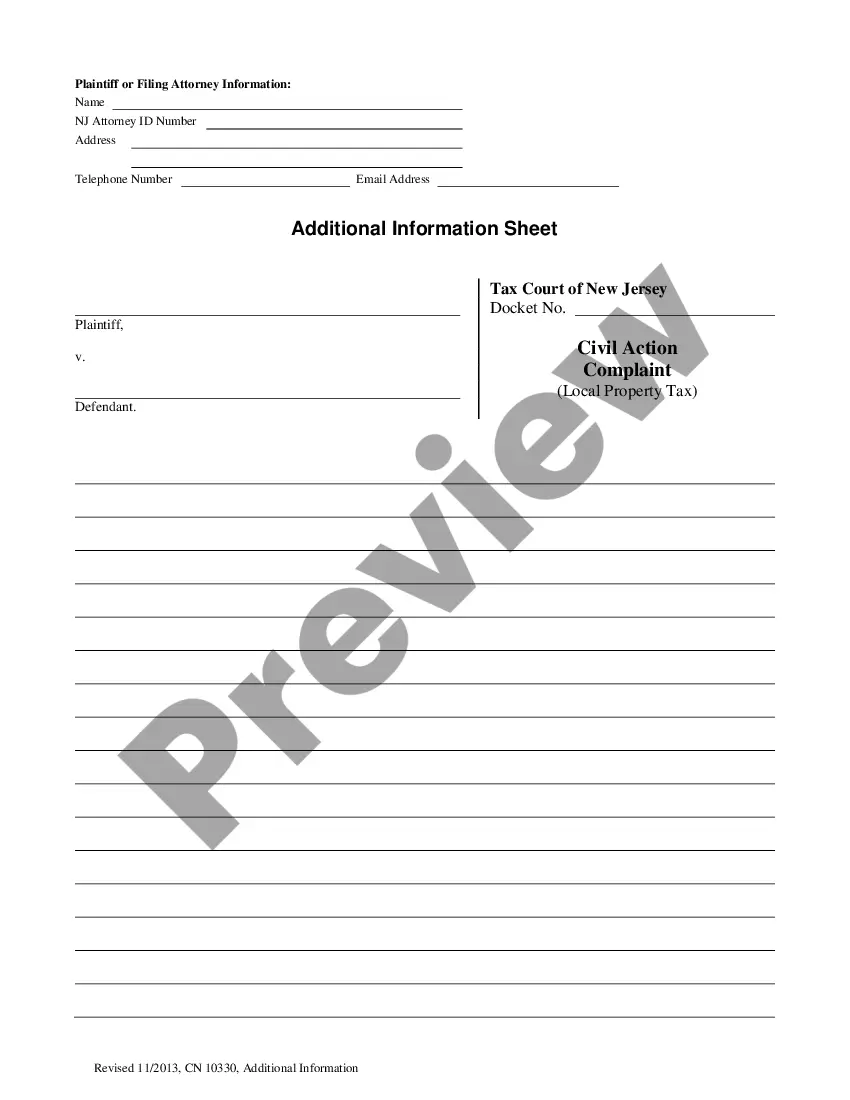

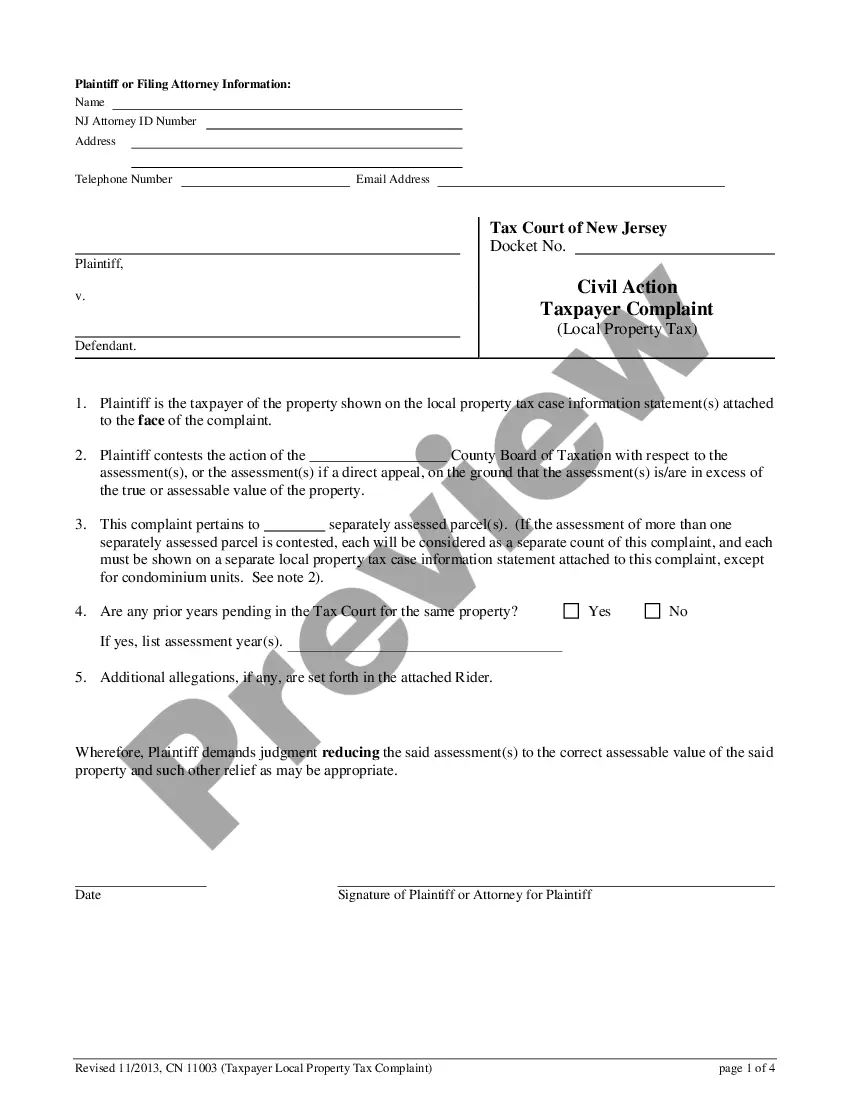

New Jersey Complaint (To Be Used For Tax Relief Programs)

Description

How to fill out New Jersey Complaint (To Be Used For Tax Relief Programs)?

US Legal Forms is really a special platform to find any legal or tax template for filling out, including New Jersey Complaint (To Be Used For Tax Relief Programs). If you’re sick and tired of wasting time searching for ideal samples and paying money on record preparation/lawyer fees, then US Legal Forms is precisely what you’re trying to find.

To enjoy all of the service’s benefits, you don't need to install any application but just select a subscription plan and register your account. If you have one, just log in and get an appropriate template, download it, and fill it out. Saved files are stored in the My Forms folder.

If you don't have a subscription but need to have New Jersey Complaint (To Be Used For Tax Relief Programs), check out the guidelines below:

- Double-check that the form you’re considering applies in the state you want it in.

- Preview the form its description.

- Click Buy Now to access the sign up page.

- Choose a pricing plan and proceed registering by providing some information.

- Decide on a payment method to complete the sign up.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are uncertain about your New Jersey Complaint (To Be Used For Tax Relief Programs) sample, contact a attorney to review it before you send or file it. Get started without hassles!

Form popularity

FAQ

Age 65 or older and disabled exemptions: Individuals age 65 or older or disabled residence homestead owners qualify for a $10,000 homestead exemption for school district taxes, in addition to the $25,000 exemption for all homeowners.Each taxing unit decides if it will offer the exemption and at what percentage.

Form PTR-2 is a personalized application that we mail only to those who filed an application and met all the eligibility requirements for a reimbursement the previous year.

65 or older as of December 31, 2019; or. Actually receiving federal Social Security disability benefit payments (not benefit payments received on behalf of someone else) on or before December 31, 2019, and on or before December 31, 2020.

To appeal your property's assessment, File Form A-1 and Form A-1 Comp. Sale with the County Board of Taxation. Occasionally, property owners make changes or additions to real property after October 1, when municipalities set the value of property for tax purposes for the following tax year.

Though we try to mail applications to those who may be eligible for the program, it may be necessary to contact the Senior Freeze Information Line at 1-800-882-6597 to request an application or print a copy of Form PTR-1 from our website.

609-826-4400 or 1-800-323-4400 (within NJ, NY, PA, DE, and MD) Listen to prerecorded information on common tax issues.

An annual $250 deduction from real property taxes is provided for the dwelling of a qualified senior citizen, disabled person or their surviving spouse. To qualify, you must be age 65 or older, or a permanently and totally disabled individual or the unmarried surviving spouse, age 55 or more, of such person.

The Senior Freeze program, which is really a reimbursement program rather than an actual freezing of tax amounts, is available to state residents 65 and older or individuals with disabilities who meet the eligibility requirements.Taxpayers must pay the full tax bill every year.