New Mexico Seller's Information for Appraiser provided to Buyer

About this form

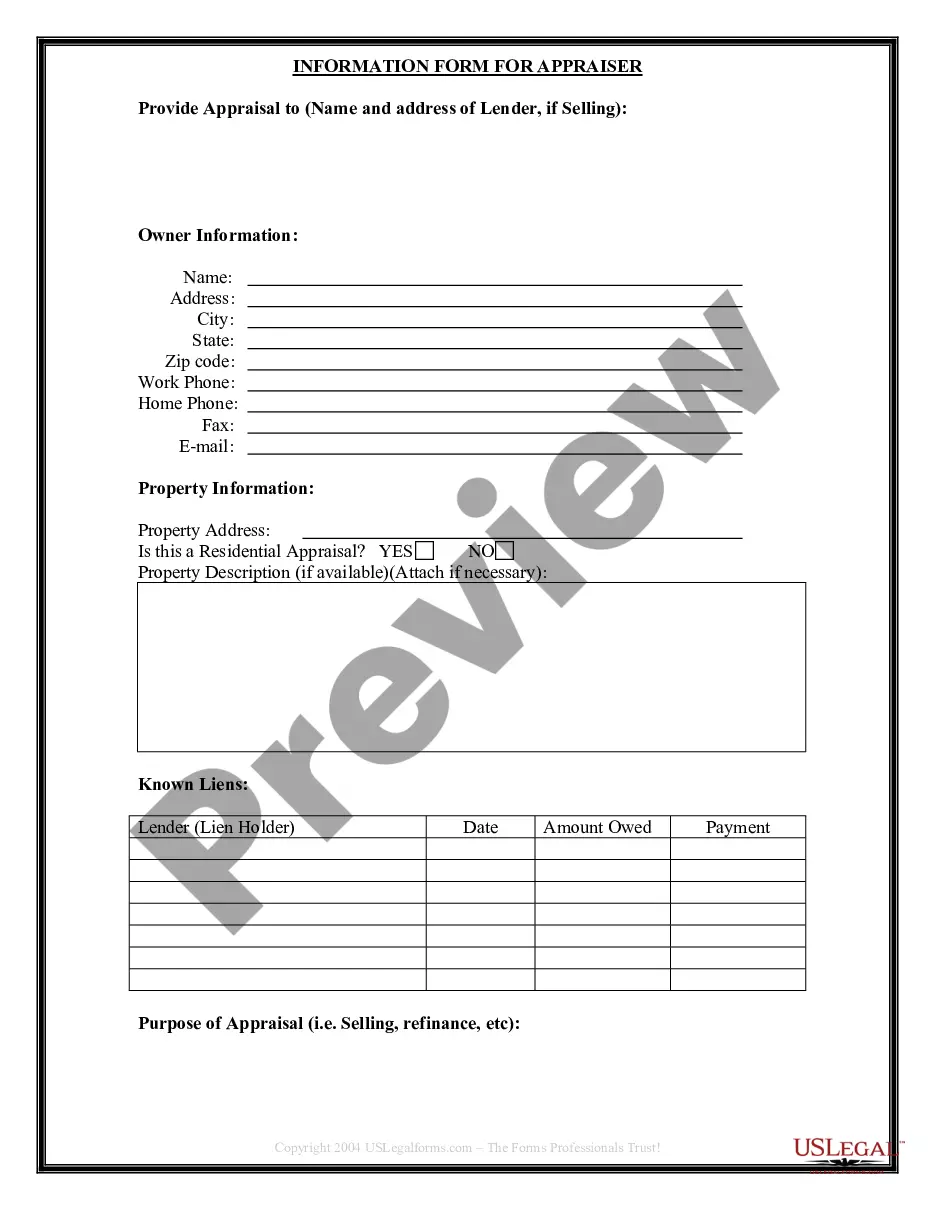

The Seller's Information for Appraiser provided to Buyer form is a legal document used by buyers in New Mexico. It collects essential information required by an appraiser to conduct a property appraisal before a purchase. This form helps streamline the transaction process by ensuring that appraisers receive the necessary data from sellers, facilitating a smoother home buying experience compared to other forms used in real estate transactions.

Key components of this form

- Seller's contact information

- Property description, including address and specifics

- Details on recent improvements or repairs made to the property

- Disclosure of any known issues or defects with the property

- Additional notes relevant for the appraiser

When to use this form

This form should be used when a buyer is preparing to purchase property in New Mexico and requires an appraisal. The buyer will provide this form to the seller, who must complete it and return it to relay crucial information that will aid the appraiser in evaluating the propertyâs value. It is particularly useful when dealing with various types of properties, ensuring that all pertinent details are captured for the appraisal process.

Intended users of this form

This form is intended for:

- Buyers in New Mexico who are in the process of acquiring property

- Sellers who need to provide their information to the buyer for appraisal purposes

- Real estate agents facilitating transactions between buyers and sellers

- Appraisers requiring a detailed overview of the property from the seller

Instructions for completing this form

- Identify and enter the seller's contact information at the top of the form.

- Provide a detailed description of the property being appraised, including its address.

- List any recent improvements or repairs made to the property in the designated section.

- Disclose any known issues or defects associated with the property.

- Include any additional notes that may assist the appraiser in their evaluation.

Is notarization required?

Notarization is not commonly needed for this form. However, certain documents or local rules may make it necessary. Our notarization service, powered by Notarize, allows you to finalize it securely online anytime, day or night.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to provide complete contact information for the seller.

- Omitting critical details about recent property improvements.

- Not disclosing known issues or defects, which can lead to appraisal discrepancies.

- Submitting the form without a thorough review for accuracy.

Why complete this form online

- Immediate access to a legally formatted document ready for download.

- Convenient online completion ensures accuracy and saves time.

- Editability allows sellers to provide up-to-date information without hassle.

- Secure storage of documents on the platform for easy retrieval.

Looking for another form?

Form popularity

FAQ

Home sellers aren't entitled to copies of the appraisals mortgage lenders conduct on behalf of their borrowers. If a home seller wants a copy of an appraisal, she should consider asking for a copy from the buyer.However, a copy may come in handy if the appraisal comes in low and price negotiations must ensue.

A: An appraisal is generally considered a professional opinion of the market value of a property, not a fact. Although it's both legally and ethically necessary to disclose a material fact, the same requirement doesn't apply to an opinion.

Will the homebuyer receive a copy of the appraisal? A. Yes! Regulations allow real estate agents, or other persons with an interest in the real estate transaction, to communicate with the appraiser and provide additional property information, including a copy of the sales contract.

A home that appraises for higher than the purchase price is a benefit to buyers as it means instant equity. Its impact on sellers is subject to how motivated they are. Still, offering something for sale only to find out that it's worth much more may be enough to make a seller reconsider.

By looking at the type of property you're selling, it's size and features, the suburbs and local area, the property's interior and exterior features, yard features and the mechanics and style of the property, and then comparing these to similar properties in the city or suburb, your real estate agent will be able to

If you're a seller, you almost never see the appraisal, unless the buyer wants to show it to you. If the home appraised for more than sale price, the buyer might be a little reluctant to show the appraisal to you!

Home sellers aren't entitled to copies of the appraisals mortgage lenders conduct on behalf of their borrowers. If a home seller wants a copy of an appraisal, she should consider asking for a copy from the buyer.However, a copy may come in handy if the appraisal comes in low and price negotiations must ensue.

Typically, the buyer pays for a home appraisal. The buyer can pay up front at the time of the appraisal or the appraiser's fee can be included in closing costs. Yet while the buyer usually pays for the appraisal, he or she doesn't order the appraisal.

The seller often does not generally get a copy of the appraisal, but they can request one. The CRES Risk Management legal advice team noted that an appraisal is material to a transaction and like a property inspection report for a purchase, it needs to be provided to the seller, whether or not the sale closes.