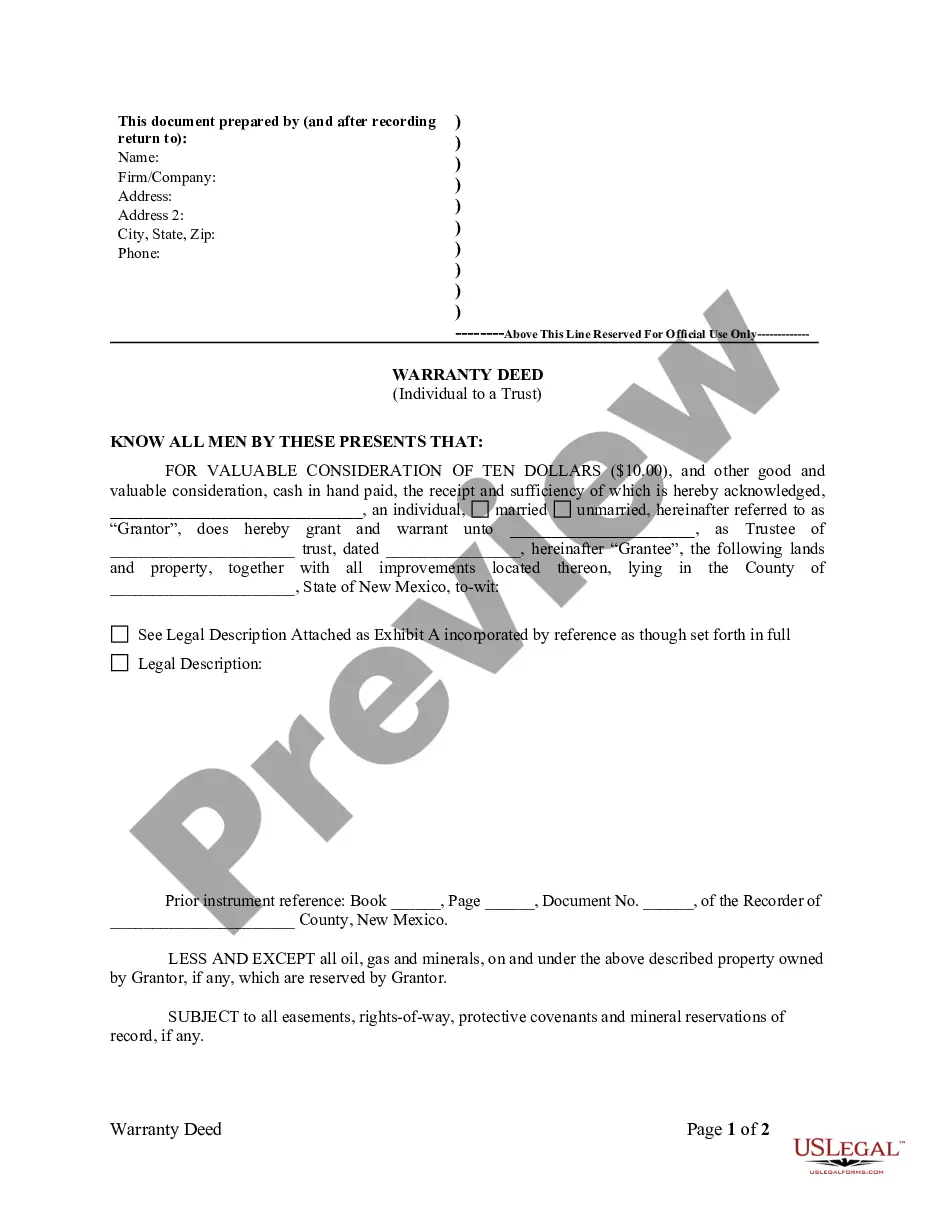

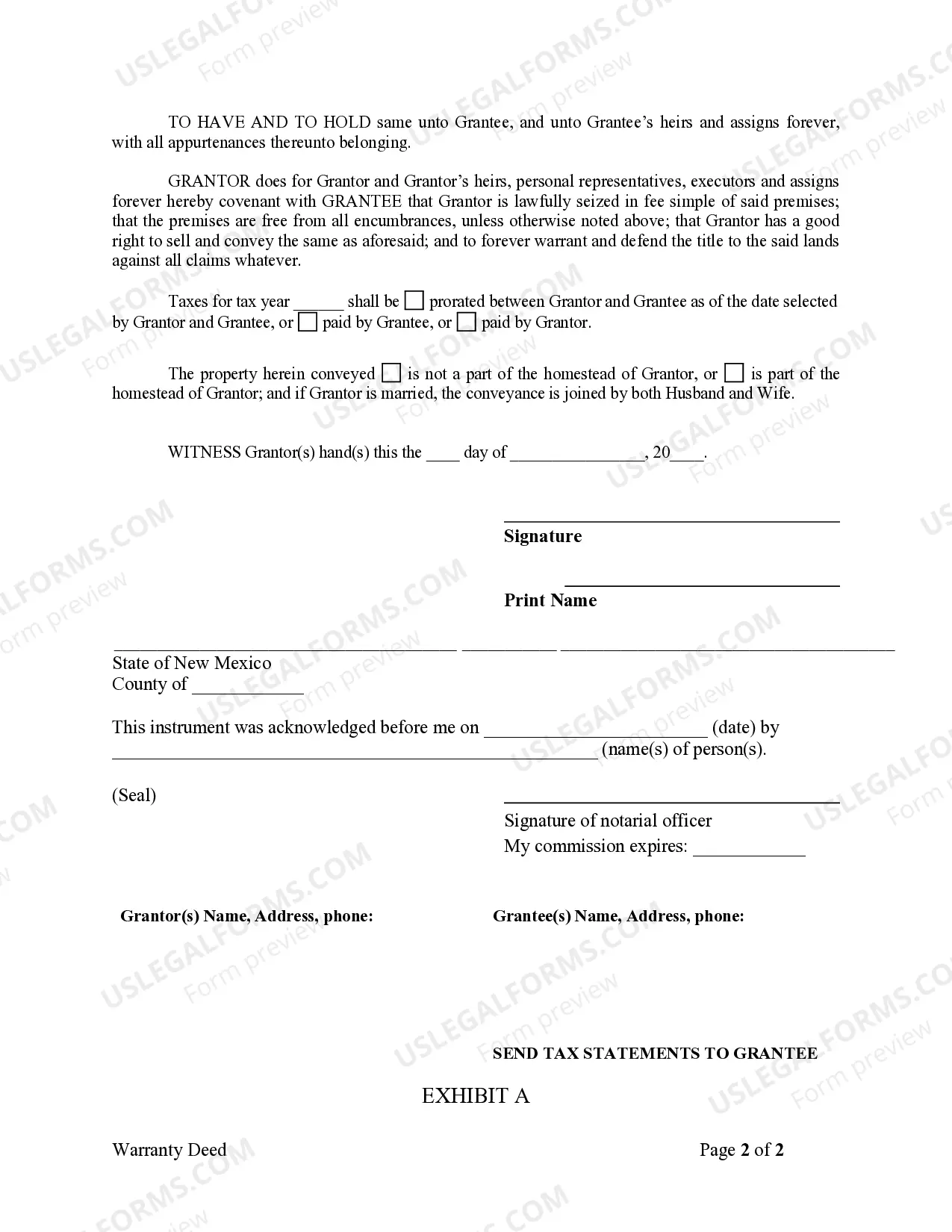

New Mexico Warranty Deed from Individual to a Trust

Description New Mexico Trust

How to fill out Warranty Individual Trust?

US Legal Forms is a special system to find any legal or tax template for completing, such as New Mexico Warranty Deed from Individual to a Trust. If you’re tired with wasting time seeking ideal samples and spending money on file preparation/lawyer service fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all the service’s benefits, you don't have to install any software but just select a subscription plan and register an account. If you have one, just log in and find the right template, download it, and fill it out. Saved documents are stored in the My Forms folder.

If you don't have a subscription but need New Mexico Warranty Deed from Individual to a Trust, have a look at the instructions listed below:

- Double-check that the form you’re considering applies in the state you want it in.

- Preview the example and read its description.

- Click on Buy Now button to access the sign up page.

- Pick a pricing plan and keep on registering by entering some information.

- Decide on a payment method to finish the registration.

- Save the document by selecting your preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you are unsure about your New Mexico Warranty Deed from Individual to a Trust sample, contact a attorney to review it before you decide to send or file it. Get started without hassles!

Warranty Deed New Mexico Form popularity

New Mexico Deed Sample Other Form Names

New Mexico Warranty Deed FAQ

In the context of a California mortgage transaction, a trust deed also transfer ownership. Only this time, the title is being placed in the hands of a third-party trustee, who holds the property on behalf of the lender and the homeowner-borrower until the mortgage is paid.

How To Establish A Trust. You will need to retain an estate attorney to draft and execute your trust document. For a simple revocable or irrevocable trust, it may cost anywhere from $2,000 $5,000.

A deed conveys ownership; a deed of trust secures a loan.

Locate your current deed. Use the proper deed. Check with your title insurance company and lender. Prepare a new deed. Sign in the presence of a notary. Record the deed in the county clerk's office. Locate the deed that's in trust. Use the proper deed.

A trustee deed offers no such warranties about the title.

No. And unless the deed identifies the trust as an owner, then father is the owner of an interest. It is a common mistake to set up a trust and then fail to deed property into the trust. However, you cannot force him to make the changes you are...

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Take the signed and notarized quitclaim deed to your county recorder's office to complete the transfer of title into your revocable trust. Check in two to four weeks to ensure it has been recorded. Include the address of the property on the asset list addendum attached to your trust.