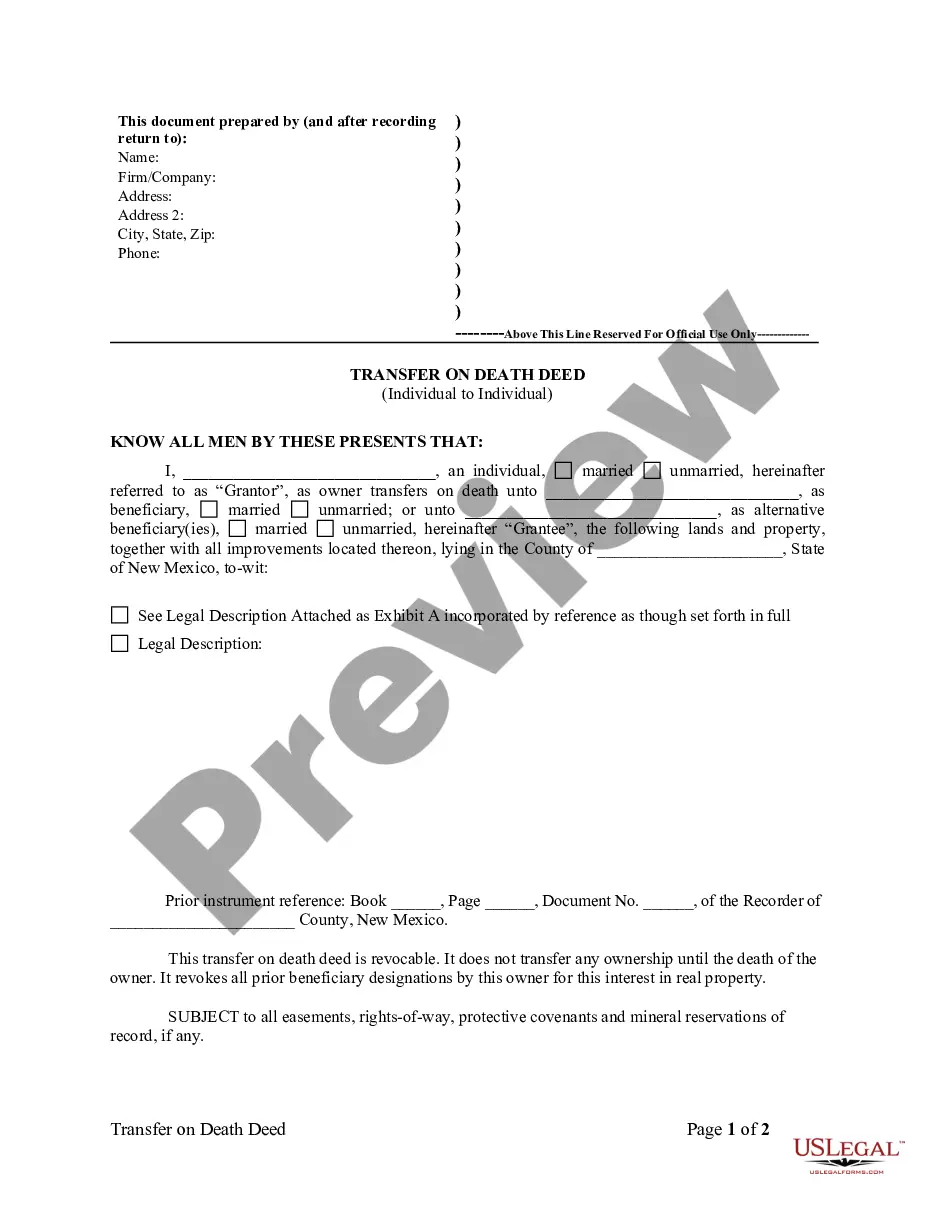

New Mexico Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description

Key Concepts & Definitions

Transfer on Death Deed (TOD) or Beneficiary Deed: A legal document that enables property owners to pass their real estate to a designated beneficiary without the need for probate upon the owner's death. This deed is effective upon the death of the owner and does not affect the owner's rights to the property during their lifetime.

Step-by-Step Guide to Creating a TOD Beneficiary Deed

- Contact a real estate law expert or an estate planning attorney to discuss your options and ensure compliance with local laws. Law firms like the Coleman Law Firm have expertise in estate planning and real estate law.

- Gather necessary personal information of the designated beneficiary such as full name, address, and relationship to the deed owner.

- Prepare the deed with precise legal descriptions of the property. This may require professional legal document preparation services.

- Review the draft deed to ensure all details are accurate and reflect the owners wishes. Engage a professional from a reputable Sacramento law firm for a thorough review.

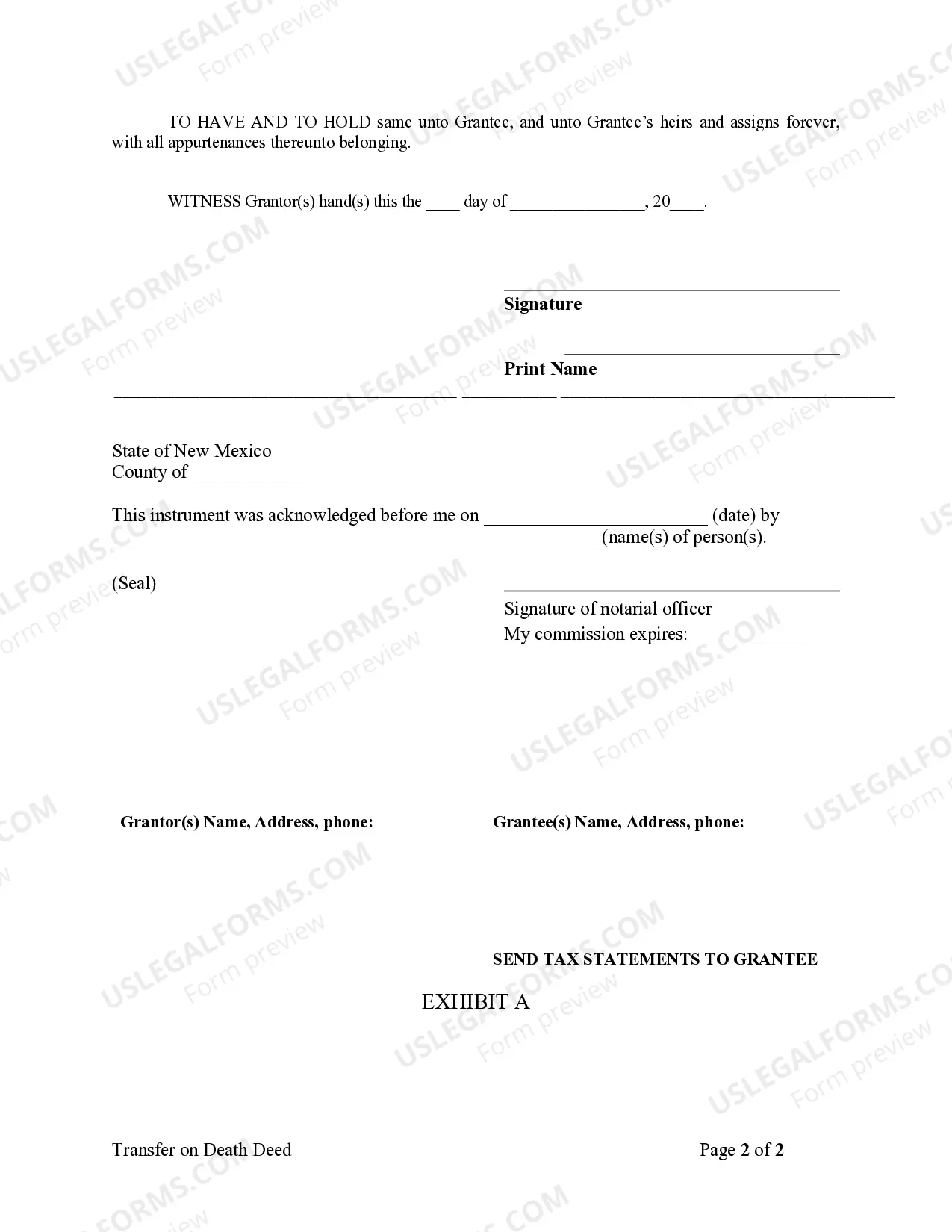

- Sign the deed in front of a notary public to ensure its legality and enforceability. Notary public services are available across the United States.

- File the signed deed with the local county recorders office to make it effective. The office may offer phone support for procedural questions.

Risk Analysis for Transfer on Death Deeds

- Probate Avoidance: TOD deeds can bypass lengthy and costly probate processes, but care must be taken to ensure all legal prerequisites are met.

- Legal Risks: Incorrectly drafted or improperly filed TOD deeds can lead to legal disputes or may not adequately protect against probate case issues.

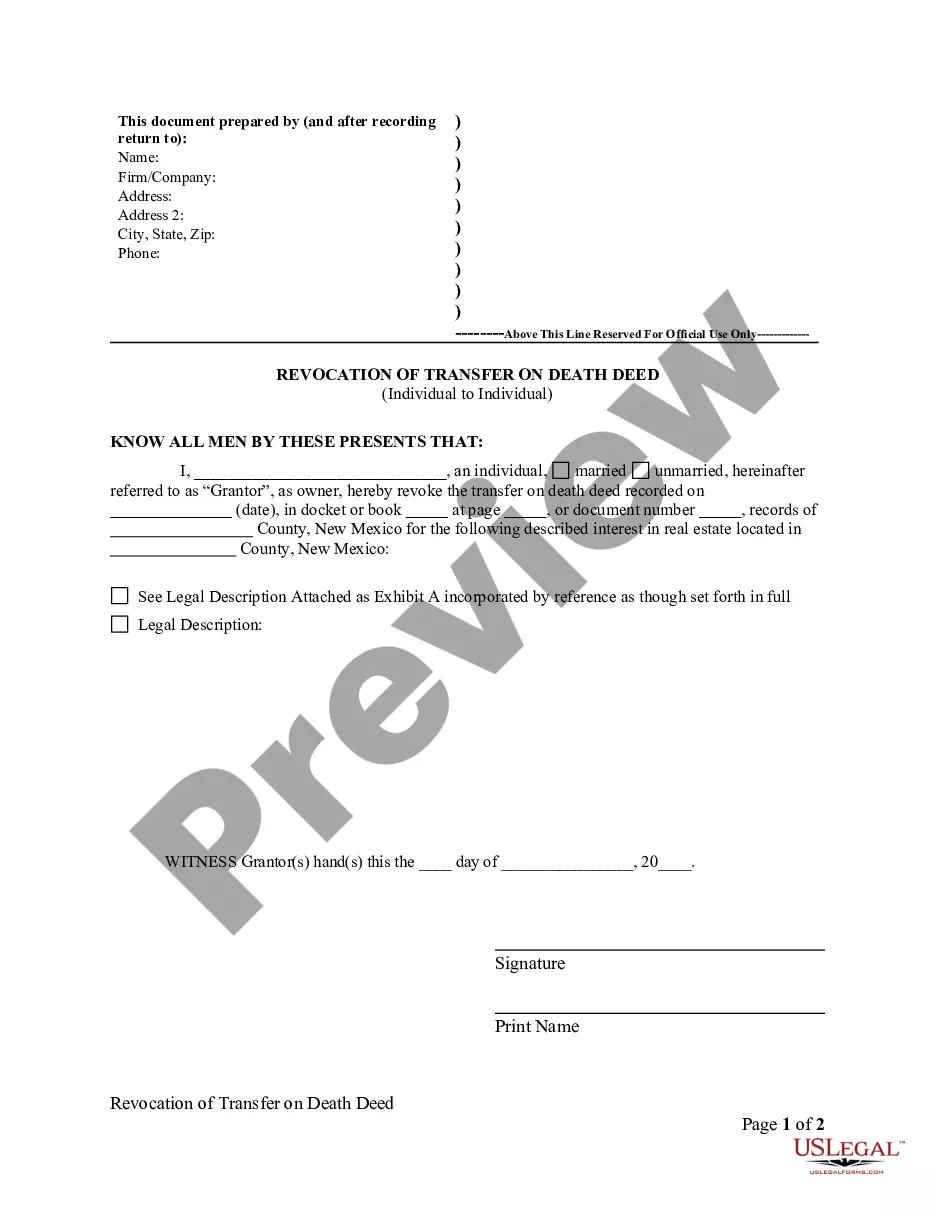

- Relationship Changes: Changes in the owner's relationship with the beneficiary (e.g., divorce, estrangement) necessitate updates to the TOD deed.

- Market Risks: Changes in real estate law and market conditions can affect the efficacy and suitability of TOD deeds over time.

Best Practices

- Regularly review and update your TOD deed in consultation with an estate planning attorney to reflect any changes in your personal circumstances or relationships.

- Ensure that all legal document rights are explicitly stated and understood to prevent future legal challenges. Discuss these details with personal injury lawyers who understand estate overlaps.

- Use clear and concise language in the preparation of the deed to avoid ambiguities that could lead to legal disputes.

How to fill out New Mexico Transfer On Death Deed Or TOD - Beneficiary Deed For Individual To Individual?

US Legal Forms is actually a unique platform where you can find any legal or tax template for filling out, such as New Mexico Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. If you’re fed up with wasting time looking for ideal samples and spending money on file preparation/lawyer charges, then US Legal Forms is precisely what you’re searching for.

To reap all the service’s benefits, you don't have to download any software but simply pick a subscription plan and sign up your account. If you already have one, just log in and look for an appropriate sample, save it, and fill it out. Downloaded documents are saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, check out the guidelines below:

- check out the form you’re checking out applies in the state you want it in.

- Preview the sample its description.

- Simply click Buy Now to reach the register webpage.

- Pick a pricing plan and continue registering by providing some info.

- Decide on a payment method to complete the registration.

- Save the file by selecting the preferred file format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain regarding your New Mexico Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual form, speak to a attorney to analyze it before you send out or file it. Start hassle-free!

Form popularity

FAQ

Transfer-on-death (TOD) arrangements may be used to pass certain assets to designated beneficiaries. A beneficiary form states who will directly inherit the asset at your death.TOD arrangements require minimal paperwork to establish.

Benefits of a California TOD Deed Form Probate Avoidance A transfer-on-death deed allows homeowners to avoid probate at death.Saving Legal Fees Although the goals of a transfer-on-death deed could also be accomplished with a living trust, a transfer-on-death deed provides a less expensive alternative.

The transfer on death designation lets beneficiaries receive assets at the time of the person's death without going through probate.With TOD registration, the named beneficiaries have no access to or control over a person's assets as long as the person is alive.

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries.

A transfer on death (TOD) account will avoid probate because assets transfer automatically to a beneficiary when the owner dies.

Receiving an inheritance can be an unexpected windfall. However, it doesn't avoid taxes.In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

As Fidelity Investments notes, a TOD is a provision of a brokerage account that allows the account's assets to pass directly to an intended beneficiary; the equivalent of a beneficiary designation. Though laws governing estate planning vary by state, many bank accounts, investment accounts and even deeds are

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.