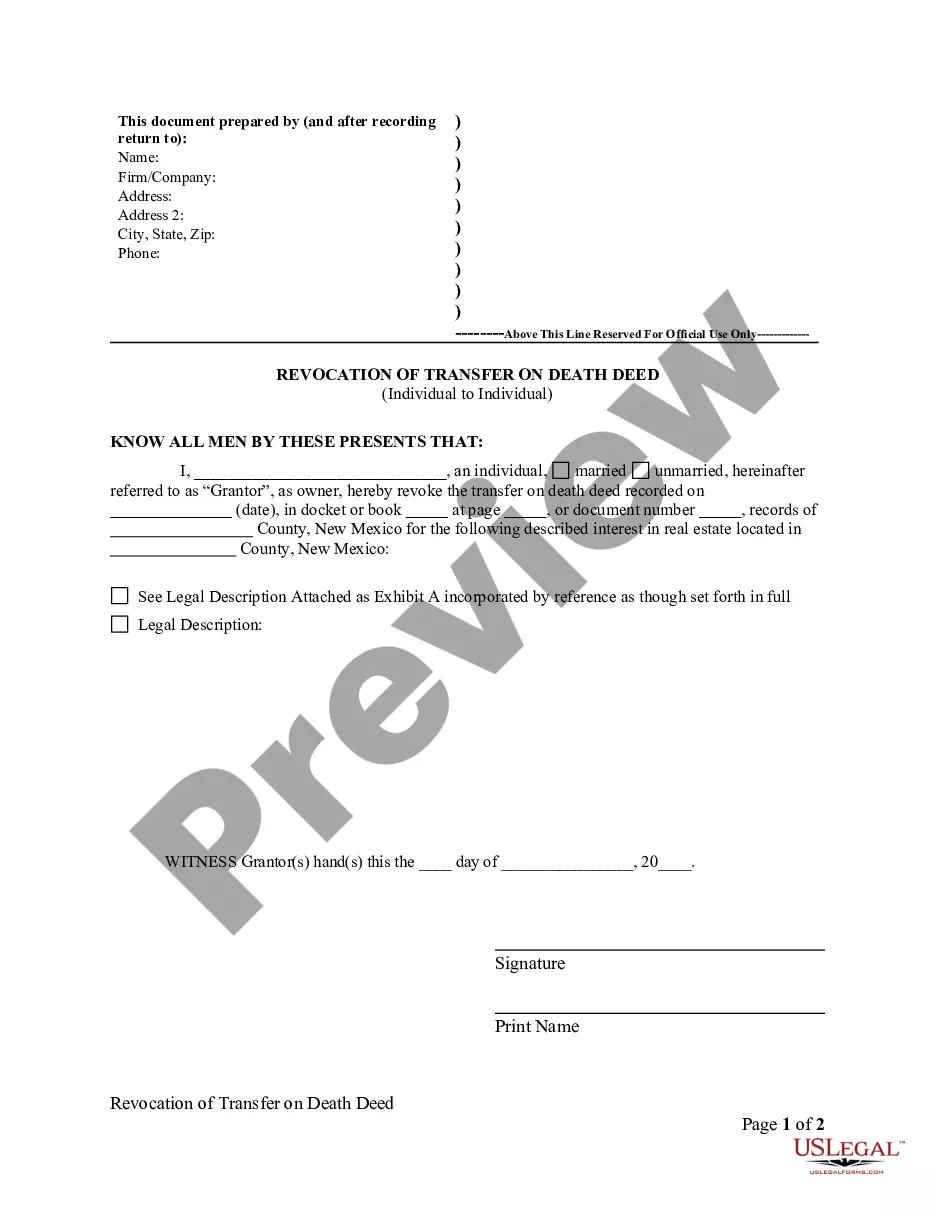

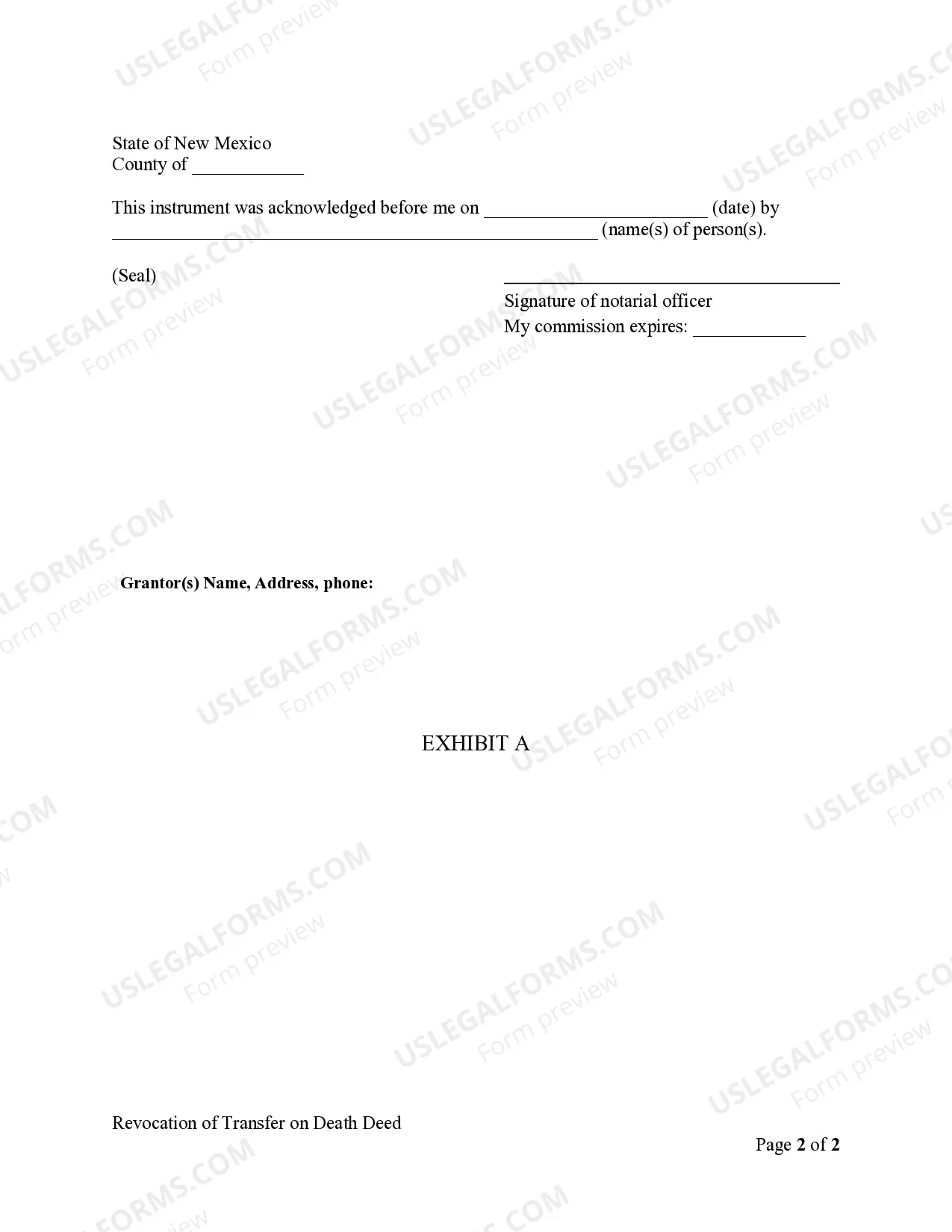

Revocation of Transfer on Death Deed - Beneficiary Deed - New Mexico - Individual to Individual: This form is a revocation of a transfer on death or beneficiary deed. It must be made by the record owner at any time prior to the death of the record owner by the record owner executing, acknowleding and recording in the office of the county clerk in the county where the real property is located an instrument describing the interest and revoking the designation. The signature, consent or agreement of or notice to the grantee beneficiary(ies) is not required. A properly executed, acknowledged and recorded transfer on death deed is not revoked by the provisions of a will.

New Mexico Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual

Description Transfer On Death Deed New Mexico Pdf

How to fill out Transfer Of Deed Upon Death Form?

US Legal Forms is really a special system to find any legal or tax document for submitting, such as New Mexico Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual. If you’re tired with wasting time searching for perfect samples and paying money on file preparation/legal professional fees, then US Legal Forms is exactly what you’re trying to find.

To experience all the service’s advantages, you don't have to download any application but simply pick a subscription plan and create an account. If you have one, just log in and get an appropriate template, download it, and fill it out. Downloaded documents are all stored in the My Forms folder.

If you don't have a subscription but need New Mexico Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual, have a look at the recommendations listed below:

- check out the form you’re looking at applies in the state you want it in.

- Preview the sample and look at its description.

- Click Buy Now to get to the sign up page.

- Select a pricing plan and keep on registering by providing some information.

- Decide on a payment method to finish the sign up.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are unsure about your New Mexico Revocation of Transfer on Death Deed or TOD - Beneficiary Deed for Individual to Individual form, contact a lawyer to examine it before you decide to send out or file it. Get started hassle-free!

Deed Of Revocation Form Form popularity

Revocation Of Transfer On Death Deed Other Form Names

What Is A Tod Form FAQ

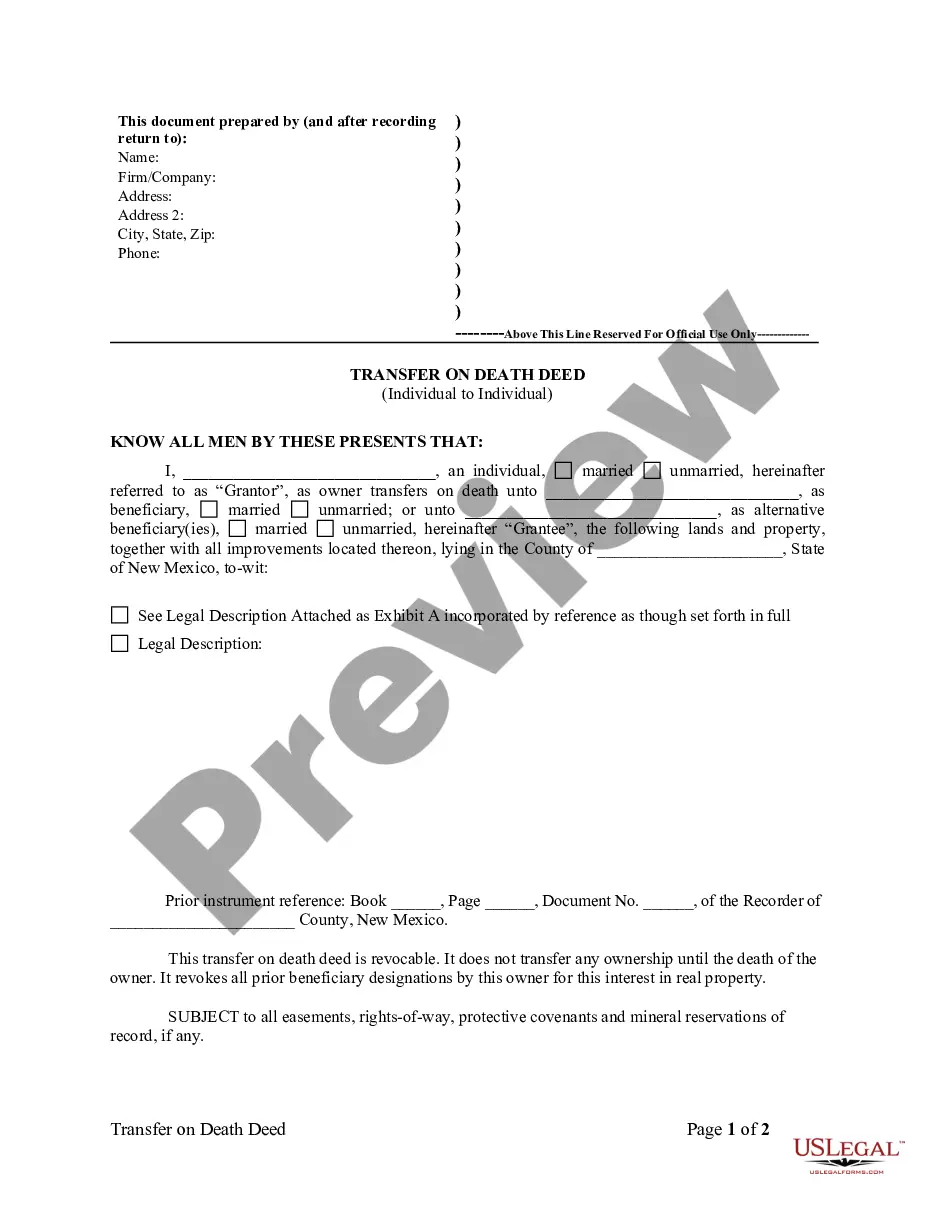

Overall, New Mexico's statutory transfer on death deed is a flexible estate planning tool that allows owners of real property in the state to convey a potential future interest in real property to one or more beneficiaries.

You can contest that too, it turns out. The same legal principles that allow a will contest forgery, fraud, undue influence, for example also apply to changes in beneficiary designation.It's not unusual for someone to have a large portion of his or her assets in beneficiary designated accounts.

Get a Deed Form or Prepare Your Own. You can buy a state-specific TOD deed form for your state or type up your own document. Name the Beneficiary. Describe the Property. Sign the Deed. Record the Deed.

200dA transfer-on-death account set up for your mutual funds or securities directs who receives the funds after your passing. A TOD designation supersedes a will.Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.

Receiving an inheritance can be an unexpected windfall. In fact, transfer on death accounts are exposed to all the same income and capital gains taxes when the account owner is alive, as well as estate and inheritance taxes upon the owner's death.

Because transfer-on-death beneficiary deeds do not become effective until you pass away, someone can challenge the validity of the deed after you die.Or, beneficiaries and family members can sue each other to take the property entirely. In this case, a court proceeding may be required to resolve the issue.

A transfer on death (TOD) account will avoid probate because assets transfer automatically to a beneficiary when the owner dies.

The bottom line: you have the right to contest a TOD Deed, just as you can a Will or Trust, but in many cases that will be no easy task.

A TOD designation supersedes a will. For bank accounts, you can set up a similar account known as payable-on-death, sometimes referred to as a Totten trust. Your beneficiaries can't touch the account while you're alive, and you're free to change beneficiaries or close the accounts at any time.