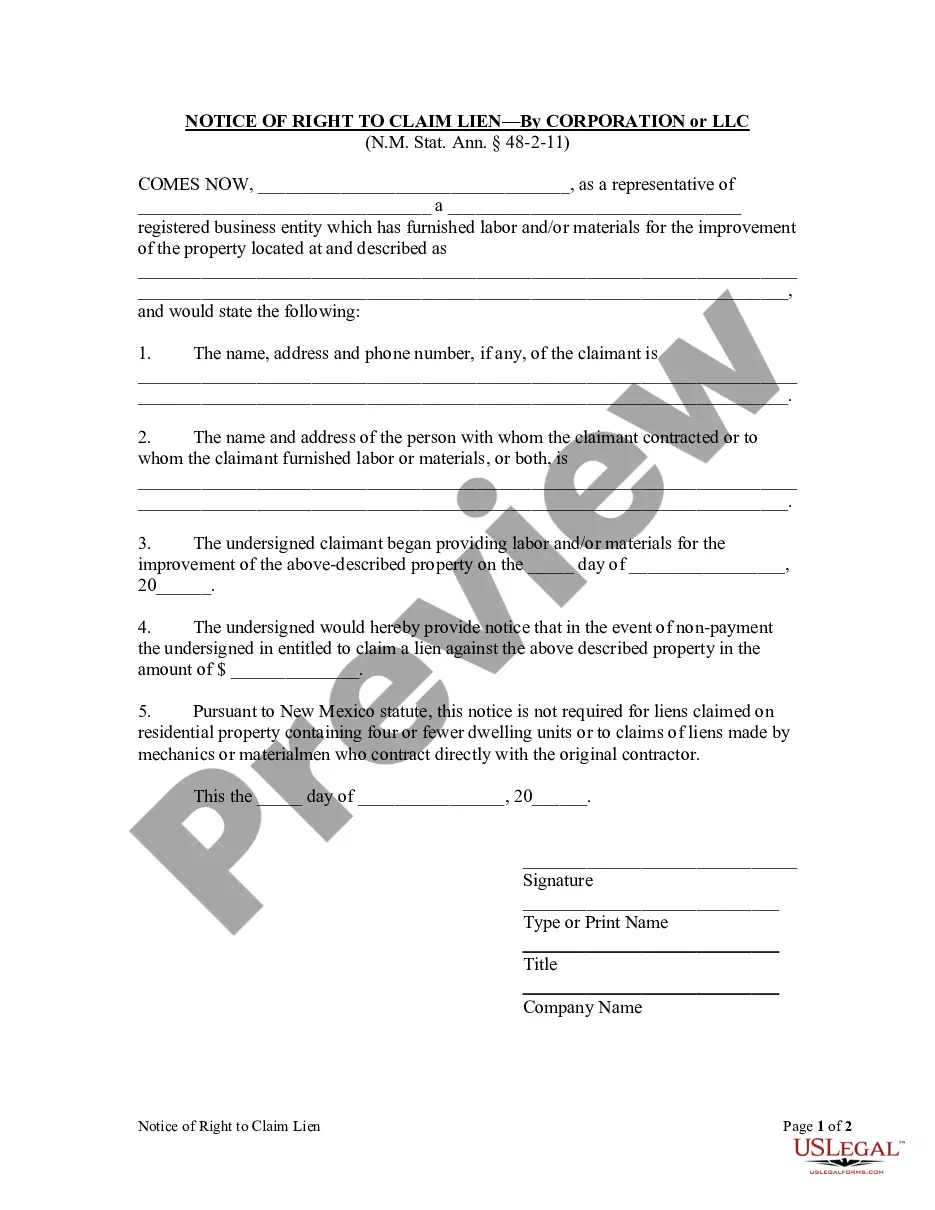

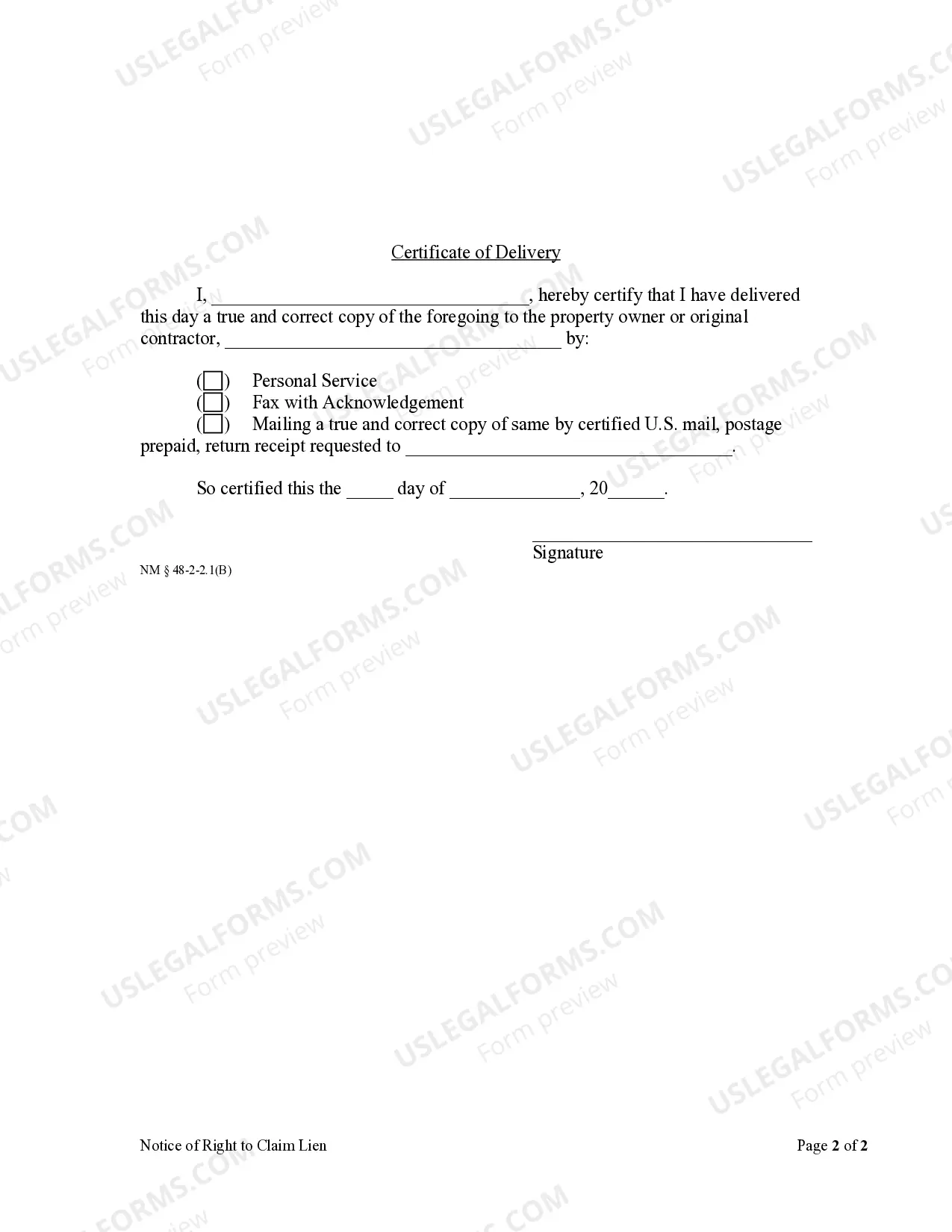

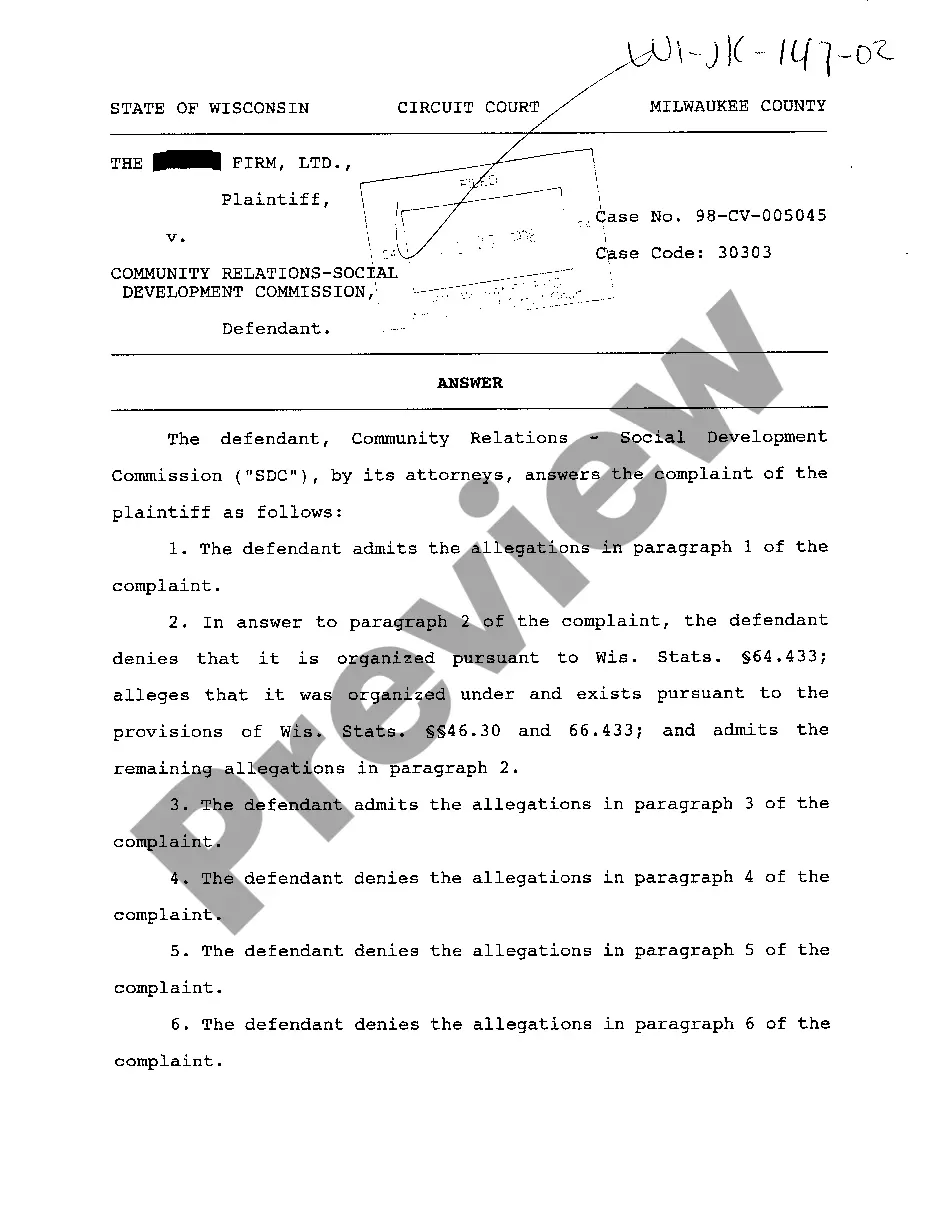

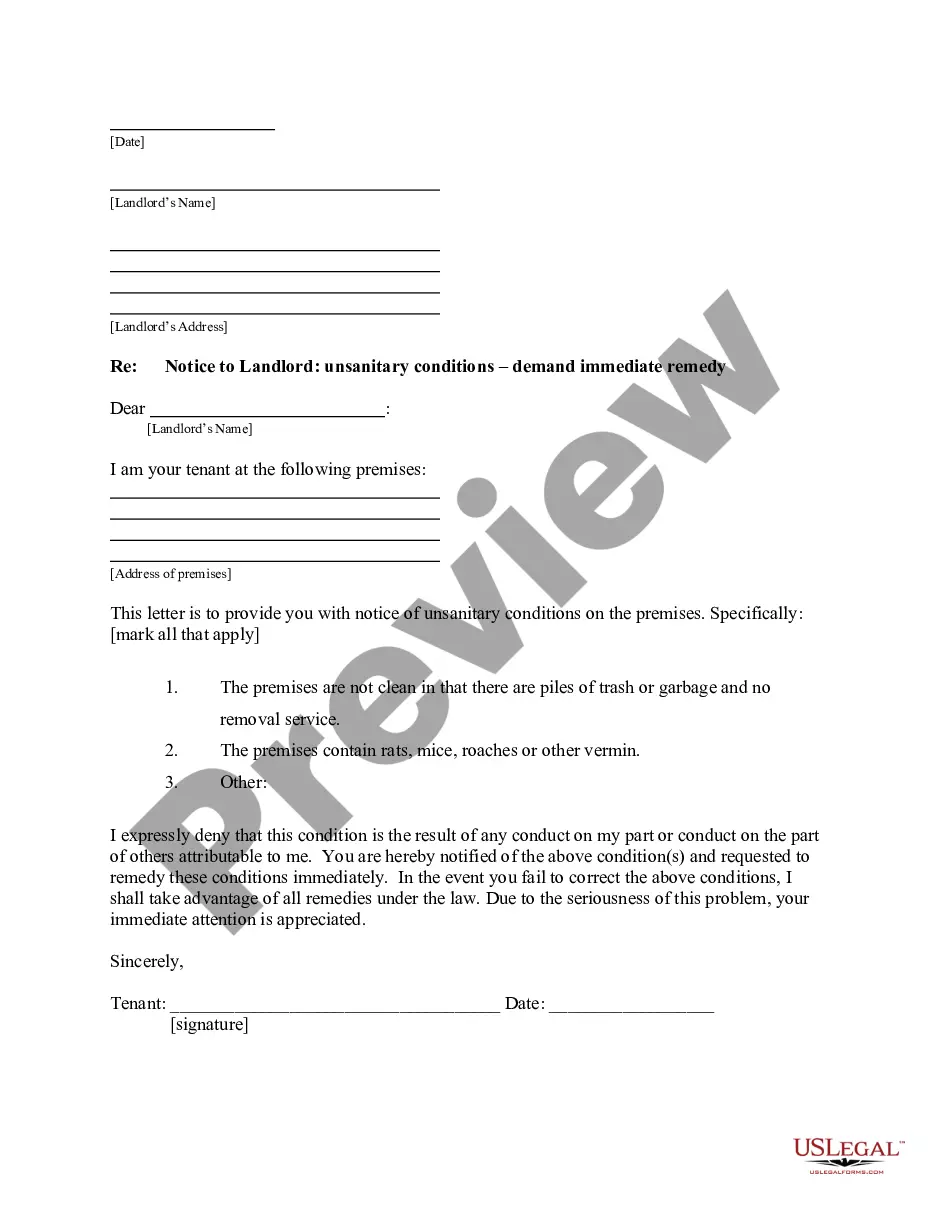

No lien of a mechanic or a materialman claimed in an amount of more than five thousand dollars ($5,000) may be enforced by action or otherwise unless the lien claimant has given notice in writing of his right to claim a lien in the event of nonpayment and that notice was given not more than sixty days after initially furnishing work or materials, or both, by either certified mail, return receipt requested, Fax with acknowledgment or personal delivery.

New Mexico Notice of Right to Claim Lien by Corporation

Description

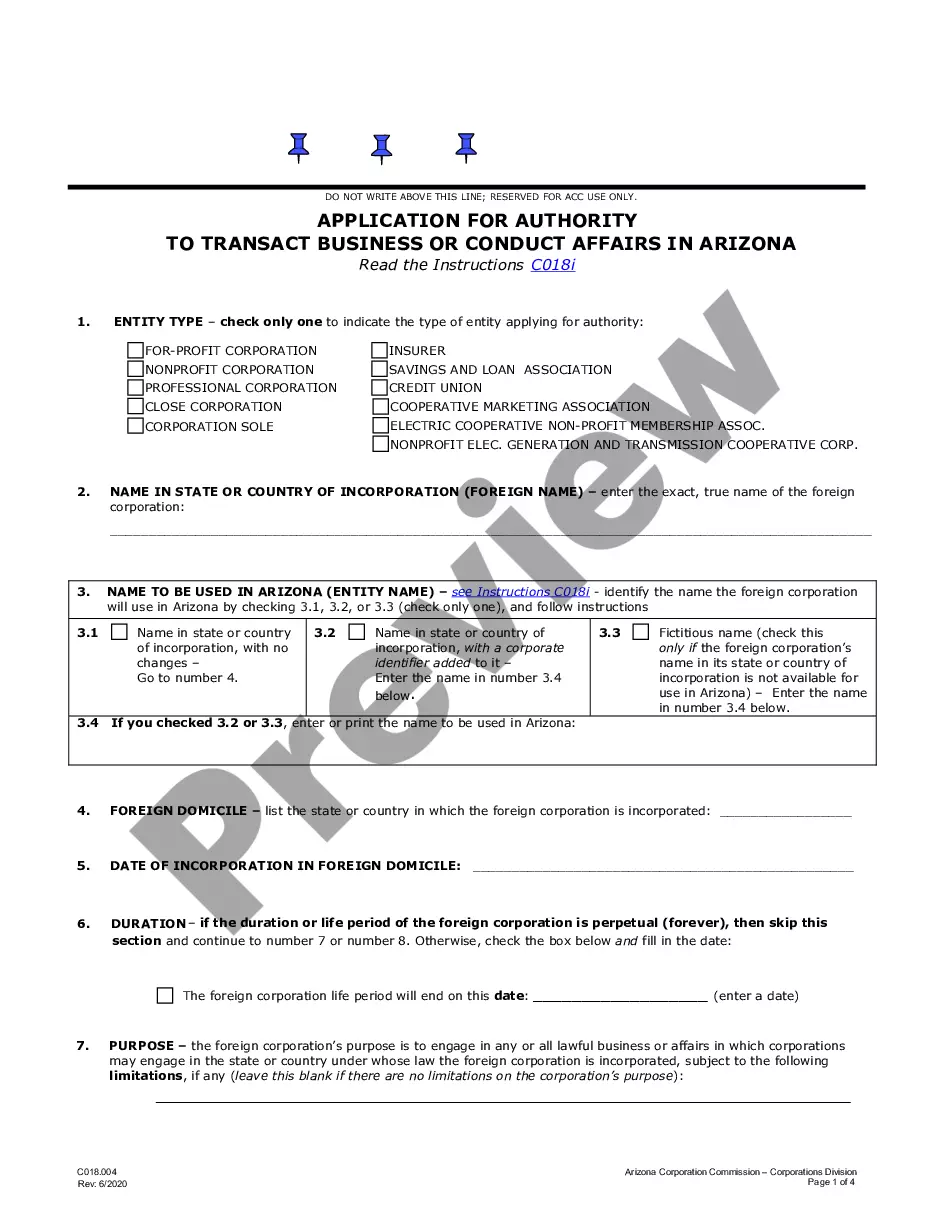

How to fill out New Mexico Notice Of Right To Claim Lien By Corporation?

US Legal Forms is actually a special platform to find any legal or tax document for submitting, including New Mexico Notice of Right to Claim Lien by Corporation or LLC. If you’re sick and tired of wasting time seeking ideal examples and spending money on record preparation/legal professional charges, then US Legal Forms is exactly what you’re seeking.

To reap all the service’s benefits, you don't need to install any application but simply choose a subscription plan and create your account. If you already have one, just log in and get a suitable template, download it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need New Mexico Notice of Right to Claim Lien by Corporation or LLC, take a look at the guidelines below:

- check out the form you’re checking out is valid in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to get to the register webpage.

- Pick a pricing plan and keep on signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are unsure about your New Mexico Notice of Right to Claim Lien by Corporation or LLC template, contact a attorney to check it before you send out or file it. Get started without hassles!

Form popularity

FAQ

Connecticut. Massachusetts. Maine. New Hampshire. New Jersey. Tennessee.

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

A lien is a claim or legal right against assets that are typically used as collateral to satisfy a debt. A lien could be established by a creditor or a legal judgement. A lien serves to guarantee an underlying obligation, such as the repayment of a loan.

Failure to record a Notice of Commencement or incorrect information on the Notice could contribute to your having to pay twice for the same work or materials. Prior to filing a lien, a lienor who does not have a direct contract with the owner, must serve the owner with a Notice to Owner.

New Mexico mechanics liens are perfected by filing the claim in the county clerk's office where the property is physically located. If the property is situated in more than one county, the claim should be filed in the clerk's office of all counties it is located in.

New Mexico mechanics liens are perfected by filing the claim in the county clerk's office where the property is physically located. If the property is situated in more than one county, the claim should be filed in the clerk's office of all counties it is located in.

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

New Mexico is known primarily as a lien theory state where the property acts as security for the underlying loan.It should be noted that New Mexico does have a non-judicial foreclosure process however this is rarely used by lenders in a residential context.