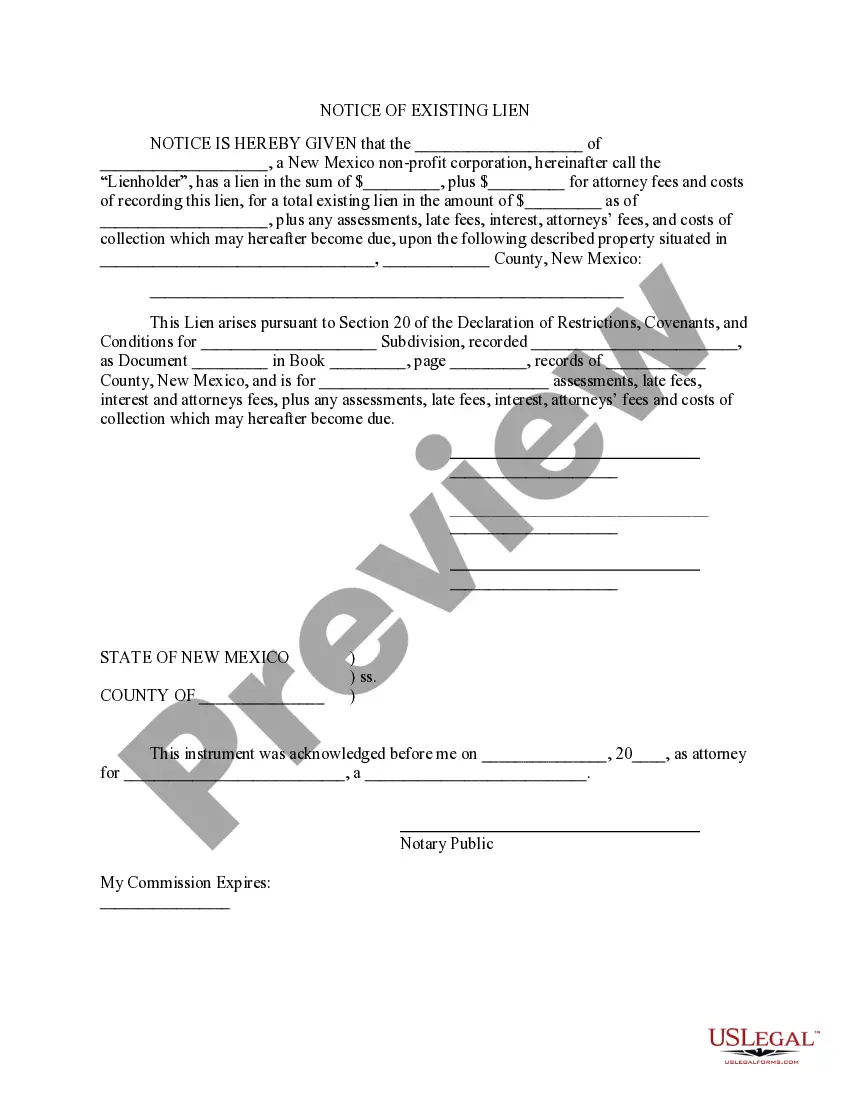

New Mexico Notice of Existing Lien

Description

How to fill out New Mexico Notice Of Existing Lien?

US Legal Forms is really a unique platform where you can find any legal or tax template for filling out, including New Mexico Notice of Existing Lien. If you’re tired of wasting time seeking appropriate samples and paying money on papers preparation/lawyer service fees, then US Legal Forms is exactly what you’re looking for.

To enjoy all of the service’s benefits, you don't have to download any application but simply select a subscription plan and create your account. If you already have one, just log in and get an appropriate template, save it, and fill it out. Saved files are all kept in the My Forms folder.

If you don't have a subscription but need New Mexico Notice of Existing Lien, take a look at the instructions below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the sample and read its description.

- Simply click Buy Now to reach the sign up page.

- Pick a pricing plan and continue signing up by entering some info.

- Select a payment method to complete the sign up.

- Download the file by choosing your preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you are uncertain regarding your New Mexico Notice of Existing Lien template, contact a legal professional to check it before you send or file it. Get started hassle-free!

Form popularity

FAQ

Subject to some exceptions, a lien for materials, services, or wages may be registered any time up to 45 days from the day the last materials, services, or wages were provided, or since the contract was abandoned. After those 45 days elapse, the lien expires.

Statutory and judgment liens have a negative impact on your credit score and report, and they impact your ability to obtain financing in the future. Consensual liens (that are repaid) do not adversely affect your credit, while statutory and judgment liens have a negative impact on your credit score and report.

A Lien Demand Letter or Notice of Intent to Lien is a formal demand for payment.A lien demand letter puts a debtor on notice of your intent to lien the job site property by a specific date deadline. Increase your odds of getting paid with a lien demand letter.

If a creditor puts a lien on your property, you may make an offer to settle the amount for less than you owe. As part of the negotiations, get the creditor to agree to release the lien. If you need help in the negotiations, consider hiring a debt settlement lawyer to help you.

New Mexico is known primarily as a lien theory state where the property acts as security for the underlying loan.It should be noted that New Mexico does have a non-judicial foreclosure process however this is rarely used by lenders in a residential context.

Formalize a defense for disputing the amount of the lien. Gather supporting documentation for your rebuttal, depending on the type of lien. Contact the agent representing the creditor to dispute the amount of the claim. Negotiate a payment settlement with the creditor if you cannot pay the amount you owe in full.

How Liens Work. A lien provides a creditor with the legal right to seize and sell the collateral property or asset of a borrower who fails to meet the obligations of a loan or contract. The property that is the subject of a lien cannot be sold by the owner without the consent of the lien holder.

Who you are. The services or materials you provided. The last date you provided the services or materials. How much payment should be. The date on which you will file a lien if you do not receive payment. How the debtor should pay.

A lien is a legal right or claim against a property by a creditor. Liens are commonly placed against property, such as homes and cars, so creditors, such as banks and credit unions, can collect what is owed to them. Liens can also be removed, giving the owner full and clear title to the property.