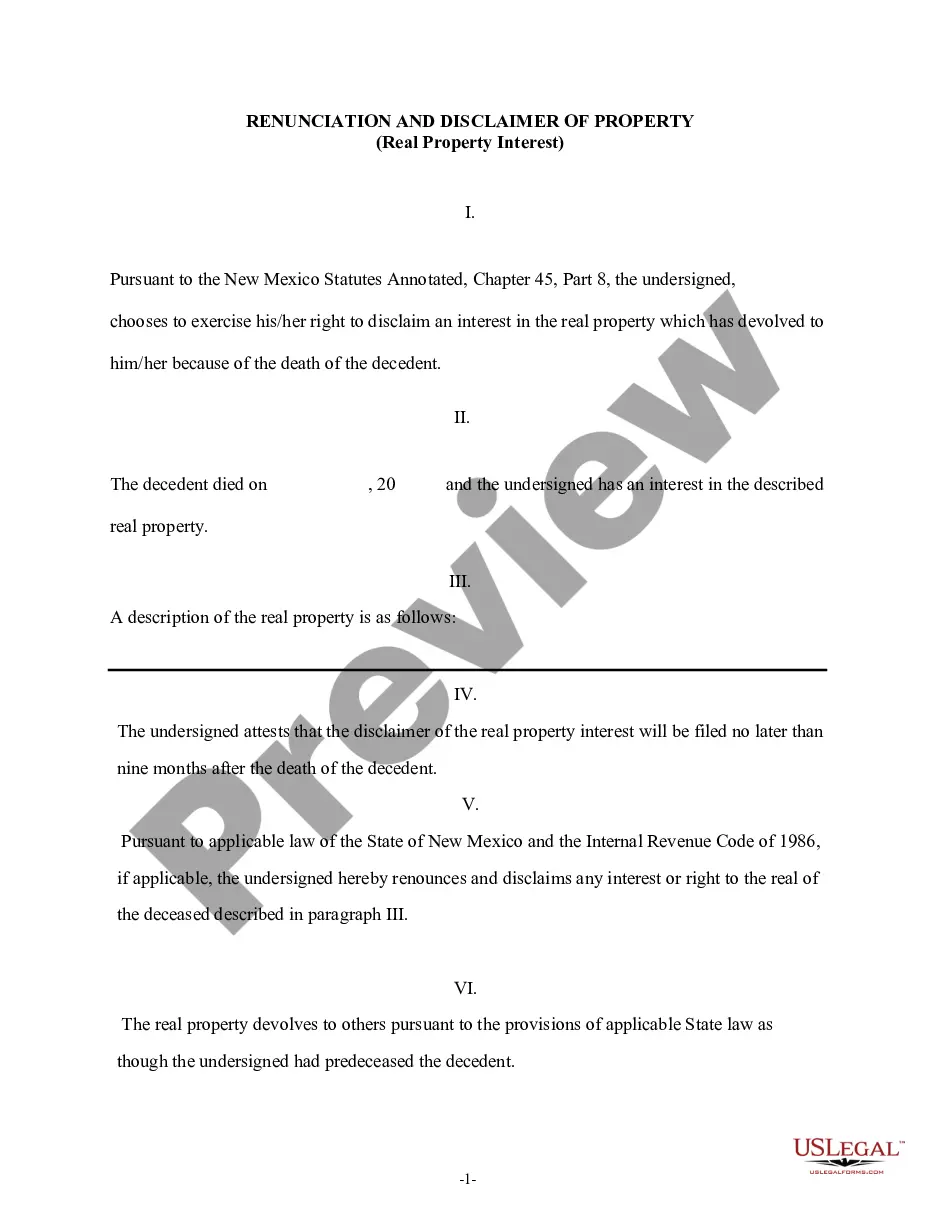

New Mexico Renunciation And Disclaimer of Real Property Interest

Description Disclaimer Real Property

How to fill out Renunciation Real Form?

US Legal Forms is a special system to find any legal or tax template for submitting, including New Mexico Renunciation And Disclaimer of Real Property Interest. If you’re tired with wasting time searching for suitable samples and paying money on file preparation/attorney fees, then US Legal Forms is exactly what you’re seeking.

To reap all of the service’s benefits, you don't need to download any software but just choose a subscription plan and create an account. If you have one, just log in and find a suitable template, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Mexico Renunciation And Disclaimer of Real Property Interest, check out the recommendations below:

- make sure that the form you’re looking at applies in the state you need it in.

- Preview the form and read its description.

- Click on Buy Now button to reach the sign up page.

- Choose a pricing plan and carry on signing up by providing some info.

- Pick a payment method to finish the sign up.

- Download the document by choosing the preferred file format (.docx or .pdf)

Now, submit the file online or print it. If you are uncertain concerning your New Mexico Renunciation And Disclaimer of Real Property Interest sample, speak to a attorney to check it before you decide to send or file it. Start without hassles!

Property Interest Form popularity

Nm Renunciation Agreement Other Form Names

Real Property Interest FAQ

Put the disclaimer in writing. Deliver the disclaimer to the person in control of the estate usually the executor or trustee. Complete the disclaimer within nine months of the death of the person leaving the property. Do not accept any benefit from the property you're disclaiming.

By filing a properly drafted petition with the circuit court, which includes the consent of the trustee and the trust beneficiaries, an Order can be obtained directing the collapse of the ILIT and the distribution of its assets in any way the parties agree.

A marital disclaimer trust has provisions (usually contained in a will) that allow a surviving spouse to put assets in a trust by disclaiming ownership of a portion of the estate that they would have inherited after the death of the first spouse.

Yes, a fiduciary can disclaim an interest in property if the will, trust or power of attorney gives the fiduciary that authority or if the appropriate probate court authorizes the disclaimer.The primary reason an executor or trustee might disclaim property passing to an estate or trust is to save death taxes.

Property owned in joint tenancy automatically passes, without probate, to the surviving owner(s) when one owner dies. Setting up a joint tenancy is easy, and it doesn't cost a penny.

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor,

Disclaimer of interest, in the law of inheritance, wills and trusts, is a term that describes an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust. A disclaimer of interest is irrevocable.

Jointly owned property is treated as consisting of a both present and a future interest in the jointly owned property. Thus, a surviving spouse may disclaim the future interest in jointly owned property on the death of their spouse, including assets that were held by the spouses as tenants by the entirety.

Any disclaimer of an interest in a trust by a trust beneficiary must be made to the trustee of that trust. For a disclaimer to be valid, it must be supported by some evidence that the beneficiary is disclaiming their interest. Silence or otherwise passive behaviour will not suffice.