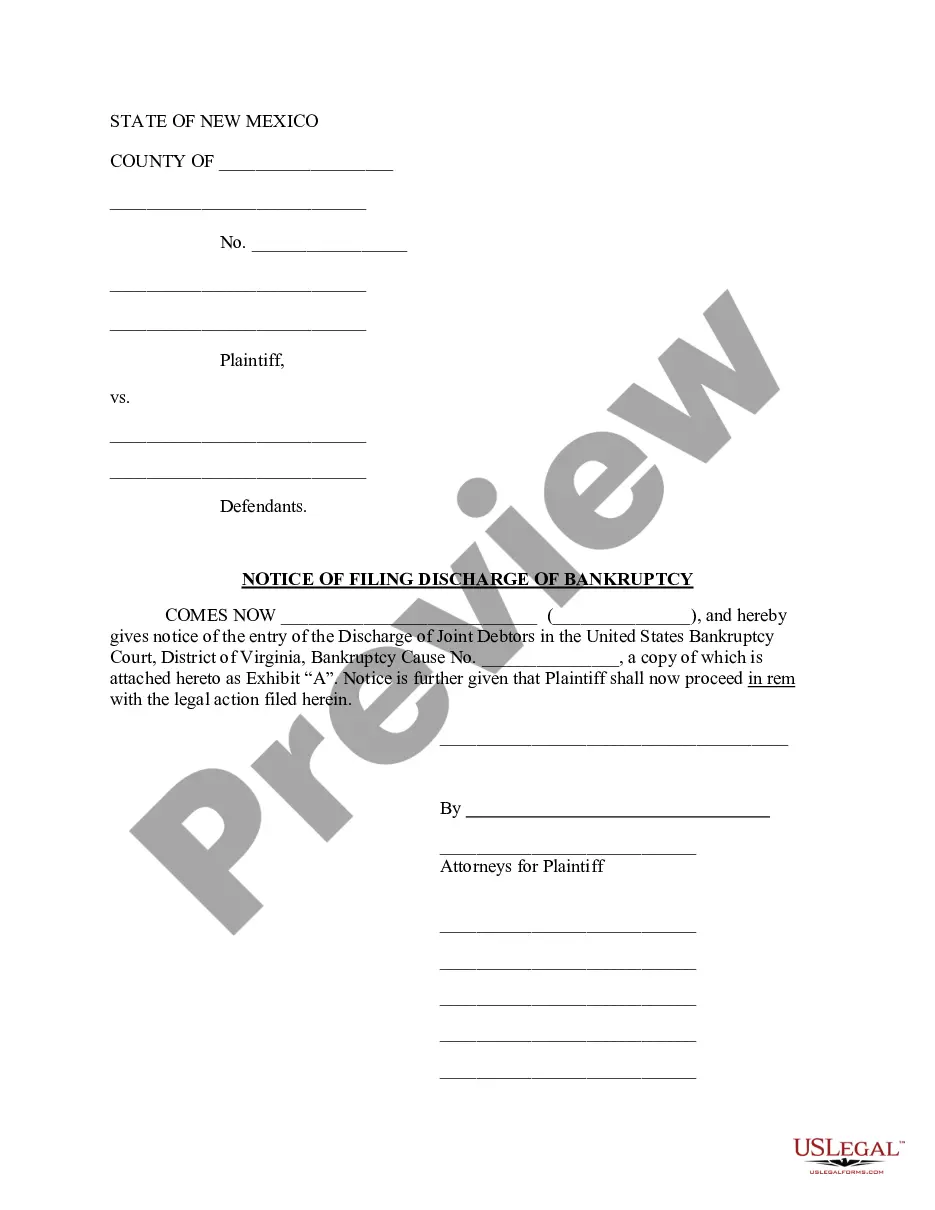

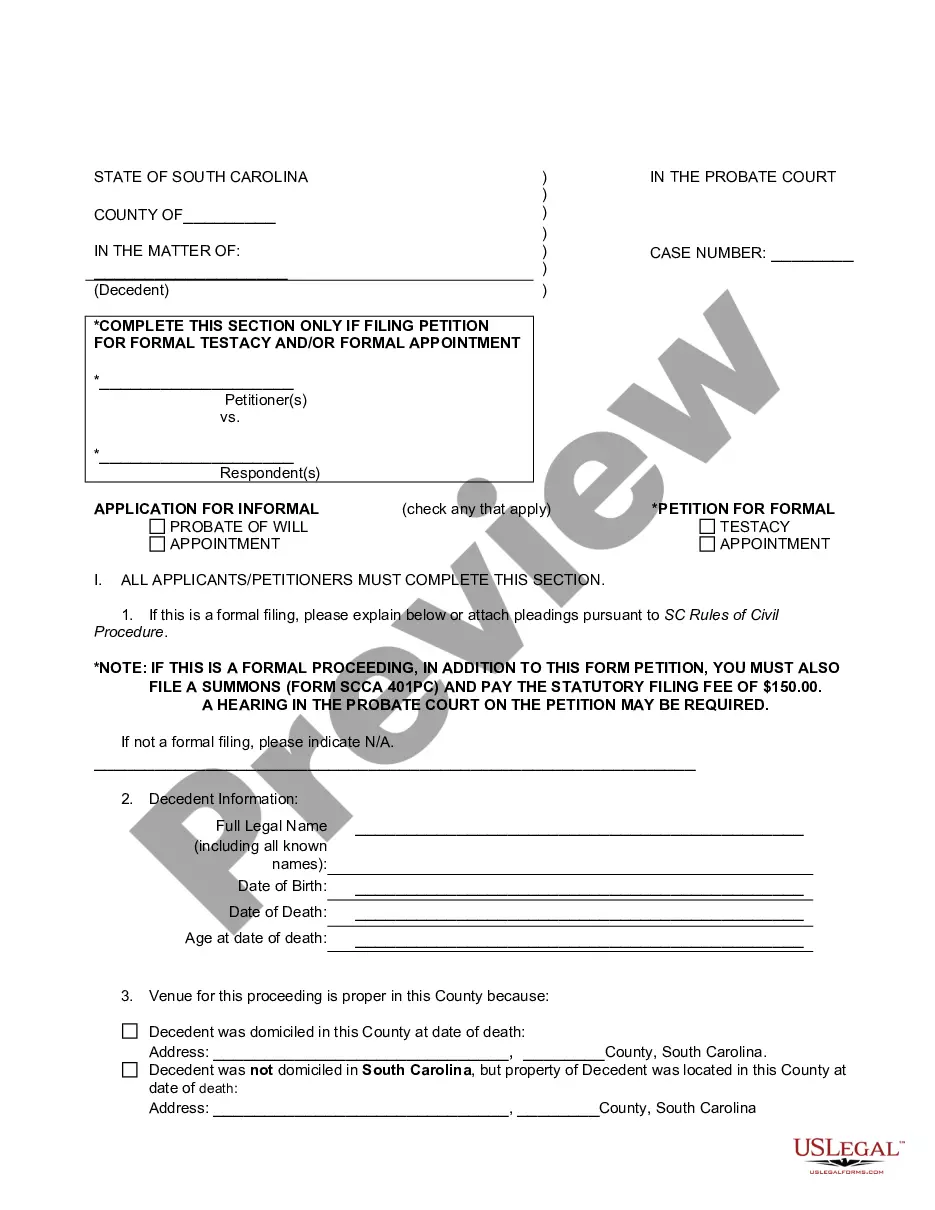

New Mexico Notice of Filing Discharge of Bankruptcy

Description What Is A Bankruptcy Discharge

How to fill out New Mexico Notice Of Filing Discharge Of Bankruptcy?

US Legal Forms is really a special system to find any legal or tax template for completing, including New Mexico Notice of Filing Discharge of Bankruptcy. If you’re fed up with wasting time looking for perfect samples and spending money on record preparation/attorney fees, then US Legal Forms is precisely what you’re seeking.

To reap all of the service’s advantages, you don't need to download any application but just choose a subscription plan and sign up an account. If you have one, just log in and find an appropriate template, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need New Mexico Notice of Filing Discharge of Bankruptcy, take a look at the recommendations below:

- check out the form you’re taking a look at applies in the state you need it in.

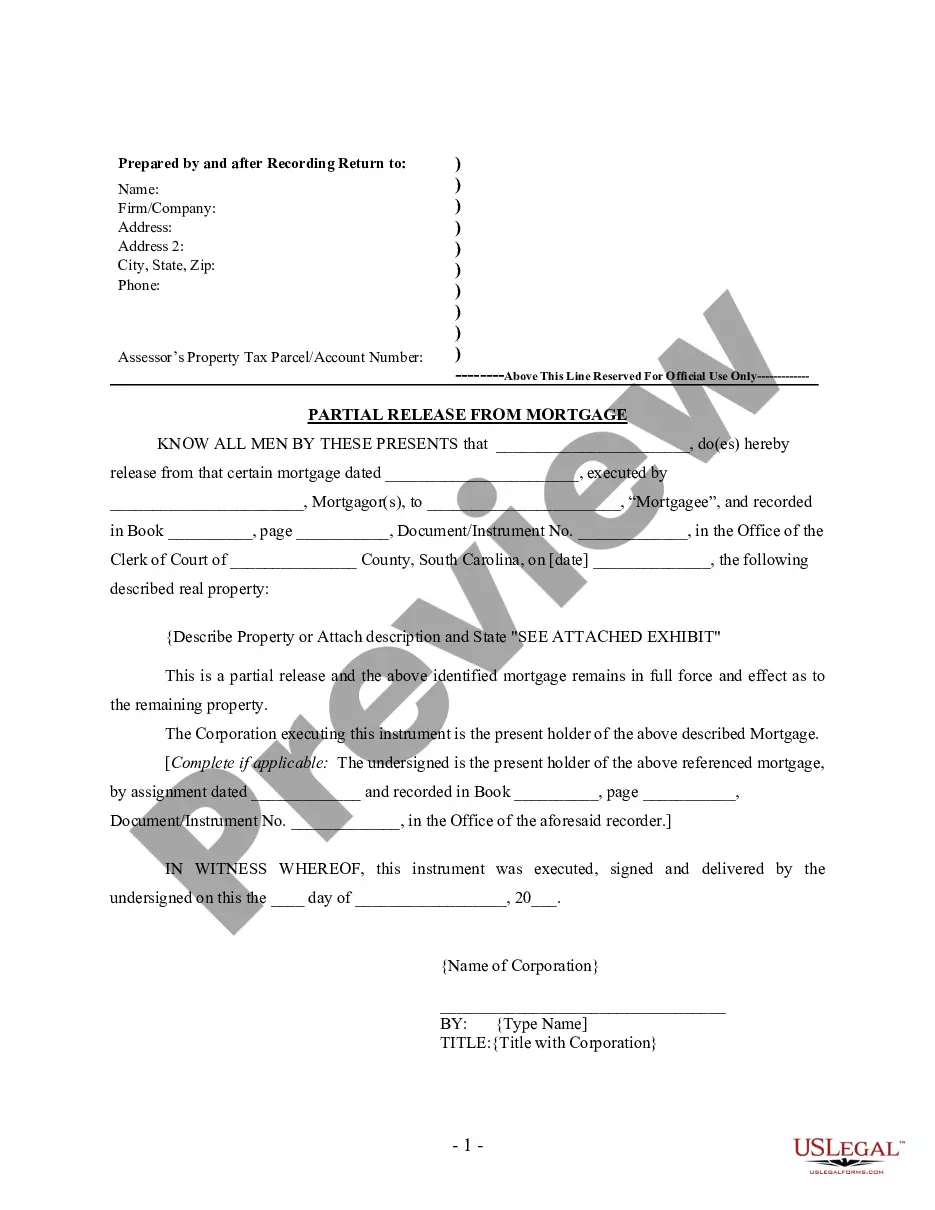

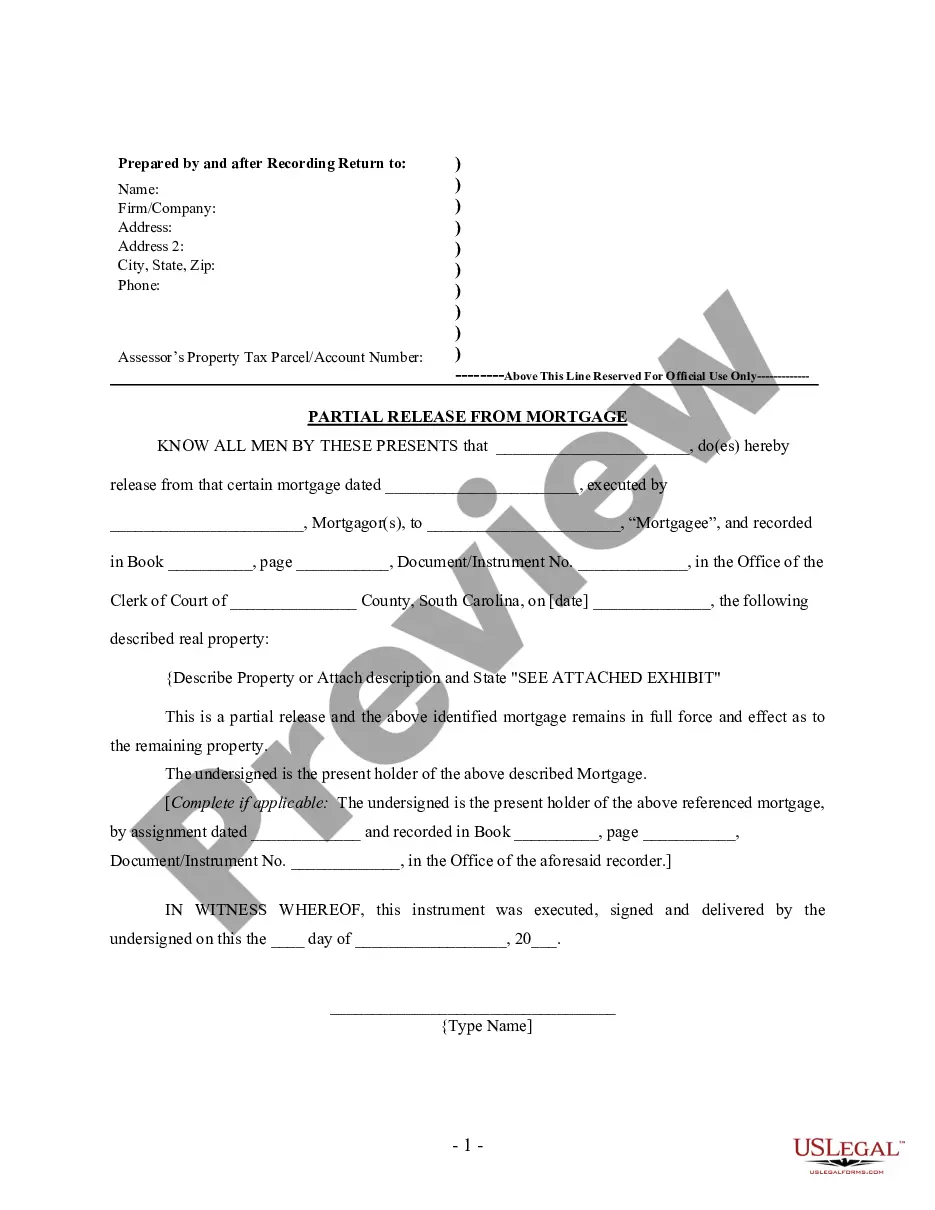

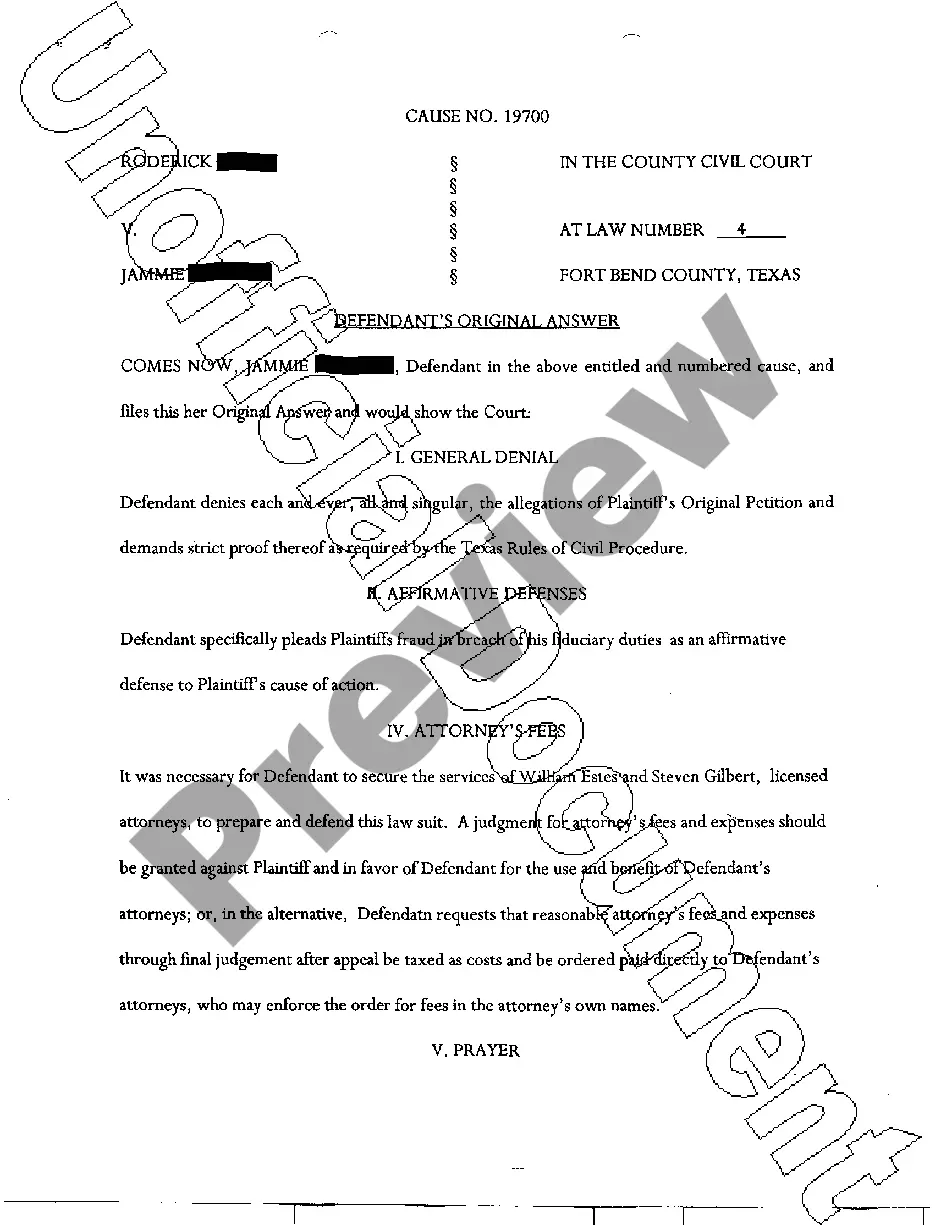

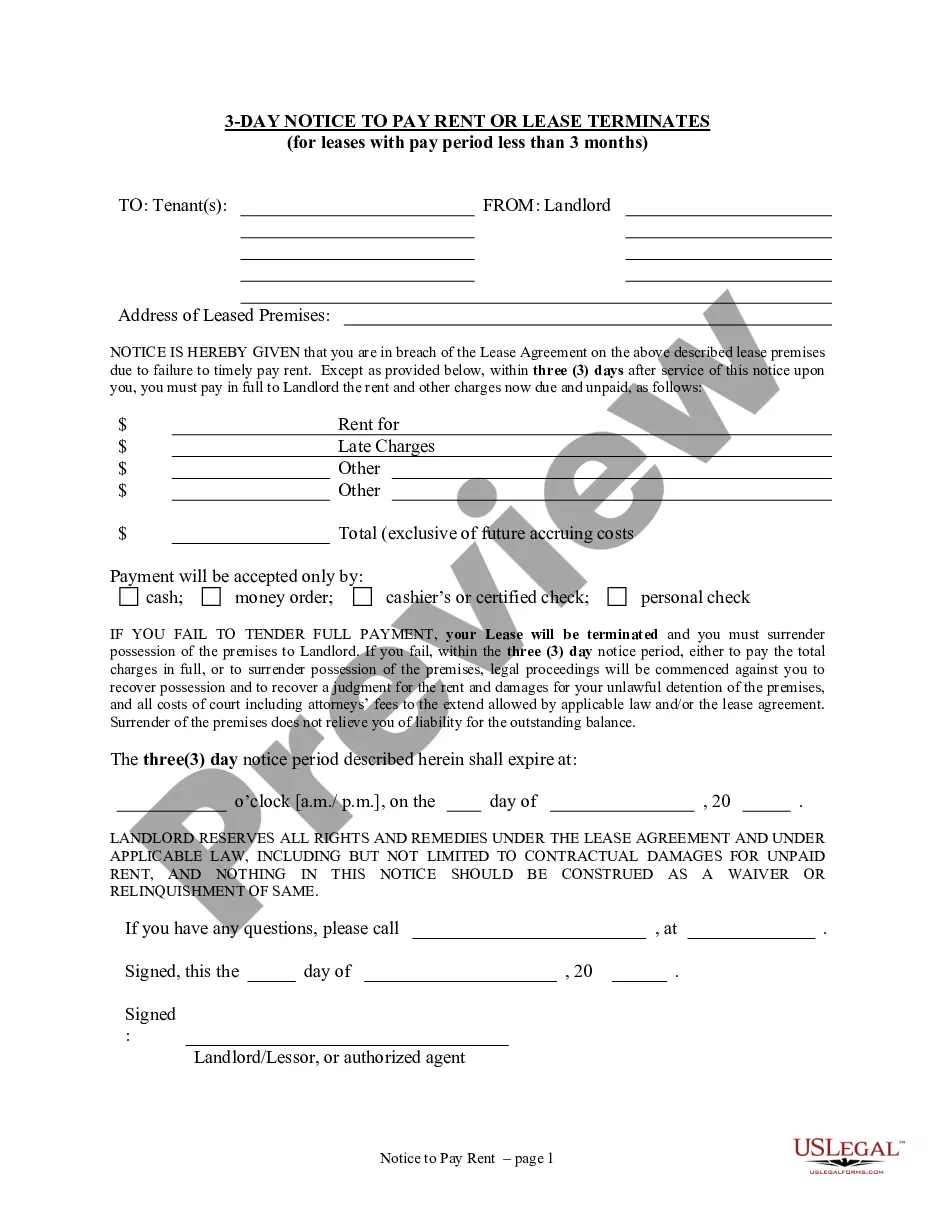

- Preview the form its description.

- Click Buy Now to reach the sign up page.

- Select a pricing plan and proceed signing up by providing some information.

- Select a payment method to complete the registration.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, fill out the file online or print it. If you are uncertain regarding your New Mexico Notice of Filing Discharge of Bankruptcy sample, speak to a lawyer to review it before you decide to send or file it. Get started without hassles!

Chapter 7 Discharge Letter Form popularity

What Does A Discharge Letter Look Like Other Form Names

New Mexico Bankruptcy Form FAQ

The bankruptcy is reported in the public records section of your credit report. Both the bankruptcy and the accounts included in the bankruptcy should indicate they are discharged once the bankruptcy has been completed. To verify this, the first step is to get a copy of your personal credit report.

The court alerts all involved (the debtor, creditors, and legal counsel) by mailing a copy of the discharge order, or, as called by some, the discharge letter. It won't explicitly list the debts discharged in your matter, but rather the categories of debt commonly discharged in bankruptcy.

When you log into your account, you will see a month and year in the top right corner. As a general rule, this is a the approximate date as to when your Chapter 13 bankruptcy will finish.

If you filed a Chapter 13 and wish to file a second Chapter 13 you will need to wait 2 years from your previous Chapter 13 filing date to be able to get a discharge in the second case.

Your Chapter 7 bankruptcy case is closed when the court issues an order closing it. If you have no nonexempt assets for the bankruptcy trustee to sell, your case will be closed shortly after you receive your discharge noticeusually about four months after you file your petition.

Filing a Chapter 13 after a previous Chapter 13 discharge (2 years). If you had a Chapter 13 filing that ended with a discharge and you need to refile Chapter 13 again, you cannot file any sooner than two years from when your previous case was filed.

Once filed, a Chapter 7 bankruptcy typically takes about 4 - 6 months to complete. The bankruptcy discharge is granted 3 - 4 months after filing in most cases. Written by Attorney Andrea Wimmer. Most Chapter 7 bankruptcy cases take between 4 - 6 months to complete after filing the case with the court.

For many people, I would say keep it for no more than 3 - 4 years. Far more important is the list of creditors that were included in the paperwork.

Your credit score after a Chapter 13 Bankruptcy discharge will vary. Your new score will depend on how good or bad your credit score was prior to the filing of the Chapter 13 Bankruptcy. For most individuals, you can expect to see quite a dip in your overall credit score.