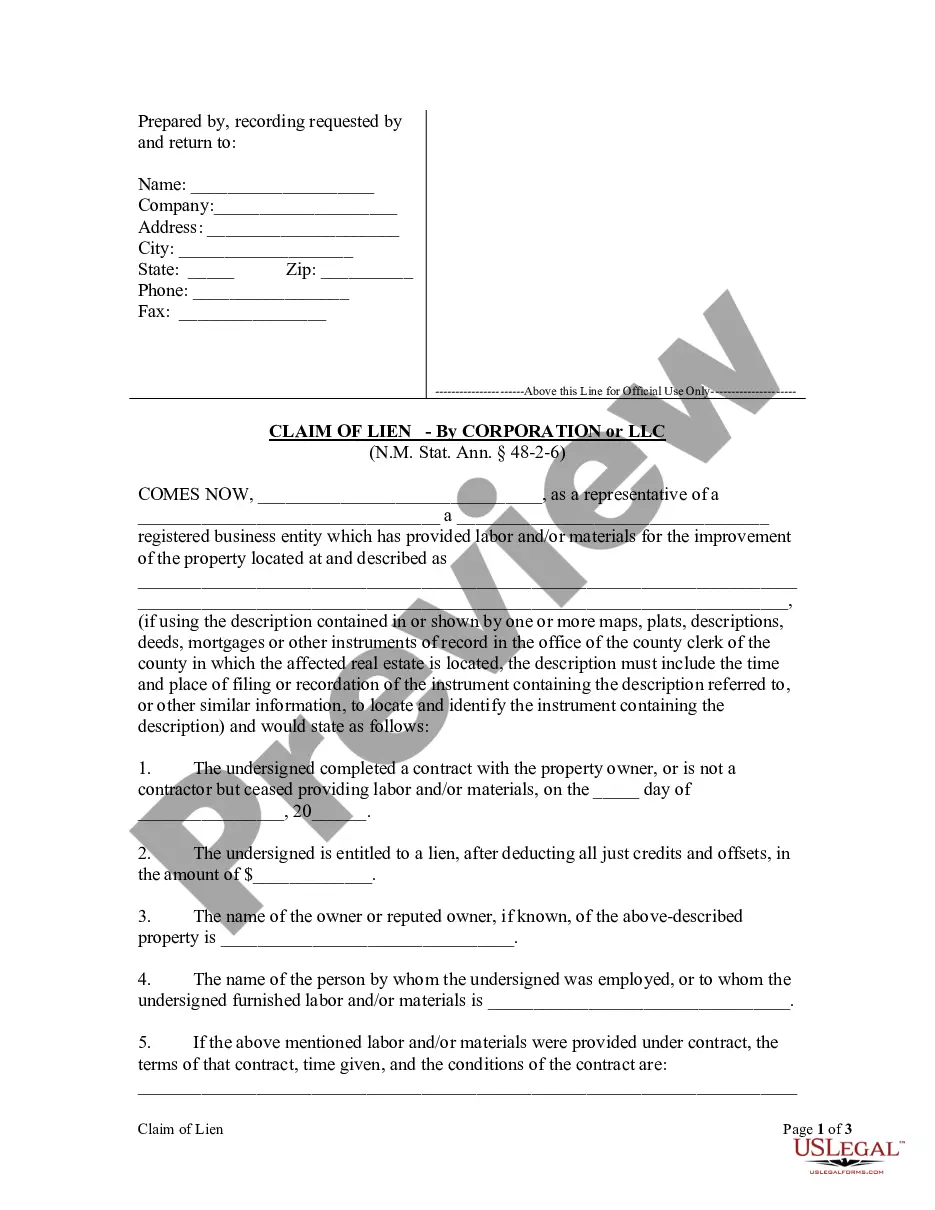

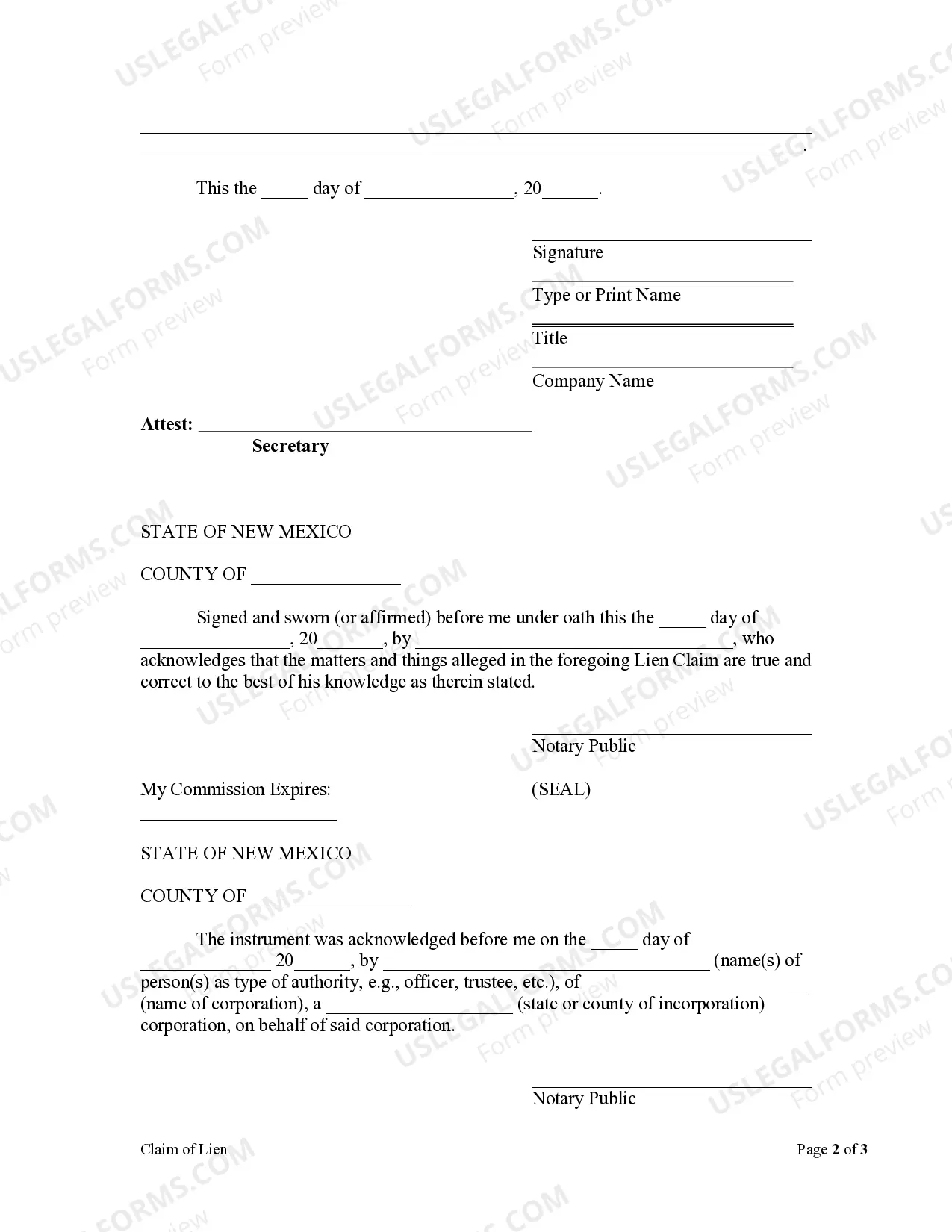

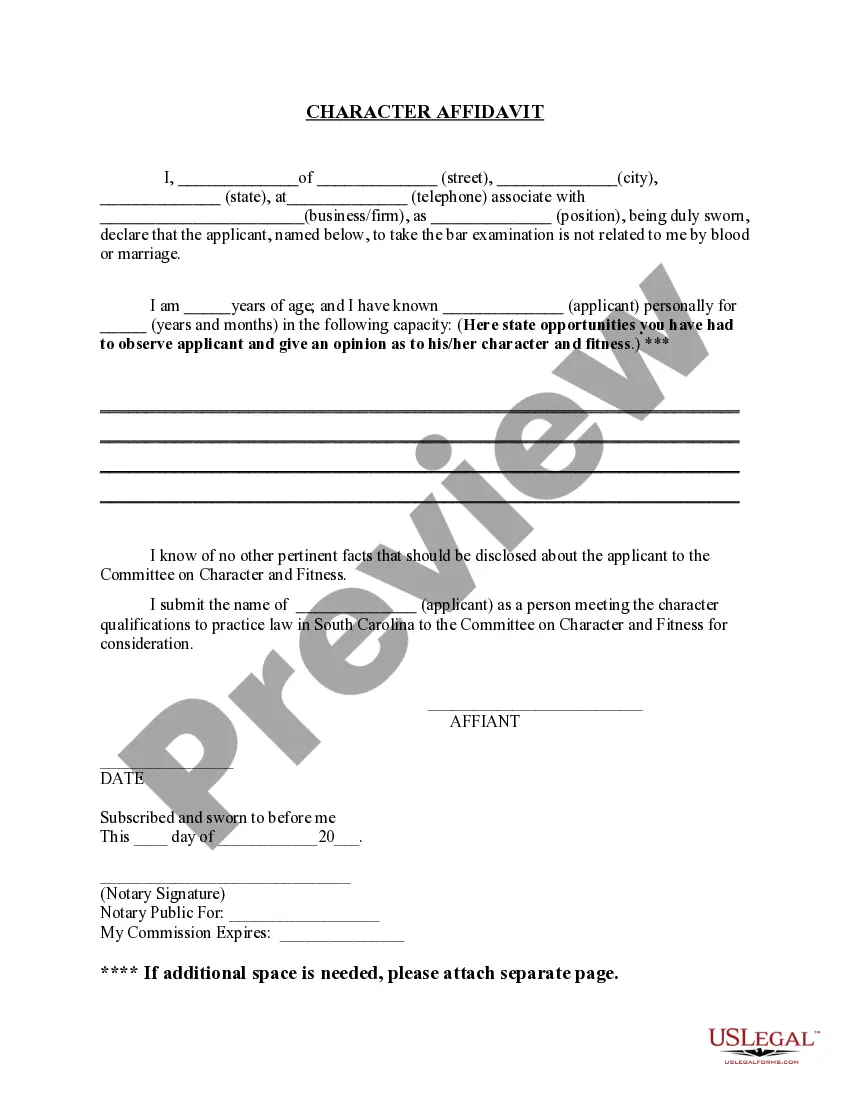

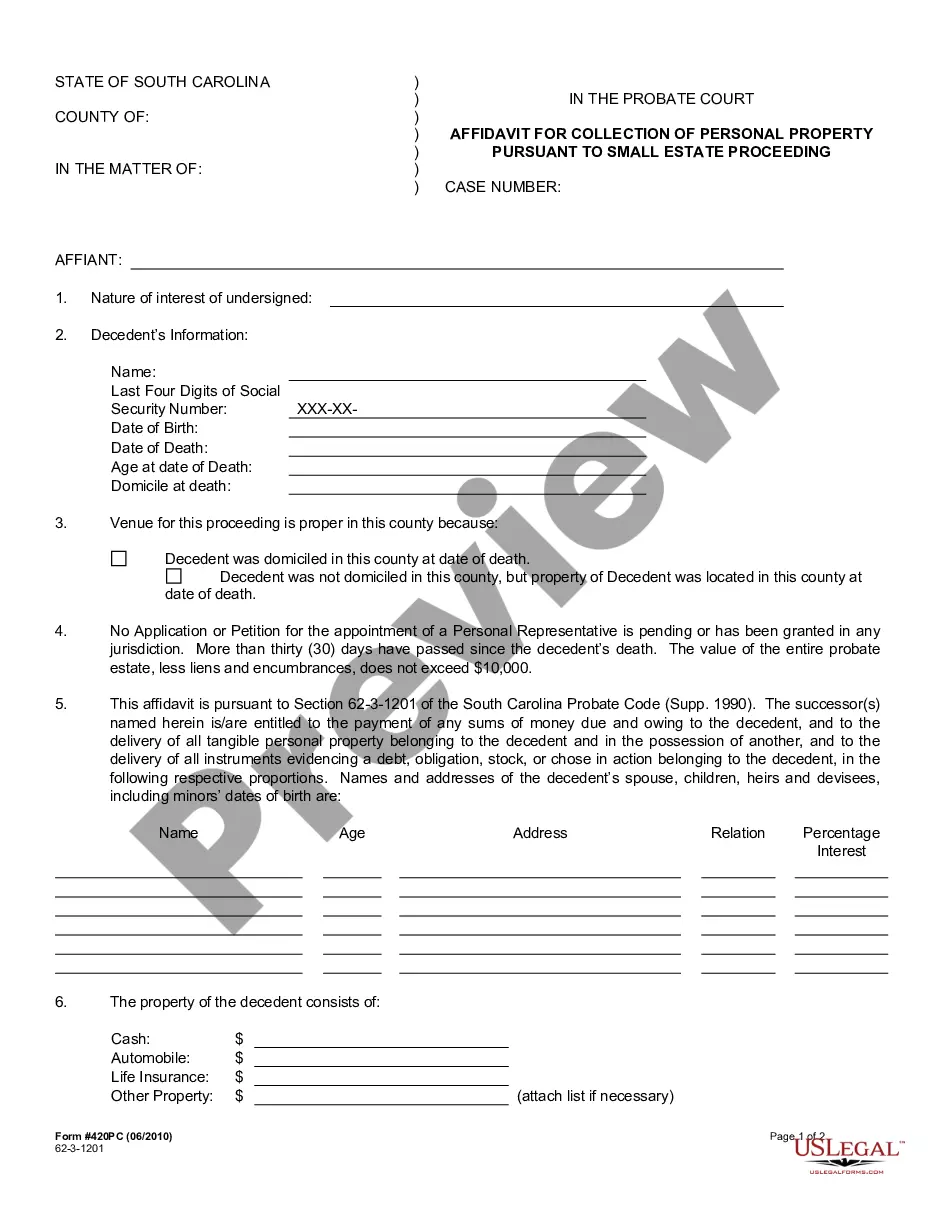

Every original contractor, within one hundred and twenty days after the completion of his contract, and every person, except the original contractor, desiring to claim a lien pursuant to Sections 48-2-1 through 48-2-19 NMSA 1978, must, within ninety days after the completion of any building, improvement or structure, or after the completion of the alteration or repair thereof, or the performance of any labor in a mining claim, file for record with the county clerk of the county in which such property or some part thereof is situated, a claim containing a statement of his demands, after deducting all just credits and offsets. The claim shall state the name of the owner or reputed owner, if known, and also the name of the person by whom he was employed, or to whom he furnished the materials, and shall include a statement of the terms, time given and the conditions of the contract, and also a description of the property to be charged with the lien, sufficient for identification. The claim must be verified by the oath of himself or of some other person.

New Mexico Claim of Lien by Corporation

Description New Mexico Corporation Mechanics Contract

How to fill out New Mexico Lien Mechanics?

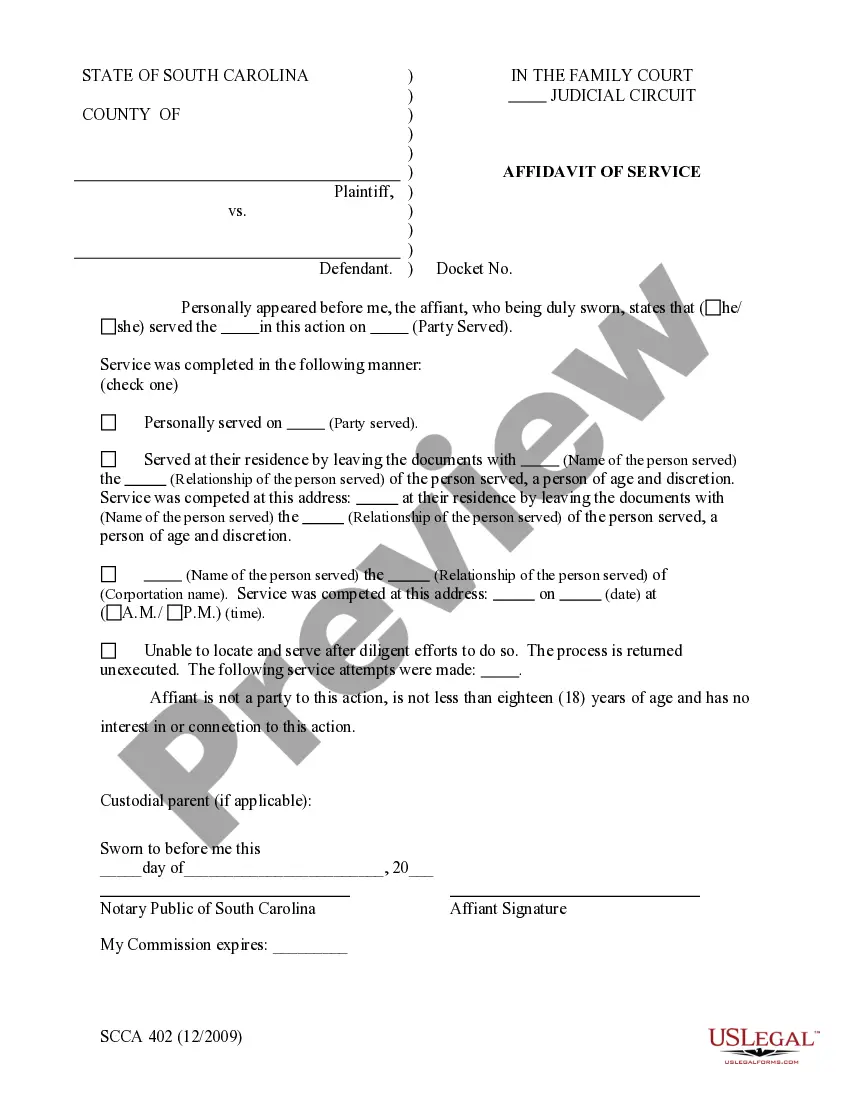

US Legal Forms is actually a unique platform to find any legal or tax template for submitting, including New Mexico Claim of Lien by Corporation or LLC. If you’re fed up with wasting time searching for suitable samples and spending money on file preparation/attorney service fees, then US Legal Forms is precisely what you’re seeking.

To reap all of the service’s advantages, you don't need to install any application but simply pick a subscription plan and register an account. If you already have one, just log in and look for an appropriate template, download it, and fill it out. Downloaded files are saved in the My Forms folder.

If you don't have a subscription but need New Mexico Claim of Lien by Corporation or LLC, check out the guidelines below:

- check out the form you’re considering is valid in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to get to the register webpage.

- Choose a pricing plan and proceed registering by entering some info.

- Decide on a payment method to complete the registration.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure about your New Mexico Claim of Lien by Corporation or LLC template, contact a legal professional to check it before you decide to send or file it. Get started hassle-free!

Nm Lien Corporation Online Form popularity

New Mexico Mechanics Template Other Form Names

Claim Corporation Construction Mechanics Paper FAQ

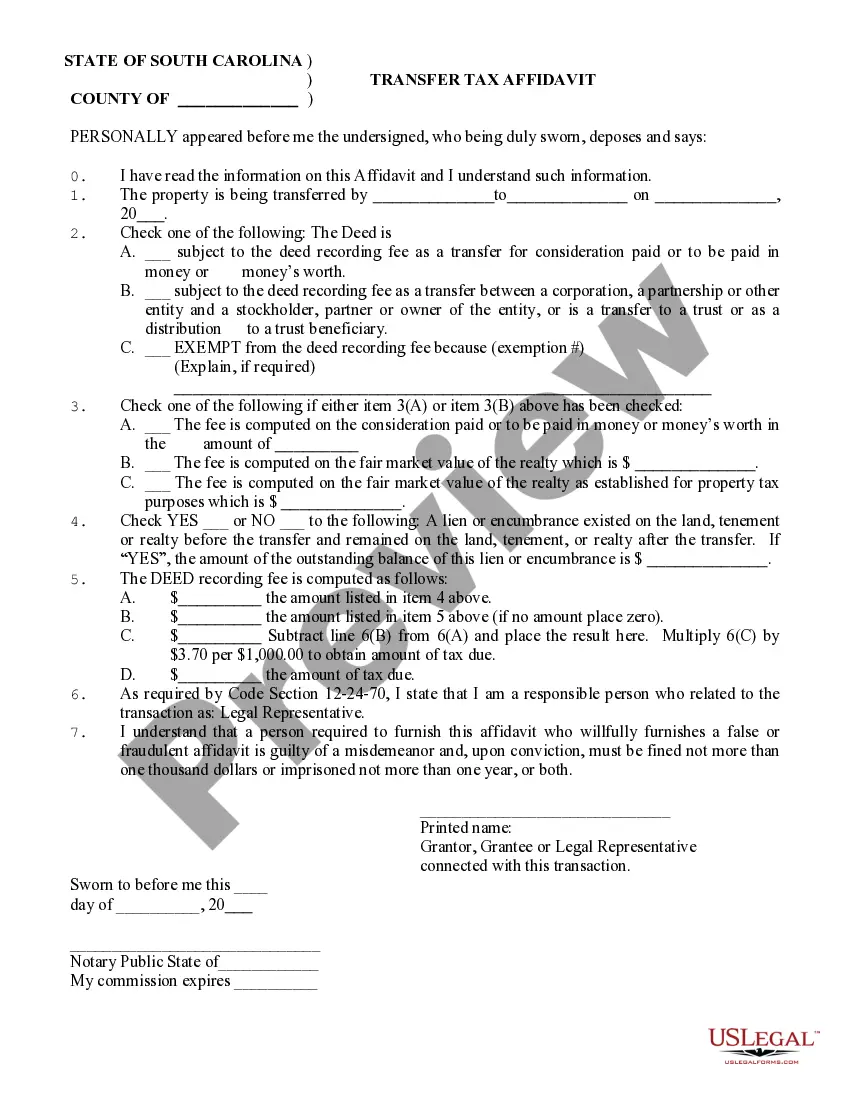

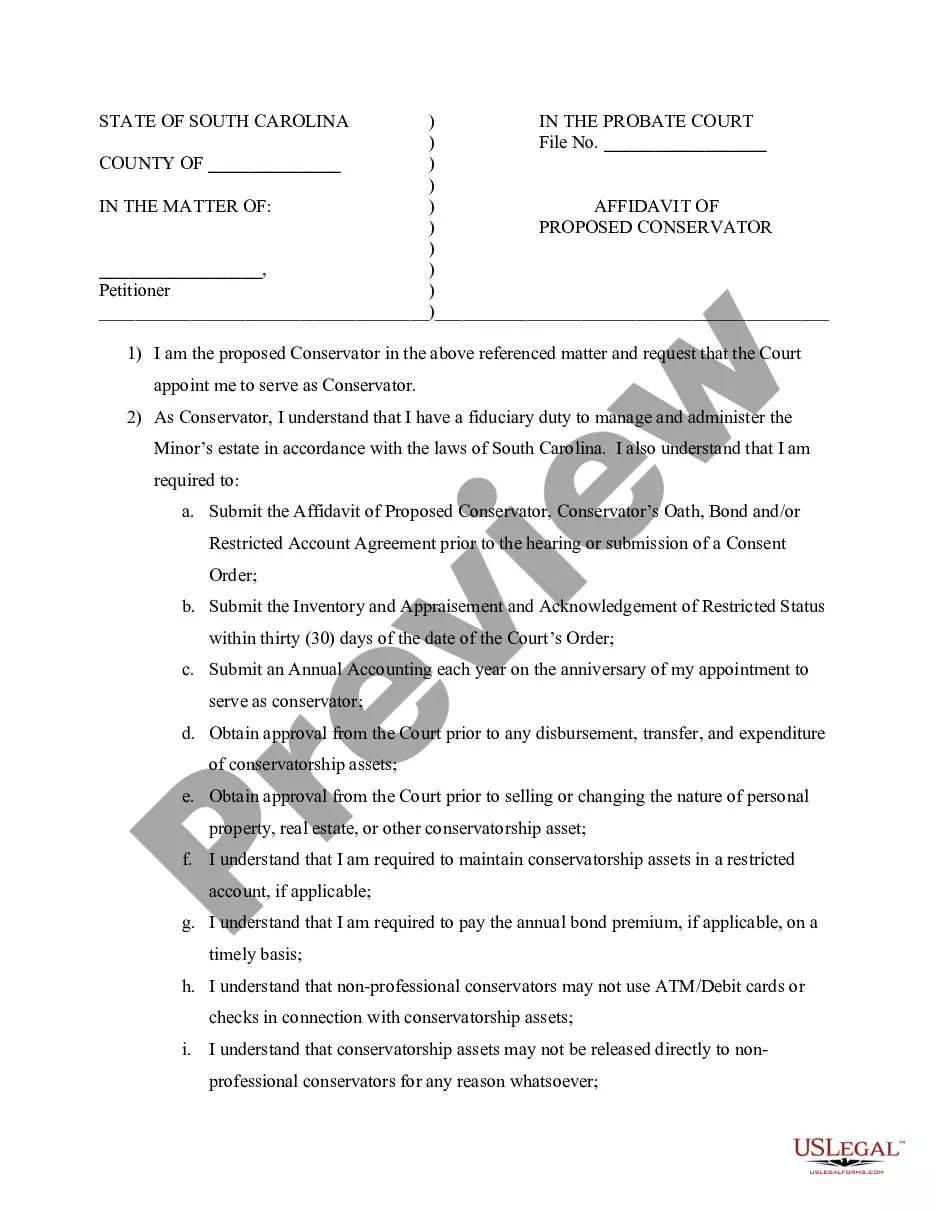

Someone who is owed money is generally not able to just put a lien on property without first securing a judgment. Securing a judgment requires the creditor to sue the debtor. This may be through circuit court in many jurisdictions. If under a certain dollar amount, this suit may be through the small claims court.

New Mexico mechanics liens are perfected by filing the claim in the county clerk's office where the property is physically located. If the property is situated in more than one county, the claim should be filed in the clerk's office of all counties it is located in.

The simplest way to prevent liens and ensure that subcontractors and suppliers are paid is to pay with joint checks. This is when both parties endorse the check. Compare the contractor's materials or labor bill to the schedule of payments in your contract and the Preliminary Notices.

Therefore, liens are not officially recorded, and personal property could be sold off to a third party who is unaware of the lien's existence. In most states, judgment liens must be filed by the creditor through the county or state.

A contractor's lien (often known as a mechanic's lien, or a construction lien) is a claim made by contractors or subcontractors who have performed work on a property, and have not yet been paid.After all, contractors would rather work out a deal than go through the hassle of filing a lien against your property.

When your efforts to collect a bill from a business that owes you money have been unsuccessful, you can place a lien on the assets of the business. As a lienholder, you gain legal rights to the company's property and the authority to sell the property and use the proceeds to repay what is owed to you.

Filing a Court Claim Before you can place a lien on business property, you must first have a court order a judgment directing the debtor to pay what is owed. After filing a claim with the court and submitting proof of the amounts owed to you, the business must answer and explain why the debt is not owed.

To place a lien, you must first demonstrate that you have a valid debt that has not been paid by the property holder for example if you performed construction work as a contractor or subcontractor at company headquarters and the business did not pay your bill.

New Mexico mechanics liens are perfected by filing the claim in the county clerk's office where the property is physically located. If the property is situated in more than one county, the claim should be filed in the clerk's office of all counties it is located in.