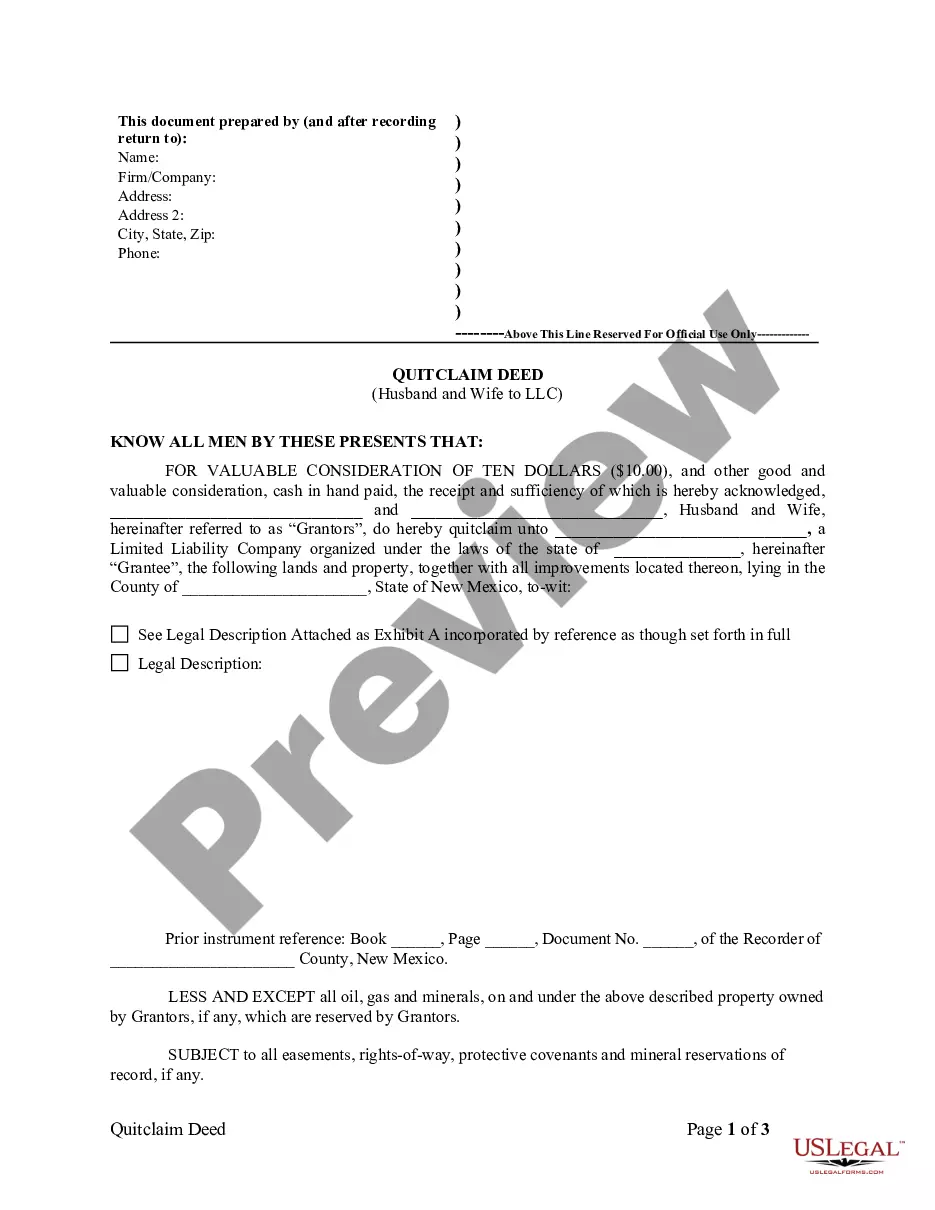

New Mexico Quitclaim Deed from Husband and Wife to LLC

Description

How to fill out New Mexico Quitclaim Deed From Husband And Wife To LLC?

US Legal Forms is really a unique system to find any legal or tax template for completing, including New Mexico Quitclaim Deed from Husband and Wife to LLC. If you’re sick and tired of wasting time looking for appropriate samples and spending money on record preparation/lawyer service fees, then US Legal Forms is exactly what you’re searching for.

To experience all the service’s advantages, you don't have to download any application but just select a subscription plan and create your account. If you have one, just log in and find an appropriate template, download it, and fill it out. Saved files are all kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Quitclaim Deed from Husband and Wife to LLC, have a look at the recommendations listed below:

- Double-check that the form you’re taking a look at applies in the state you want it in.

- Preview the sample its description.

- Click Buy Now to reach the register webpage.

- Select a pricing plan and continue signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Download the file by choosing the preferred format (.docx or .pdf)

Now, complete the document online or print it. If you are uncertain regarding your New Mexico Quitclaim Deed from Husband and Wife to LLC sample, speak to a legal professional to examine it before you send out or file it. Get started without hassles!

Form popularity

FAQ

Notary Public (Section 47-1-44) In New Mexico it must be signed with a Notary Public viewing the Grantor(s) signature(s). Recording A quit claim deed is required to be filed at the County Clerk's Office where the property is located along with the required recording fee(s).

In order to transfer ownership of the marital home pursuant to a divorce, one spouse is going to need to sign a quitclaim deed, interspousal transfer deed, or a grant deed, in order to convey the title to the property.

How to Quitclaim Deed to LLC. A quitclaim deed to LLC is actually a very simple process. You will need a deed form and a copy of the existing deed to make sure you identify titles properly and get the legal description of the property.

A quitclaim deed transfers title but makes no promises at all about the owner's title.A person who signs a quitclaim deed to transfer property they do not own results in no title at all being transferred since there is no actual ownership interest. The quitclaim deed only transfers the type of title you own.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

The drawback, quite simply, is that quitclaim deeds offer the grantee/recipient no protection or guarantees whatsoever about the property or their ownership of it. Maybe the grantor did not own the property at all, or maybe they only had partial ownership.

It is also crucial that a spouse know about the loan, even if he or she is not on the mortgage. In general, the spouse must sign a deed of trust, the Truth in Lending and Right to Cancel documents. By signing these documents, they are simply acknowledging the existence of the mortgage.

A quitclaim deed is a legal instrument that is used to transfer interest in real property.The owner/grantor terminates (quits) any right and claim to the property, thereby allowing the right or claim to transfer to the recipient/grantee.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.