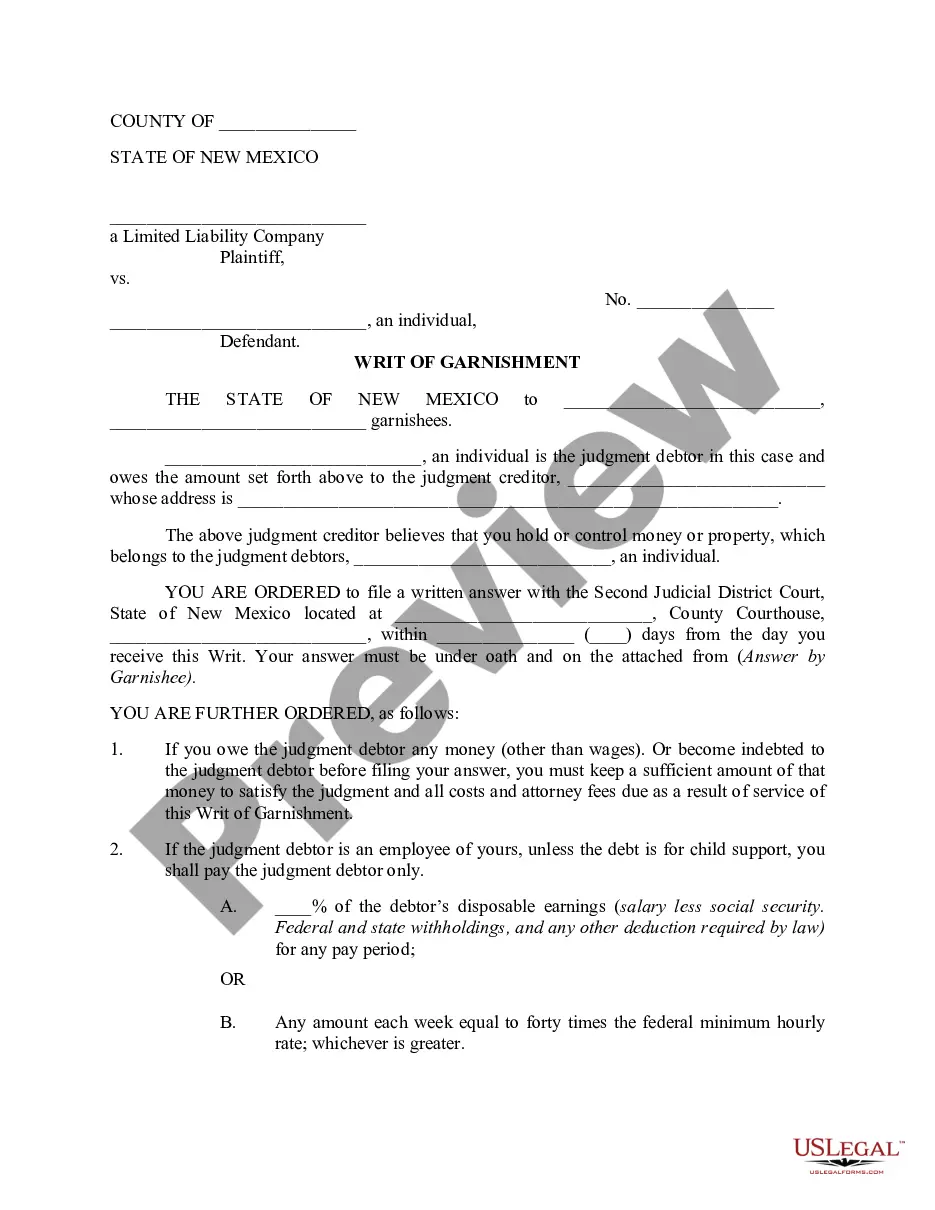

New Mexico Writ of Garnishment

Description

How to fill out New Mexico Writ Of Garnishment?

US Legal Forms is actually a special system to find any legal or tax document for completing, including New Mexico Writ of Garnishment. If you’re fed up with wasting time looking for perfect examples and spending money on file preparation/legal professional fees, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s benefits, you don't have to download any software but just select a subscription plan and register an account. If you have one, just log in and look for the right template, download it, and fill it out. Saved documents are all kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Writ of Garnishment, take a look at the recommendations below:

- make sure that the form you’re looking at is valid in the state you want it in.

- Preview the sample and look at its description.

- Click on Buy Now button to access the sign up webpage.

- Pick a pricing plan and keep on registering by entering some information.

- Decide on a payment method to finish the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you are uncertain regarding your New Mexico Writ of Garnishment sample, speak to a lawyer to analyze it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

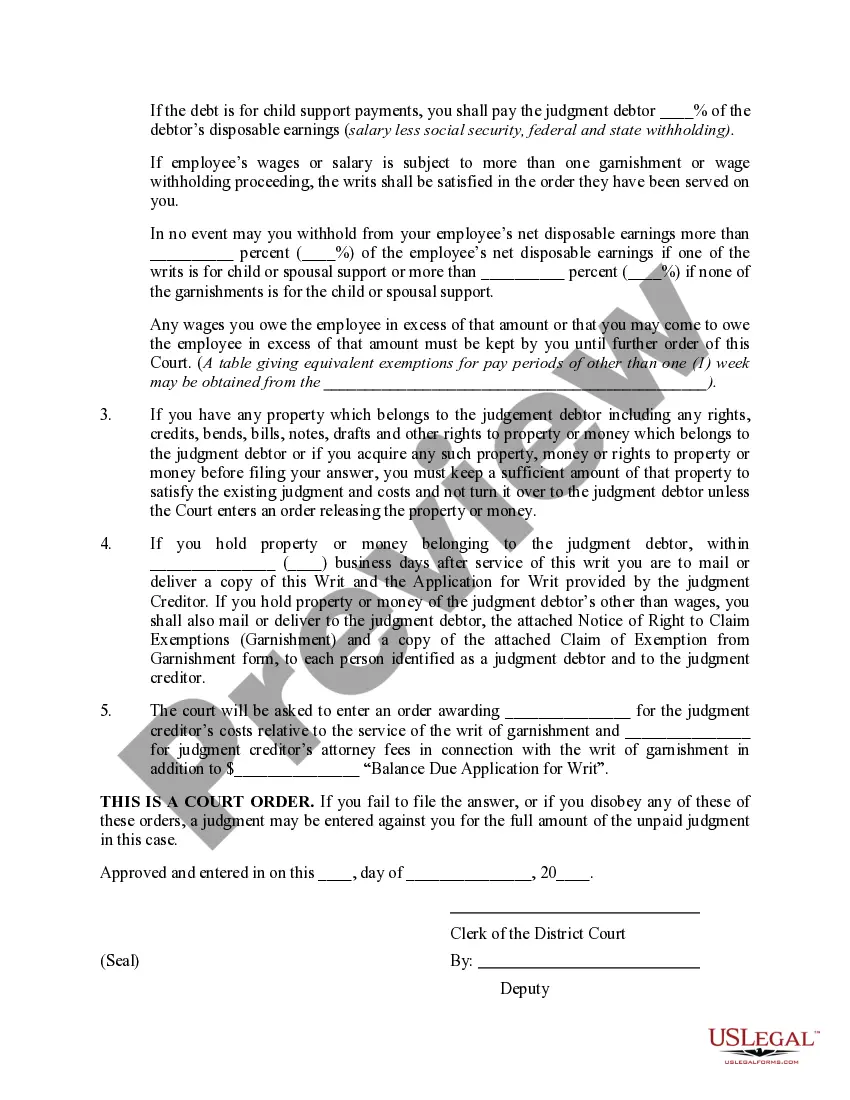

In Alberta, for instance, you keep the first $800 of your monthly net income, then creditors can garnish 50% of your monthly net income between $800 and $2400, and 100% of any net income above $2400. Then these exemption limits are increased by $200 for each dependent you support.

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

It means that the court order to your employer to garnish your wages is dismissed. However, if you still owe money to the creditor, the creditor still can pursue you through other channels including if you start a new job elsewhere.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.