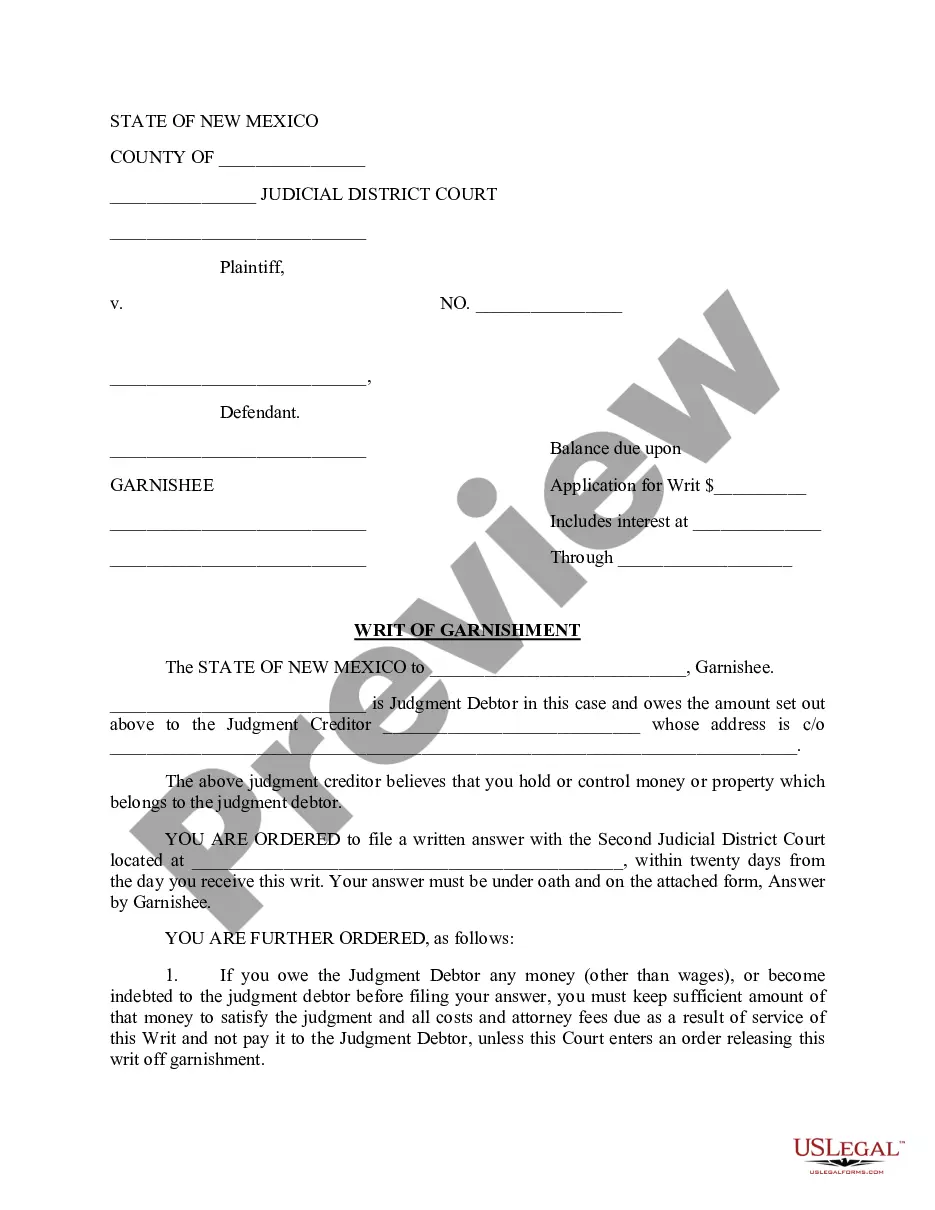

New Mexico Writ of Garnishment

Description

How to fill out New Mexico Writ Of Garnishment?

US Legal Forms is a special system where you can find any legal or tax document for completing, including New Mexico Writ of Garnishment. If you’re tired of wasting time searching for suitable examples and paying money on file preparation/attorney fees, then US Legal Forms is precisely what you’re looking for.

To enjoy all of the service’s benefits, you don't need to download any application but just select a subscription plan and sign up an account. If you already have one, just log in and look for the right template, download it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Writ of Garnishment, have a look at the instructions below:

- check out the form you’re checking out applies in the state you need it in.

- Preview the form its description.

- Click Buy Now to access the sign up page.

- Choose a pricing plan and keep on registering by entering some info.

- Decide on a payment method to complete the sign up.

- Save the file by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain about your New Mexico Writ of Garnishment form, contact a legal professional to check it before you send or file it. Get started hassle-free!

Form popularity

FAQ

In Alberta, for instance, you keep the first $800 of your monthly net income, then creditors can garnish 50% of your monthly net income between $800 and $2400, and 100% of any net income above $2400. Then these exemption limits are increased by $200 for each dependent you support.

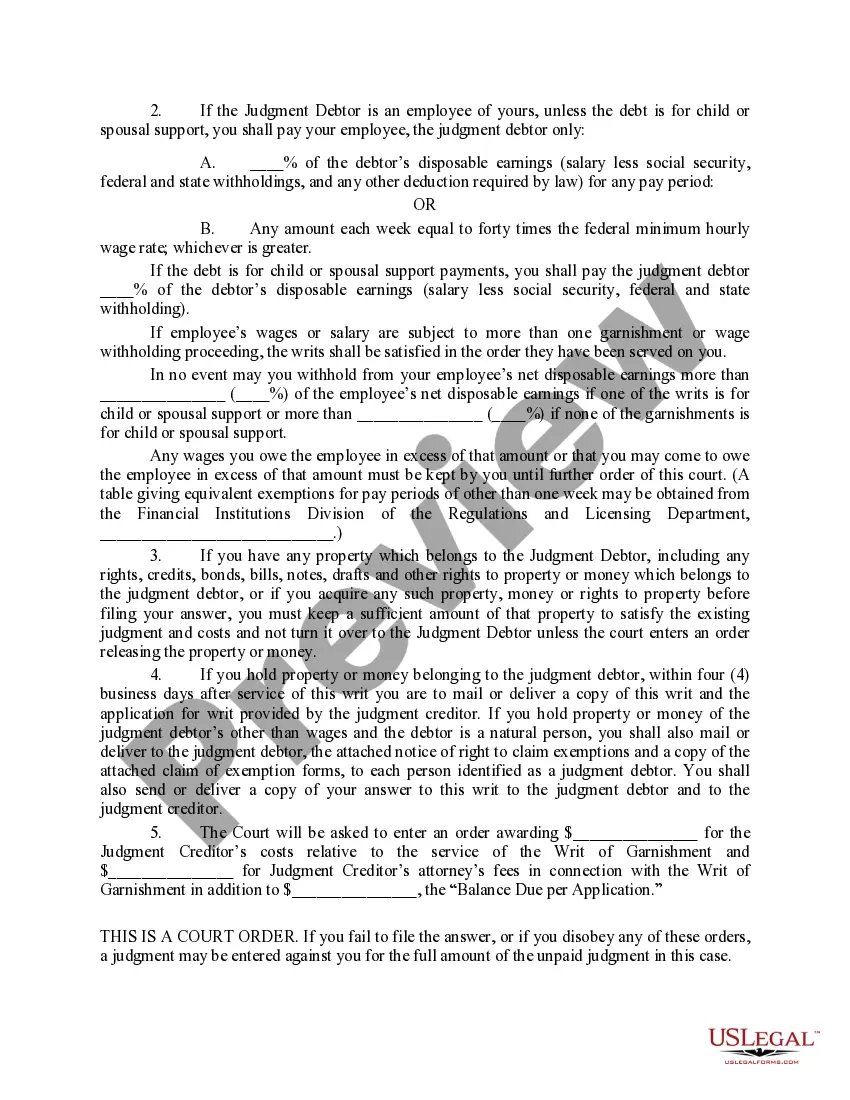

What you can do about wage garnishment.You have to be legally notified of the garnishment. You can file a dispute if the notice has inaccurate information or you believe you don't owe the debt. Some forms of income, such as Social Security and veterans benefits, are exempt from garnishment as income.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.

It means that the court order to your employer to garnish your wages is dismissed. However, if you still owe money to the creditor, the creditor still can pursue you through other channels including if you start a new job elsewhere.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

The Order dissolves the existing writ of garnishment. It means that whatever was being garnished, wages or bank accounts, are no longer subject to the writ of garnishment.

Once a garnishment is approved in court, the creditor will notify you before contacting your bank to begin the actual garnishment. However, the bank itself has no legal obligation to inform you when money is withdrawn due to an account garnishment.