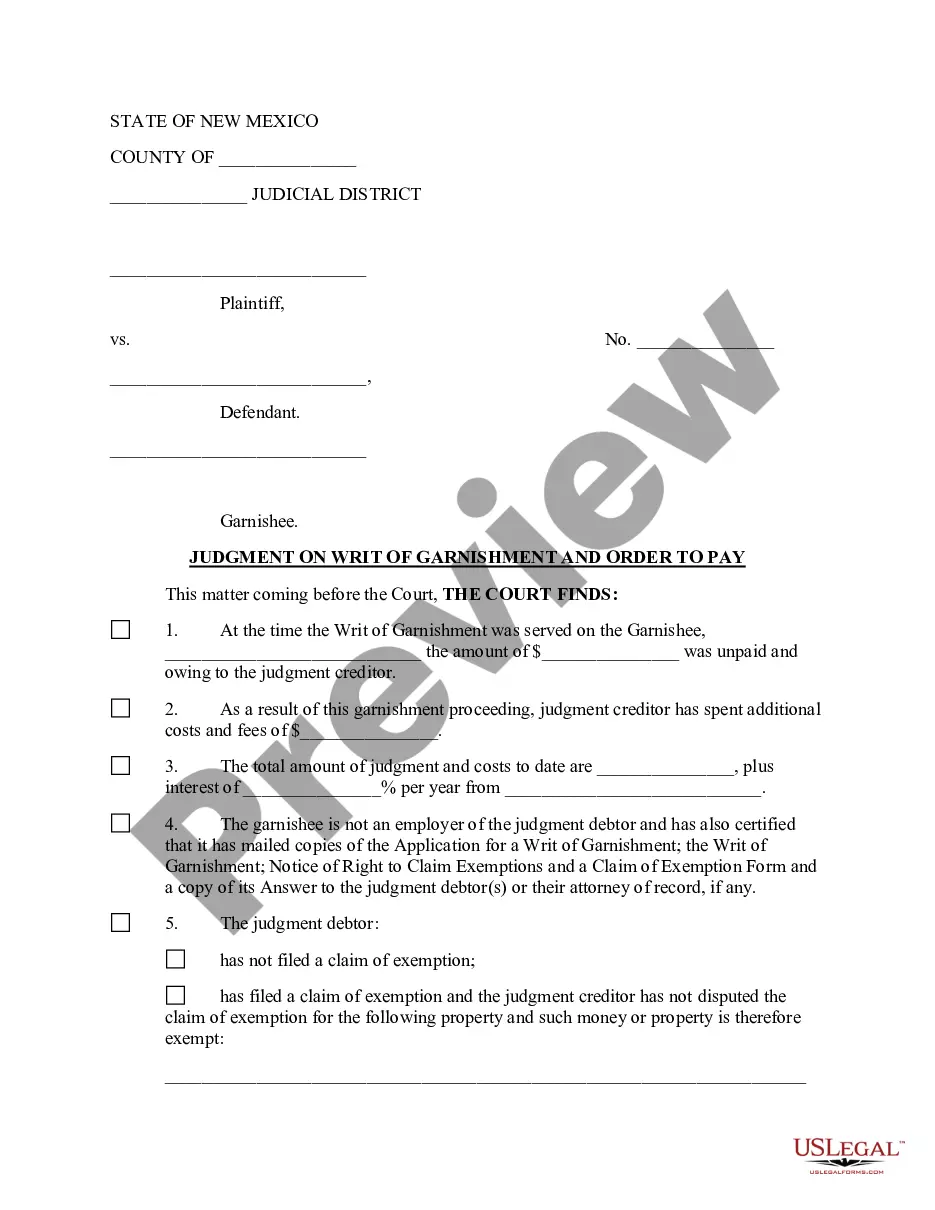

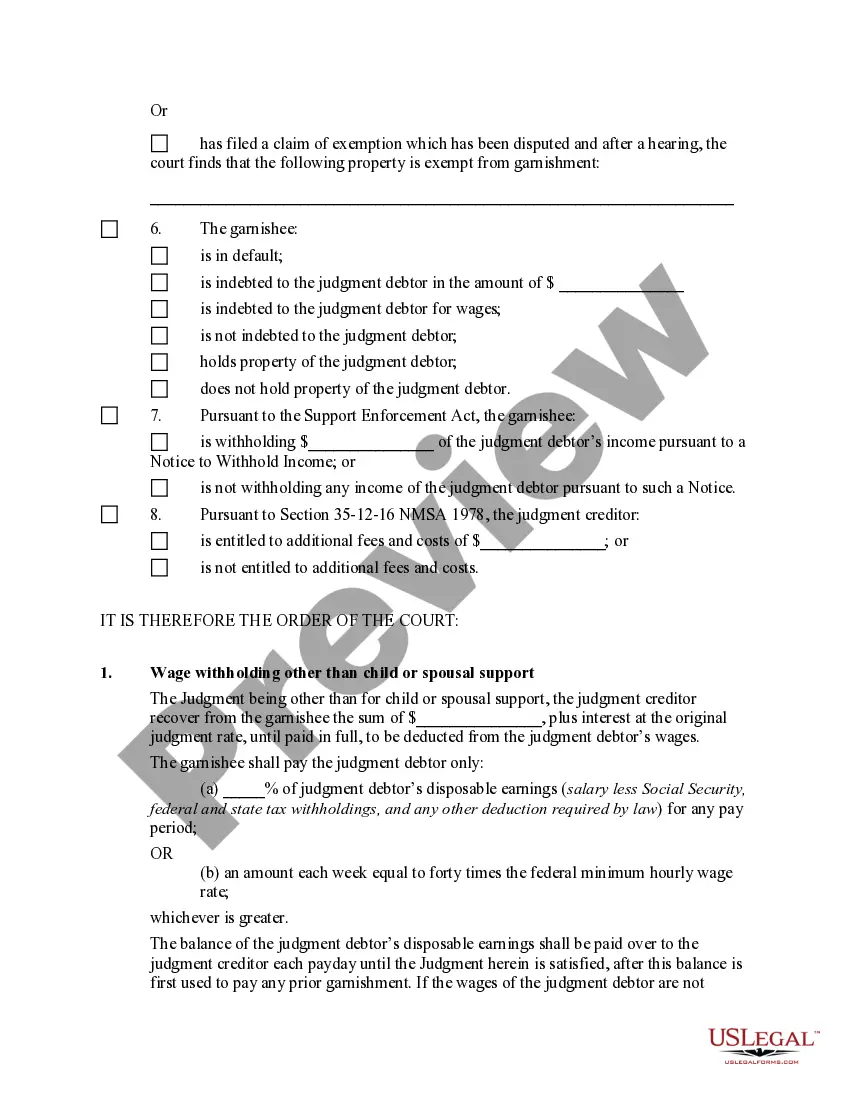

New Mexico Judgment on Writ of Garnishment and Order to Pay

Description New Mexico Writ

How to fill out New Mexico Judgment On Writ Of Garnishment And Order To Pay?

US Legal Forms is actually a special system where you can find any legal or tax template for submitting, such as New Mexico Judgment on Writ of Garnishment and Order to Pay. If you’re tired with wasting time searching for suitable samples and spending money on file preparation/legal professional fees, then US Legal Forms is precisely what you’re looking for.

To experience all the service’s advantages, you don't need to download any software but just select a subscription plan and sign up your account. If you have one, just log in and find a suitable template, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need to have New Mexico Judgment on Writ of Garnishment and Order to Pay, take a look at the instructions below:

- Double-check that the form you’re taking a look at is valid in the state you need it in.

- Preview the sample its description.

- Click Buy Now to reach the sign up page.

- Select a pricing plan and keep on signing up by providing some information.

- Choose a payment method to complete the registration.

- Download the document by selecting your preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel unsure concerning your New Mexico Judgment on Writ of Garnishment and Order to Pay template, speak to a attorney to review it before you send out or file it. Get started hassle-free!

Form popularity

FAQ

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

It releases your garnishment! When a creditor sues you, they eventually get a judgment in court. With this judgment, they can send a letter to your employer so that they can garnish your wages.A release of garnishment would stop any future garnishments.

Respond to the Creditor's Demand Letter. Seek State-Specific Remedies. Get Debt Counseling. Object to the Garnishment. Attend the Objection Hearing (and Negotiate if Necessary) Challenge the Underlying Judgment. Continue Negotiating.

Once a judgment is issued and the creditor is able to receive payment through wage garnishment, you have little leverage for negotiating a settlement. At this point, the creditor has sufficiently proven the debt is valid and the court has ordered you to repay it.

Generally, any creditor can garnish your wages.Specifically, most must file a lawsuit and obtain a money judgment and court order before garnishing your wages. However, not all creditors need a court order. It depends on the type of debt.

You can stop a garnishment by paying the debt in full. You can stop a wage garnishment by asking the court to order installment payments in your case. Read Getting an Installment Payment Plan to learn more. Objecting to a garnishment will stop it until the objection is decided.

Call the creditor and negotiate payment terms and have them remove the garnishment; Liquidate assets or obtain a loan to pay off the creditor in full; Ceasing employment with that employer, though not often the best option, will not give the creditor any income to garnish;

If it's already started, you can try to challenge the judgment or negotiate with the creditor. But, they're in the driver's seat, and if they don't allow you to stop a garnishment by agreeing to make voluntary payments, you can't really force them to. You can, however, stop the garnishment by filing a bankruptcy case.

If you are served with a garnishment summons, do not ignore these documents because they do not directly involve a debt that you owe. Instead, you should immediately freeze any payments to the debtor, retain the necessary property, and provide the required written disclosure.