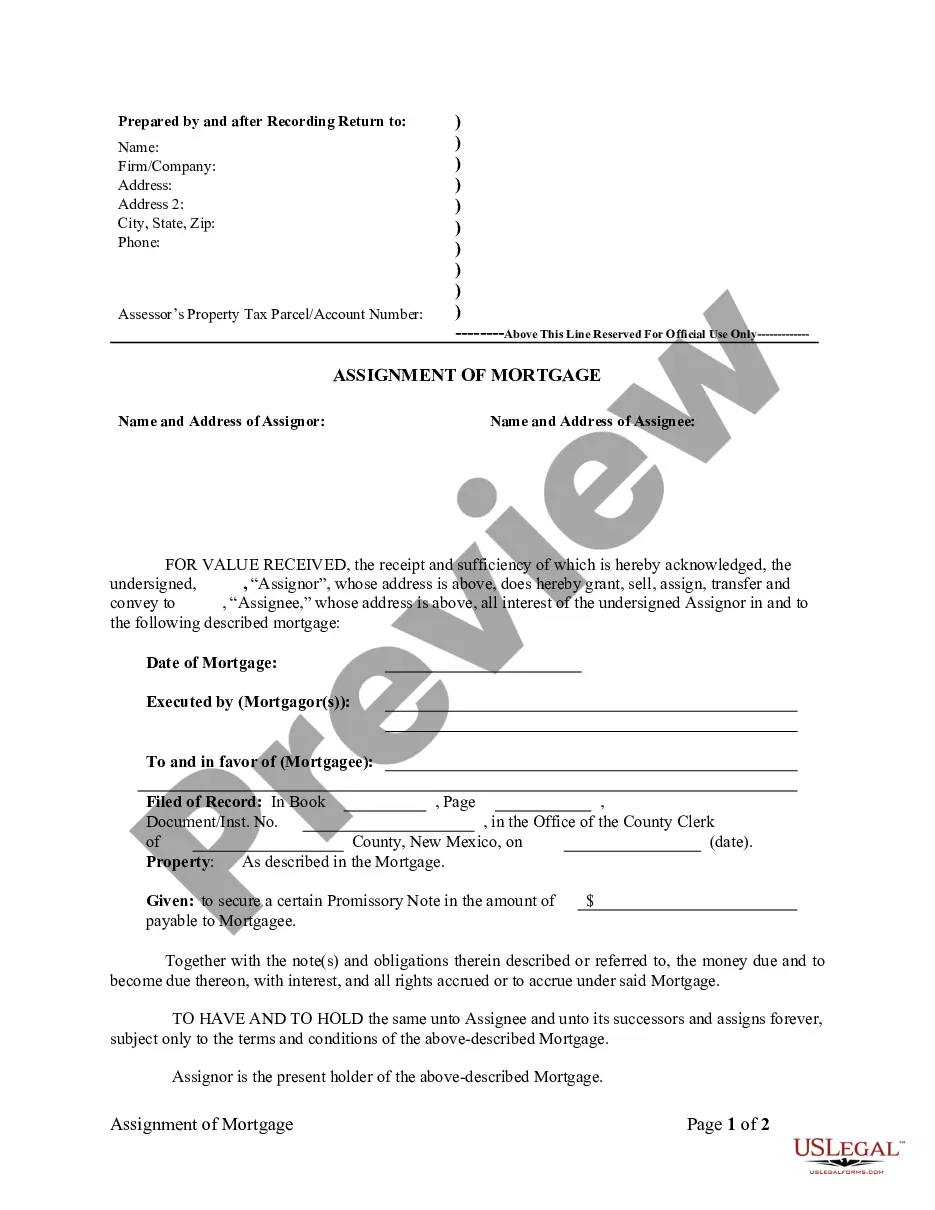

New Mexico Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out New Mexico Assignment Of Mortgage By Individual Mortgage Holder?

US Legal Forms is actually a unique platform to find any legal or tax template for completing, including New Mexico Assignment of Mortgage by Individual Mortgage Holder. If you’re sick and tired of wasting time searching for appropriate samples and paying money on papers preparation/legal professional charges, then US Legal Forms is exactly what you’re searching for.

To enjoy all the service’s advantages, you don't have to install any application but simply choose a subscription plan and register an account. If you already have one, just log in and look for an appropriate sample, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Assignment of Mortgage by Individual Mortgage Holder, take a look at the recommendations below:

- check out the form you’re considering applies in the state you need it in.

- Preview the example its description.

- Simply click Buy Now to get to the register page.

- Choose a pricing plan and continue registering by entering some info.

- Pick a payment method to complete the registration.

- Save the document by choosing the preferred file format (.docx or .pdf)

Now, submit the document online or print out it. If you feel uncertain concerning your New Mexico Assignment of Mortgage by Individual Mortgage Holder template, speak to a attorney to examine it before you decide to send or file it. Begin hassle-free!

Form popularity

FAQ

A collateral assignment of life insurance is a conditional assignment appointing a lender as the primary beneficiary of a death benefit to use as collateral for a loan. If the borrower is unable to pay, the lender can cash in the life insurance policy and recover what is owed.

You will need to sign a promissory note and a mortgage or trust deed.The document should be signed and dated by the borrower, and you will need to file or record the document at the local recorder of deeds office or other office responsible for the filing of real estate documents.

A collateral assignment refers to the transfer of ownership rights of an asset. When you borrow money, or when someone spends money on your behalf, often they will require you to pledge collateral in the form of an asset in order to protect them from loss.

Banks often sell and buy mortgages from each other as a way to liquidate assets and improve their credit ratings. When the original lender sells the debt to another bank or an investor, a mortgage assignment is created and recorded in the public record and the promissory note is endorsed.

If the borrower on a recorded mortgage defaults, the lender can foreclose and either be paid in full or receive the property. However, if a mortgage or deed of trust was not recorded, the lender cannot foreclose against the property, just against the defaulting borrower personally.

Corporate mortgage assignment defined. An assignment of a mortgage occurs when a loan for a piece of property (home or otherwise) is assigned to another party.A corporate assignment of a mortgage occurs when the third party that assumes the obligation for the loan is a corporation.

An assignment transfers all of the original mortgagee's interest under the mortgage or deed of trust to the new bank. Generally, the mortgage or deed of trust is recorded shortly after the mortgagors sign it and, if the mortgage is subsequently transferred, each assignment is to be recorded in the county land records.

An assignment of mortgage gives the loan seller's rights under the mortgage, including the right to foreclose if the borrower doesn't make payments, to the new owner of the loan.

The Collateral Assignment of Mortgage and related Collateral Assignment of Assignment of Leases, if any, or assignment of any other agreement executed in connection with such Mortgage Loan constitutes the legal, valid and binding assignment of such Mortgage from Borrower to or for the benefit of Agent, and validly