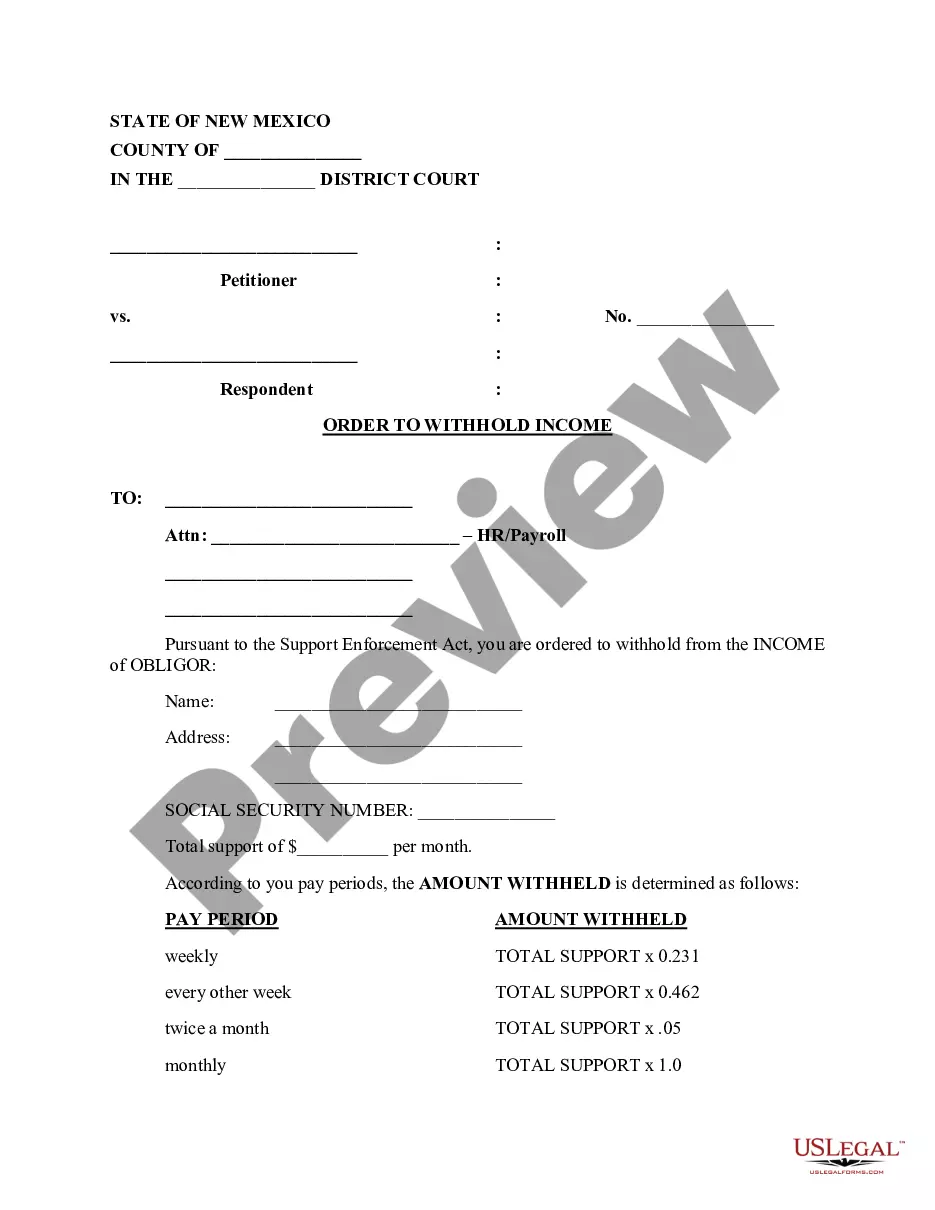

New Mexico Order to Withhold Income

Description

Key Concepts & Definitions

Order to Withhold Income is a legal document issued typically by courts directing an employer to deduct directly from an employee's earnings to pay for child support, alimony, or other legal obligations. This process ensures that payments are made systematically and reduces the possibility of non-payment.

Step-by-Step Guide

- Obtaining the Order: This step usually begins when an individual files a request with the state court for withholding income due to reasons like child support.

- Issuance of the Order: Once approved, the court issues the order to withhold income directly to the employer.

- Notification: The employer notifies the employee about the order.

- Implementation: The employer starts deducting the specified amount from the employee's paycheck.

- Remittance: The employer must remit the deducted amount to the appropriate state or federal agency.

Risk Analysis

- Legal Compliance Risks: Failure to comply with the order can lead to significant penalties for employers.

- Financial Implications: Employees might face financial hardship due to deduction from their regular income.

- Error in Deduction: Incorrect deduction amount can lead to legal conflicts and require adjustments.

Key Takeaways

- Always verify the accuracy of the withholding order.

- Employers should keep detailed records of all deducted and remitted amounts.

- Employees should review their earnings statements to ensure correct deductions.

Common Mistakes & How to Avoid Them

- Delay in Implementation: Employers should act promptly on receiving the order to prevent accumulation of unpaid amounts.

- Miscalculating the Deduction: Regular checks and balances can mitigate errors in calculation.

How to fill out New Mexico Order To Withhold Income?

US Legal Forms is really a special platform to find any legal or tax template for completing, including New Mexico Order to Withhold Income. If you’re tired with wasting time looking for suitable examples and paying money on document preparation/legal professional fees, then US Legal Forms is exactly what you’re looking for.

To experience all of the service’s advantages, you don't have to download any software but just choose a subscription plan and sign up your account. If you have one, just log in and find a suitable template, save it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Order to Withhold Income, check out the guidelines below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the form and look at its description.

- Click on Buy Now button to access the sign up page.

- Pick a pricing plan and proceed signing up by entering some info.

- Select a payment method to complete the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print it. If you feel uncertain regarding your New Mexico Order to Withhold Income template, speak to a lawyer to review it before you send out or file it. Start without hassles!

Form popularity

FAQ

Alabama. Arizona. Arkansas. California. Connecticut. District of Columbia. Georgia. Hawaii.

New Mexico bases its withholding tax on an estimate of an employee's State income tax liability. The State credits taxes withheld against the employee's actual income tax liability on the New Mexico personal income tax return. State withholding tax is like federal withholding tax.

Introduction. In addition to federal income taxes, U.S. citizens are liable for various state taxes as well. While some states do not levy a state income tax, all states assess some form of tax, such as sales or use taxes. And some of these taxes will require you to submit a separate state tax form each year.

Unlike most other states, New Mexico continues to use the federal Form W-4 for state withholding purposes. New Mexico does not have a state equivalent of the federal W-4 form.

Once you receive an IWO, you should withhold child support as soon as possible. Most states require that you start withholding no later than the pay period beginning 14 days after the agency mailed the IWO. If you don't withhold child support after receiving an income withholding order, you will face penalties.

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions.

New Mexico State Income Taxes for Tax Year 2020 (January 1 - Dec. 31, 2020) can be prepared and e-Filed now along with an IRS or Federal Income Tax Return (or you can learn how to only prepare and file a NM state return).

Payments subject to withholding include compensation for services, interest, dividends, rents, royalties, annuities, and certain other payments. Tax is withheld at 30% of the gross amount of the payment. This withholding rate may be reduced under a tax treaty.

An income withholding order (IWO) is a document sent to employers to tell them to withhold child support from an employee's wages. The IWO can come from a state, tribal, or territorial agency; a court; an attorney; or an individual.