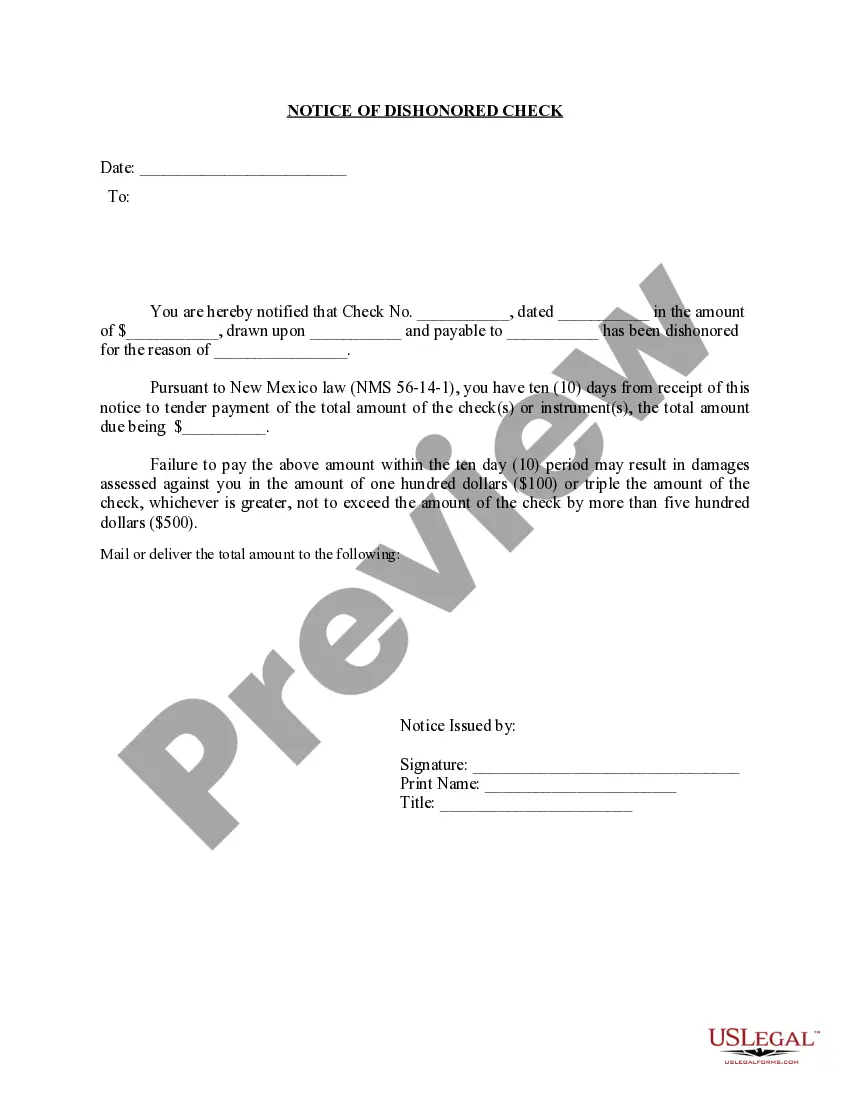

New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check

Description Notice Check Bad

How to fill out Nm Keywords Bounced?

US Legal Forms is actually a unique platform where you can find any legal or tax form for filling out, such as New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check. If you’re sick and tired of wasting time looking for appropriate examples and spending money on file preparation/legal professional charges, then US Legal Forms is exactly what you’re seeking.

To experience all of the service’s benefits, you don't have to install any software but just pick a subscription plan and create an account. If you have one, just log in and find an appropriate sample, save it, and fill it out. Saved documents are all saved in the My Forms folder.

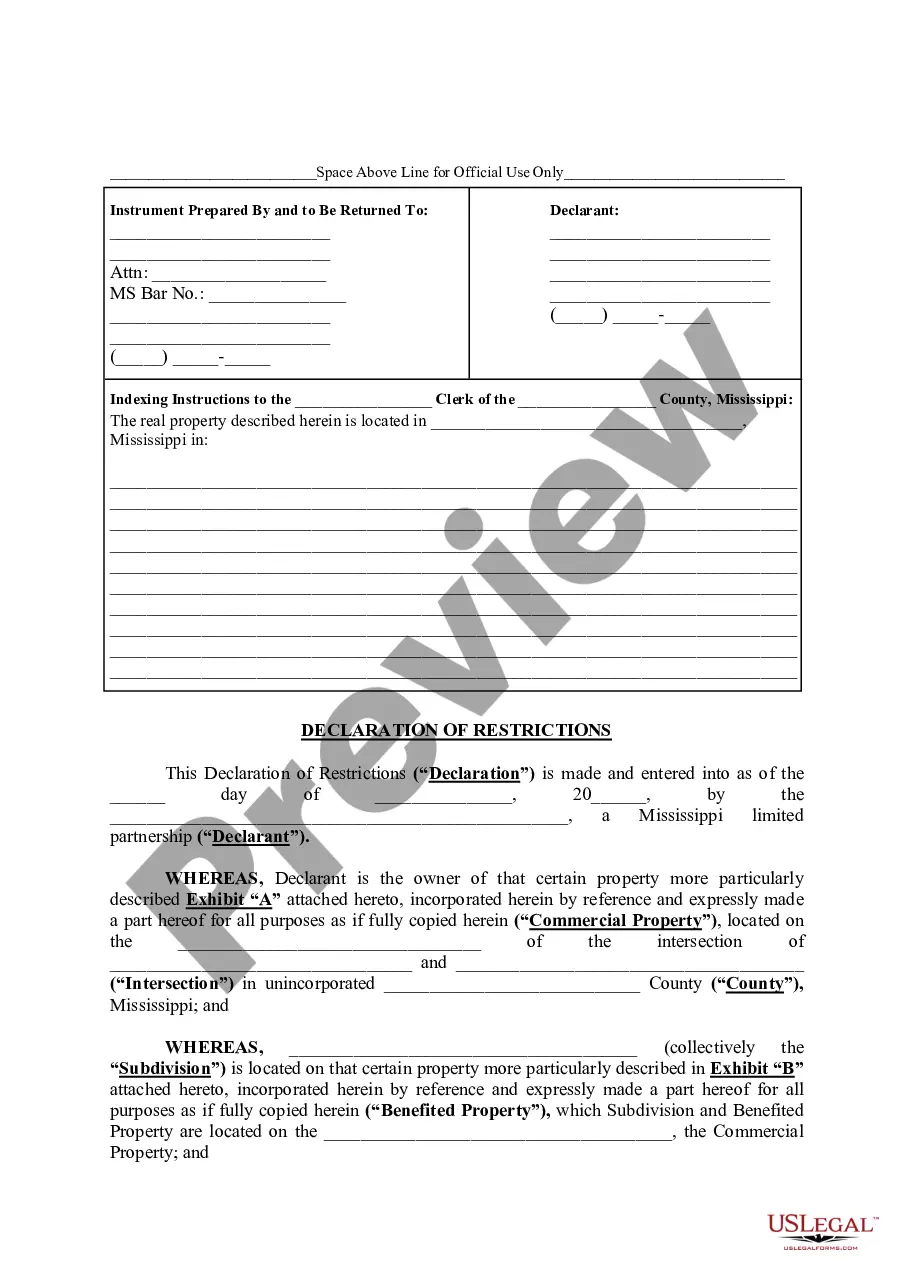

If you don't have a subscription but need New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check, check out the guidelines below:

- check out the form you’re considering is valid in the state you need it in.

- Preview the example and look at its description.

- Click Buy Now to get to the register webpage.

- Select a pricing plan and continue registering by providing some information.

- Decide on a payment method to complete the registration.

- Save the document by choosing your preferred format (.docx or .pdf)

Now, complete the file online or print it. If you are uncertain about your New Mexico Notice of Dishonored Check - Civil - Keywords: bad check, bounced check sample, contact a attorney to review it before you decide to send or file it. Begin without hassles!

Nm Bad Form popularity

How To Report Someone For Writing Bad Checks Other Form Names

Nm Bad File FAQ

If someone writes you a bad check and you deposit the check at the bank, or cash it at your bank you will be penalized. They will charge you a fee for the bounced check and it may take a couple days for it to reflect.If you are worried about bad checks, insist on getting paid in cash.

Writing bad checks can lead to several theft charges, but with the help of a skilled defense attorney, you can work to reduce or even dismiss charges.

When there are insufficient funds in an account, and a bank decides to bounce a check, it charges the account holder an NSF fee. If the bank accepts the check, but it makes the account negative, the bank charges an overdraft (OD) fee. If the account stays negative, the bank may charge an extended overdraft fee.

Penal Code 476a PC is the California statute that makes it a crime for a person to write or pass a bad check, knowing there are insufficient funds to cover payment of the check. The offense can be charged as a felony if the value of the bad checks is more than $950.00. Otherwise, the offense is only a misdemeanor.

People who write bad checks are normally charged fees by their banks and could be on the hook for any fees incurred by the payee. Knowingly writing a bad check may constitute a misdemeanor or felony, depending on the amount of the check and the state in which it was written.

Writing a bad check, also known as a hot check, is illegal. Banks normally charge a fee to anyone who writes a bad check unintentionally. The punishment for trying to pass a bad check intentionally ranges from a misdemeanor to a felony.

A bounced check occurs when the writer of the check has insufficient funds available to fulfill the payment amount on the check to the payee. When a check bounces, they are not honored by the depositor's bank, and may result in fees and banking restrictions.

If the tellers at the checks bank tell you there ARE sufficient funds you have three options: cash the check immediately (actually get cash - probably not recommended if it's several thousand dollars), take the check to YOUR bank and deposit the funds (this will take 2-3 days for the check to clear - not recommended),

Bouncing a check can happen to anyone. Write one and you'll owe your bank an NSF fee of between $27 and $35, and the recipient of the check is permitted to charge a returned-check fee of between $20 and $40 or a percentage of the check amount.