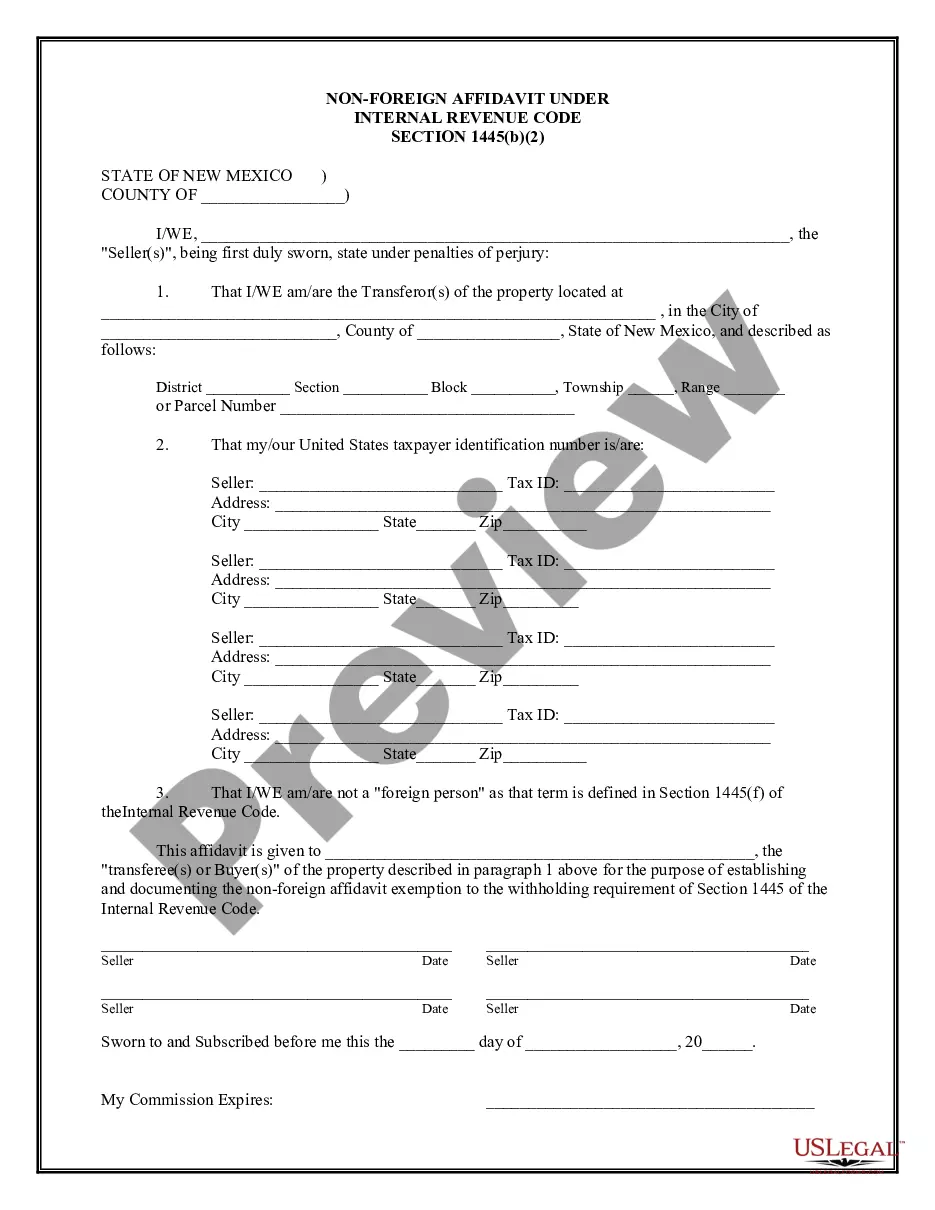

New Mexico Non-Foreign Affidavit Under IRC 1445

Description

How to fill out New Mexico Non-Foreign Affidavit Under IRC 1445?

US Legal Forms is actually a unique platform to find any legal or tax form for submitting, such as New Mexico Non-Foreign Affidavit Under IRC 1445. If you’re fed up with wasting time searching for appropriate examples and paying money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re trying to find.

To experience all the service’s advantages, you don't have to install any software but simply choose a subscription plan and create an account. If you have one, just log in and look for the right template, save it, and fill it out. Downloaded documents are stored in the My Forms folder.

If you don't have a subscription but need to have New Mexico Non-Foreign Affidavit Under IRC 1445, check out the recommendations listed below:

- make sure that the form you’re considering applies in the state you want it in.

- Preview the sample and look at its description.

- Simply click Buy Now to get to the register page.

- Select a pricing plan and continue registering by entering some information.

- Choose a payment method to complete the registration.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain about your New Mexico Non-Foreign Affidavit Under IRC 1445 template, speak to a legal professional to examine it before you send out or file it. Begin hassle-free!

Form popularity

FAQ

What Is a Certification of Non-Foreign Status? With a Certification of Non-Foreign Status, the seller of real estate is certifying under penalty of perjury, that the seller is not foreign. Therefore, the seller and the transaction will not have the withholding requirements.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA) income tax withholding. FIRPTA authorized the United States to tax foreign persons on dispositions of U.S. real property interests.

FIRPTA Certificate: Certification of Non-Foreign Status - FIRPTA is the Foreign Investment in Real Property Act and Form 8288. It was developed to ensure that foreign sellers of U.S. property be subject to U.S. tax on the sale.

You or a member of your family must have definite plans to reside at the property for at least 50% of the number of days the property is used by any person during each of the first two 12-month periods following the date of transfer.

This document, included in the seller's opening package, requests that the seller swears under penalty of perjury that they are not a non-resident alien for purposes of United States income taxation. A Seller unable to complete this affidavit may be subject to withholding up to 15%.

A: The buyer must agree to sign an affidavit stating that the purchase price is under $300,000 and the buyer intends to occupy. The buyer may choose not to sign the form, in which case withholding must be done.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The transferee is the withholding agent.If the transferor is a foreign person and you fail to withhold, you may be held liable for the tax.

The Foreign Investment in Real Property Transfer Act (FIRPTA) requires any buyer of a U.S. real property interest to withhold ten percent of the amount realized by a foreign seller. 26 USC § 1445(a).