New Mexico Dissolution Package to Dissolve Corporation

Description Dissolve Corporation

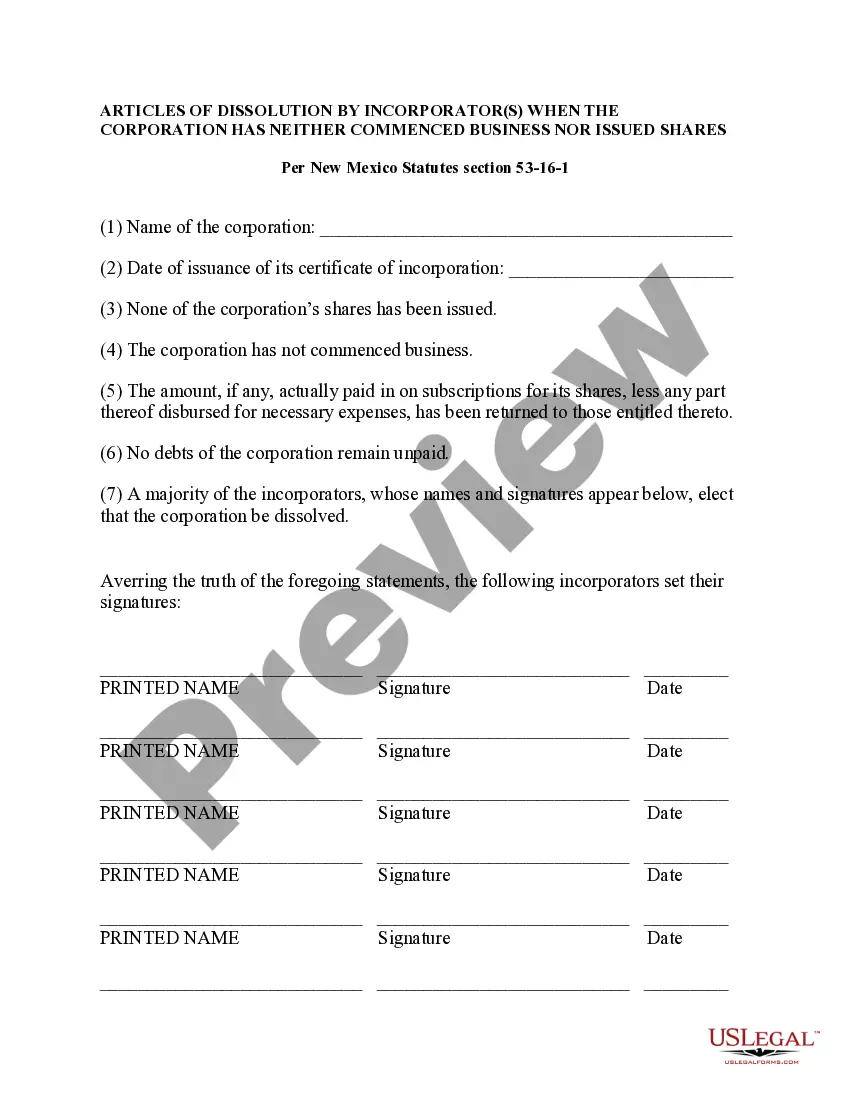

How to fill out Corporation Business Shares?

US Legal Forms is actually a unique platform to find any legal or tax form for completing, such as New Mexico Dissolution Package to Dissolve Corporation. If you’re tired with wasting time seeking perfect examples and spending money on record preparation/lawyer service fees, then US Legal Forms is exactly what you’re searching for.

To reap all of the service’s benefits, you don't need to install any application but just choose a subscription plan and sign up your account. If you already have one, just log in and find a suitable template, save it, and fill it out. Saved files are all saved in the My Forms folder.

If you don't have a subscription but need New Mexico Dissolution Package to Dissolve Corporation, have a look at the recommendations below:

- check out the form you’re taking a look at applies in the state you want it in.

- Preview the form its description.

- Simply click Buy Now to access the register webpage.

- Pick a pricing plan and continue registering by entering some info.

- Choose a payment method to finish the sign up.

- Download the file by selecting your preferred format (.docx or .pdf)

Now, complete the document online or print it. If you feel unsure concerning your New Mexico Dissolution Package to Dissolve Corporation template, contact a legal professional to review it before you decide to send out or file it. Get started without hassles!

Dissolution Corporation Editable Form popularity

Nm Package Dissolve Other Form Names

Dissolution Corporation Sample FAQ

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

Failing to dissolve the corporation allows third parties to continue to sue the corporation as if it is still in operation. A judgment might mean that shareholders use the money received from distributed assets when the corporation closed down to satisfy judgments against the corporation.

In order to officially dissolve your LLC, you must file Articles of Dissolution with the Secretary of State. Articles of Dissolution carry a $50 filing fee. Normal processing for the Public Regulation Commission is between 10 and 15 business days.

When a corporation is dissolved, it no longer legally exists and, in most cases, its debts disappear as well. State laws usually give additional time beyond the dissolution for creditors to file suits for failure to pay any corporate debts or for the wrongful distribution of corporate assets.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets.Assets used as security for loans must be given to the bank or creditor that extended the loan, or you must pay off the loan before selling such assets.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

File Articles of Dissolution with the state. Visit an online legal document creation service such as Legal Docs.com or Legal Zoom.com and write the LLC's Articles of Dissolution. These documents are necessary to legally separate each LLC member from the entity.