New Mexico Dissolution Package to Dissolve Limited Liability Company LLC

Description Dissolution Dissolve Company

How to fill out Dissolution Limited Company?

US Legal Forms is a unique platform where you can find any legal or tax form for submitting, including New Mexico Dissolution Package to Dissolve Limited Liability Company LLC. If you’re tired of wasting time looking for suitable examples and spending money on file preparation/attorney fees, then US Legal Forms is precisely what you’re seeking.

To experience all of the service’s advantages, you don't need to install any application but just select a subscription plan and sign up your account. If you have one, just log in and find an appropriate template, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need New Mexico Dissolution Package to Dissolve Limited Liability Company LLC, check out the guidelines below:

- make sure that the form you’re taking a look at is valid in the state you need it in.

- Preview the example its description.

- Simply click Buy Now to access the register page.

- Pick a pricing plan and continue registering by providing some info.

- Decide on a payment method to finish the sign up.

- Save the document by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you are uncertain concerning your New Mexico Dissolution Package to Dissolve Limited Liability Company LLC form, contact a legal professional to review it before you send out or file it. Begin without hassles!

Nm Dissolve Company Form popularity

Package Dissolve Company Other Form Names

New Mexico Dissolve FAQ

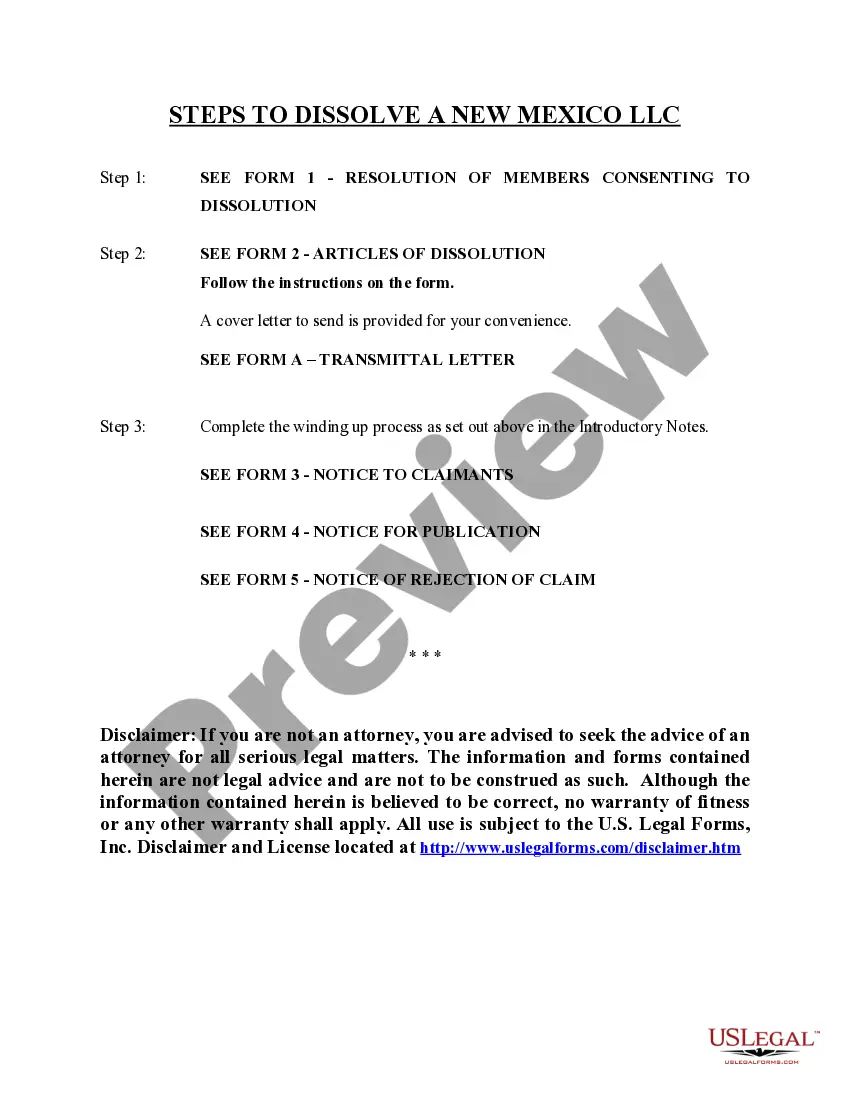

Tell Customers and Creditors You Are Going Out of Business. Pay Off Debts to Your Creditors. Vote to Dissolve Your Business. Complete and File the Necessary Forms. Inform the IRS of Your Dissolution. Cancel Foreign Qualifications.

The Effect of Dissolution After you close your LLC in California, that LLC shall be canceled, and its powers, rights, and privileges shall end upon the filing of the Certificate of Cancellation. This means you can no longer conduct business using that LLC.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office.

Dissolve the Legal Entity (LLC or Corporation) with the State. An LLC or Corporation needs to be officially dissolved. Pay Any Outstanding Bills. You need to satisfy any company debts before closing the business. Cancel Any Business Licenses or Permits. File Your Final Federal and State Tax Returns.

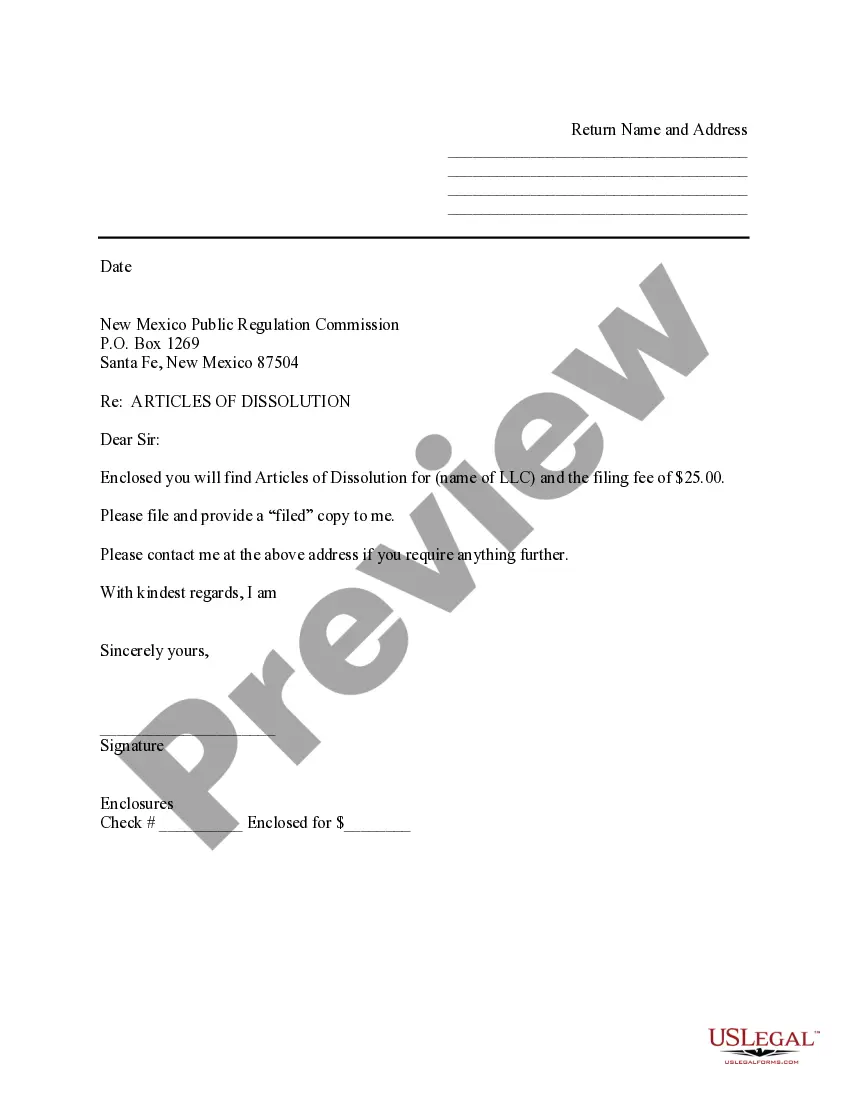

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

Step 1: Corporation or LLC action. Step 2: Filing the Certificate of Dissolution with the state. Step 3: Filing federal, state, and local tax forms. Step 4: Notifying creditors your business is ending. Step 5: Settling creditors' claims.

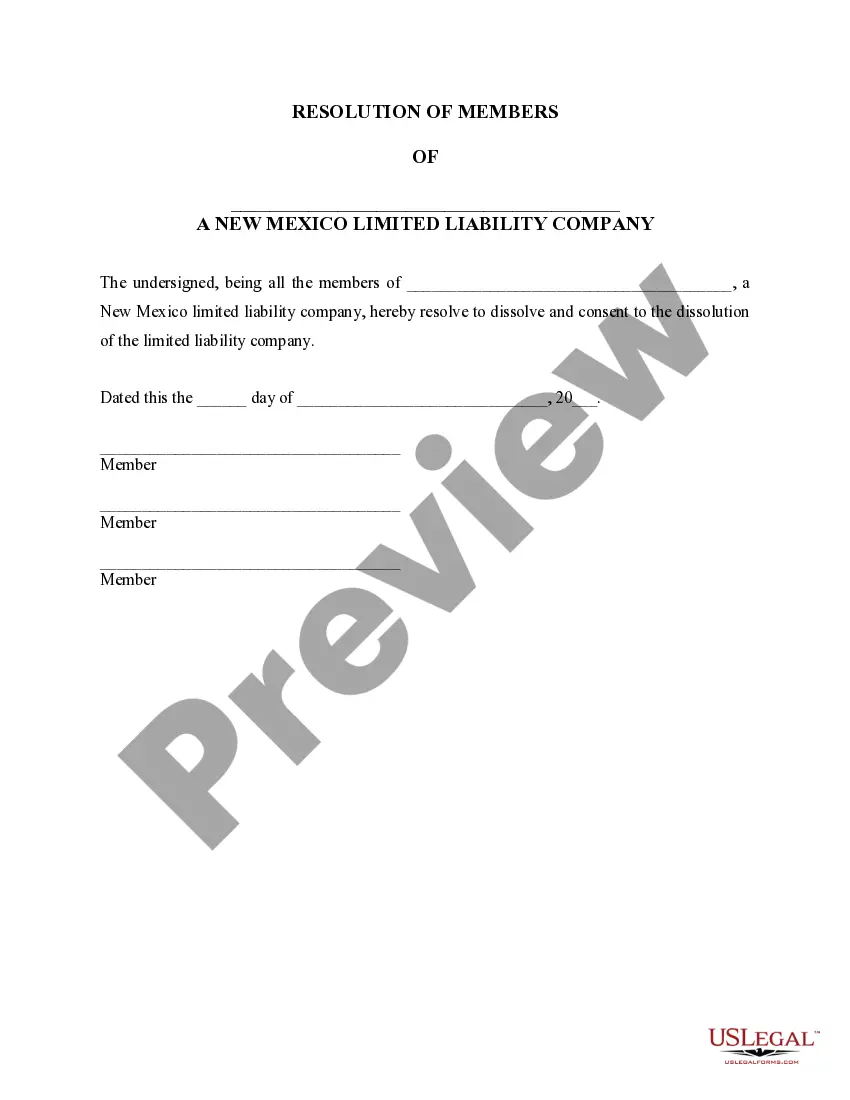

Method 1: You can voluntarily dissolve your LLC. This requires a majority vote from all members or a certain percentage of votes as required per your operating agreement. With the required votes, you can move forward with the dissolution.