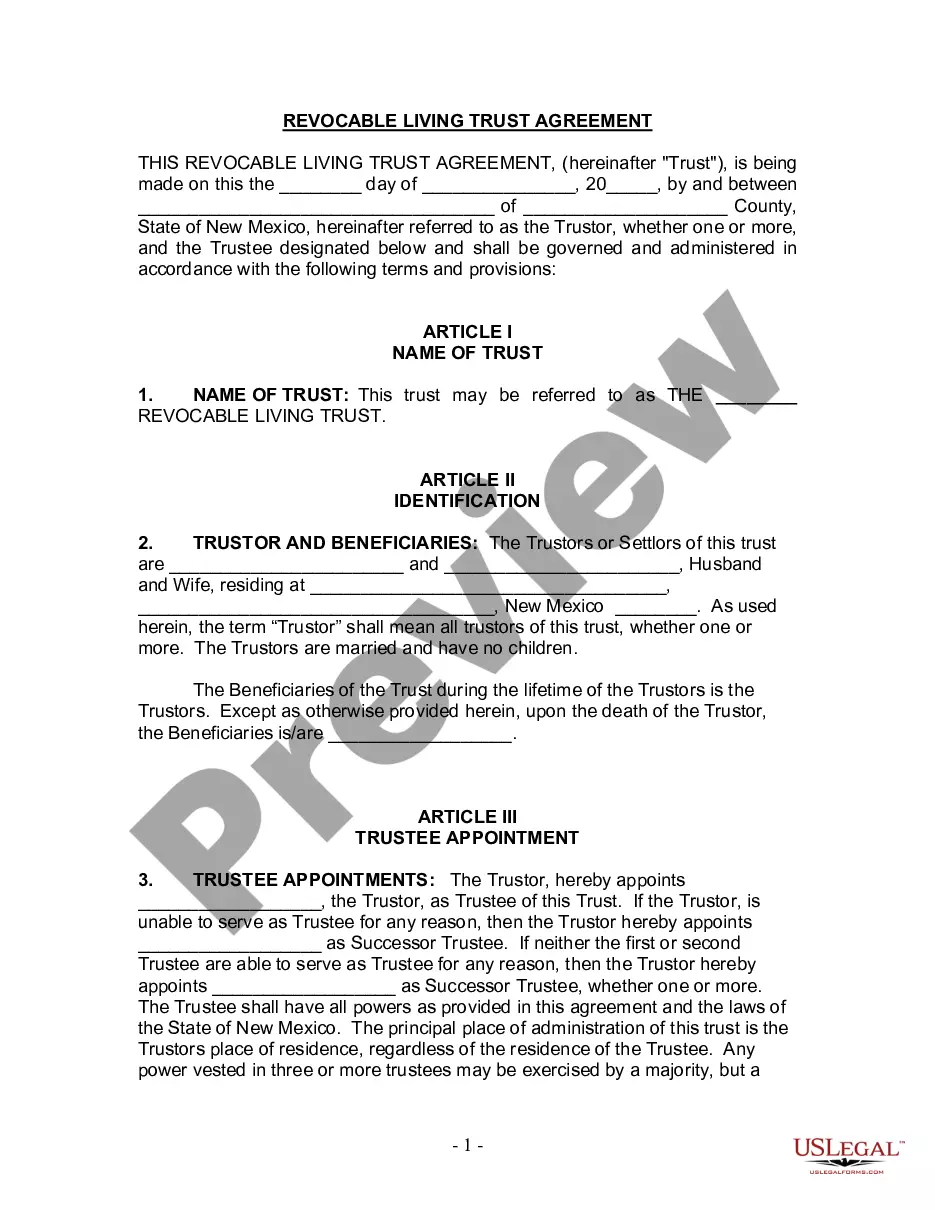

New Mexico Living Trust for Husband and Wife with No Children

Description

How to fill out New Mexico Living Trust For Husband And Wife With No Children?

US Legal Forms is actually a unique platform where you can find any legal or tax document for filling out, such as New Mexico Living Trust for Husband and Wife with No Children. If you’re sick and tired of wasting time seeking appropriate samples and paying money on papers preparation/legal professional service fees, then US Legal Forms is precisely what you’re seeking.

To reap all of the service’s benefits, you don't have to install any software but just select a subscription plan and sign up an account. If you have one, just log in and look for a suitable sample, download it, and fill it out. Saved documents are stored in the My Forms folder.

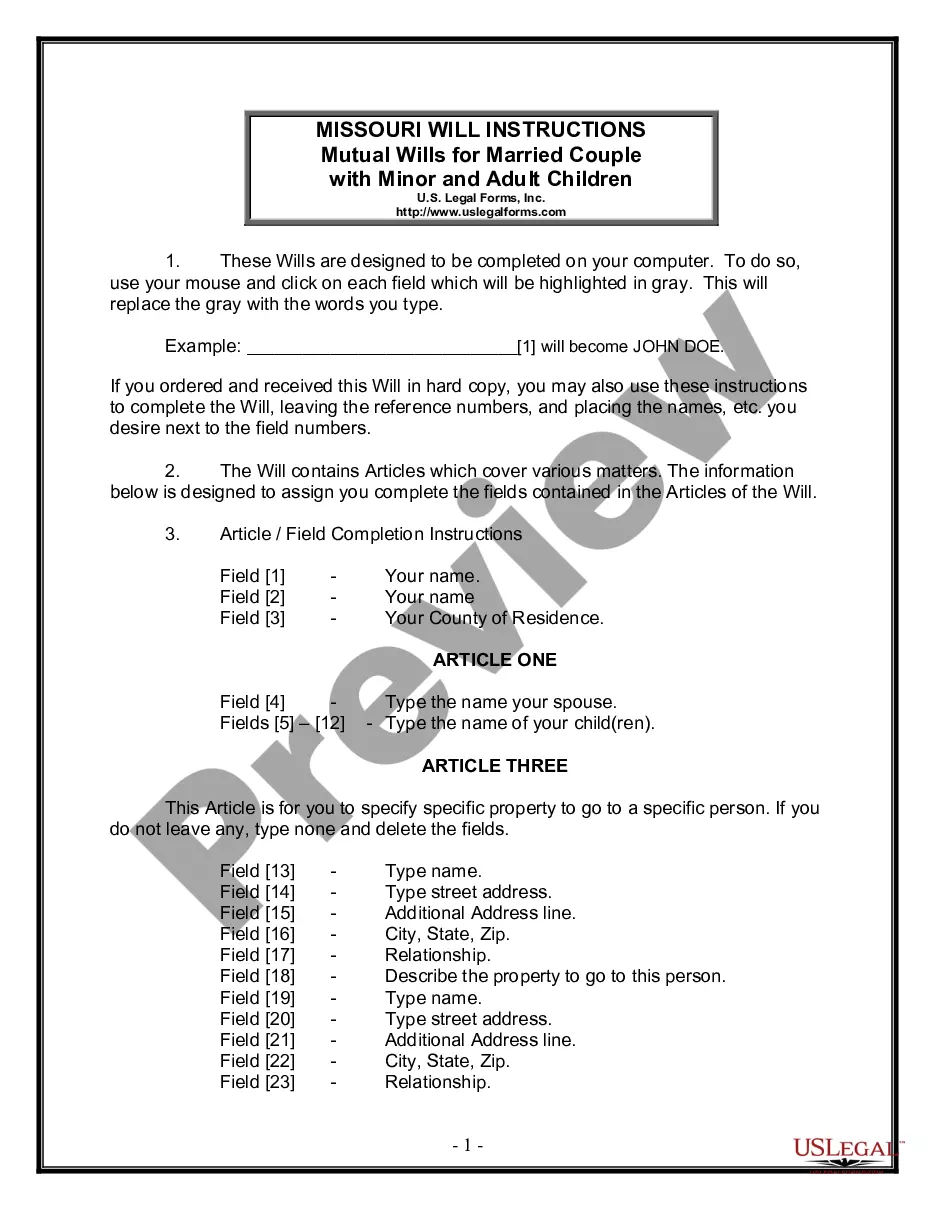

If you don't have a subscription but need New Mexico Living Trust for Husband and Wife with No Children, take a look at the guidelines listed below:

- check out the form you’re considering is valid in the state you want it in.

- Preview the sample and look at its description.

- Simply click Buy Now to reach the sign up webpage.

- Pick a pricing plan and carry on registering by providing some info.

- Decide on a payment method to complete the sign up.

- Save the document by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print out it. If you are uncertain concerning your New Mexico Living Trust for Husband and Wife with No Children template, speak to a legal professional to review it before you send or file it. Begin hassle-free!

Form popularity

FAQ

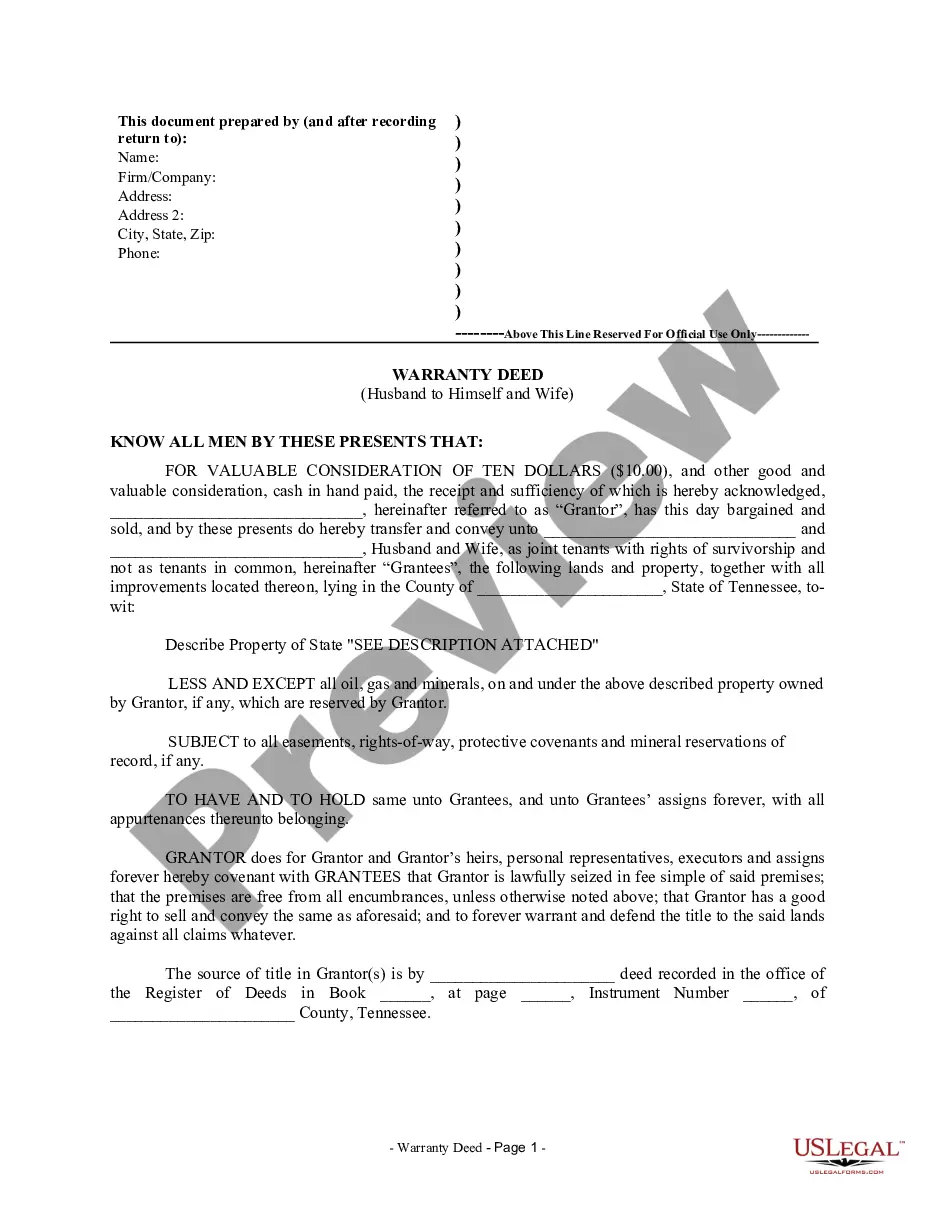

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In New Mexico, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Dying without a Will in New MexicoIf you die without a valid will, you'll lose control over what happens to your assets after your death.If there isn't a will, the court will appoint someone, usually an adult child or surviving spouse, to be the executor or personal representative.

When someone dies without a will (or intestate), New Mexico probate law designates the surviving family members to whom the estate will pass.If the deceased left no surviving spouse, then the deceased's surviving children (both biological and adopted) receive the deceased's property in equal shares.

Children - if there is no surviving married or civil partner If there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

Inheritance is Considered Separate Property It's also considered separate property under California law. This means that it is yours, and yours alone, if and when you get a divorce. Your spouse will have no ownership rights to that inheritance.You decide to add your spouse's name to the deed.

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

California is a community property state, which means that following the death of a spouse, the surviving spouse will have entitlement to one-half of the community property (i.e., property that was acquired over the course of the marriage, regardless of which spouse acquired it).

But to protect spouses from being disinherited, most of these states give a surviving spouse the right to claim one-third to one-half of the deceased spouse's estate, no matter what the will provides. (For other limitations on what a will can do, see What a Will Won't Do.)