New Mexico Living Trust for Individual Who is Single, Divorced or Widow or Widower with Children

What this document covers

This Living Trust is a legal document designed for individuals who are single, divorced, or widowed and have children. Unlike a will, a living trust allows you to manage your assets during your lifetime and specify how they should be distributed after your death, bypassing the lengthy probate process. This trust gives you control of your assets while providing for your children, making it a valuable tool for estate planning.

What’s included in this form

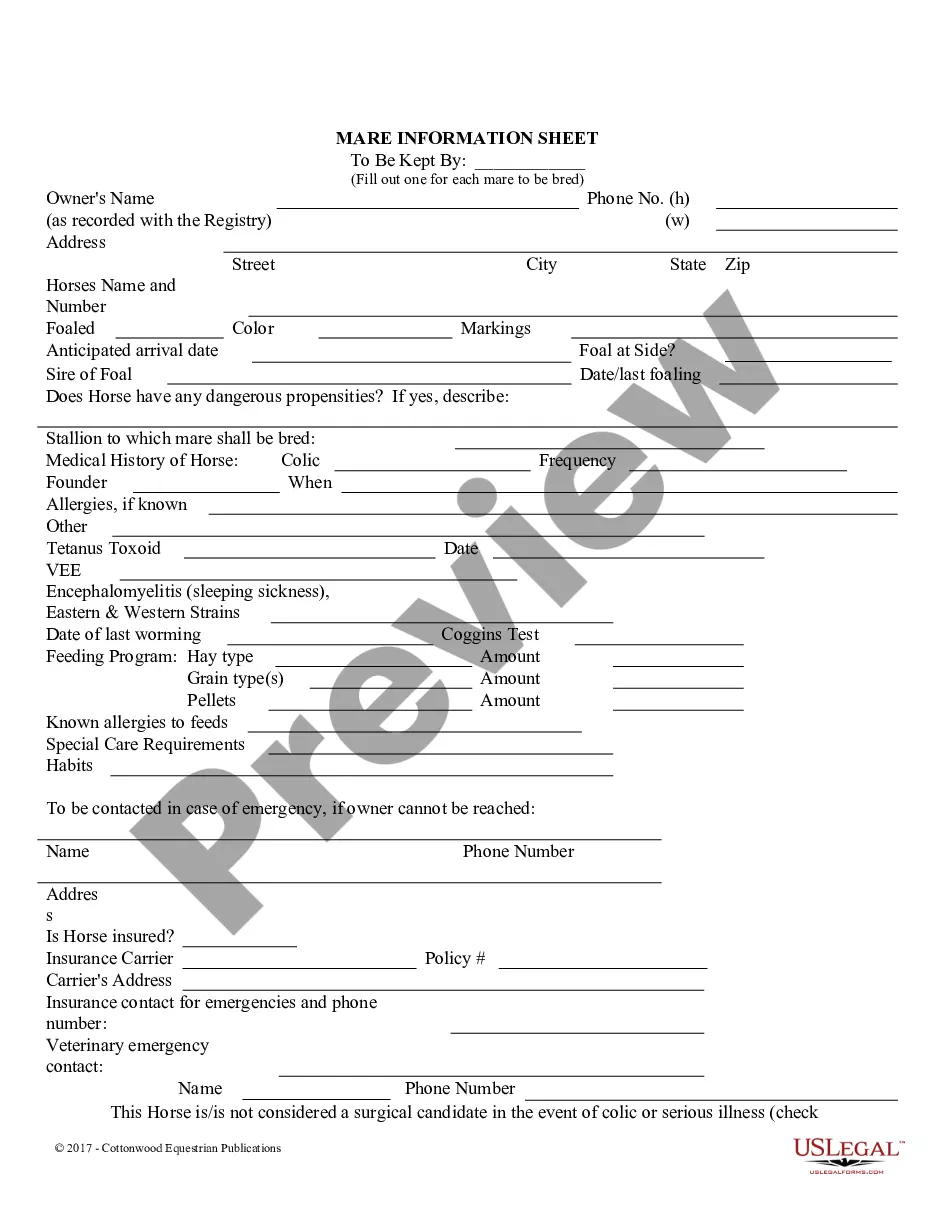

- Identification of the Trustor, Trustee, and Beneficiaries

- Clarification of the assets included in the trust

- Trustee powers and responsibilities

- Procedures for trust administration during the Trustor's lifetime

- Distribution instructions upon the Trustor's death

When to use this document

This form is appropriate for individuals who want to ensure their assets are managed according to their wishes during their lifetime and distributed to their children after their death. It is especially useful for single parents, those who have been divorced, or surviving spouses who wish to safeguard their children's inheritance while maintaining control over their assets.

Intended users of this form

- Individuals who are single, divorced, or widowed

- Parents with one or more children

- Anyone looking to avoid probate and ensure a smooth transition of assets to their children

- Individuals who want to retain control over their assets during their lifetime

How to complete this form

- Identify the Trustor and Trustee by entering their names and addresses.

- List the beneficiaries, specifically naming your children.

- Detail the assets being included in the trust (Schedule A).

- Specify the powers and responsibilities of the Trustee within the trust document.

- Sign the document in the presence of a notary if required by law.

Does this form need to be notarized?

Notarization is required for this form to take effect. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Avoid these common issues

- Not clearly identifying all beneficiaries.

- Failing to list all assets intended to be included in the trust.

- Neglecting to update the trust after significant life changes, such as marriage or divorce.

- Forgetting to sign and date the document in the presence of a notary when required.

Advantages of online completion

- Convenience of drafting the form from home at your own pace.

- Edit and customize the trust to fit your specific needs.

- Access to professional legal guidance through the templates provided by licensed attorneys.

- Secure and straightforward process with built-in compliance checks.

Looking for another form?

Form popularity

FAQ

Using a revocable living trust instead of a will means assets owned by your trust will bypass probate and flow to your heirs as you've outlined in the trust documents. A trust lets investors have control over their assets long after they pass away.

Paperwork. Setting up a living trust isn't difficult or expensive, but it requires some paperwork. Record Keeping. After a revocable living trust is created, little day-to-day record keeping is required. Transfer Taxes. Difficulty Refinancing Trust Property. No Cutoff of Creditors' Claims.

A living trust holds your assets during your lifetime and allows them to be distributed to the people you choose upon your death. To more easily understand how a living trust works, think of a trust as an empty box. You can put your assets into this box, including financial accounts and real estate.

When it comes to protecting your loved ones, having both a will and a trust is essential. The difference between a will and a trust is when they kick into action. A will lays out your wishes for after you die. A living revocable trust becomes effective immediately.