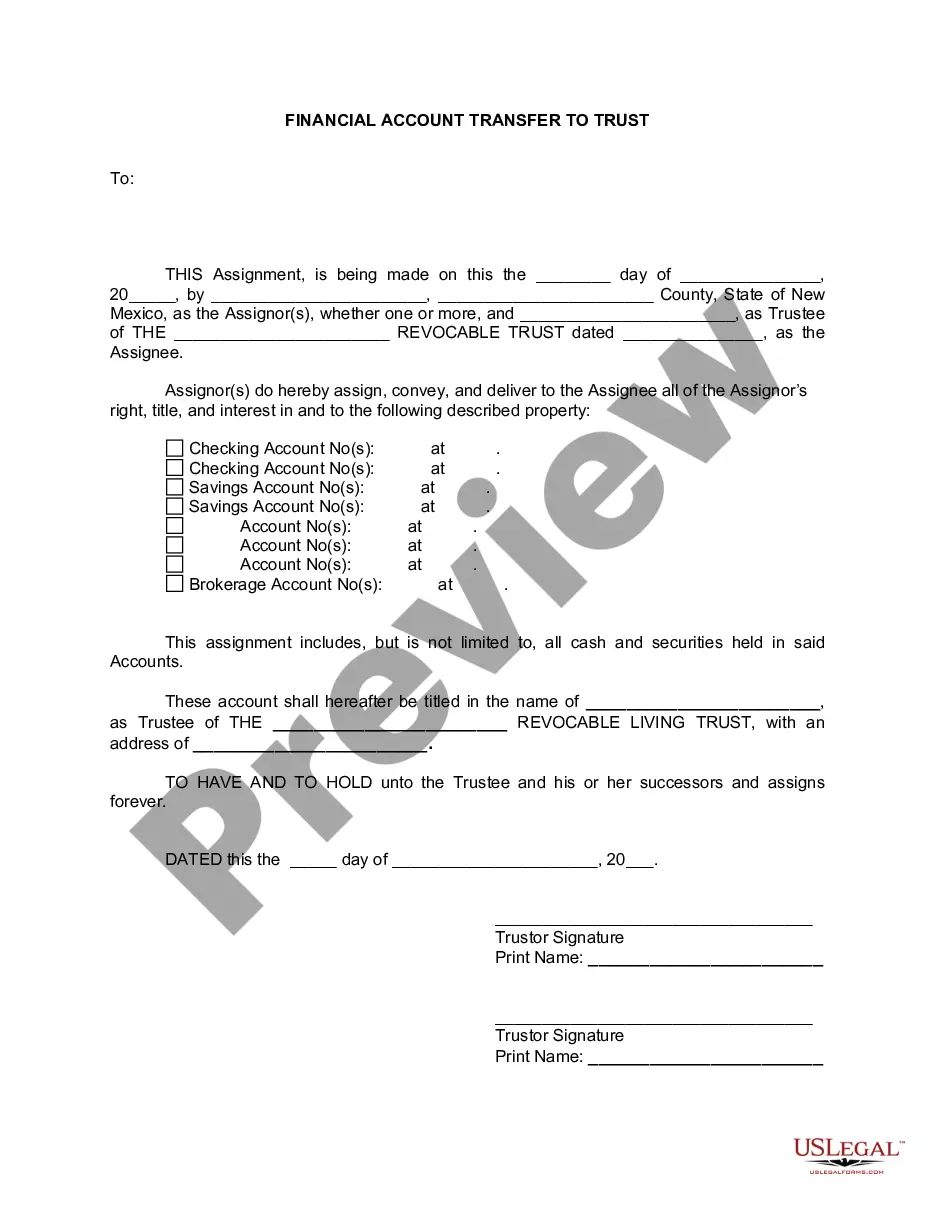

New Mexico Financial Account Transfer to Living Trust

Description

How to fill out New Mexico Financial Account Transfer To Living Trust?

US Legal Forms is a special system where you can find any legal or tax template for submitting, such as New Mexico Financial Account Transfer to Living Trust. If you’re tired of wasting time looking for ideal examples and spending money on papers preparation/lawyer fees, then US Legal Forms is precisely what you’re searching for.

To reap all the service’s advantages, you don't need to download any software but just select a subscription plan and register an account. If you already have one, just log in and find an appropriate template, save it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Financial Account Transfer to Living Trust, check out the guidelines below:

- make sure that the form you’re taking a look at applies in the state you want it in.

- Preview the example and read its description.

- Click on Buy Now button to access the register webpage.

- Pick a pricing plan and continue signing up by providing some information.

- Pick a payment method to complete the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, submit the file online or print it. If you feel unsure concerning your New Mexico Financial Account Transfer to Living Trust form, contact a attorney to analyze it before you decide to send out or file it. Begin without hassles!

Form popularity

FAQ

To put checking or savings accounts into the trust, go down to your bank and fill out the institutional paperwork. You don't have to change the name on the checks. When you die, your successor trustee will assume control of the account and distribute the money to your heirs.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

Lifetime Gift Tax Exemption The IRS allows you, as of 2014, to give up to $5.34 million in gifts or, after you die, bequests free of estate tax. This means you can put additional money into your irrevocable trust and, as long as you stay below your lifetime limit, it'll be a tax-free transfer.

When Should You Put a Bank Account into a Trust?More specifically, you can hold up to $166,250 of real or personal property outside a trust and avoid full probate in California. However, if you have more than $166,250 in a bank account, you should consider transferring it into your trust.

To transfer assets into a trust, the grantor must transfer titles from their name to the legal name of the trust. A grantor can create a living trust using an online legal document provider or by hiring an attorney. They can transfer almost any asset, including bank accounts, into a trust.

Visit your local bank branch and let the branch manager or representative know you want to transfer your bank account into the trust. Give the bank representative a signed and notarized copy of your trust document. The bank will need to confirm that you're the owner and verify the name of the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.