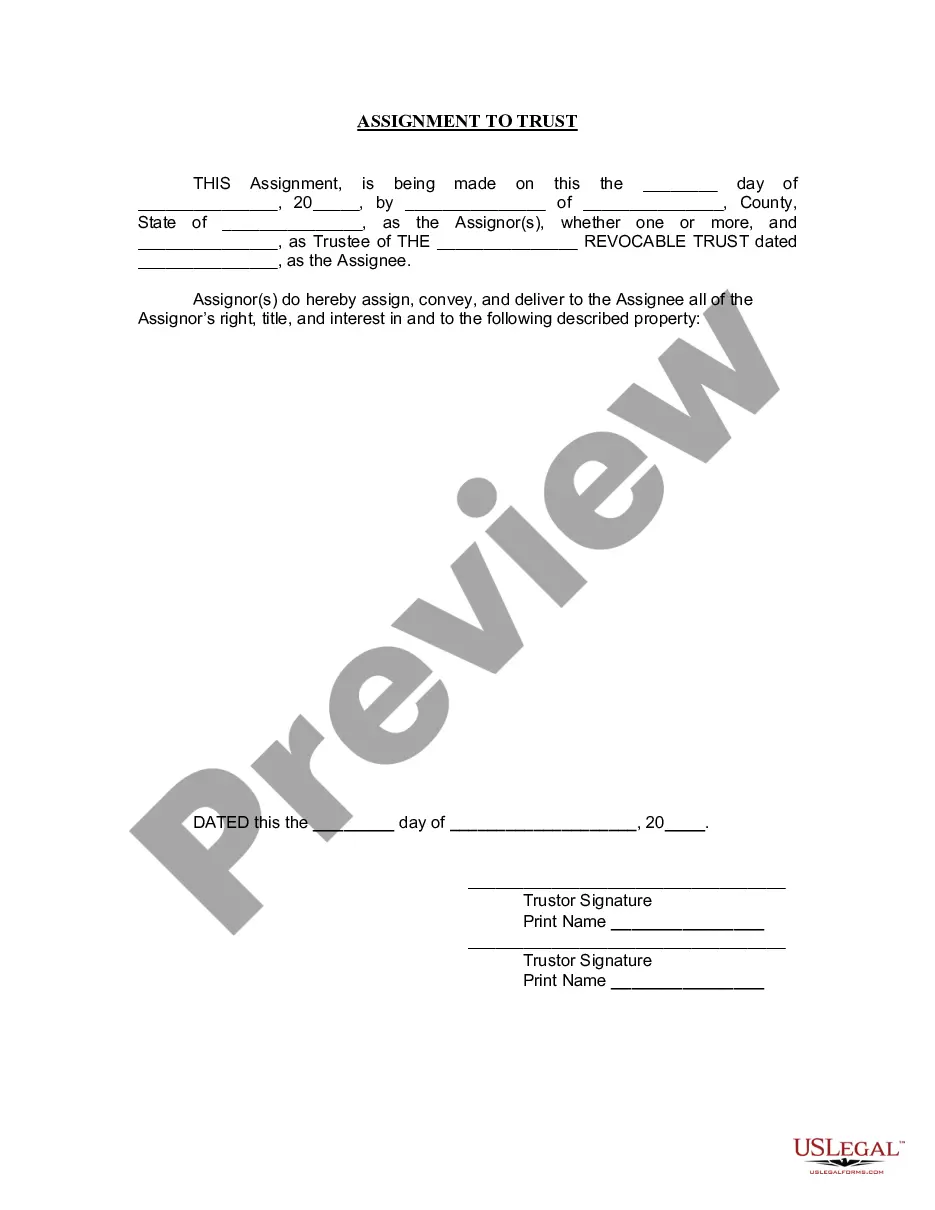

New Mexico Assignment to Living Trust

Description New Mexico Trust

How to fill out New Mexico Assignment To Living Trust?

US Legal Forms is actually a special system where you can find any legal or tax template for completing, such as New Mexico Assignment to Living Trust. If you’re sick and tired of wasting time searching for ideal samples and spending money on file preparation/legal professional fees, then US Legal Forms is exactly what you’re looking for.

To experience all the service’s advantages, you don't need to install any software but simply choose a subscription plan and create an account. If you have one, just log in and get a suitable template, save it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need New Mexico Assignment to Living Trust, check out the guidelines below:

- make sure that the form you’re considering applies in the state you need it in.

- Preview the sample its description.

- Simply click Buy Now to reach the sign up page.

- Pick a pricing plan and keep on signing up by entering some info.

- Decide on a payment method to complete the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, submit the document online or print it. If you are uncertain about your New Mexico Assignment to Living Trust form, contact a legal professional to analyze it before you send out or file it. Get started without hassles!

Form popularity

FAQ

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Get death certificates. find and file the will with the local probate court. notify the Social Security Administration of the death. notify the state Department of Health. identify the trust beneficiaries. notify the beneficiaries. inventory trust assets. protect trust property.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

A living trust is an important part of your estate plan. Most people can create a living trust without an attorney using software or an online service.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.