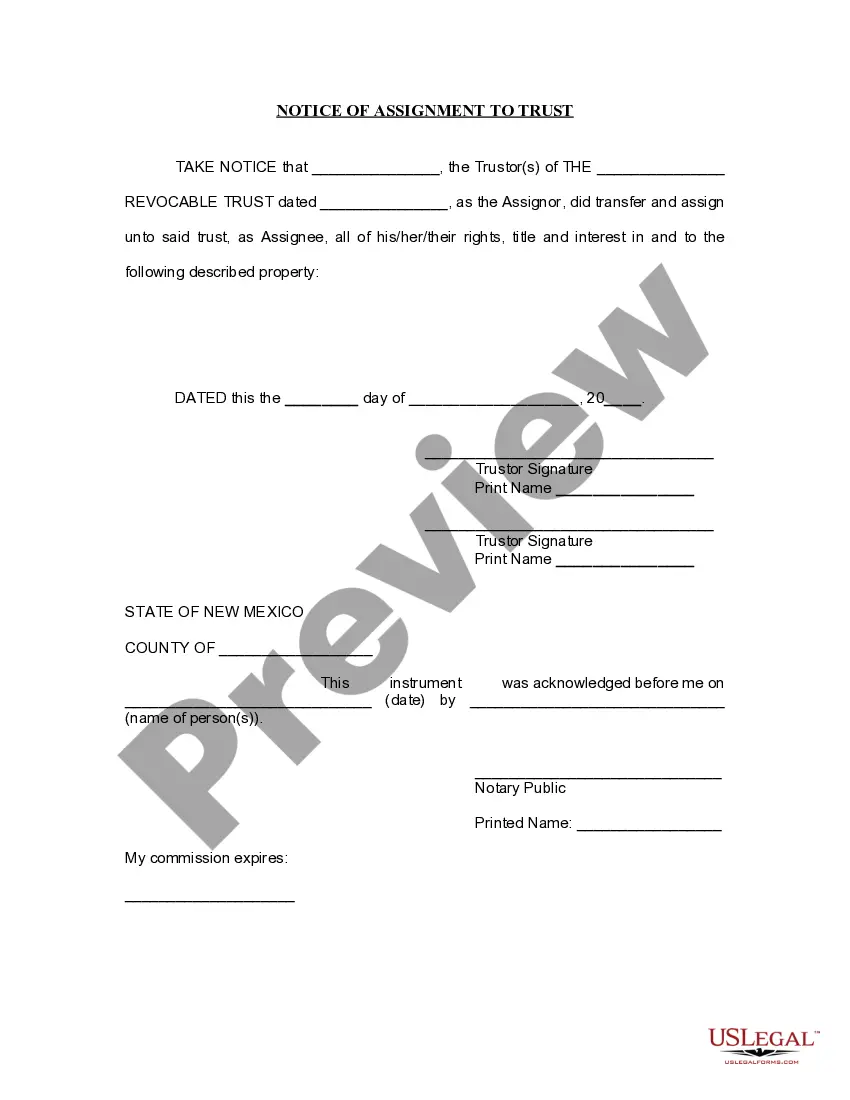

New Mexico Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

How to fill out New Mexico Notice Of Assignment To Living Trust?

US Legal Forms is a unique platform where you can find any legal or tax form for filling out, including New Mexico Notice of Assignment to Living Trust. If you’re tired of wasting time seeking appropriate examples and paying money on record preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To reap all of the service’s advantages, you don't have to install any application but just select a subscription plan and create your account. If you have one, just log in and get an appropriate template, download it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need New Mexico Notice of Assignment to Living Trust, check out the guidelines listed below:

- check out the form you’re checking out is valid in the state you need it in.

- Preview the form and read its description.

- Click Buy Now to reach the sign up webpage.

- Select a pricing plan and keep on registering by entering some info.

- Decide on a payment method to finish the sign up.

- Download the file by choosing the preferred file format (.docx or .pdf)

Now, fill out the file online or print it. If you feel unsure regarding your New Mexico Notice of Assignment to Living Trust form, speak to a attorney to check it before you send or file it. Start without hassles!

Form popularity

FAQ

Assuming you decide you want a revocable living trust, how much should you expect to pay? If you are willing to do it yourself, it will cost you about $30 for a book, or $70 for living trust software. If you hire a lawyer to do the job for you, get ready to pay between $1,200 and $2,000.

1Determine the Current Title and Vesting to Your Property.2Prepare a Deed.3Be Aware of Your Lender and Title Insurance.4Prepare a Preliminary Change of Ownership Report.5Execute Your Deed.6Record Your Deed.7Wait for the Deed to be Returned.8Keep the Property in the Trust.

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

A will and a trust are separate legal documents that typically share a common goal of facilitating a unified estate plan.Since revocable trusts become operative before the will takes effect at death, the trust takes precedence over the will, when there are discrepancies between the two.

Funding a Trust Is Expensive... This is the major drawback to using a revocable living trust for many people, but it's not worth the time, money, and effort to create one if the trust isn't fully funded.

Choose whether to make an individual or shared trust. Decide what property to include in the trust. Choose a successor trustee. Decide who will be the trust's beneficiaries who will get the trust property. Create the trust document.

No, you don't need a lawyer to set up a trust, but it might be a good idea to seek legal advice to ensure the trust is set up correctly and that you have considered all long-term financial and estate planning aspects of the trust.Some living trusts are revocable, which means the trust can be changed at any time.

When you create a DIY living trust, there are no attorneys involved in the process. You will need to choose a trustee who will be in charge of managing the trust assets and distributing them.You'll also need to choose your beneficiary or beneficiaries, the person or people who will receive the assets in your trust.

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.