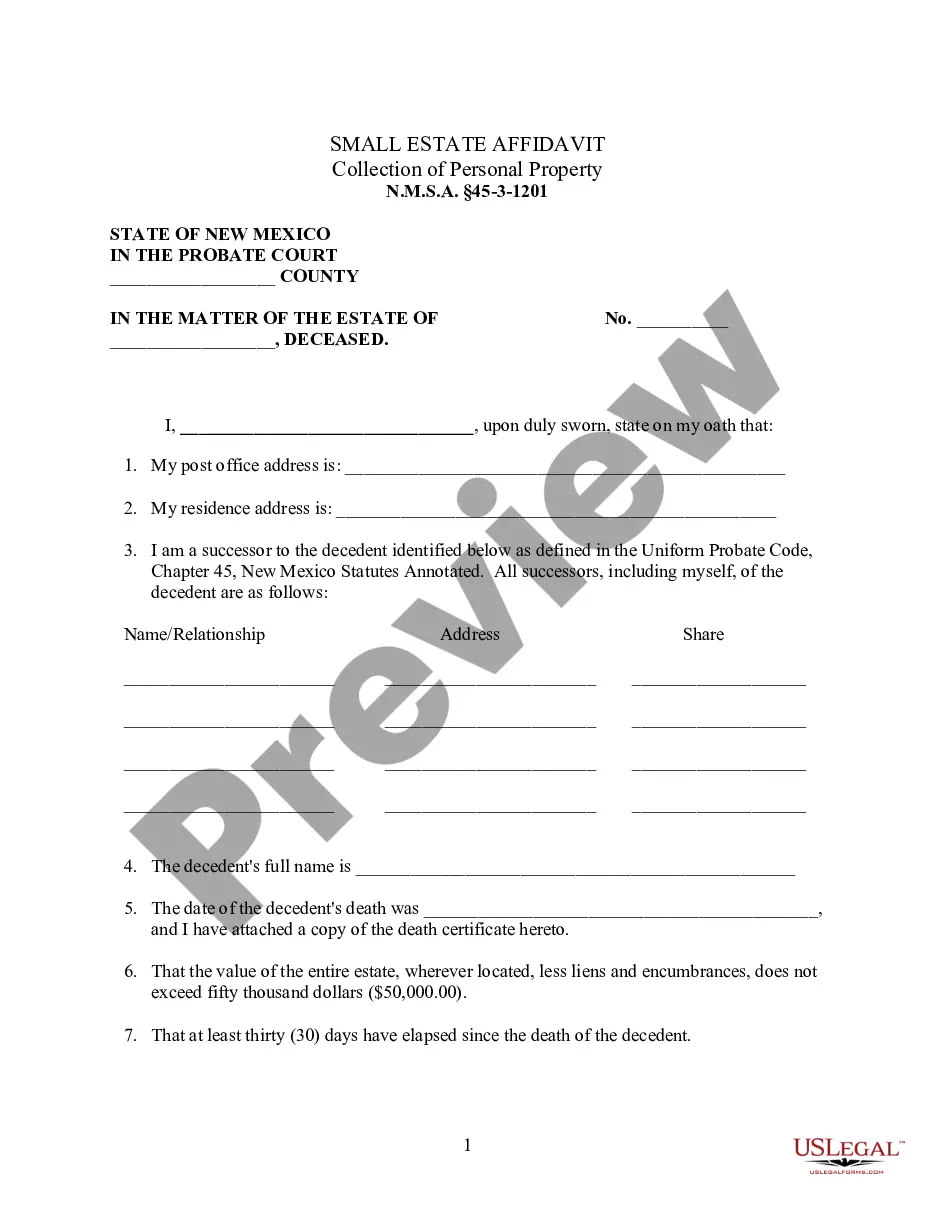

New Mexico Small Estate Affidavit for Estates under $50,000

Description

Key Concepts & Definitions

Small Estate Affidavit: A legal document used in the United States to manage the distribution of an estate worth less than a specific amount, commonly under $50,000. This process bypasses formal probate proceedings, simplifying asset transfer. EIN (Employer Identification Number): Also known as a Tax ID, this is a unique number assigned to an estate or business entity for tax filing and reporting purposes.

Step-by-Step Guide to Filing a Small Estate Affidavit

- Confirm Eligibility: Verify the estates value is under $50,000 and review state laws where the deceased resided.

- Obtain and Complete the Affidavit Form: Download the estate affidavit form free from a state government website or obtain one from a local court.

- Prepare Additional Documents: Gather all necessary documents like death certificate, list of assets, and debts.

- Apply for EIN: If managing a deceased's financial transactions, apply for an EIN through the IRS's ein apply online service.

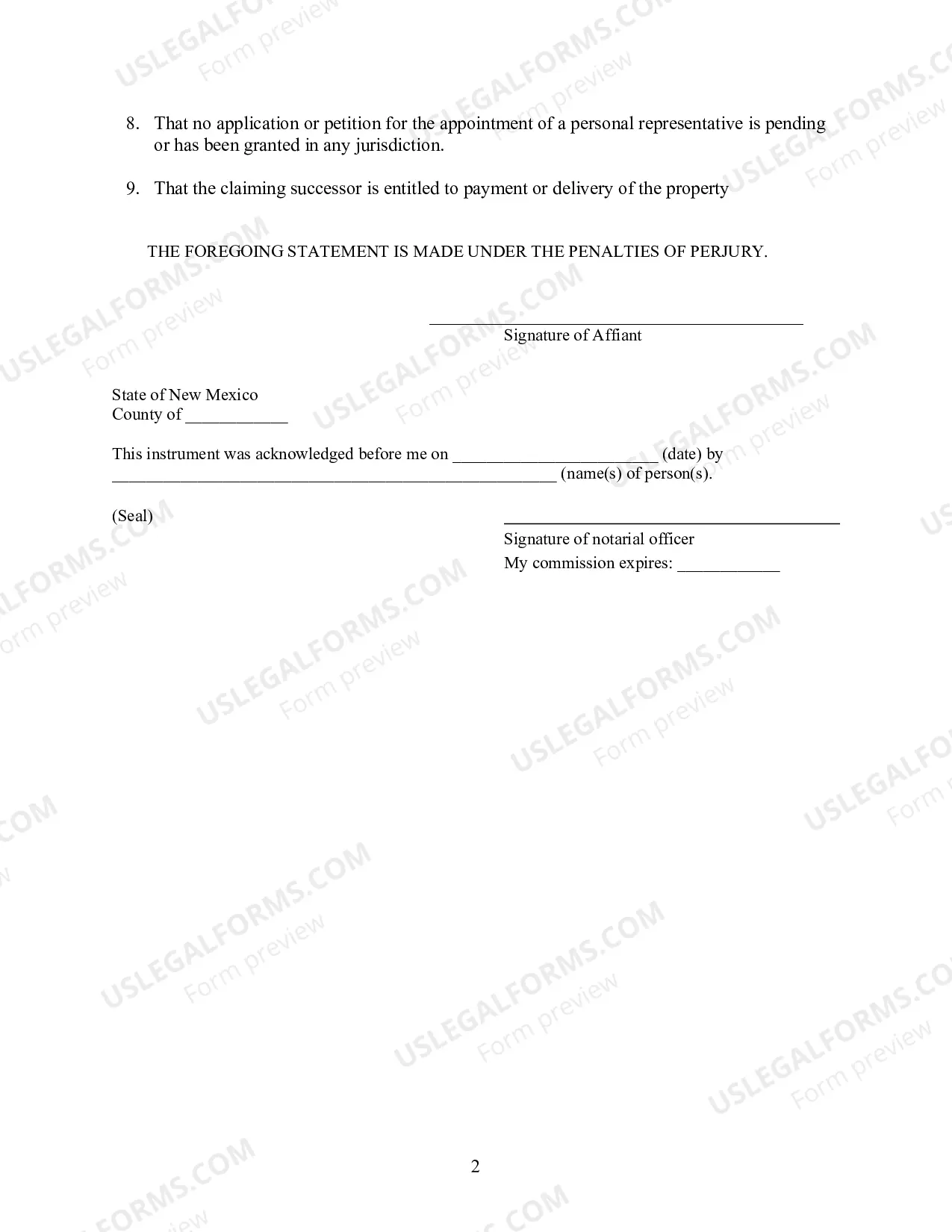

- File the Affidavit: Submit the filled affidavit forms to the necessary legal and governmental bodies.

- Distribute Assets: Following state laws, distribute the assets to rightful heirs.

Risk Analysis

- Legal Compliance Issues: Incorrect filing or failure to adhere to state-specific rules may lead to legal complications.

- Financial Errors: Inaccurate assessment of the estate's value could result in tax issues or disputes among heirs.

- Delays in Asset Transfer: Errors in document preparation or processing can lead to delays in asset distribution.

FAQ

- What is an EIN and why is it needed for a small estate? An EIN, or Employer Identification Number, is a tax ID required for estates to file taxes and open bank accounts in the deceaseds name.

- Can anyone file a small estate affidavit? Typically, the affidavit must be filed by a surviving spouse or appointed representative of the estate.

- Is there a fee involved in filing a small estate affidavit? Fees vary by state, but generally there is a minimal filing fee involved.

How to fill out New Mexico Small Estate Affidavit For Estates Under $50,000?

US Legal Forms is a special system where you can find any legal or tax form for submitting, such as New Mexico Small Estate Affidavit for Estates under $50,000. If you’re sick and tired of wasting time searching for suitable examples and paying money on document preparation/attorney service fees, then US Legal Forms is exactly what you’re seeking.

To reap all of the service’s benefits, you don't need to install any software but simply pick a subscription plan and sign up your account. If you have one, just log in and get an appropriate template, save it, and fill it out. Downloaded files are all stored in the My Forms folder.

If you don't have a subscription but need New Mexico Small Estate Affidavit for Estates under $50,000, check out the guidelines below:

- check out the form you’re taking a look at is valid in the state you want it in.

- Preview the example and look at its description.

- Click Buy Now to access the register webpage.

- Choose a pricing plan and continue registering by entering some info.

- Select a payment method to finish the sign up.

- Download the file by selecting your preferred file format (.docx or .pdf)

Now, fill out the file online or print out it. If you feel unsure regarding your New Mexico Small Estate Affidavit for Estates under $50,000 sample, contact a lawyer to check it before you send out or file it. Start without hassles!

Form popularity

FAQ

When you use a small estate affidavit , you have to pay the decedent's bills before paying money to anyone else. For example, the decedent might have owed money to a credit card company when they died. If you use the small estate affidavit, you must give money from the estate to pay the credit card company.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Visit the appropriate court office. Check the court's limits for the estate's value. Obtain the correct affidavit form. Fill out the affidavit in full. Sign the affidavit. Obtain a death certificate.

Guadalupe County Small Estate Affidavit Checklist Individuals then fill out a form without reading the statute and without understanding Texas intestacy law. They pay a $261 filing fee and expect approval.

The Illinois small estate affidavit provides a streamlined way for an heir-at-law of a decedent to gather and distribute the assets of the estate of a person who died, provided that no other petition to open an estate in probate court has been filed and that the assets of the person who died do not exceed $100,000.

New Mexico has a simplified probate process for small estates. To use it, an executor files a written request with the local probate court asking to use the simplified procedure. The court may authorize the executor to distribute the assets without having to jump through the hoops of regular probate.

In most states, however, there is the option to use a small estate affidavit when the assets of the estate are under a certain dollar amount, which varies by state. An attorney is not required to file a small estate affidavit, although it may be helpful to consult with one prior to filing the small estate affidavit.

To be able to file a small estate affidavit in Texas for a loved one, when no will was executed, you must be a person who would inherit under Texas intestacy law (this is generally the spouse and children, or other close relatives if there are no spouse or children).

Most uncontested probates in which the assets of the estate are located entirely in New Mexico can be handled by an attorney for fees ranging between $3,000 to $5,000 with the actual cost based on the hourly charges necessary to complete the probate.