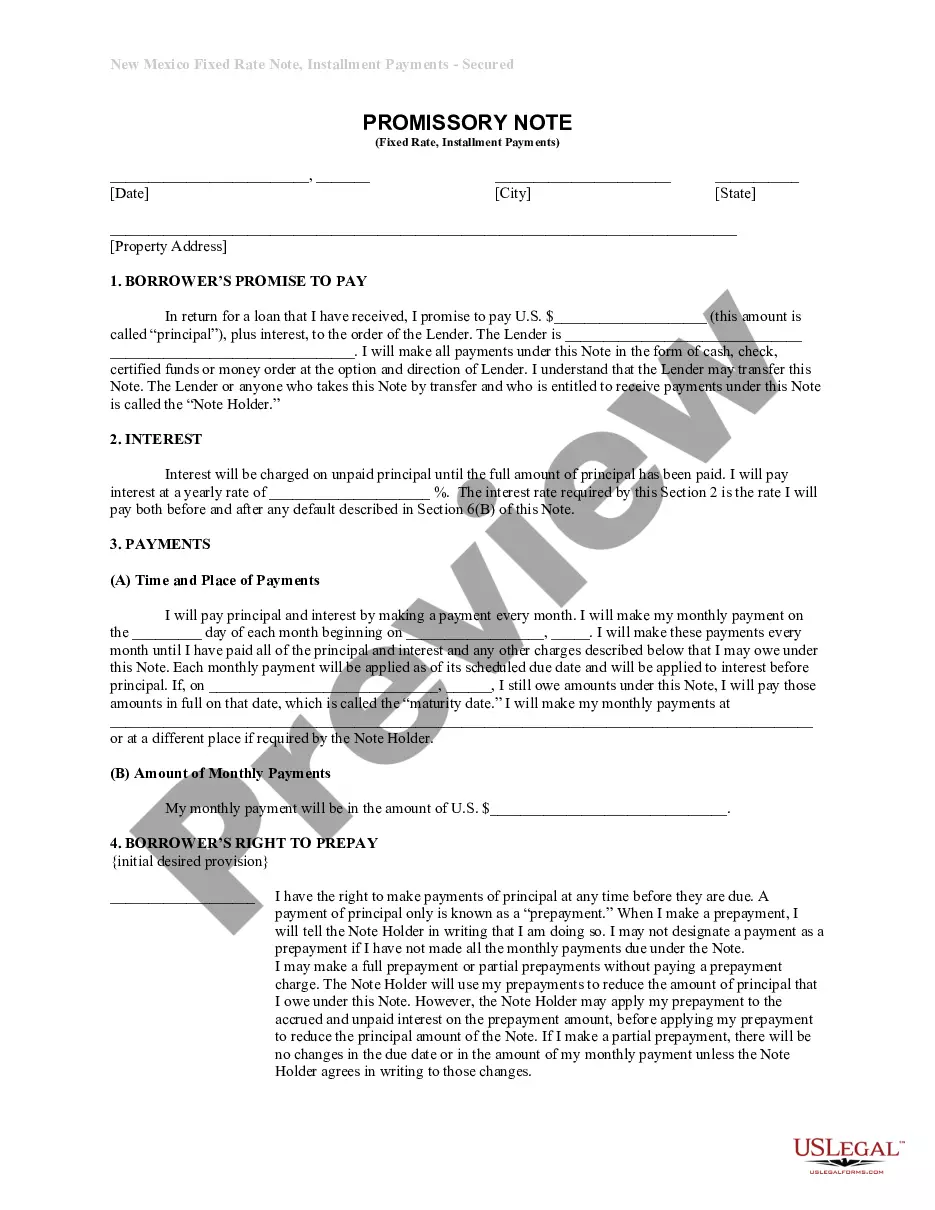

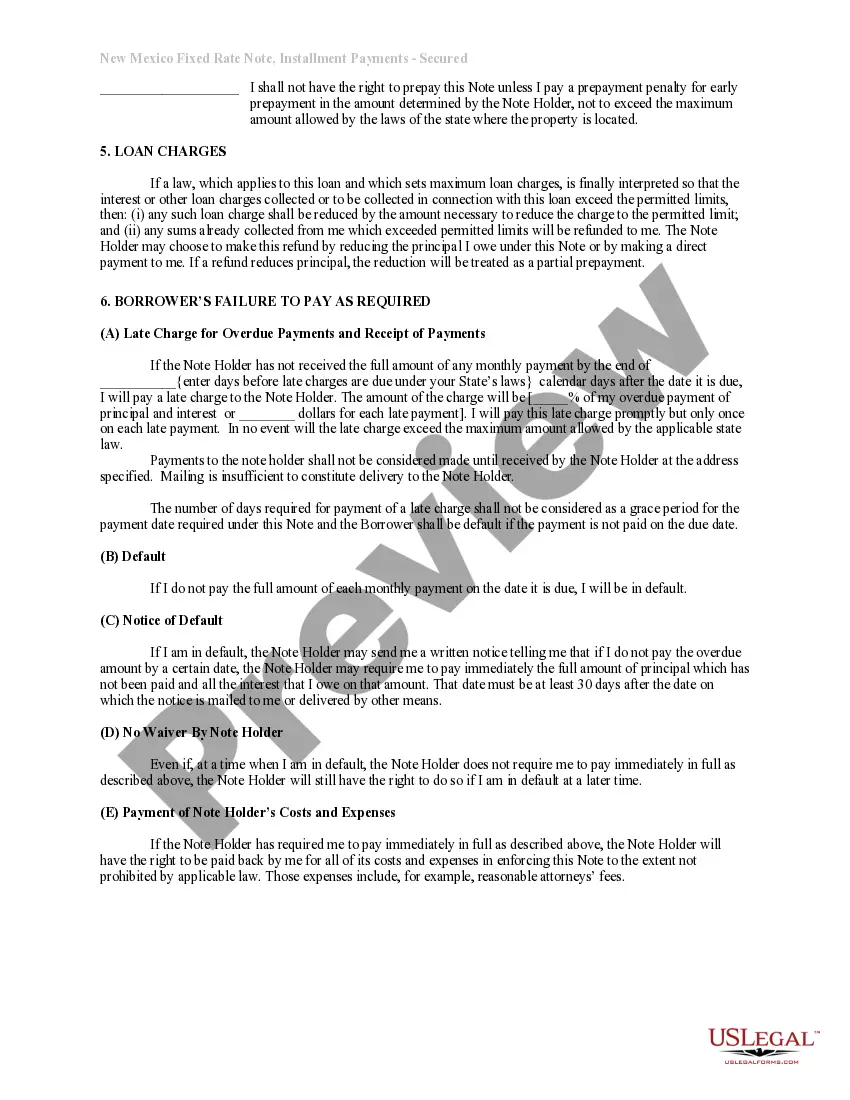

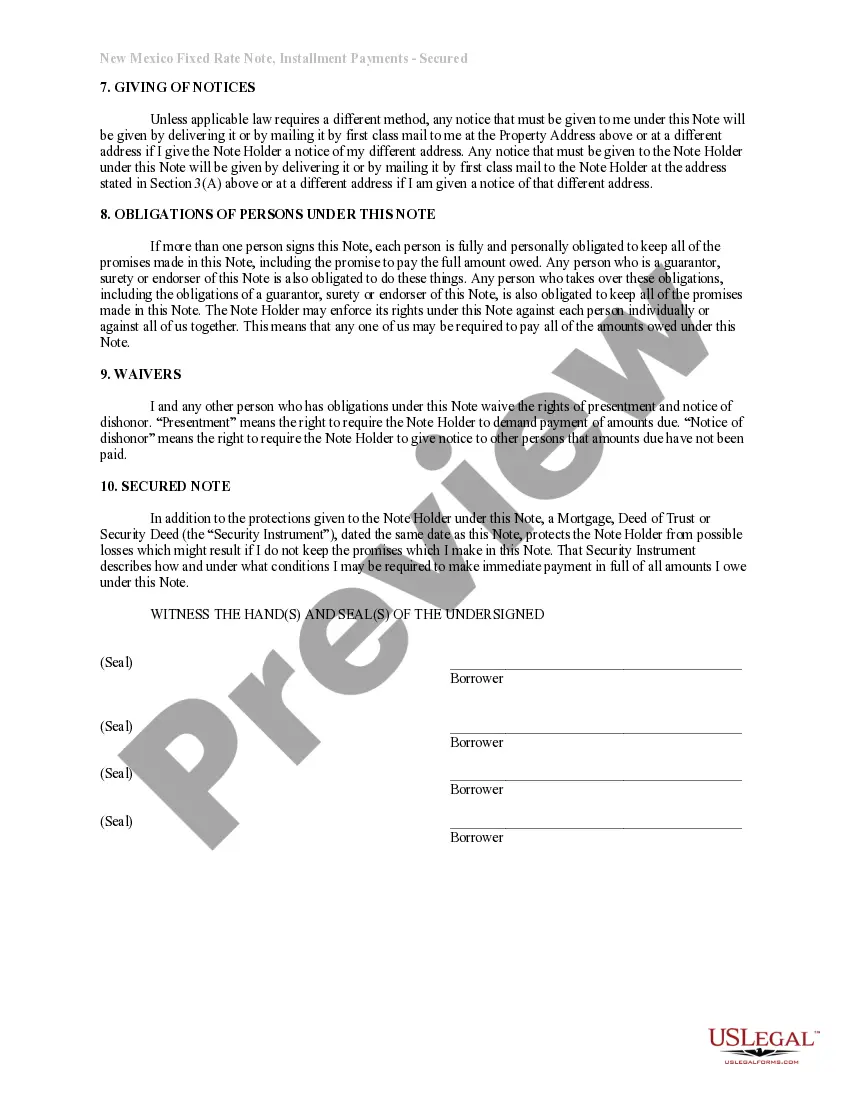

New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate

Description Promissory Note Template New Mexico

How to fill out New Mexico Installments Fixed Rate Promissory Note Secured By Residential Real Estate?

US Legal Forms is really a unique system where you can find any legal or tax template for completing, including New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate. If you’re fed up with wasting time searching for appropriate samples and paying money on document preparation/legal professional fees, then US Legal Forms is exactly what you’re searching for.

To enjoy all the service’s advantages, you don't need to download any software but simply pick a subscription plan and create your account. If you have one, just log in and look for the right template, save it, and fill it out. Downloaded documents are all saved in the My Forms folder.

If you don't have a subscription but need to have New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate, check out the guidelines listed below:

- check out the form you’re considering applies in the state you want it in.

- Preview the form and read its description.

- Click on Buy Now button to reach the sign up page.

- Select a pricing plan and proceed signing up by providing some info.

- Select a payment method to complete the sign up.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, submit the document online or print it. If you feel uncertain concerning your New Mexico Installments Fixed Rate Promissory Note Secured by Residential Real Estate template, speak to a attorney to check it before you send or file it. Get started without hassles!

Form popularity

FAQ

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed. The issuer / lender of the funds is normally the one who will hold the Promissory Note.

A promissory note is a contract, a binding agreement that someone will pay your business a sum of money. However under some circumstances if the note has been altered, it wasn't correctly written, or if you don't have the right to claim the debt then, the contract becomes null and void.

Secured and unsecured loansPromissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.

The owner of the promissory note can file a civil lawsuit against the signer of the note if the signer refuses to pay. The purpose of the lawsuit is to obtain a judgment against the note's signer, which will give the owner of the note the ability to pursue the signer's assets.

In order for a promissory note to be valid, both the lender and the borrower must sign the documentation. If you are a co-signer for the loan, you are required to sign the promissory note. Being a co-signer requires you to repay the loan amount in the instance that the borrower defaults on payment.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.

Promissory notes are a valuable legal tool that any individual can use to legally bind another individual to an agreement for purchasing goods or borrowing money. A well-executed promissory note has the full effect of law behind it and is legally binding on both parties.