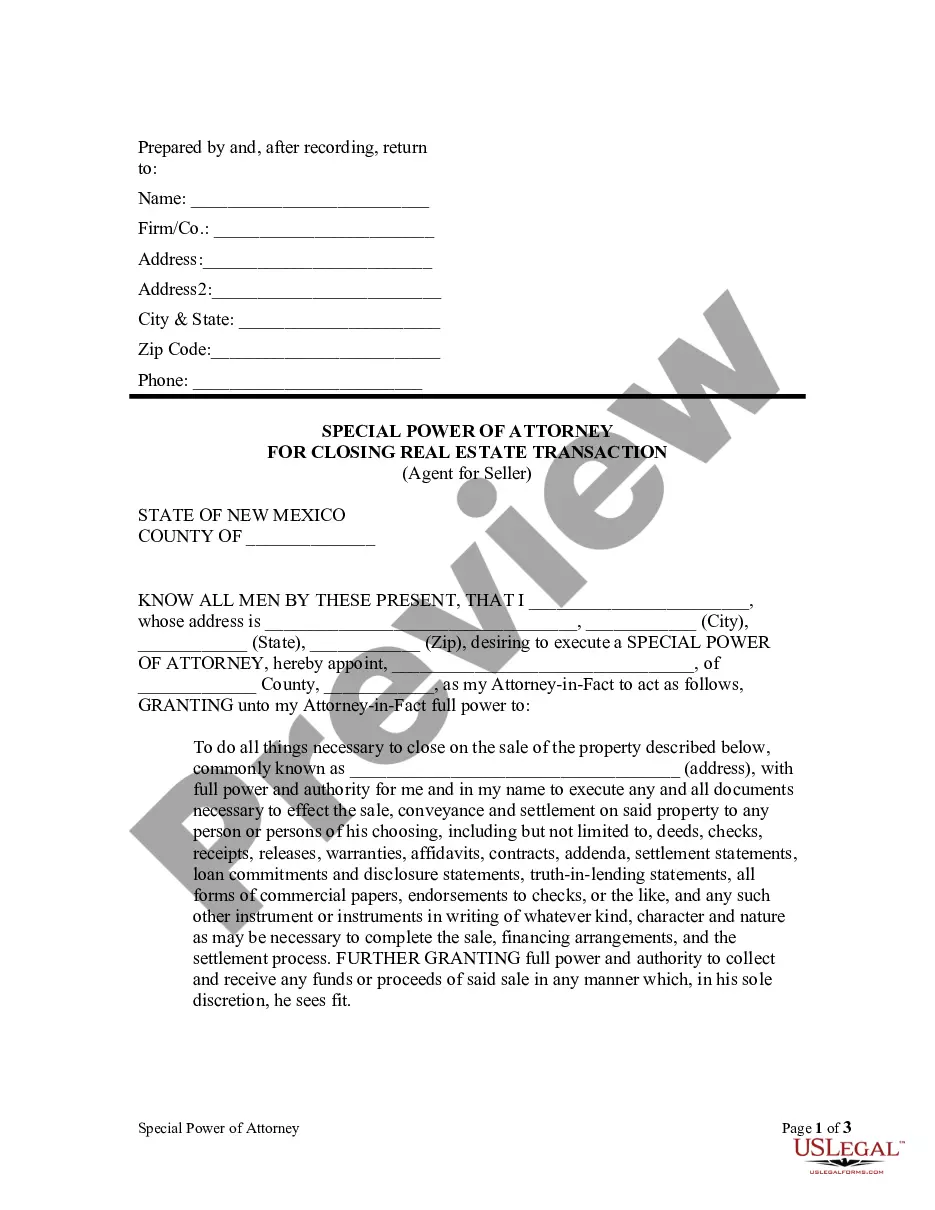

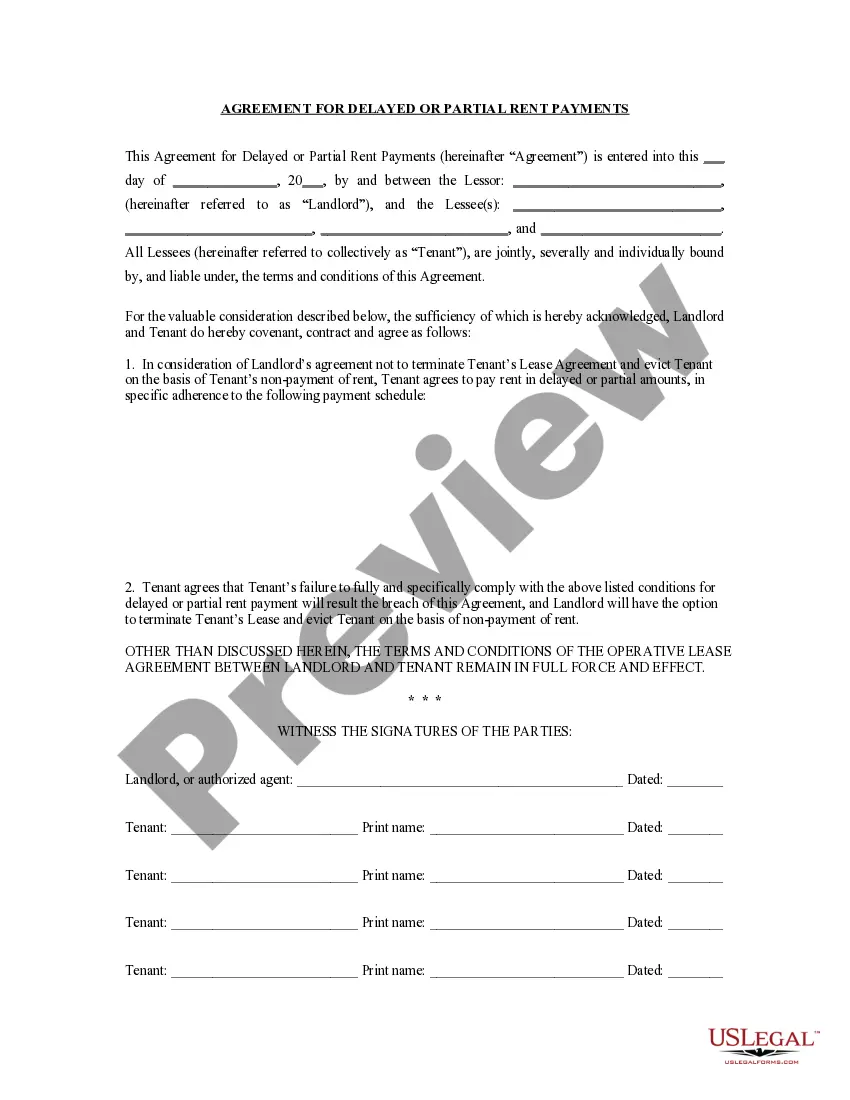

New Mexico Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller

Description

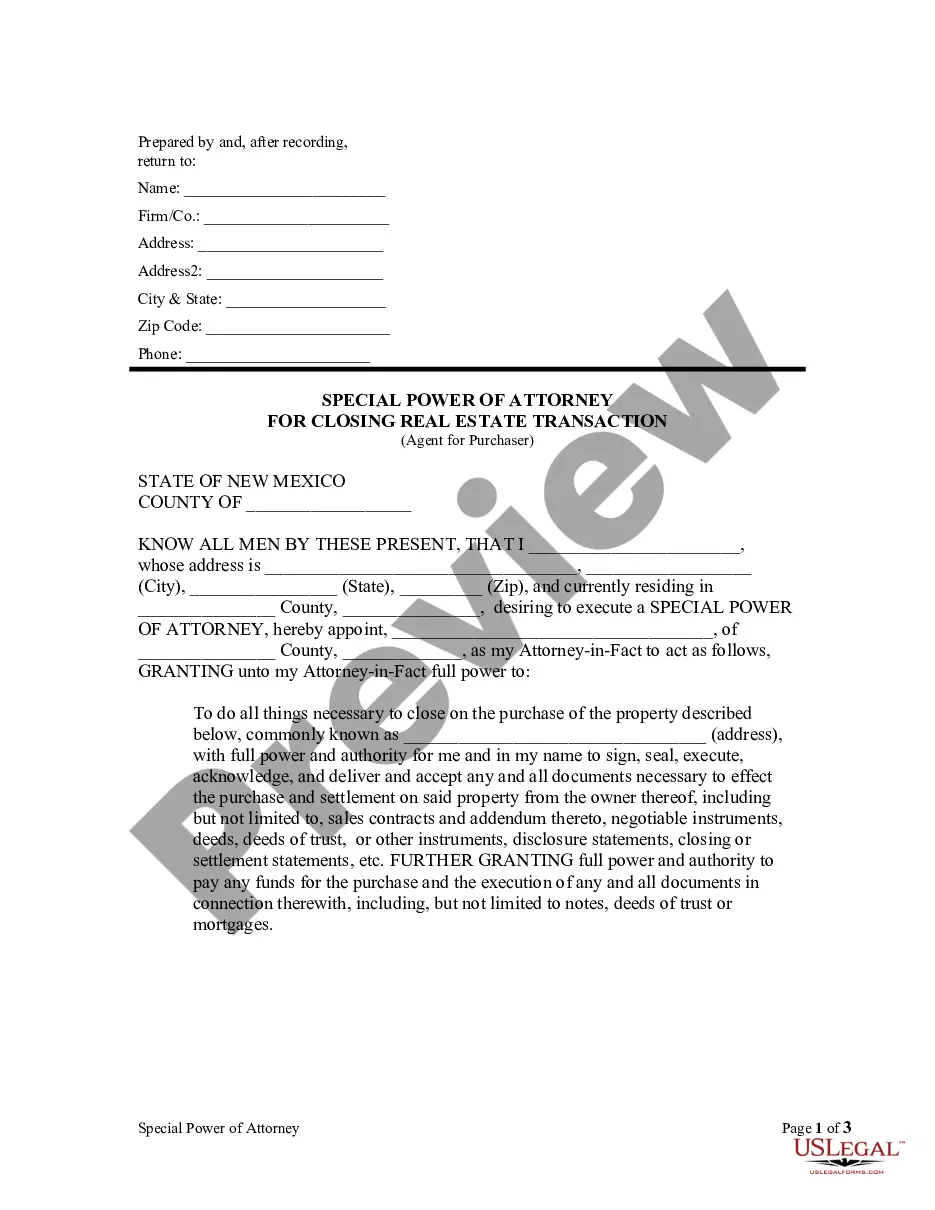

How to fill out New Mexico Special Or Limited Power Of Attorney For Real Estate Sales Transaction By Seller?

US Legal Forms is a unique system to find any legal or tax document for submitting, including New Mexico Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller. If you’re sick and tired of wasting time looking for ideal examples and paying money on record preparation/legal professional service fees, then US Legal Forms is precisely what you’re trying to find.

To experience all of the service’s advantages, you don't need to download any software but simply pick a subscription plan and register an account. If you have one, just log in and get a suitable template, save it, and fill it out. Saved documents are all saved in the My Forms folder.

If you don't have a subscription but need New Mexico Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller, have a look at the instructions listed below:

- check out the form you’re considering applies in the state you need it in.

- Preview the example and look at its description.

- Simply click Buy Now to get to the register page.

- Choose a pricing plan and keep on registering by providing some information.

- Pick a payment method to finish the sign up.

- Download the file by selecting the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you feel uncertain concerning your New Mexico Special or Limited Power of Attorney for Real Estate Sales Transaction By Seller sample, contact a attorney to review it before you decide to send or file it. Start without hassles!

Form popularity

FAQ

No, in New Mexico, you do not need to notarize your will to make it legal. However, New Mexico allows you to make your will "self-proving" and you'll need to go to a notary if you want to do that. A self-proving will speeds up probate because the court can accept the will without contacting the witnesses who signed it.

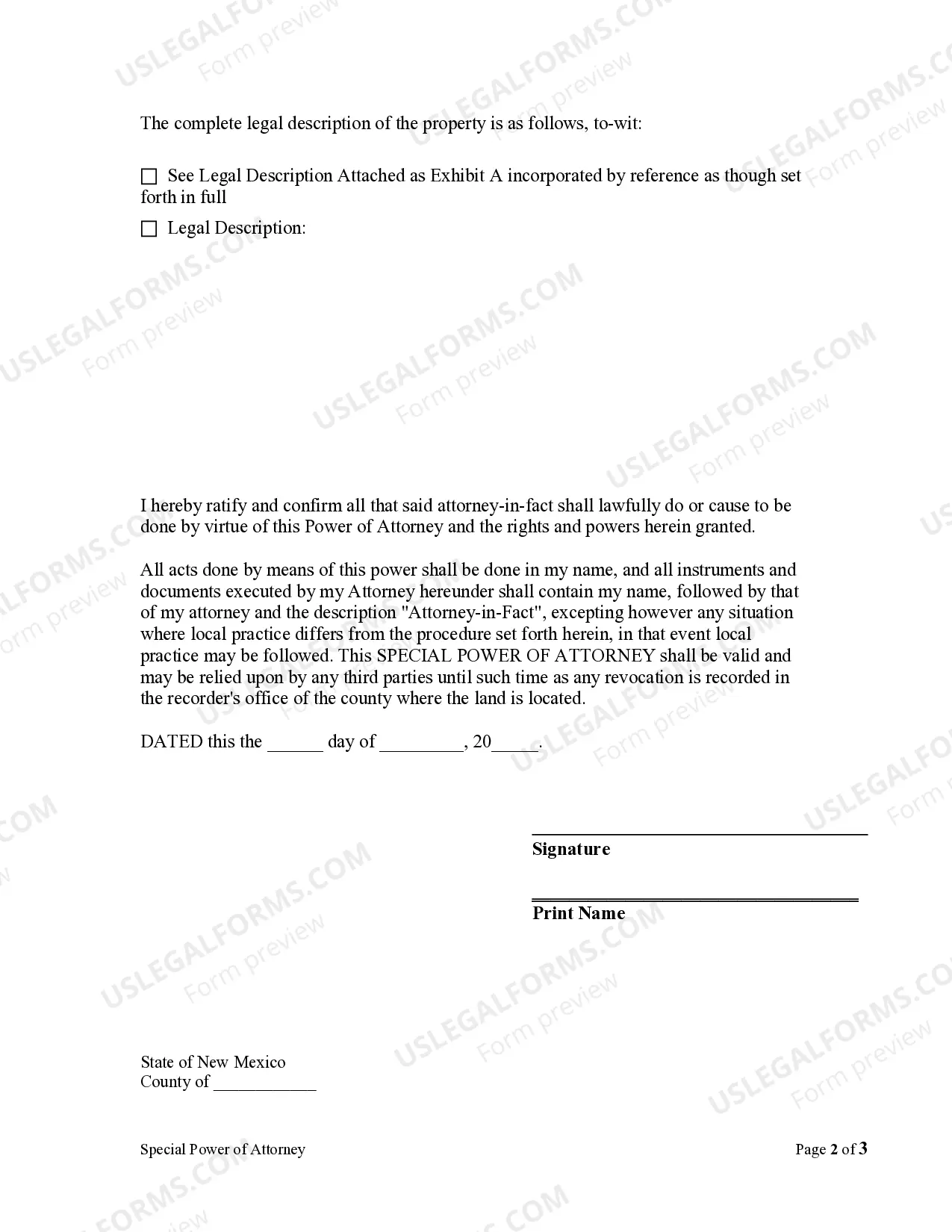

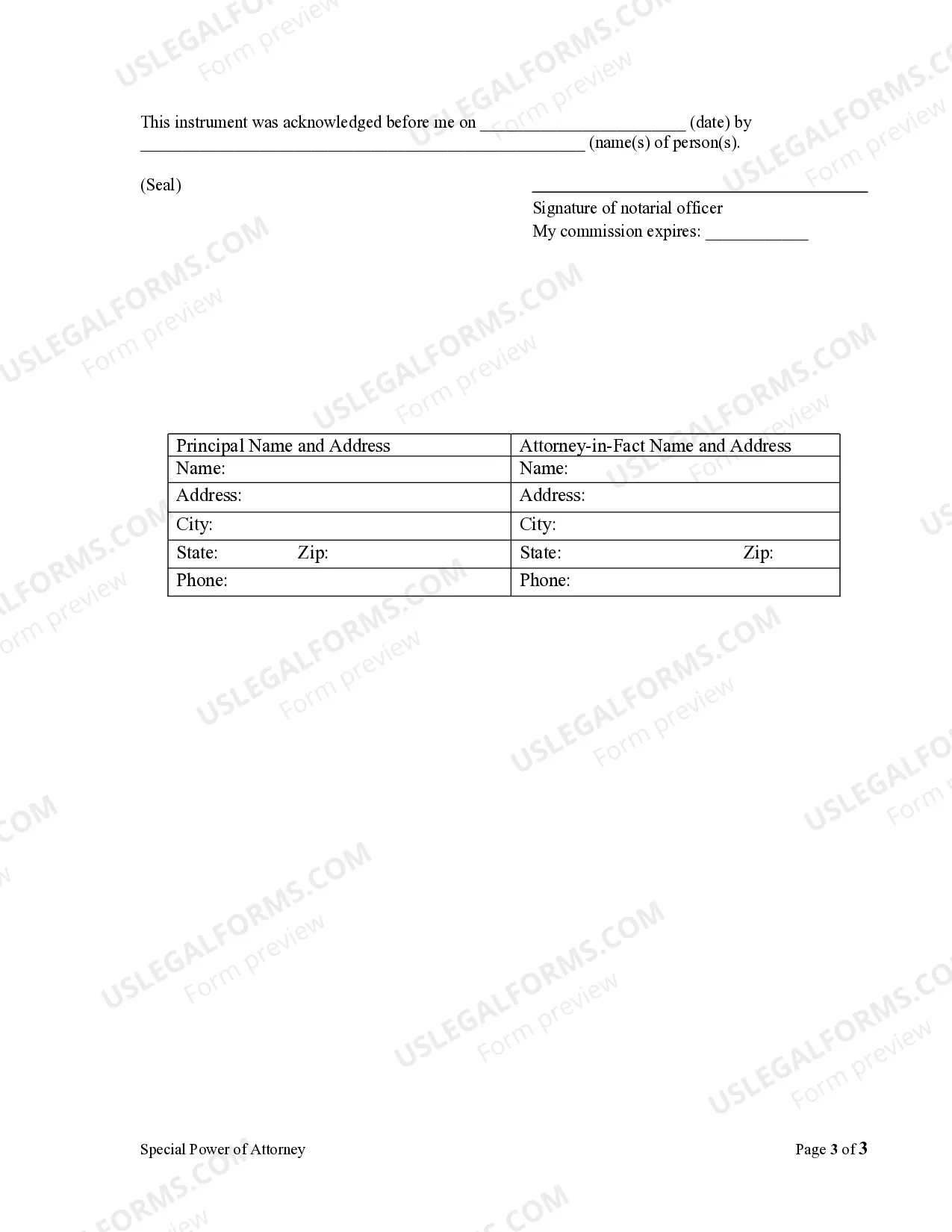

Summary: New Mexico enacts the Uniform Power of Attorney Act (UPOAA).The Act doesn't require a power of attorney to be notarized, but a court will presume the signature to be genuine if it is acknowledged before a Notary or an officer authorized to take acknowledgments.

A power of attorney (or POA) is a legal document that grants a person or organization the legal authority to act on another's behalf and make certain decisions for them.A power of attorney needs to be signed in front of a licensed notary public in order to be legally binding.

A power of attorney (POA) for a real estate closing is permissible if not all parties can make it to the settlement table, but is not to be used as a matter of convenience. A POA is written authorization to act in a legal capacity on another's behalf, in certain circumstances, which are laid out in the document.

Most states offer simple forms to help you create a power of attorney for finances. Generally, the document must be signed, witnessed and notarized by an adult. If your agent will have to deal with real estate assets, some states require you to put the document on file in the local land records office.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

Remember that all of the authorized agents under the power of attorney or representatives in an estate must sign the listing agreement, disclosure documents, etc. For example, when there are two executors in an estate, then they both must sign the Listing Contract.

The POA can be a useful tool in residential real estate transactions when a necessary party will be unavailable to execute documents prior to or attend the closing.In order to be recorded, the POA presented must contain the original signature of the principal, and it must be notarized.

Name, signature, and address of the principal. Name, signature, and address of the agent. Properties and activities under the authority of the agent. Date of effect and termination of authority. Compensation to services of the agent.