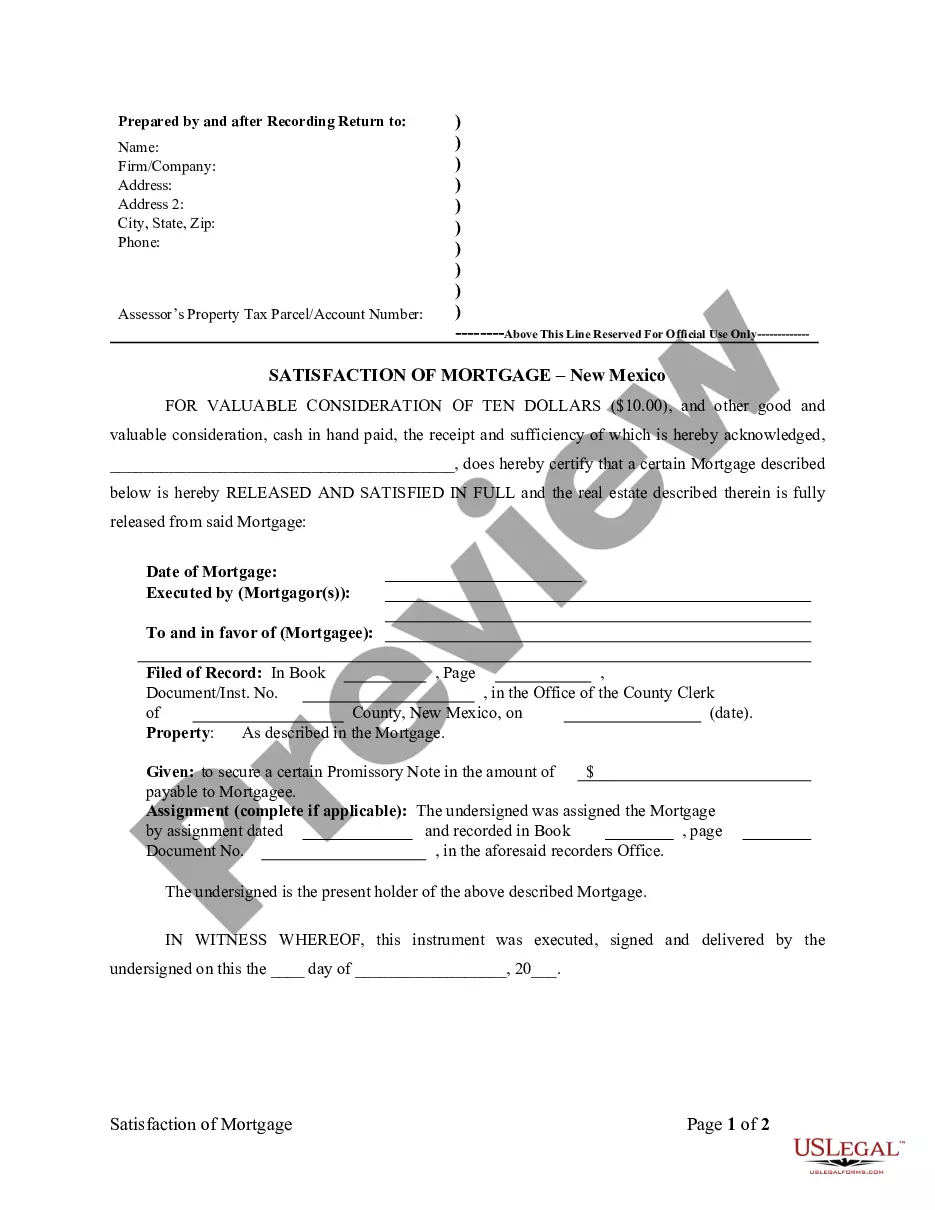

New Mexico Satisfaction - Release of Mortgage by Mortgagee - Individual Lender or Holder

Description Inst Satisfied Promissory

How to fill out Mortgagor Book Favor?

US Legal Forms is really a unique system where you can find any legal or tax form for submitting, including New Mexico Satisfaction - Release of Mortgage by Mortgagee - Individual Lender or Holder. If you’re fed up with wasting time searching for perfect examples and paying money on papers preparation/lawyer fees, then US Legal Forms is exactly what you’re seeking.

To enjoy all the service’s advantages, you don't need to download any software but just choose a subscription plan and register your account. If you have one, just log in and get the right sample, save it, and fill it out. Downloaded files are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Satisfaction - Release of Mortgage by Mortgagee - Individual Lender or Holder, take a look at the guidelines listed below:

- Double-check that the form you’re checking out applies in the state you want it in.

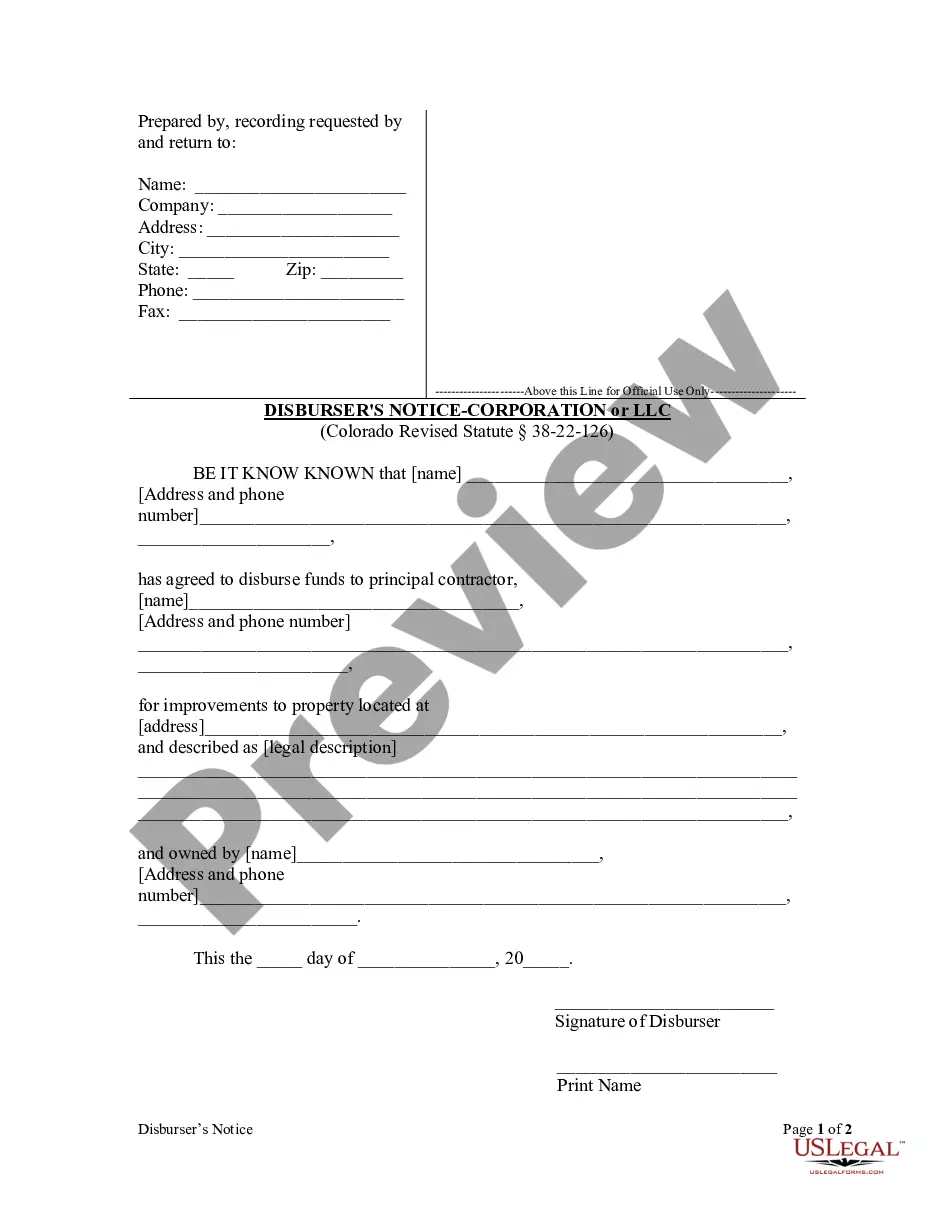

- Preview the form and look at its description.

- Simply click Buy Now to get to the register page.

- Select a pricing plan and carry on signing up by providing some info.

- Decide on a payment method to finish the registration.

- Save the file by choosing the preferred format (.docx or .pdf)

Now, submit the document online or print out it. If you are uncertain regarding your New Mexico Satisfaction - Release of Mortgage by Mortgagee - Individual Lender or Holder sample, contact a lawyer to examine it before you send or file it. Start hassle-free!

Satisfaction Release Mortgage Document Form popularity

Mortgagee Satisfied Favor Other Form Names

Inst Released Mortgage FAQ

Go to the county recorder's office or local courthouse to find recorded mortgages. In states such as California, deeds, liens, mortgage documents and various types of land documents are available for review in the recorder's office.

In some cases, a mortgage may have been sold by the mortgage lender to another financial institution. If sold, the owner of the mortgage at the time of the final payment is responsible for completing the satisfaction of mortgage documentation.

Once you've paid off your outstanding mortgage debt, the lender must prepare and issue a release of mortgage. This document officially discharges you from the debt obligation and removes the lien against the property.

In order to clear the title to the real property owned by the mortgagor, the Satisfaction of Mortgage document must be recorded with the County Recorder or Recorder of Deeds. If the mortgagee fails to record a satisfaction within the set time limits, the mortgagee may be responsible for damages set out by statute.

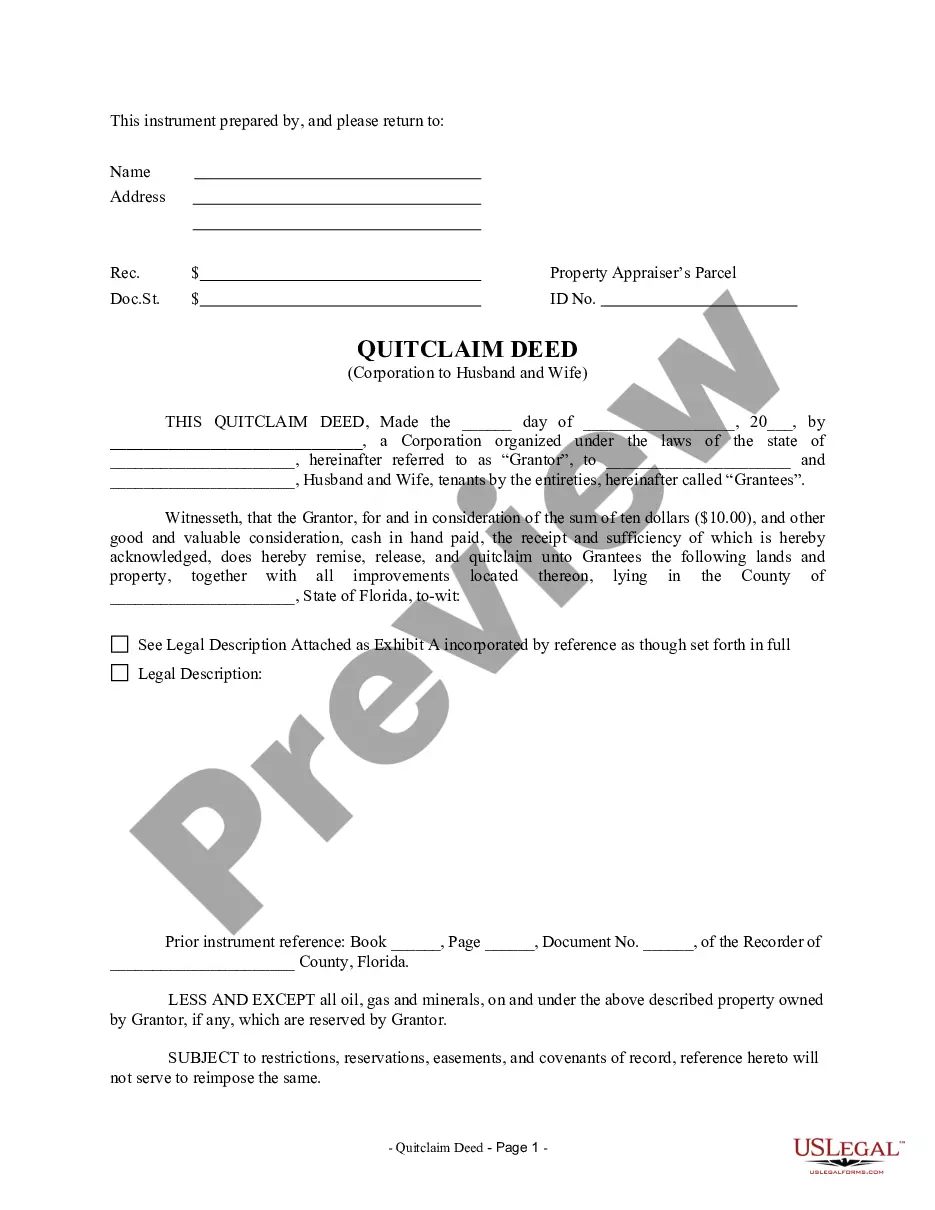

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Key Takeaways. A satisfaction of mortgage is a signed document confirming that the borrower has paid off the mortgage in full and that the mortgage is no longer a lien on the property.

If a lender takes longer than 90 days to record it, they can be charged up to $1,500 in penalties. So, in theory, a satisfaction should be recorded within 30-90 days of payoff regardless of what state you work in.

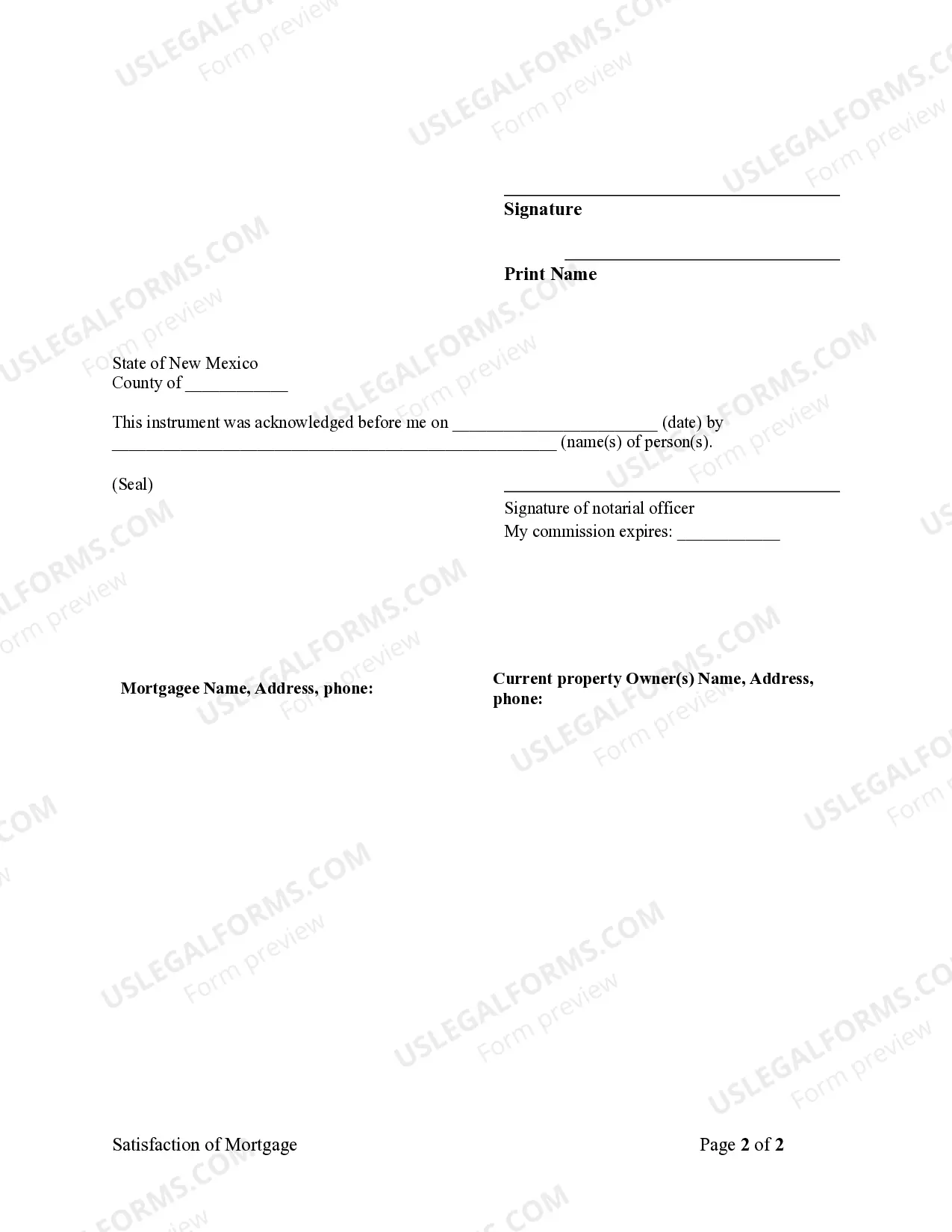

Step 1 Identify the parties. The appropriate parties should be documented on the Satisfaction of Mortgage. Step 2 Fill and Sign. The Satisfaction of Mortgage should be signed by the mortgagee, after it has been issued. Step 3 File and Record the Form.