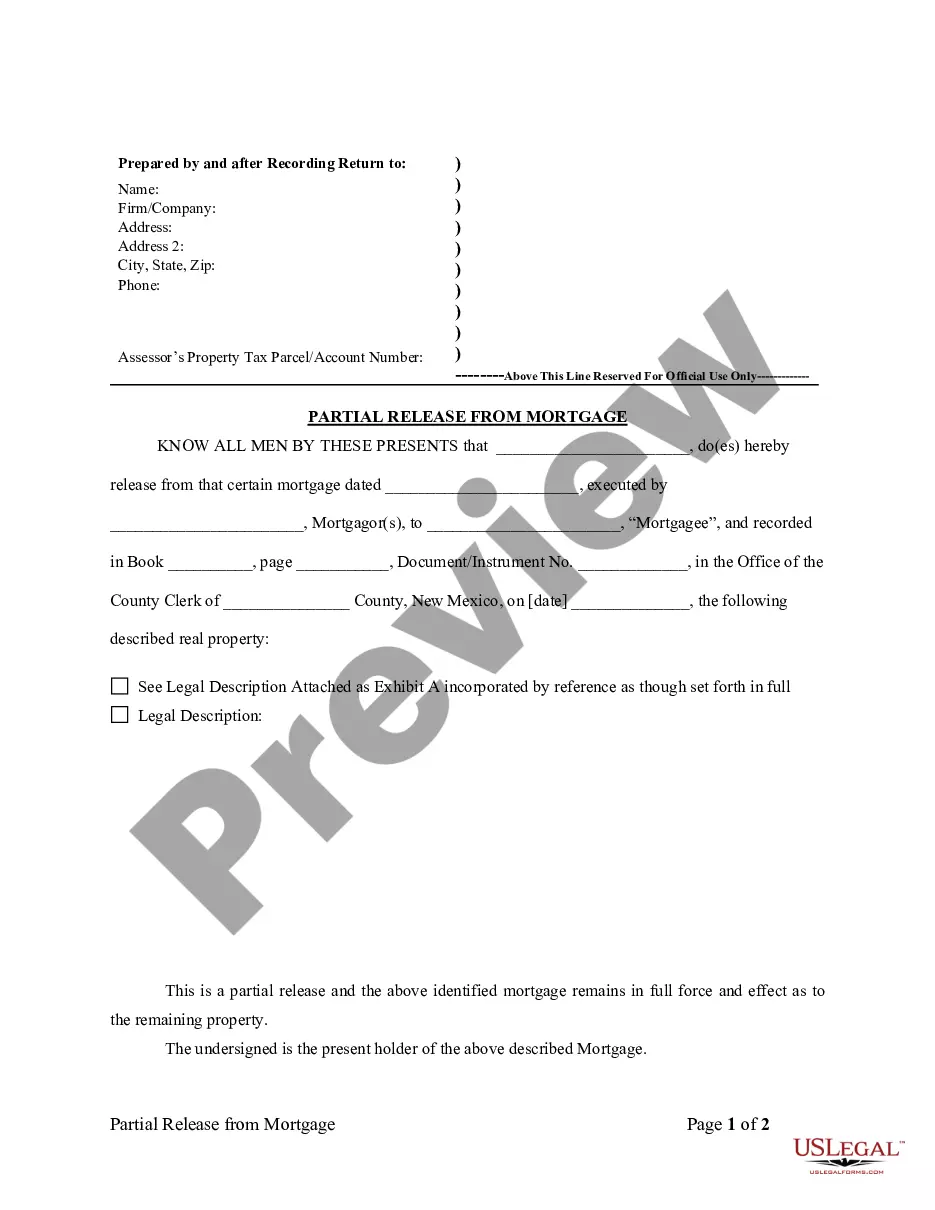

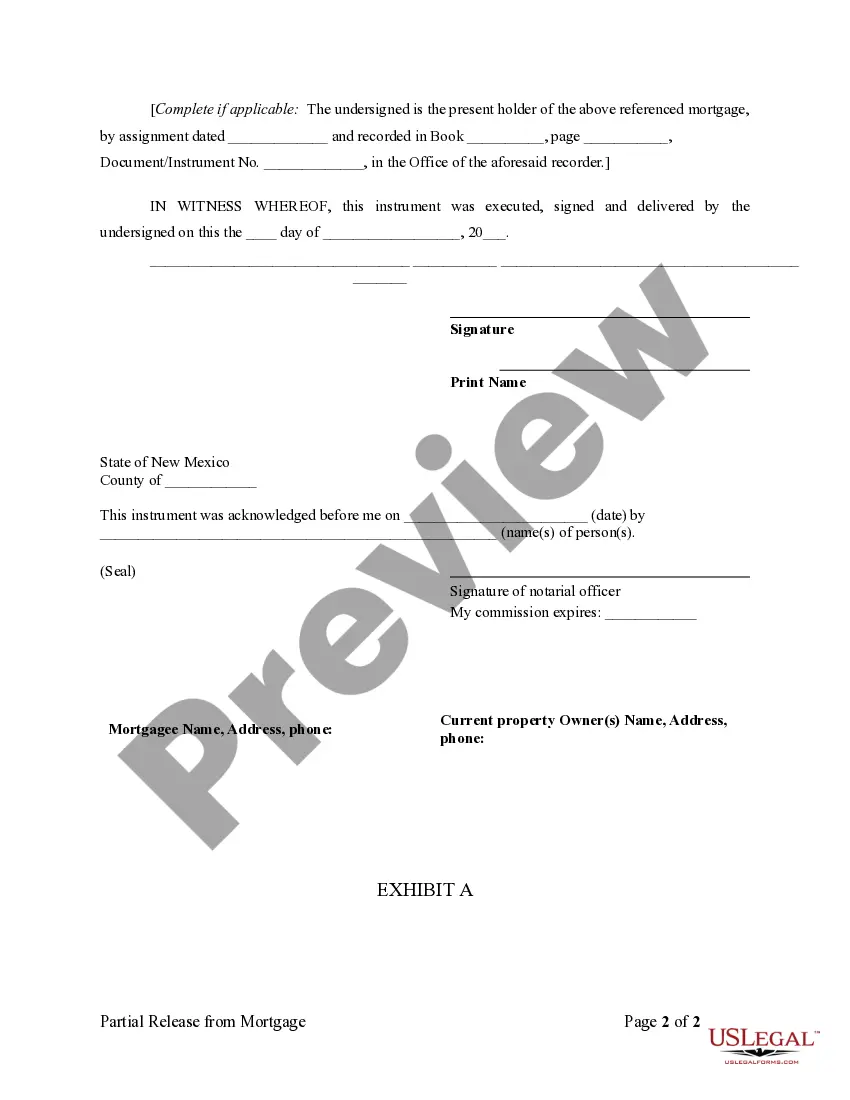

New Mexico Partial Release of Property From Mortgage by Individual Holder

Description

How to fill out New Mexico Partial Release Of Property From Mortgage By Individual Holder?

US Legal Forms is actually a unique platform where you can find any legal or tax document for filling out, including New Mexico Partial Release of Property From Mortgage by Individual Holder. If you’re sick and tired of wasting time searching for ideal examples and paying money on papers preparation/attorney charges, then US Legal Forms is precisely what you’re trying to find.

To reap all the service’s benefits, you don't need to install any application but just pick a subscription plan and create an account. If you have one, just log in and get the right template, download it, and fill it out. Saved documents are kept in the My Forms folder.

If you don't have a subscription but need to have New Mexico Partial Release of Property From Mortgage by Individual Holder, have a look at the guidelines listed below:

- check out the form you’re looking at is valid in the state you need it in.

- Preview the sample and look at its description.

- Simply click Buy Now to access the register page.

- Select a pricing plan and proceed registering by entering some information.

- Pick a payment method to complete the registration.

- Download the document by choosing the preferred format (.docx or .pdf)

Now, fill out the document online or print it. If you are unsure about your New Mexico Partial Release of Property From Mortgage by Individual Holder template, contact a attorney to check it before you decide to send out or file it. Start without hassles!

Form popularity

FAQ

Mortgages and deeds of trust both grant the title for your property to your lender until the loan is paid. A mortgage is an agreement made between you and the lender. A mortgage grants ownership of your home to the lender which will transfer the title back to you after the loan is paid.

In title theory states, a lender holds the actual legal title to a piece of real estate for the life of the loan while the borrower/mortgagor holds the equitable title.

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

When a borrower prepays their mortgage or makes the final mortgage payment, a satisfaction of mortgage document must be prepared, signed, and filed by the financial institution in ownership of the mortgage. The satisfaction of mortgage document is created by a lending institution and their legal counsel.

The title deeds to a property with a mortgage are usually kept by the mortgage lender. They will only be given to you once the mortgage has been paid in full.

Deed: This is the document that proves ownership of a property. It transfers ownership of the property to the grantee, also known as the buyer.Mortgage: This is the document that gives the lender a security interest in the property until the Note is paid in full.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

If the mortgage has been registered, then you should take an NOC from registrar's office to get the lien removed. For this both the parties, borrower and representative of the bank need to be present there. In case, the mortgage is not registered, the bank will simply return your documents.

Simply put, yes, you do own your home but your mortgage lender does have interest in the property based on documents signed at closing.Deed of Trust this document lists the legal obligations and rights of you and the lender. It also states the lender's right to foreclose on the home if you default on the loan.