New Mexico Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants

Description

How to fill out New Mexico Warranty Deed To Separate Property Of One Spouse To Both Spouses As Joint Tenants?

Among countless free and paid examples that you find online, you can't be sure about their accuracy and reliability. For example, who created them or if they’re competent enough to deal with what you require these people to. Keep calm and utilize US Legal Forms! Find New Mexico Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants templates created by skilled attorneys and get away from the high-priced and time-consuming procedure of looking for an attorney and then paying them to draft a document for you that you can easily find yourself.

If you already have a subscription, log in to your account and find the Download button near the file you’re looking for. You'll also be able to access all your previously saved files in the My Forms menu.

If you are making use of our service the very first time, follow the tips below to get your New Mexico Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants fast:

- Ensure that the file you find applies where you live.

- Review the file by reading the description for using the Preview function.

- Click Buy Now to start the purchasing process or find another example using the Search field found in the header.

- Choose a pricing plan sign up for an account.

- Pay for the subscription using your credit/debit/debit/credit card or Paypal.

- Download the form in the needed format.

As soon as you have signed up and bought your subscription, you can utilize your New Mexico Warranty Deed to Separate Property of One Spouse to Both Spouses as Joint Tenants as many times as you need or for as long as it stays active where you live. Edit it with your preferred editor, fill it out, sign it, and print it. Do much more for less with US Legal Forms!

Form popularity

FAQ

The dangers of joint tenancy include the following: Danger #1: Only delays probate. When either joint tenant dies, the survivor usually a spouse or child immediately becomes the owner of the entire property. But when the survivor dies, the property still must go through probate.

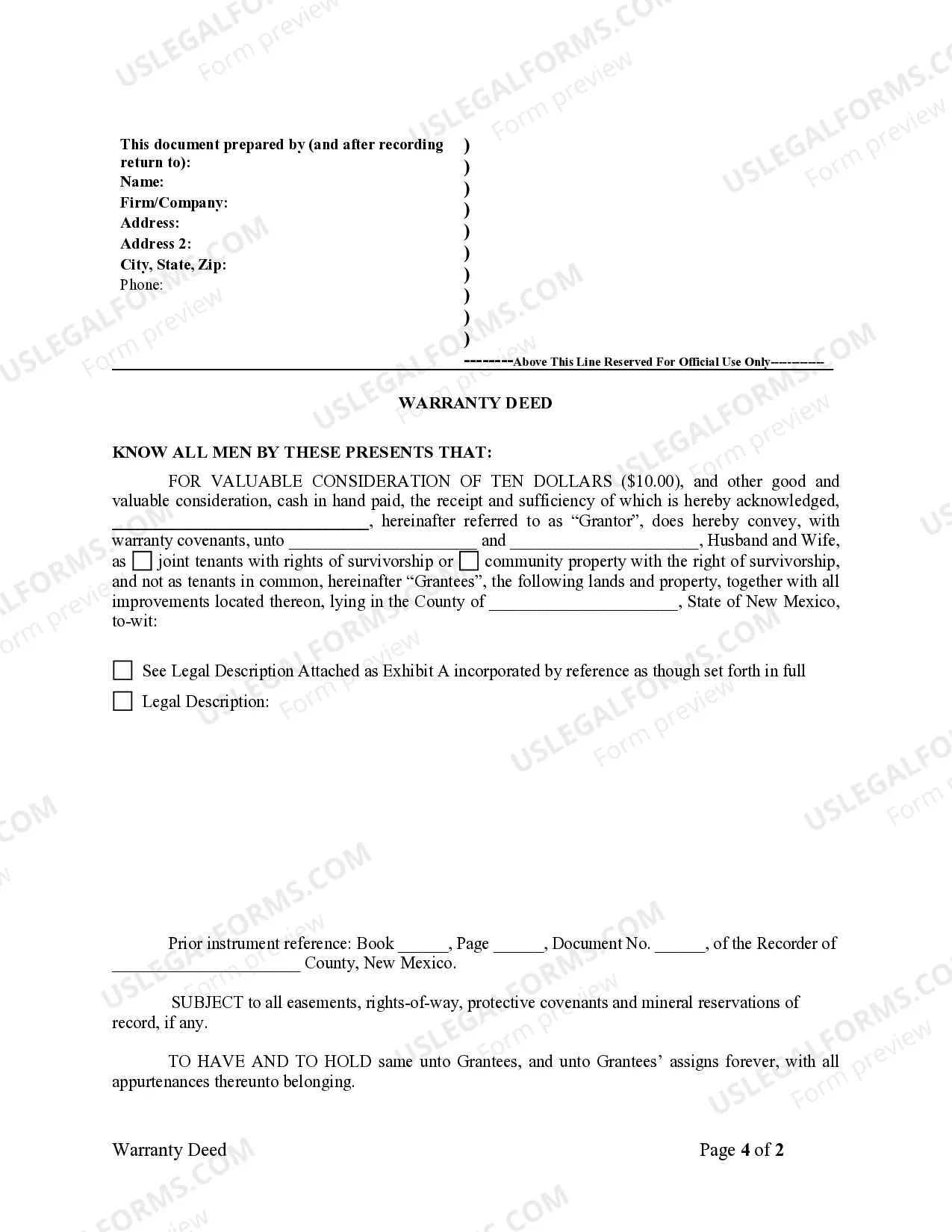

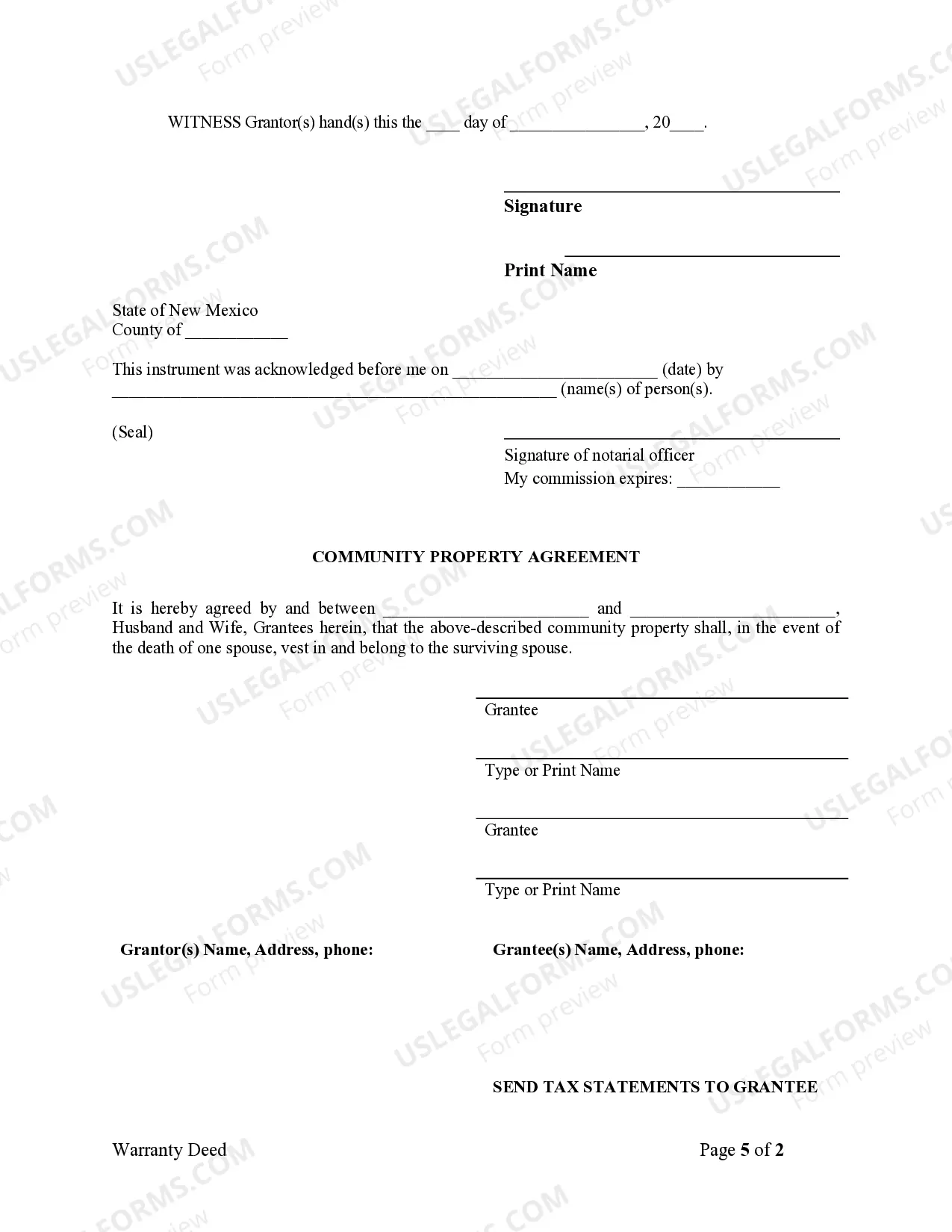

Each party has a full ownership interest in the property. The property will pass instantly to the survivor upon the death of the other without probate. Conveyance by one party without the other breaks the joint tenancy. Seller warrants that he/she has good title and will warrant and defend title.

The term joint tenancy refers to a legal arrangement in which two or more people own a property together, each with equal rights and obligations. Joint tenancies can be created by married and non-married couples, friends, relatives, and business associates.

In California, most married couples hold real property (such as land and buildings) as joint tenants with right of survivorship.For instance, many married couples share real property as joint tenants. This way, upon the death of a spouse, the surviving spouse will own 100% share of the property.

If you are a joint tenant with your partner, you both have the right to carry on living in the property. However, either of you can give notice to the landlord to end the tenancy (unless it's a fixed-term tenancy).You might be able to negotiate with the landlord so that one of you can take out a new tenancy.

It's often easier to qualify for a joint mortgage, because both spouses can contribute income and assets to the application. However, if one spouse can qualify for a mortgage based on his own income and credit, the mortgage does not need to be in both spouses' names unless you live in a community property state.

In California, all property bought during the marriage with income that was earned during the marriage is deemed "community property." The law implies that both spouses own this property equally, regardless of which name is on the title deed.

When a property is owned by joint tenants with survivorship, the interest of a deceased owner automatically gets transferred to the remaining surviving owners. For example, if four joint tenants own a house and one of them dies, each of the three remaining joint tenants ends up with a one-third share of the property.

Joint tenancy is ideal for spousesJoint tenancy might look like an appealing shortcut in estate planning because it contains a right of survivorship, meaning assets avoid the probate process and surviving joint tenants assume immediate control. However, joint tenancy does have substantial risk associated with it.