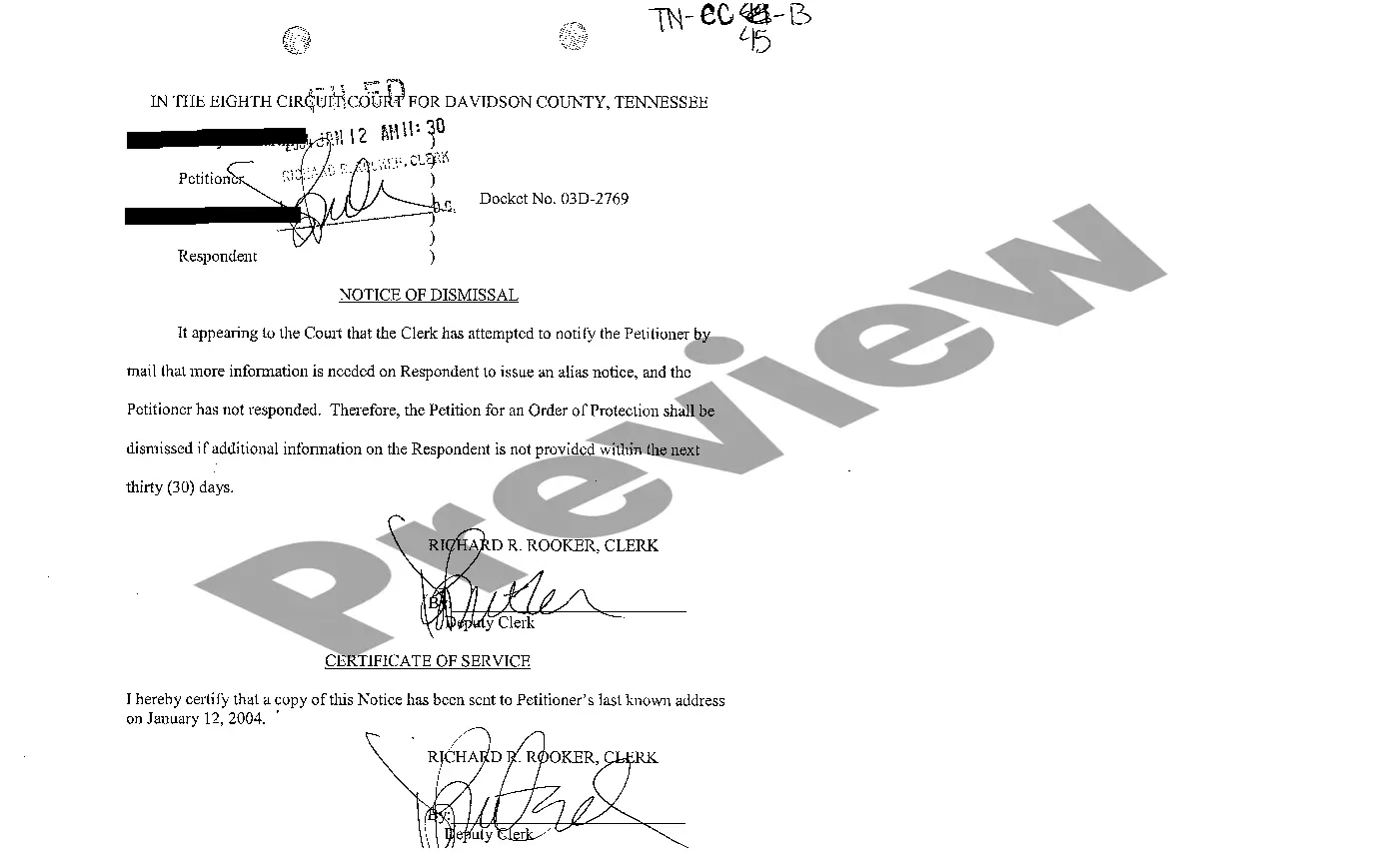

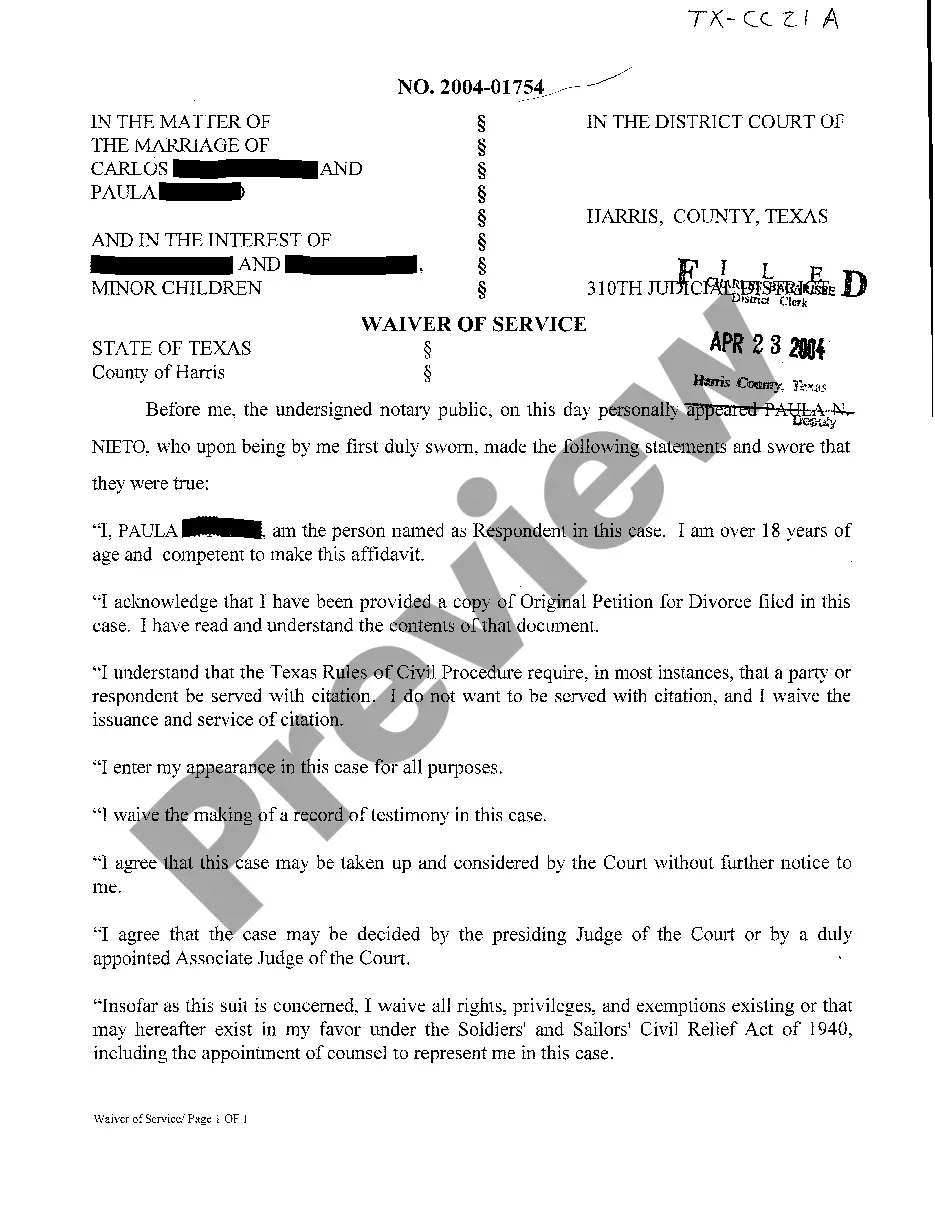

New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing is a document required to be filed with the bankruptcy court in order to provide notice to additional parties who may have an interest in a bankruptcy case. This document is typically filed when the debtor has failed to list all the parties who may have an interest in the case. The purpose of the late notice is to ensure that all parties are notified and given the opportunity to participate in the proceedings. There are two main types of New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing: (1) Notice to Creditors, and (2) Notice to Other Parties of Interest. The Notice to Creditors provides notice to all creditors who have not been previously listed in the petition or schedules, and the Notice to Other Parties of Interest provides notice to those parties who may have an interest in the case, such as lien holders, landlords, or other parties. Both of these notices must be filed with the bankruptcy court and served to the appropriate parties.

New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing

Description

How to fill out New Mexico Late Notice To Additional Parties Of Bankruptcy Case Filing?

Coping with legal documentation requires attention, precision, and using well-drafted templates. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing template from our library, you can be certain it complies with federal and state laws.

Working with our service is straightforward and quick. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing within minutes:

- Remember to attentively examine the form content and its correspondence with general and law requirements by previewing it or reading its description.

- Look for an alternative official blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and save the New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing in the format you need. If it’s your first experience with our website, click Buy now to proceed.

- Create an account, select your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it electronically.

All documents are drafted for multi-usage, like the New Mexico Late Notice To Additional Parties of Bankruptcy Case Filing you see on this page. If you need them one more time, you can fill them out without re-payment - just open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork quickly and in total legal compliance!

Form popularity

FAQ

A party who has standing to be heard by the court in a matter to be decided in the bankruptcy case. The debtor, the U.S. trustee or bankruptcy administrator, the case trustee and creditors are parties in interest for most matters. There is currently no content classified with this term.

Secured Creditors - often a bank, is paid first. Unsecured Creditors - such as banks, suppliers, and bondholders, have the next claim. Stockholders - owners of the company, have the last claim on assets and may not receive anything if the Secured and Unsecured Creditors' claims are not fully repaid.

This is basically a document, usually filed by an attorney for a creditor, indicating that the attorney is representing the creditor in the bankruptcy case, and that the attorney, on behalf of his client, would like to be served with copies of all documents that the debtor and other parties may be required to serve in

A debtor is a person or business concerning whom a case under the Bankruptcy Code has been commenced. A person or business who files a Chapter 11 case is referred to as a debtor. A debtor who qualifies may be treated as a small business debtor in a Chapter 11 case.

For a chapter 13 plan to be confirmed (approved) by the bankruptcy court, it must satisfy the ?best interests of creditors? test. The best interests of creditors test requires that general unsecured creditors receive through the chapter 13 plan at least what they would have received in chapter 7 liquidation.

What is a Bankruptcy Notice? A Notice of Bankruptcy is sent to creditors after one of their debtors files a petition with the court attempting to claim bankruptcy. After receiving the notice, the creditor must take certain steps to protect their interest in the money they are owed.

There are 4 major participants in any bankruptcy case: debtor, creditors, trustee, and bankruptcy judge. The purpose of bankruptcy is to give the debtor a fresh start and to pay its unsecured creditors a pro rata portion of whatever the law allows in a bankruptcy case.