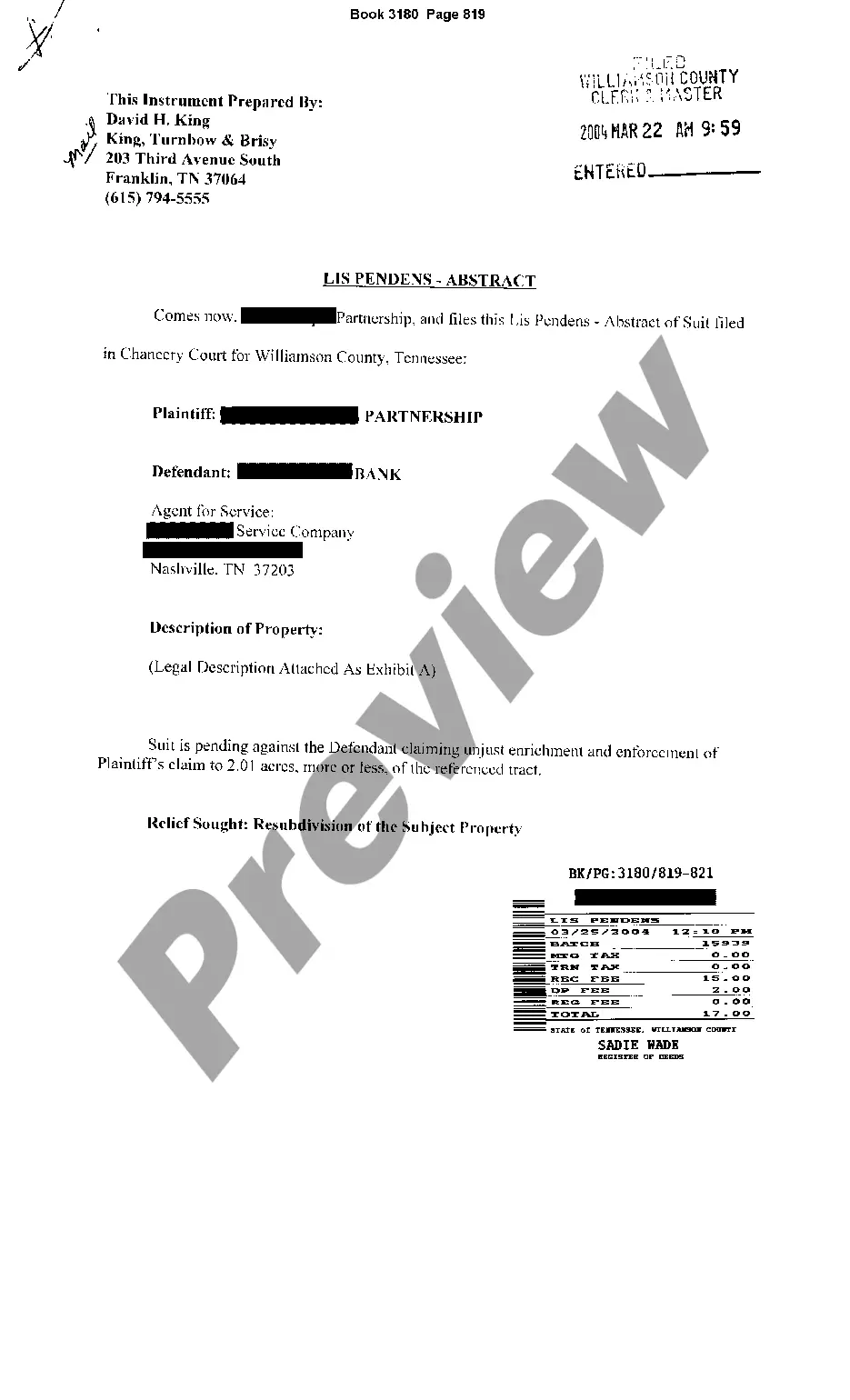

New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp) is a document used to make changes to a New Mexico domestic nonprofit corporation’s existing articles of incorporation. It is filed with the New Mexico Public Regulation Commission to update the articles of incorporation, such as changing the corporate name, updating the address of the corporation, adding or deleting business purposes, changing the number of board members, or changing the duration of the corporation. There are three types of New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp): Amendment of Articles of Incorporation, Amendment of Articles of Incorporation with Merger, and Amendment of Articles of Incorporation with Conversion.

New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp)

Description

How to fill out New Mexico Articles Of Amendment To Articles Of Incorporation (Domestic Nonprofit Corp)?

Preparing legal paperwork can be a real stress if you don’t have ready-to-use fillable templates. With the US Legal Forms online library of formal documentation, you can be confident in the blanks you obtain, as all of them comply with federal and state laws and are checked by our experts. So if you need to fill out New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp), our service is the best place to download it.

Getting your New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp) from our service is as simple as ABC. Previously authorized users with a valid subscription need only sign in and click the Download button once they find the proper template. Afterwards, if they need to, users can pick the same document from the My Forms tab of their profile. However, even if you are unfamiliar with our service, signing up with a valid subscription will take only a few minutes. Here’s a quick guideline for you:

- Document compliance verification. You should carefully examine the content of the form you want and ensure whether it suits your needs and complies with your state law requirements. Previewing your document and looking through its general description will help you do just that.

- Alternative search (optional). Should there be any inconsistencies, browse the library using the Search tab on the top of the page until you find an appropriate template, and click Buy Now once you see the one you need.

- Account creation and form purchase. Create an account with US Legal Forms. After account verification, log in and choose your preferred subscription plan. Make a payment to proceed (PayPal and credit card options are available).

- Template download and further usage. Choose the file format for your New Mexico Articles of Amendment To Articles of Incorporation (Domestic Nonprofit Corp) and click Download to save it on your device. Print it to complete your paperwork manually, or take advantage of a multi-featured online editor to prepare an electronic copy faster and more effectively.

Haven’t you tried US Legal Forms yet? Subscribe to our service now to obtain any formal document quickly and easily any time you need to, and keep your paperwork in order!

Form popularity

FAQ

To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

To make a business name change in New Mexico, you need to file Articles of Amendment with the Secretary of State. This applies to both limited liability companies (LLCs) and corporations.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501(c) of the Internal Revenue Code with a classification as an educational or social entity. Your gross receipts may be exempt from gross receipts tax under Section 7-9-29 NMSA 1978.

Nonprofit organizations recognized by the federal government under Section 501(c) of the Internal Revenue Code enjoy tax-exempt status in New Mexico to varying degrees for income (not pur- chases) covered by their IRS letters of authoriza- tion. Federal law distinguishes among many types of nonprofit organizations.

If you run a for-profit small business, you may wonder whether it's possible to change to a nonprofit business model. In most cases, the answer is yes. Converting your for-profit to a nonprofit is likely possible, but you'll want to consider several important factors before moving forward.

Nonprofit organizations recognized by the federal government under Section 501(c) of the Internal Revenue Code enjoy tax-exempt status in New Mexico to varying degrees for income (not pur- chases) covered by their IRS letters of authoriza- tion. Federal law distinguishes among many types of nonprofit organizations.

Can you change the New Mexico LLC members or managers on an amendment? Yes, you can change your LLC's members and managers by amending articles. If you want to amend your LLC and add extra members, you will have to file a paper form. It costs $50 to process.

Non-profit organizations must register if they are doing business in New Mexico. Registering with New Mexico's Combined Reporting System (CRS) is a precursor to obtaining exemption from gross receipts tax.