Are you currently inside a position the place you will need files for both organization or personal functions almost every day? There are plenty of lawful file themes available on the net, but discovering versions you can depend on isn`t easy. US Legal Forms delivers thousands of form themes, like the New Mexico Participating or Participation Loan Agreement in Connection with Secured Loan Agreement, that are composed to satisfy federal and state needs.

When you are already knowledgeable about US Legal Forms web site and get a merchant account, merely log in. Next, you are able to obtain the New Mexico Participating or Participation Loan Agreement in Connection with Secured Loan Agreement design.

Should you not provide an profile and need to start using US Legal Forms, abide by these steps:

- Find the form you require and ensure it is for that proper town/area.

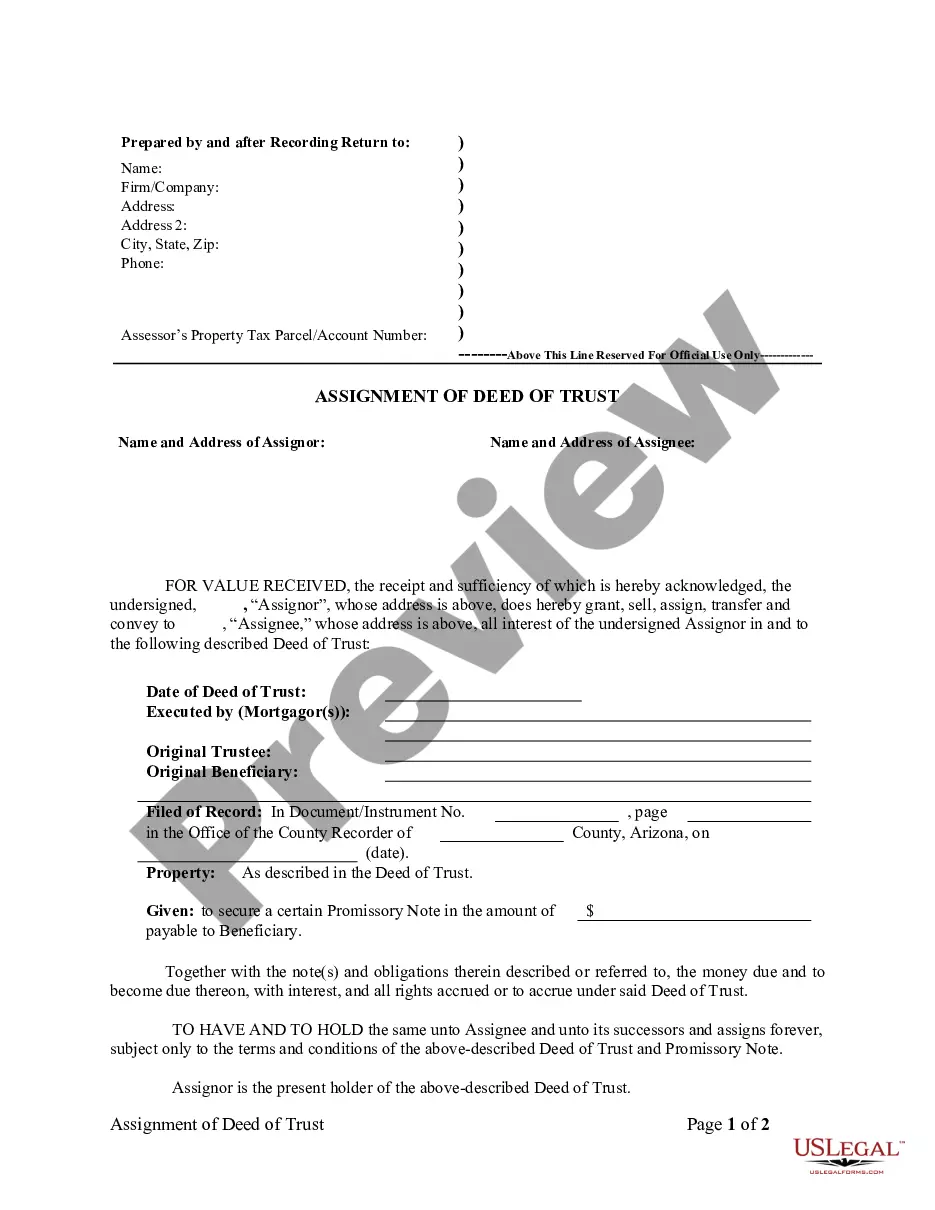

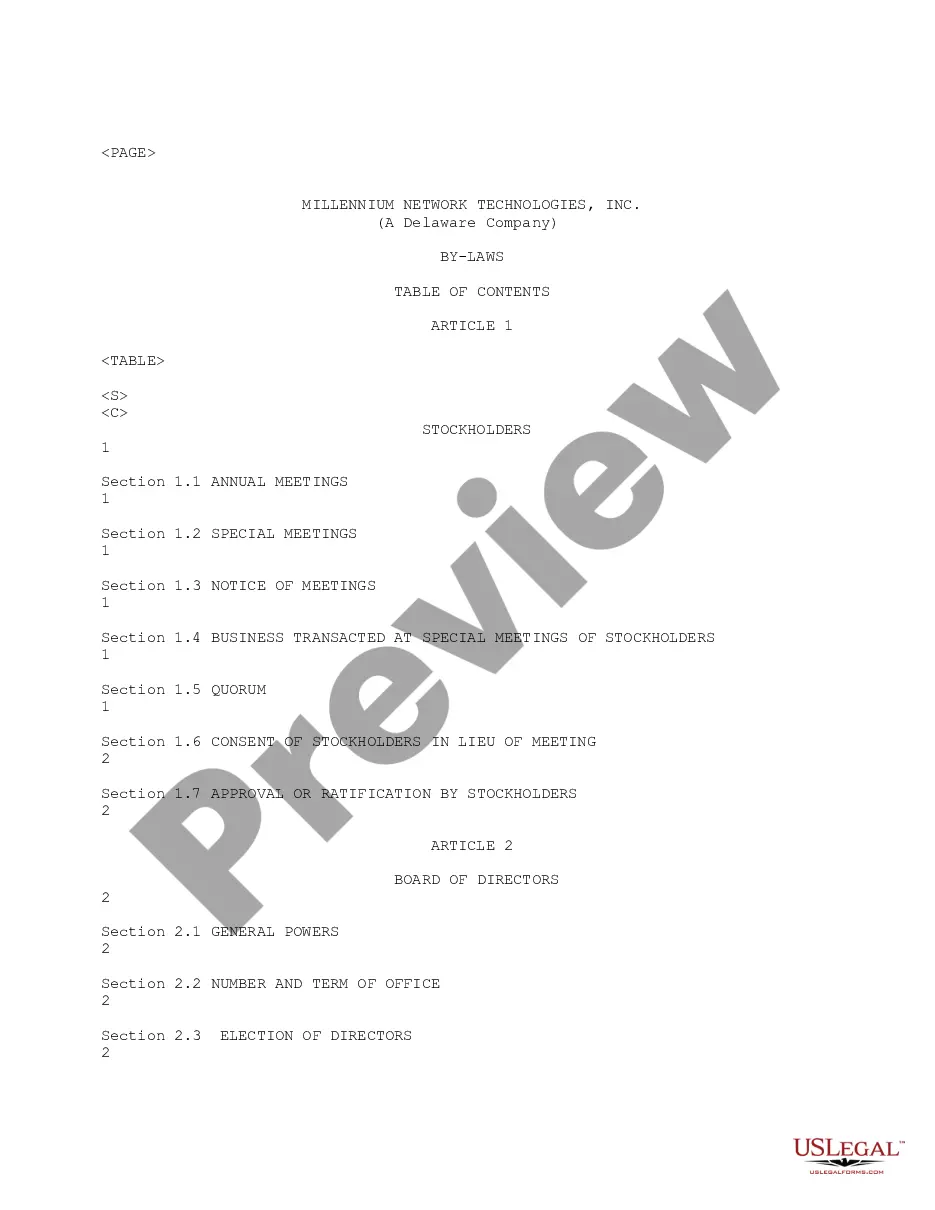

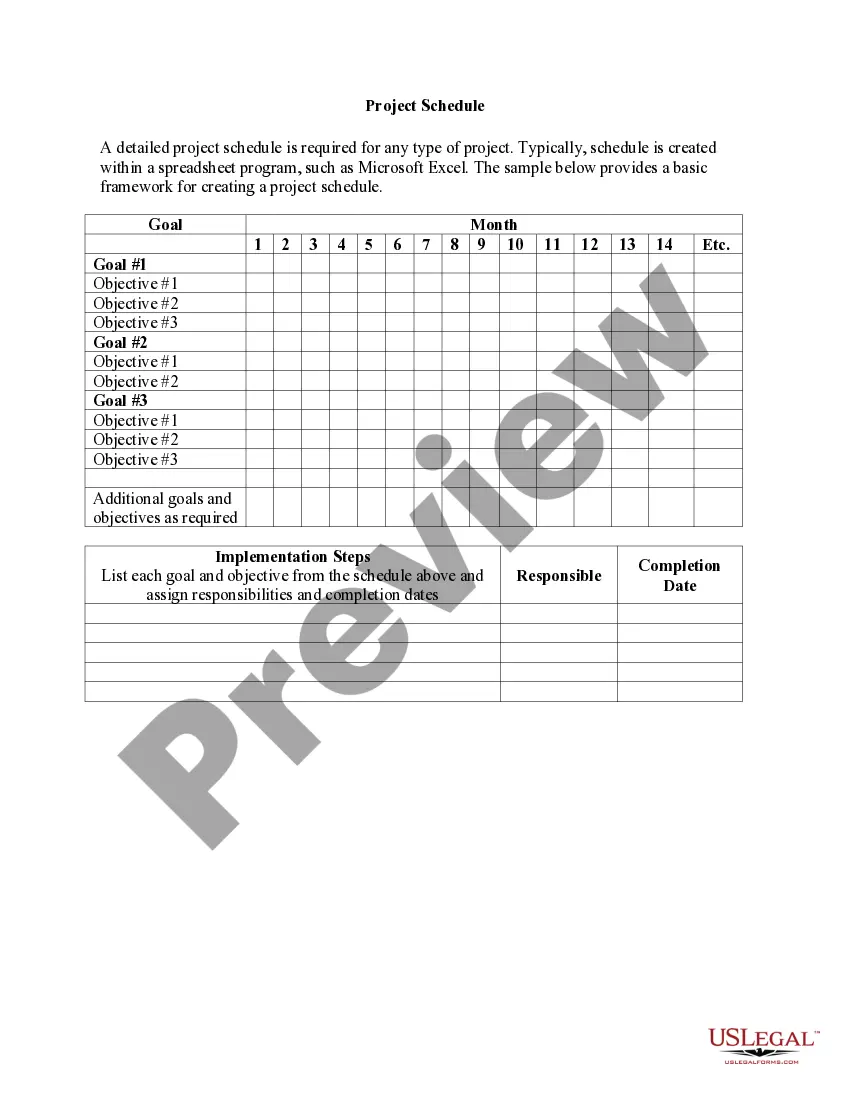

- Use the Review button to examine the form.

- See the outline to ensure that you have selected the correct form.

- When the form isn`t what you`re trying to find, utilize the Look for discipline to get the form that suits you and needs.

- Once you get the proper form, just click Purchase now.

- Select the rates program you want, fill in the required details to generate your account, and pay for an order with your PayPal or charge card.

- Choose a practical data file file format and obtain your backup.

Find all of the file themes you may have bought in the My Forms menu. You can aquire a additional backup of New Mexico Participating or Participation Loan Agreement in Connection with Secured Loan Agreement anytime, if needed. Just click on the required form to obtain or printing the file design.

Use US Legal Forms, probably the most considerable selection of lawful types, to save efforts and prevent blunders. The services delivers professionally produced lawful file themes that can be used for a variety of functions. Produce a merchant account on US Legal Forms and commence producing your daily life easier.