A New Mexico Promissory Note — Balloon Note is a legal document that outlines the terms and conditions of a loan, focusing on a large final payment, commonly referred to as a "balloon payment." This type of promissory note is generally used in situations where the borrower may not be able to make substantial regular payments but is confident in their ability to pay a lump sum at the end of the loan term. The key elements of a New Mexico Promissory Note — Balloon Note include the principal amount borrowed, the interest rate applied to the loan, the repayment terms, and the maturity date. The principal amount refers to the total amount of money borrowed from the lender, while the interest rate determines the additional cost the borrower will bear for the loan. The repayment terms of a balloon note typically involve small monthly or periodic payments over a predetermined period, often referred to as the "amortization period." However, unlike traditional loans, the balloon note does not require the borrower to completely pay off the principal and interest over the amortization period. Instead, it consists of regular payments, possibly at a lower interest rate, leading up to a final balloon payment, which usually signifies the remaining balance of the loan. It is crucial for both the lender and the borrower to clearly define the terms of the balloon note to avoid any misunderstandings or legal disputes. Some specific requirements that should be included in a New Mexico Promissory Note — Balloon Note are the details of the lender and borrower, such as their legal names and contact information, the specific loan amount, the agreed-upon interest rate, and any penalties for late or missed payments. Additionally, the note may include provisions regarding prepayment, default, and collateral. While there are no specific variations of a New Mexico Promissory Note — Balloon Note, it is essential to consult with an attorney or financial advisor to ensure compliance with state laws and tailor the balloon note to the particular circumstances of the loan. Local regulations may require specific disclosures or limitations on interest rates, so it is crucial to understand these aspects before drafting the note. In summary, a New Mexico Promissory Note — Balloon Note is a legal document that establishes the terms and conditions of a loan, emphasizing a large final payment at the end of the loan term. Properly outlining the terms in a balloon note is critical to protect the interests of both the lender and the borrower and ensure a smooth loan repayment process.

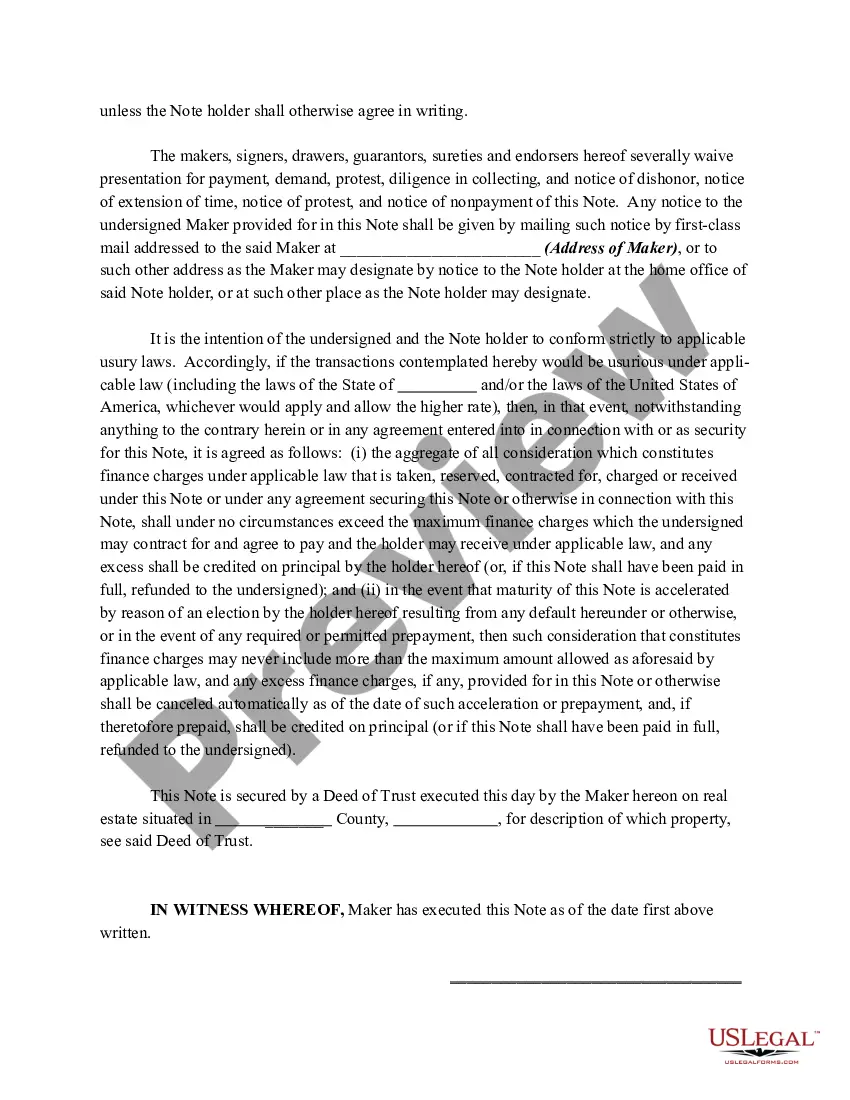

New Mexico Promissory Note - Balloon Note

Description

How to fill out New Mexico Promissory Note - Balloon Note?

Have you been within a situation the place you need to have papers for sometimes organization or individual functions virtually every working day? There are tons of lawful papers layouts available on the Internet, but discovering ones you can trust is not effortless. US Legal Forms offers thousands of develop layouts, much like the New Mexico Promissory Note - Balloon Note, that happen to be published to meet federal and state requirements.

In case you are already acquainted with US Legal Forms site and possess a merchant account, merely log in. After that, you are able to obtain the New Mexico Promissory Note - Balloon Note web template.

Unless you offer an account and want to start using US Legal Forms, follow these steps:

- Find the develop you need and make sure it is for your proper town/region.

- Utilize the Review key to examine the form.

- Browse the information to actually have chosen the proper develop.

- In case the develop is not what you are looking for, use the Search area to obtain the develop that suits you and requirements.

- If you find the proper develop, just click Purchase now.

- Select the pricing strategy you desire, fill out the specified information and facts to create your bank account, and purchase an order using your PayPal or bank card.

- Decide on a handy document file format and obtain your version.

Find every one of the papers layouts you have bought in the My Forms food selection. You can get a more version of New Mexico Promissory Note - Balloon Note anytime, if needed. Just select the necessary develop to obtain or printing the papers web template.

Use US Legal Forms, by far the most substantial variety of lawful types, in order to save efforts and stay away from blunders. The support offers professionally produced lawful papers layouts that can be used for a range of functions. Generate a merchant account on US Legal Forms and begin generating your way of life a little easier.