New Mexico Loan Form Corporation — Corporate Resolutions act as important legal documents for businesses operating in the state of New Mexico. These resolutions serve as official acknowledgments of key decisions and actions taken by the corporation's board of directors or shareholders. The resolutions are crucial for maintaining compliance with state laws and regulations and ensuring the proper functioning of the corporation. Some key types of New Mexico Loan Form Corporation — Corporate Resolutions include: 1. Appointment of Officers: This resolution documents the appointment of various officers within the corporation, such as the Chief Executive Officer (CEO), Chief Financial Officer (CFO), and Secretary, among others. It outlines their roles, responsibilities, and authority within the organization. 2. Approval and Adoption of Bylaws: This resolution records the formal approval and adoption of the corporation's bylaws, which outline the internal governance and rules guiding the corporation's operations. 3. Opening Bank Accounts and Establishing Lines of Credit: This resolution authorizes the corporation to open bank accounts and establish lines of credit with financial institutions. It provides details about the designated signatories who are authorized to carry out financial transactions on behalf of the corporation. 4. Approval of Loans and Financing: This resolution authorizes the corporation to obtain loans or financing from banks, financial institutions, or other sources. It sets parameters, such as loan amount, interest rates, repayment terms, and any collateral requirements. 5. Declaration of Dividends: This resolution declares the distribution of dividends by the corporation to its shareholders. It outlines the dividend amount, payment date, and any special conditions or restrictions. 6. Appointment of Auditors: This resolution appoints independent auditors to review and audit the corporation's financial statements and records. It ensures transparency and compliance with accounting standards. 7. Authorization for Legal Actions: This resolution grants authority to the corporation to take legal actions, such as filing lawsuits, entering into settlements, or engaging in legal agreements on the corporation's behalf. 8. Merger or Acquisition: This resolution authorizes the corporation to merge with or acquire another company. It specifies the terms and conditions of the merger or acquisition, including the exchange of shares and assets. These various types of corporate resolutions are crucial for ensuring transparency, accountability, and compliance within a New Mexico Loan Form Corporation. They provide a legal framework for the corporation's decision-making processes, financial transactions, and overall governance.

New Mexico Loan Form Corporation - Corporate Resolutions

Description

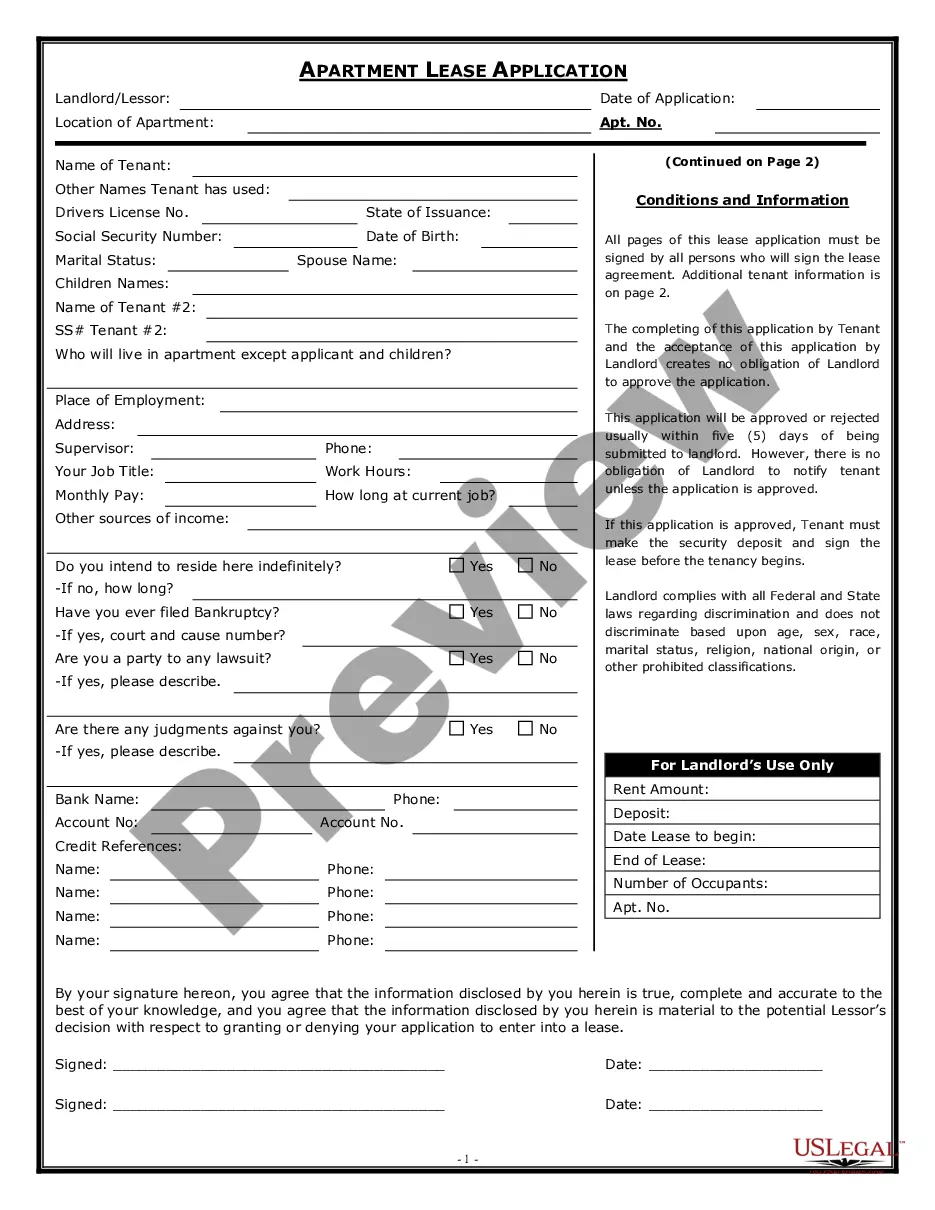

How to fill out New Mexico Loan Form Corporation - Corporate Resolutions?

Choosing the best lawful papers format can be quite a struggle. Needless to say, there are a variety of web templates available on the net, but how do you get the lawful type you require? Make use of the US Legal Forms web site. The support provides 1000s of web templates, including the New Mexico Loan Form Corporation - Corporate Resolutions, which can be used for company and private requires. All of the varieties are checked by pros and fulfill state and federal specifications.

Should you be previously authorized, log in for your accounts and then click the Download key to obtain the New Mexico Loan Form Corporation - Corporate Resolutions. Use your accounts to appear from the lawful varieties you might have acquired in the past. Visit the My Forms tab of the accounts and get another copy of the papers you require.

Should you be a fresh user of US Legal Forms, listed below are straightforward instructions for you to follow:

- Very first, make certain you have chosen the right type to your town/county. You are able to check out the shape making use of the Review key and look at the shape information to make sure it will be the right one for you.

- In the event the type is not going to fulfill your requirements, take advantage of the Seach discipline to get the correct type.

- When you are certain the shape would work, click the Purchase now key to obtain the type.

- Opt for the prices strategy you desire and enter the needed information and facts. Design your accounts and pay money for the order utilizing your PayPal accounts or bank card.

- Pick the data file structure and download the lawful papers format for your system.

- Comprehensive, edit and printing and indicator the obtained New Mexico Loan Form Corporation - Corporate Resolutions.

US Legal Forms is definitely the most significant collection of lawful varieties that you will find various papers web templates. Make use of the service to download professionally-produced paperwork that follow express specifications.

Form popularity

FAQ

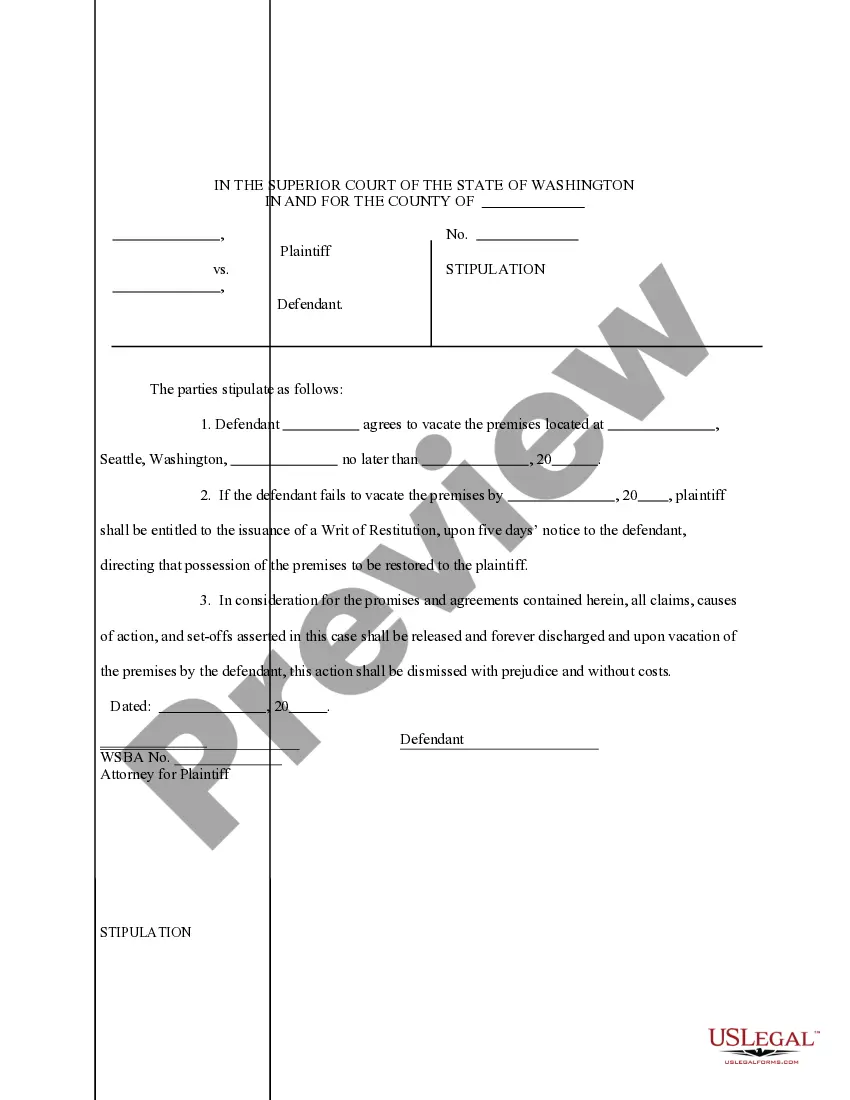

A corporate resolution outlines the decisions and actions made by a company's board of directors. A corporation might use a corporate resolution to establish itself as an independent legal entity, which is separate from the owners.

A borrowing resolution is a legally binding document that approves a corporation's management or executives to borrow funds on behalf of the corporation. The company's board generally approves it.

When you create a resolution to loan funds, you need to include the following information: The legal name of the corporation. Full name and the role in the corporation. Numerical loan amount requested, along with interest.

The purpose of any corporate resolution is to document the actions the board of directors will take on behalf of a corporation. When you create a resolution to sell real estate property, you need to include the following information: The legal name of the corporation.

Loan Resolution means the separate Loan Owner at the registered address, as shown on the periodically in the manner and at the times hereinaftermoneys in the bank account shall be allocated on the. Sample 1. Loan Resolution means the Loan Resolution (Form RUS Bulletin 1780-27) of the Issuer.

Here is an example of a conclusion versus a resolution: Resolution: The team happily celebrated their victory after a challenging face-off with their rival. Here, the resolution marks the end of a story.

7 Steps for Writing a Resolution Put the date and resolution number at the top. ... Give the resolution a title that relates to the decision. ... Use formal language. ... Continue writing out each critical statement. ... Wrap up the heart of the resolution in the last statement.

Corporate resolutions are formal declarations of major decisions made by a corporate entity. The resolutions are used to determine which corporate officers are legally able to sign contracts, make transfers or assignments, sell or lease real estate, and make other important decisions that bind the corporation.