Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

New Mexico Notice to Debtor of Authority of Agent to Receive Payment

Description

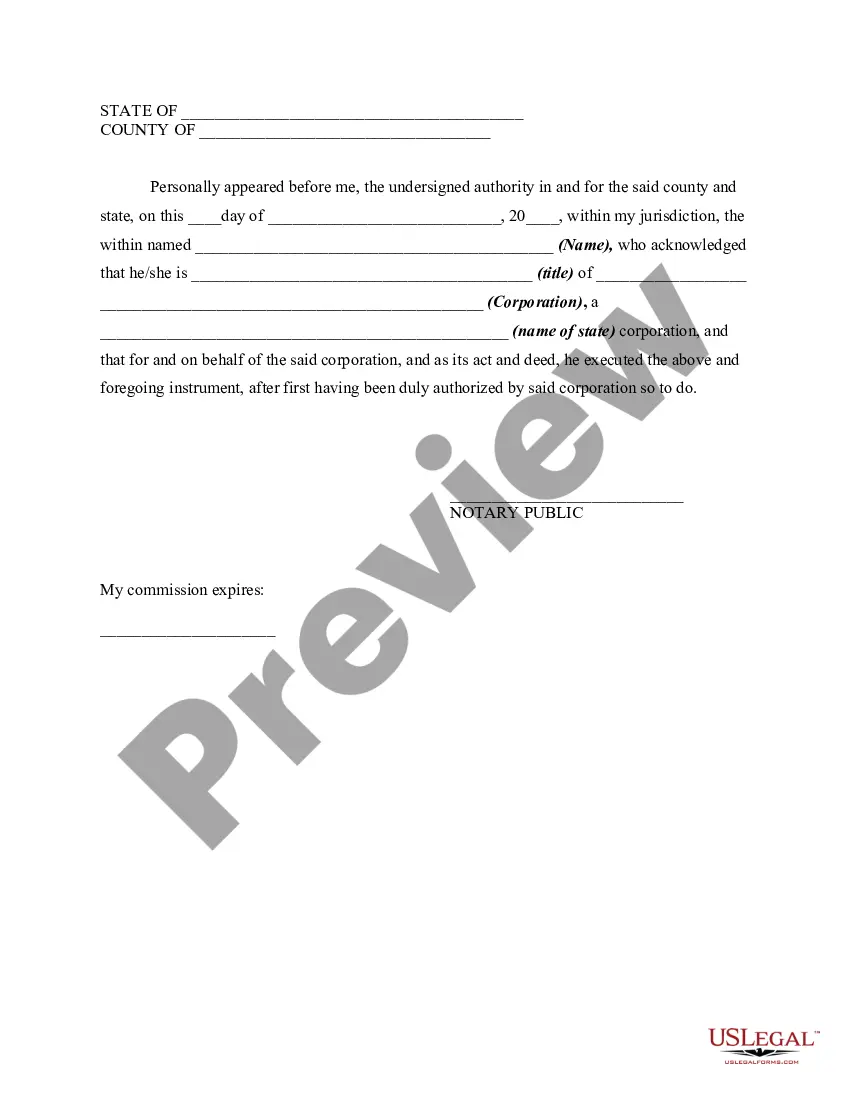

How to fill out Notice To Debtor Of Authority Of Agent To Receive Payment?

You might spend a considerable amount of time online trying to locate the sanctioned document template that meets the state and federal requirements you desire.

US Legal Forms offers a vast array of legal documents that have been examined by professionals.

You can download or create the New Mexico Notice to Debtor of Authority of Agent to Receive Payment from my service.

If you wish to find another version of the document, use the Search field to locate the template that suits your needs and requirements.

- If you already have a US Legal Forms account, you can Log In and click on the Acquire button.

- Afterwards, you can complete, modify, print, or sign the New Mexico Notice to Debtor of Authority of Agent to Receive Payment.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy of the purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/town of your choice.

- Review the form details to confirm that you have chosen the right one.

- If available, utilize the Preview button to view the document template as well.

Form popularity

FAQ

Agents have several key obligations to their principals outlined in the New Mexico Notice to Debtor of Authority of Agent to Receive Payment. Primarily, agents must act in the best interest of the principal, maintaining loyalty and confidentiality. They should keep the principal informed about significant developments and ideally act within the scope of authority granted. By fulfilling these responsibilities, agents ensure transparency and trust in their relationship with the principal.

In the context of the New Mexico Notice to Debtor of Authority of Agent to Receive Payment, the agent is an individual or entity authorized to act on behalf of the principal, who is the person or entity granting that authority. An agent handles specific responsibilities, such as receiving payments, under the principal's instructions. This relationship is based on trust, and the actions of the agent can legally bind the principal. Recognizing the distinction between these roles is essential for effective representation.

The phrase 'notice to agent is notice to principal' means that any information shared with an agent regarding the New Mexico Notice to Debtor of Authority of Agent to Receive Payment is also considered to be communicated to the principal. This principle ensures that the agent acts with the authority granted by the principal. Consequently, the agent must convey all relevant notices and information to the principal. Understanding this concept is crucial to maintain clear communication in financial transactions.

New Mexico is indeed a stop and identify state. This means that when a law enforcement officer stops a person, that person must provide their name and identification, which promotes accountability and transparency. It's important to understand your rights in such situations, including how the New Mexico Notice to Debtor of Authority of Agent to Receive Payment can help clarify financial matters if necessary. Make sure to stay informed and seek assistance if needed.

New Mexico is not a race notice state; instead, it operates under a notice system. In this system, the New Mexico Notice to Debtor of Authority of Agent to Receive Payment plays a crucial role in keeping all parties informed about payment responsibilities. This notice ensures that debtors understand who is authorized to receive payments on their behalf. Therefore, it is essential to follow the proper procedures to avoid potential disputes.

In New Mexico, a debt generally becomes uncollectible after six years, according to the statute of limitations. This timeframe is critical for debtors to recognize their rights and obligations. The New Mexico Notice to Debtor of Authority of Agent to Receive Payment plays a role in informing debtors about their status and potential payment options.

The statute of limitations for claims under the Unfair Practices Act in New Mexico is four years. This period starts from the date of the grievance. Understanding your rights under the New Mexico Notice to Debtor of Authority of Agent to Receive Payment can help protect you against unfair collection practices.

Collection agencies can attempt to collect on older debts, but they cannot legally open them as new debts if they are past the statute of limitations. If you receive a notice referencing the New Mexico Notice to Debtor of Authority of Agent to Receive Payment, it’s prudent to verify the age of the debt in question.

In most cases, a 10-year-old debt cannot be collected in New Mexico due to the statute of limitations. This period typically limits collection efforts to six years for most types of debts. However, knowing about the New Mexico Notice to Debtor of Authority of Agent to Receive Payment is vital for understanding any notices you may receive.

Contract law in New Mexico follows the principles of common law and governs agreements between parties. It addresses issues such as the validity of contracts and the enforcement of obligations. Familiarizing yourself with the implications of the New Mexico Notice to Debtor of Authority of Agent to Receive Payment can provide clarity in these situations.