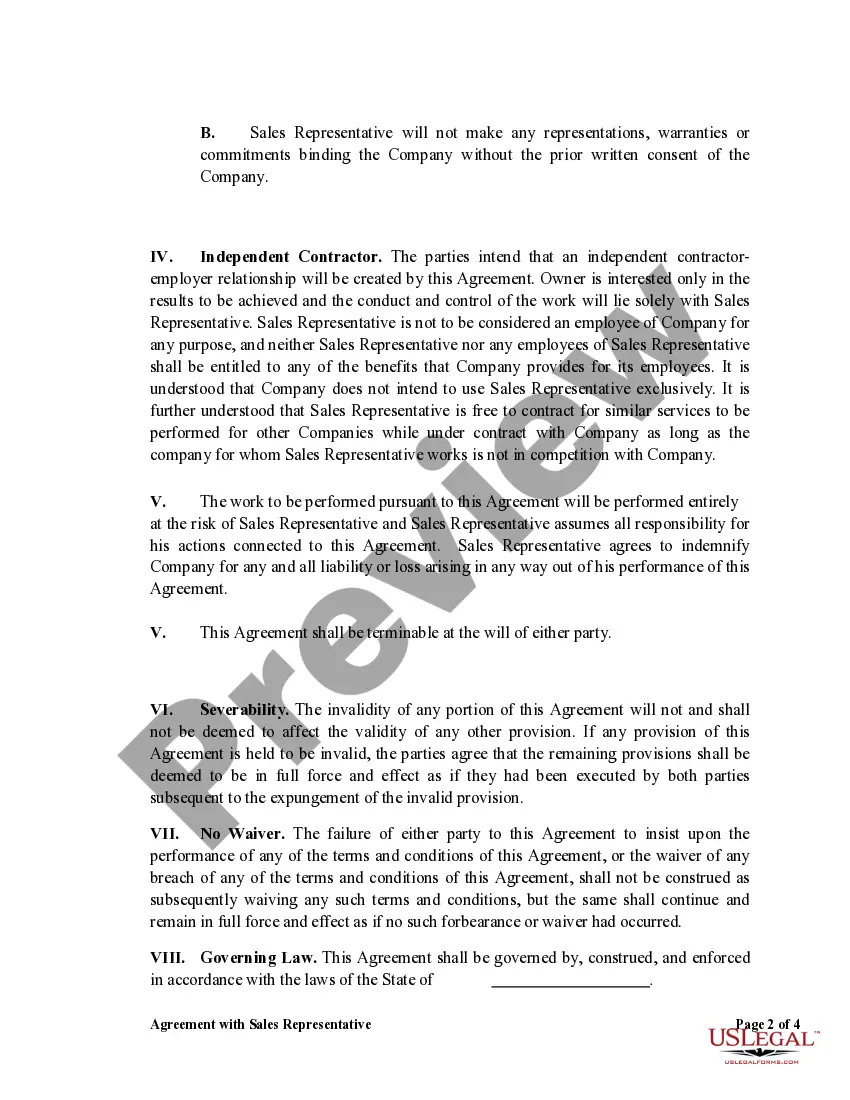

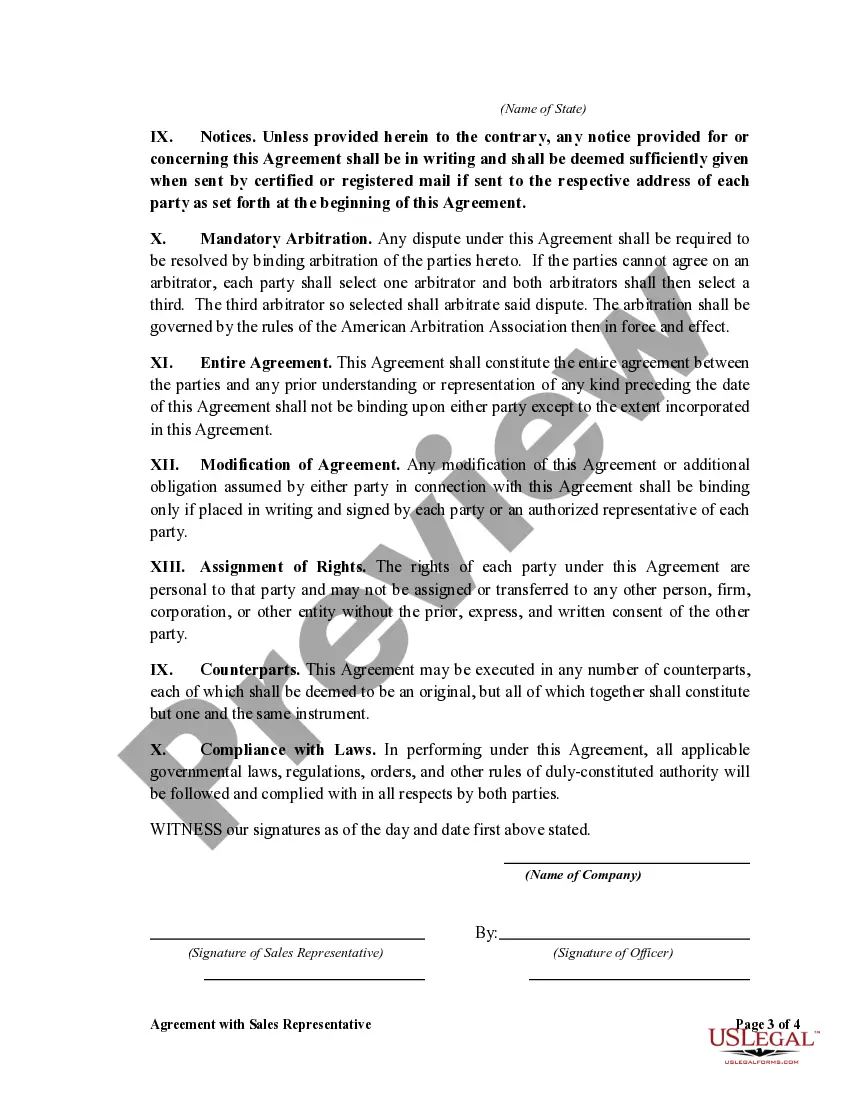

The New Mexico Agreement with Sales Representative to Sell Advertising and Related Services is a legal contract that establishes the terms and conditions between a company and a sales representative for the sale of advertising and related services in the state of New Mexico. This agreement outlines the rights and responsibilities of both parties and ensures a smooth business relationship. In this agreement, the company appoints the sales representative as an authorized agent to sell advertising space or services on their behalf. The sales representative acts as a liaison between the company and potential clients, promoting and selling advertising opportunities to drive revenue. This agreement typically covers various advertising mediums such as print media, online platforms, radio, television, or any other relevant marketing channels. Some key elements addressed in the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services include: 1. Obligations of the Sales Representative: This section outlines the duties and responsibilities of the sales representative, including promoting the company's advertising services, prospecting potential clients, negotiating contracts, and facilitating the execution of advertising campaigns. 2. Compensation and Commission: The agreement specifies the compensation structure for the sales representative, which is usually based on a commission structure. The commission may vary depending on factors such as the type of advertising, sales volume, or other incentives and bonuses established by the company. 3. Sales Targets and Performance: The agreement may define specific sales targets or performance metrics that the sales representative is expected to achieve. These targets aim to ensure the effectiveness and productivity of the sales representative and may be subject to periodic evaluation and adjustment. 4. Confidentiality and Non-Disclosure: This section ensures the protection of the company's confidential information, trade secrets, client database, or other proprietary information shared with the sales representative during their engagement. It sets out the obligations to keep information confidential both during and after the contract termination. 5. Termination: This section outlines the conditions under which either party can terminate the agreement, including breach of contract, non-performance, or other material violations. It may also define notice periods required for termination and any potential post-termination obligations. Types of New Mexico Agreements with Sales Representative to Sell Advertising and Related Services may include: 1. Exclusive Agreement: This type of agreement grants the sales representative exclusive rights to sell the company's advertising services within a specific territory or market segment. It restricts the company from appointing other sales representatives in the same area or segment. 2. Non-Exclusive Agreement: In contrast to an exclusive agreement, a non-exclusive agreement allows the company to appoint multiple sales representatives to sell its advertising services simultaneously. This may be beneficial for targeting different markets or expanding the sales reach. 3. Short-Term Agreement: A short-term agreement has a specific duration, often for a single advertising campaign or limited period. It enables the company to engage a sales representative for a specific project or time frame, without a long-term commitment. In conclusion, the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services is a crucial legal instrument for businesses wanting to establish relationships with sales representatives responsible for promoting and selling their advertising services. By defining the rights, obligations, and compensation structure, this agreement ensures a clear understanding between parties and protects both their interests.

New Mexico Agreement with Sales Representative to Sell Advertising and Related Services

Description

How to fill out New Mexico Agreement With Sales Representative To Sell Advertising And Related Services?

Are you in a position where you require documents for potential business or personal reasons almost every business day.

There are numerous legal document templates available online, but locating forms you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services, designed to comply with state and federal regulations.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes.

The service offers professionally crafted legal document templates that can be utilized for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you require and ensure it is for the correct city/county.

- Use the Preview button to review the form.

- Check the details to ensure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Get now.

- Select the pricing plan you prefer, fill in the required information to set up your account, and purchase your order using your PayPal or credit card.

- Choose a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents section. You can download an additional copy of the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services anytime if necessary. Just select the required form to download or print the document template.

Form popularity

FAQ

A commission agreement generally includes the identities of the parties, commission rates, payment terms, and performance expectations. It may also cover confidentiality clauses and conditions for terminating the agreement. To streamline this process and ensure compliance with local regulations, consider using the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services provided by USLegalForms.

A typical sales commission contract details the commission structure and expectations between the company and the sales representative. It may specify the commission rate, payment schedule, and terms related to termination or disputes. Having a clear and concise New Mexico Agreement with Sales Representative to Sell Advertising and Related Services can protect the interests of both parties involved in the sales process.

A sales commission policy outlines how representatives earn commissions based on sales performance. For instance, a policy might state that representatives receive a 10% commission on all sales generated each month. Such a policy helps ensure transparency and motivates the sales team. Utilizing a well-structured New Mexico Agreement with Sales Representative to Sell Advertising and Related Services can provide clarity on your commission policy.

Yes, if you are selling taxable goods or services in New Mexico, you will need to obtain a sales tax permit. This requirement may also apply when engaging in activities outlined in the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services. Having a sales tax permit ensures compliance with state tax regulations and helps avoid potential legal issues. For assistance with permits and understanding your obligations, platforms like US Legal Forms can provide valuable resources.

To write a sales commission agreement, begin by clearly outlining the roles of both parties involved, emphasizing the specific services and products covered under the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services. Define the commission structure, including payment terms and conditions for performance. It’s essential to include clauses for termination and dispute resolution to protect both parties. For guidance, consider using online resources that provide customizable templates.

A sales representative agreement is a formal contract that outlines the relationship between a company and an individual or entity tasked with selling its products or services. Specifically, in the context of the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services, this document details responsibilities, commission structures, and expectations. By establishing clear terms, both parties can create a mutually beneficial partnership. Utilizing templates from reliable sources can simplify the drafting process.

In New Mexico, certain services, including those related to the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services, can be exempt from sales tax. Services like advertising, promotional materials, and certain consulting services may qualify for an exemption. It's vital to review New Mexico's tax policies to ensure compliance and proper categorization of services. For precise guidance, consider consulting with experts or using platforms that specialize in legal forms.

When writing a sales commission agreement, clearly outline the commission structure and the roles of the sales representative. Specify the conditions under which the commission is earned, including sales targets or performance metrics. Familiarizing yourself with the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services can enhance the clarity and legality of your agreement.

Writing a simple sales contract involves presenting clear terms without unnecessary complexity. Include the names of the parties, the description of the item or service being sold, and the payment method. Adhering to standards set by the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services can make your contract more effective.

To write a simple contract agreement, focus on simplicity and clarity. Clearly state the agreement's intent and details such as the parties involved, obligations, and terms of performance. Incorporating principles from the New Mexico Agreement with Sales Representative to Sell Advertising and Related Services ensures streamlined communication and understanding.

Interesting Questions

More info

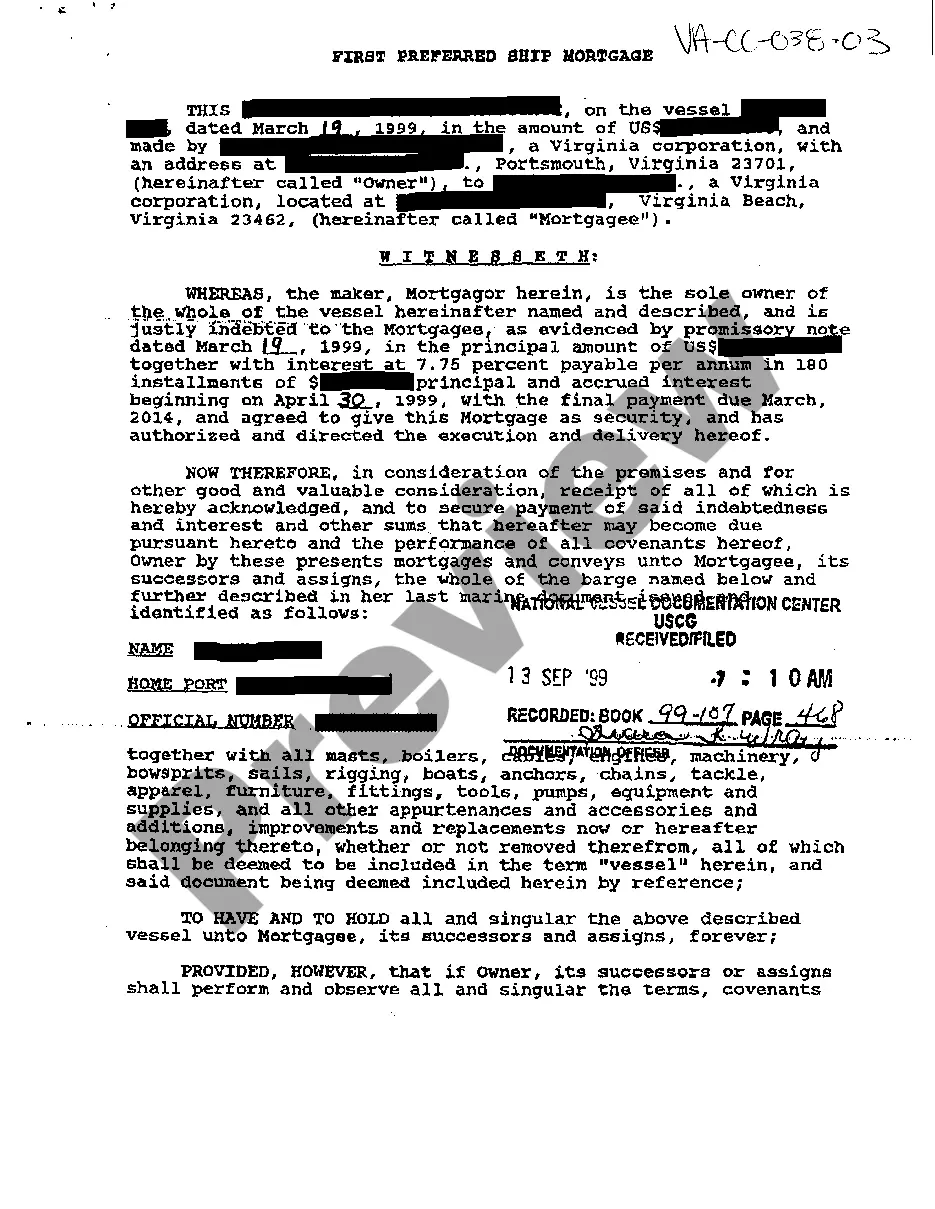

(“FBI”) and K&D Electric Co. (“K&D”), hereby sets forth the terms of and subject to the rights of such party with respect to the sale and distribution by K&D of all or part of the assets of the Company and all or part of FBI's shares of K&D stock upon liquidation. The rights under this SALES REPRESENTATIVE AGREEMENT do not affect or limit any rights under any other sales contract between the parties and are not to be construed as a waiver of any rights under a laterally-opposed agreement. 1. Purchases of Assets and Shares. Purchases of the assets of the Company and any of its assets by FBI shall be made pursuant to a contract between the parties, or by the exercise of any rights under any such written contract or any agreement between the parties, in the exercise of either of the following options: a.