New Mexico Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust

Description

How to fill out Contract Of Sale And Leaseback Of Apartment Building With Purchaser Assuming Outstanding Note Secured By A Mortgage Or Deed Of Trust?

Discovering the right lawful record web template can be a have difficulties. Needless to say, there are tons of themes accessible on the Internet, but how can you get the lawful develop you require? Utilize the US Legal Forms website. The support offers a large number of themes, like the New Mexico Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust, that you can use for company and personal needs. All of the kinds are inspected by specialists and meet federal and state needs.

Should you be currently authorized, log in to your account and click the Down load option to have the New Mexico Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust. Utilize your account to search with the lawful kinds you may have ordered formerly. Proceed to the My Forms tab of your respective account and get one more copy of your record you require.

Should you be a new end user of US Legal Forms, allow me to share straightforward directions for you to follow:

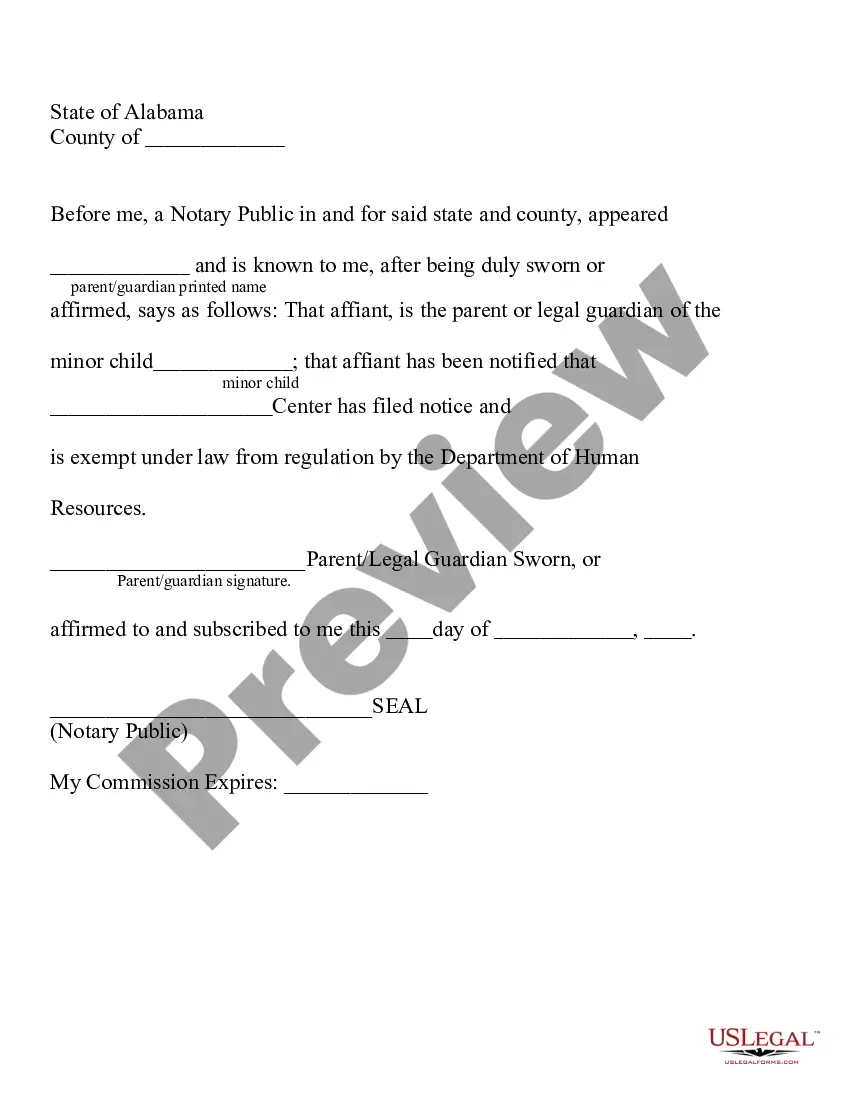

- First, be sure you have selected the right develop to your city/area. You may look through the form while using Review option and look at the form information to make sure it will be the right one for you.

- In the event the develop fails to meet your requirements, utilize the Seach field to get the appropriate develop.

- Once you are certain that the form would work, click on the Acquire now option to have the develop.

- Pick the costs plan you desire and enter the necessary details. Make your account and purchase the transaction utilizing your PayPal account or credit card.

- Opt for the file formatting and download the lawful record web template to your gadget.

- Full, edit and printing and signal the acquired New Mexico Contract of Sale and Leaseback of Apartment Building with Purchaser Assuming Outstanding Note Secured by a Mortgage or Deed of Trust.

US Legal Forms is the greatest collection of lawful kinds where you can discover numerous record themes. Utilize the company to download appropriately-produced paperwork that follow express needs.