The New Mexico Auction of Real Property Agreement is a legal contract that outlines the terms and conditions for the sale of real estate through an auction process in the state of New Mexico. This agreement serves as a binding agreement between the seller, often a financial institution, and the highest bidder, who agrees to purchase the property at the auction. Key elements included in the New Mexico Auction of Real Property Agreement are the identification of the property being auctioned, the auction date, time, and location, as well as the terms of the auction such as the minimum bid, bidding increments, and any reserve price set by the seller. It also addresses the buyer's responsibilities, financing arrangements, and closing deadlines. It is important to note that there may be different types of New Mexico Auction of Real Property Agreements depending on the specific circumstances or entities involved. Some common variations may include: 1. Foreclosure Auction Agreement: This type of agreement is commonly used when a property is being auctioned off due to foreclosure. The contract may include additional clauses related to the foreclosure process and the seller's obligations regarding title clearance. 2. Tax Lien Auction Agreement: In cases where a property owner has unpaid property taxes, the county or municipality may conduct a tax lien auction to recover the outstanding taxes. This agreement would address the sale of the property to satisfy the tax lien. 3. Estate Auction Agreement: When a property is being sold as part of an estate settlement, an estate auction agreement may be used. This agreement would include specific provisions related to the distribution of proceeds among multiple heirs or beneficiaries. In conclusion, the New Mexico Auction of Real Property Agreement is a legally binding contract that governs the sale of real estate through an auction process in New Mexico. It outlines the terms and conditions of the auction and may have different variations depending on the circumstances, such as foreclosure, tax lien, or estate proceedings.

New Mexico Auction of Real Property Agreement

Description

How to fill out Auction Of Real Property Agreement?

You may devote hours online trying to locate the sanctioned document template that meets the federal and state criteria you require.

US Legal Forms provides a vast array of legal forms that are vetted by professionals.

It's easy to download or print the New Mexico Auction of Real Property Agreement from my service.

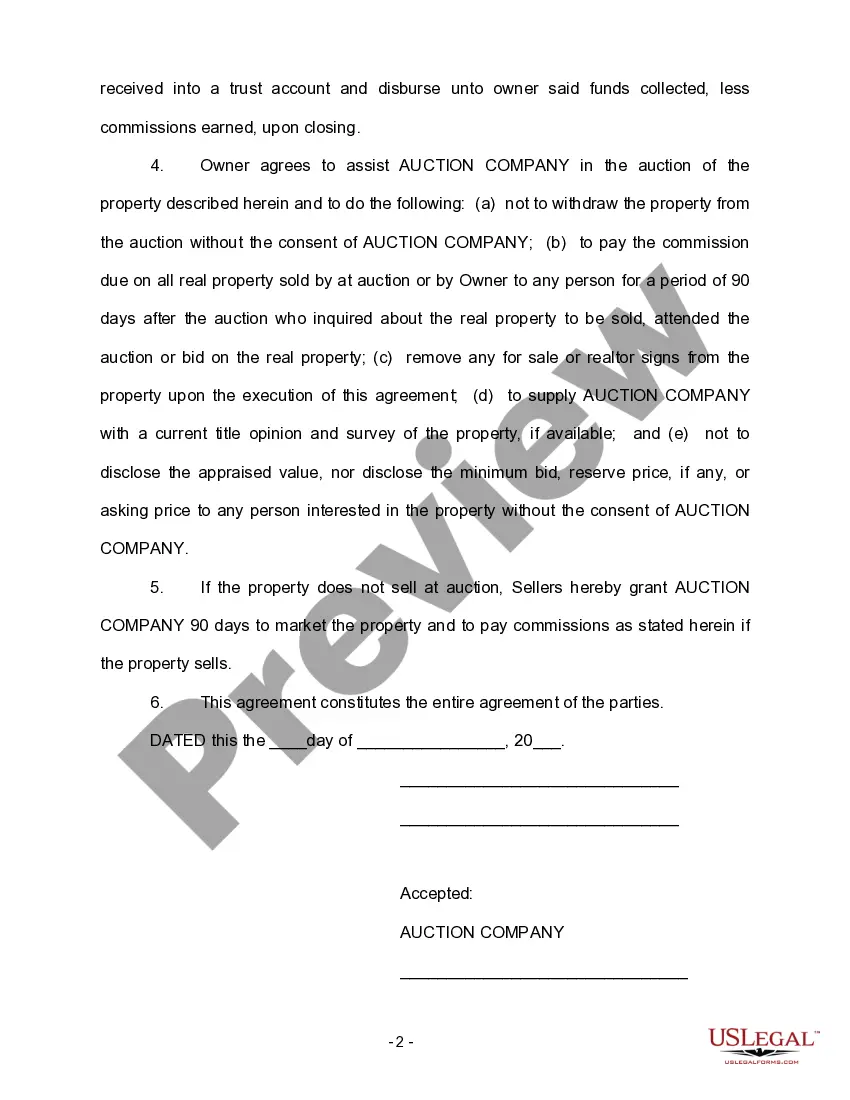

If available, use the Preview button to examine the document template as well.

- If you already possess a US Legal Forms account, you can sign in and then click the Download button.

- After that, you can fill out, modify, print, or sign the New Mexico Auction of Real Property Agreement.

- Each legal document template you acquire is yours to keep indefinitely.

- To obtain another copy of any downloaded form, go to the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions outlined below.

- First, ensure that you have selected the correct document template for the county/town of your preference.

- Review the form description to ensure you have chosen the right one.

Form popularity

FAQ

To find property liens in New Mexico, you can start by checking the county clerk's office. Each county maintains public records, which include liens associated with properties. Additionally, using online databases or services can simplify your search. These resources can complement your efforts in securing a New Mexico Auction of Real Property Agreement, streamlining the process of understanding any existing obligations tied to a property.

The statute of limitations on tax liens in New Mexico typically mirrors the four-year window for tax collections. This means the state has four years to enforce tax liens against property. Familiarity with this timeline empowers property owners to take action as needed. Leveraging a New Mexico Auction of Real Property Agreement can provide essential insights into managing tax liens effectively.

In New Mexico, property owners aged 65 and older may qualify for a property tax exemption. This exemption can significantly reduce or even eliminate certain tax liabilities. It’s beneficial for senior citizens to explore available options to maximize their savings. A New Mexico Auction of Real Property Agreement can assist in understanding these benefits and how to apply for them.

Generally, you can go without paying property taxes for one year in New Mexico before facing a potential tax sale. After this timeframe, the county moves forward with the auction process to recover unpaid taxes. Being informed about your tax situation is key to avoiding property loss. The New Mexico Auction of Real Property Agreement serves as a valuable resource in these situations.

In New Mexico, property taxes can go unpaid for up to one year before a tax sale occurs. After this period, the property may be auctioned to satisfy the tax debt. It's important to stay informed about your property tax status to avoid unwanted sales. A New Mexico Auction of Real Property Agreement can clarify your obligations and options.

New Mexico operates primarily as a tax deed state. This means that if property taxes go unpaid, the county can sell the property at a tax sale, granting ownership through a deed. Understanding this distinction is essential for property owners. A New Mexico Auction of Real Property Agreement can help you navigate these processes effectively.

To recover property after a tax sale in New Mexico, you generally need to redeem it within a specified period, which is usually limited to three years. This involves paying the back taxes plus any applicable interest. It’s crucial to act quickly, as time is of the essence. Utilizing a New Mexico Auction of Real Property Agreement can guide you through the redemption process.

In New Mexico, the statute of limitations on taxes is typically four years. This means that the state has four years to collect any unpaid taxes. For property owners, understanding the timeline can help plan for potential tax obligations. Engaging with a New Mexico Auction of Real Property Agreement can provide clarity on tax liabilities.

A notice of tax lien in New Mexico is an official statement that the government has a claim against a property due to unpaid taxes. This notice is recorded in the county clerk's office, notifying potential buyers of the financial obligations linked to the property. Understanding this document is critical when considering properties available through the New Mexico Auction of Real Property Agreement. It helps you assess the financial risks involved in such transactions.

In New Mexico, the redemption period for tax sales is typically nine months from the date of the sale. During this time, the original owner can reclaim their property by paying the owed taxes, plus any applicable fees. This period is crucial, and understanding it can aid in decisions around the New Mexico Auction of Real Property Agreement. Knowing your rights can save you significant financial loss.