New Mexico Agreement to Store Certain Personal Property in Portion of Garage

Description

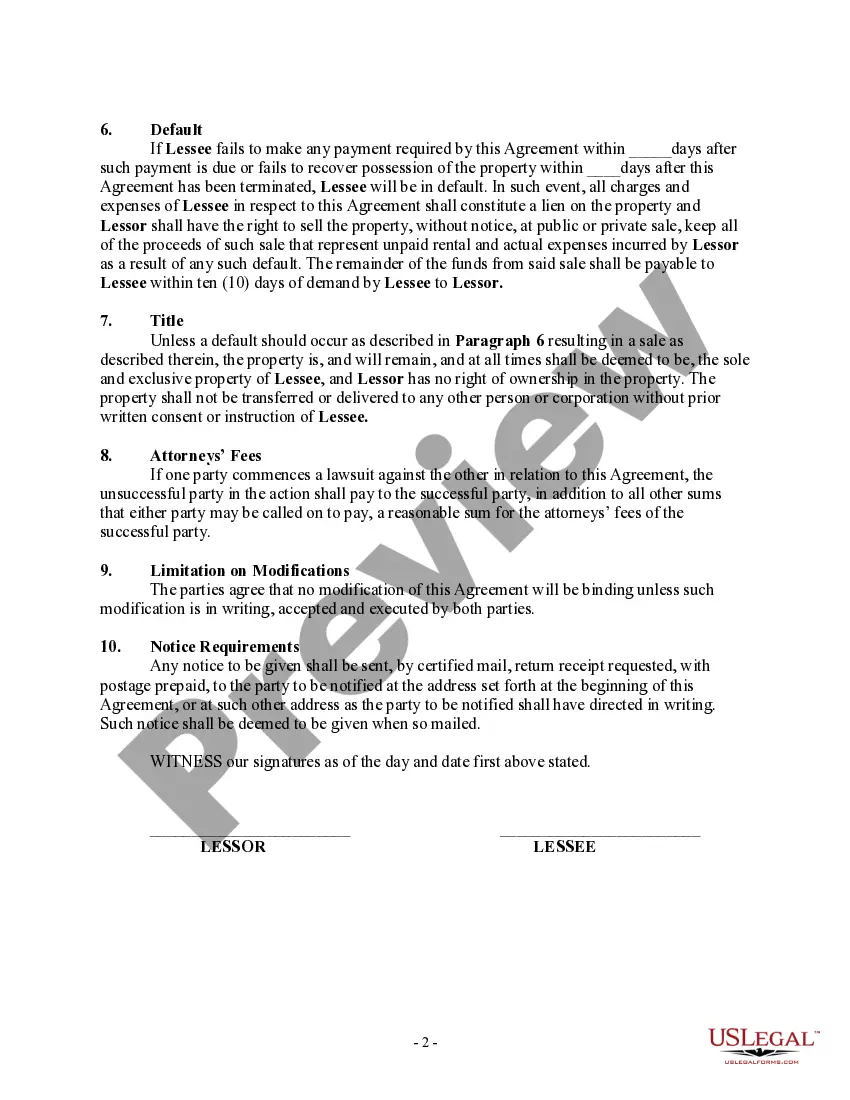

How to fill out Agreement To Store Certain Personal Property In Portion Of Garage?

If you wish to be thorough, download, or create legal document templates, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Employ the site’s simple and user-friendly search to locate the documents you need.

A range of templates for commercial and personal purposes are categorized by type and jurisdiction, or by keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of your legal form template.

Step 4. Once you find the form you need, select the Purchase now option. Choose your preferred payment plan and provide your details to register for an account.

- Utilize US Legal Forms to find the New Mexico Agreement to Store Certain Personal Property in a Portion of Garage with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download option to obtain the New Mexico Agreement to Store Certain Personal Property in a Portion of Garage.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to inspect the contents of the form. Don’t forget to read the description.

Form popularity

FAQ

Renters in New Mexico have various rights, including the right to live in a habitable space and the right to privacy. They also have the right to their personal property, which means landlords must follow the legal protocols for handling belongings left behind. A New Mexico Agreement to Store Certain Personal Property in Portion of Garage provides renters with additional protection and clarity about property management.

In California, landlords cannot keep a tenant's belongings without following legal procedures. Storing a tenant's property without consent could result in legal consequences. If you are dealing with unclear terms regarding property storage, consider using a New Mexico Agreement to Store Certain Personal Property in Portion of Garage to create a clear outline for both parties.

Statute 47-8-37 in New Mexico addresses the landlord's rights regarding personal property left behind by tenants. This statute outlines the proper procedures for notifying tenants and disposing of property that has been abandoned. If you find yourself in this situation, utilizing a New Mexico Agreement to Store Certain Personal Property in Portion of Garage may clarify expectations for both parties.

Yes, a landlord may store their belongings on the property, but they typically need to notify tenants and cannot impede the tenant's use of their rented space. If a landlord intends to store items, it is wise for them to create clear agreements, such as a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, outlining how this will be managed.

A landlord in California cannot enter a tenant's property without proper notice or justification. They also cannot interfere with a tenant's right to privacy or dispose of a tenant's personal property without following legal procedures. Understanding your rights, including through a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, helps protect tenant interests.

In California, if someone leaves their belongings on your property, how long they can stay depends on various factors, including the type of property and the agreements in place. Landlords and property owners may need to follow specific guidelines, especially if a New Mexico Agreement to Store Certain Personal Property in Portion of Garage is involved, to ensure all parties understand their rights and responsibilities.

In California, a landlord can take photos of your belongings under certain conditions. They must typically provide notice before entering your space and have a legitimate reason to document what is present. If you have signed a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, this agreement might define how belongings are treated in storage situations.

Yes, New Mexico does impose a personal income tax on its residents. The tax rate varies based on income brackets, and it is essential to understand your financial obligations. Ensure you keep informed about tax laws as they may impact how you structure a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, particularly if stored items generate income.

In New Mexico, personal property is indeed subject to taxation. This includes various types of property, from vehicles to business supplies. If you are considering a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, be aware of the tax implications that may arise based on the items you’re storing.

Yes, New Mexico does levy a personal property tax on items such as vehicles, business equipment, and other tangible assets. This tax is an annual obligation that property owners must fulfill. By utilizing a New Mexico Agreement to Store Certain Personal Property in Portion of Garage, you can define ownership and potential tax responsibilities for items stored.